Are stocks ever going to go down again?

That’s a question many people are wondering these days, especially after what we’ve seen in the market over the past month.

Of course, we know that stocks can and will go down at some point. But over the past month, every time that stocks have faltered even the slightest bit, they’ve come roaring back — and that’s despite the continuous rise of coronavirus cases throughout many of the “hot spot” states such as Arizona, California, Florida and Texas.

My friend, macro analyst extraordinaire and contributor to my Successful Investing and Intelligence Report newsletters, Tom Essaye of Sevens Report Research, was literally asked that question over the weekend by a friend. And though his friend was only kidding, the sentiment behind the question here is understandably a good topic to ponder now that we have entered what I think is a crucial inflection point for stocks.

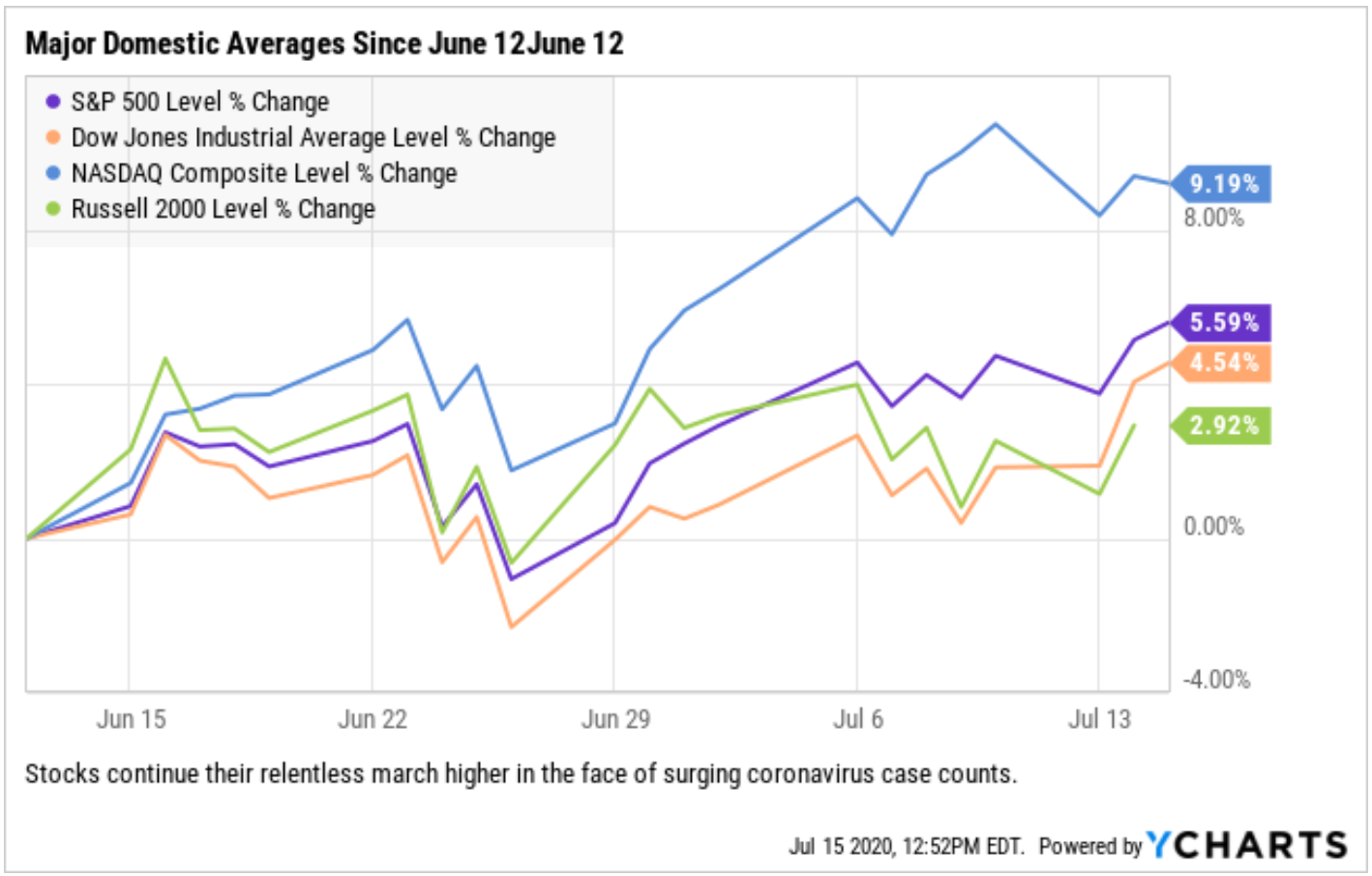

As you can see by the chart of the major domestic averages since June 12 below, stocks have been remarkably resilient. This is most impressive, especially when you consider the downbeat coronavirus headlines we’ve seen over that time. There’s been an alarming surge in the number of coronavirus case counts nationwide and a new uptrend in the amount of hospitalizations and deaths due to the virus.

More importantly, and from purely a market-centric point of view, the new coronavirus metrics have caused many states to pause, and/or reverse their economic reopening.

Where I live in Southern California, we had enjoyed a few weeks where we could go back to bars and restaurants, gyms and hair salons. This week, however, Governor Newsom moved to close gyms and hair salons, put the kibosh on indoor dining and shut down bars. Similar circumstances are occurring in Arizona, Texas and Florida.

Yet so far, the market has basically looked past these shutdowns because traders don’t believe that there’s going to be a full-blown, nationwide lockdown of the sort that was imposed upon us earlier this year. Yet if the coronavirus counts continue their disturbing rise, we will see more and more restrictions on economic activity.

But, will that cause the stocks to go down again?

Logically, it should. However, conventional logic in this COVID-19 market doesn’t really apply. Let me explain.

Right now, there are two primary reasons why it seems like stocks are never going to go down again. As Essaye explains, “The first reason is that markets are assuming that a vaccine (or a game-changing therapeutic) will come to market relatively soon. The second reason is something that market watcher Mohamed El-Erian of Allianz stated last week, the government is looking to ‘socialize’ the downturn.”

Regarding the first reason, well, that’s easy to understand. A vaccine and/or a pharmaceutical therapeutic will allow the world to go back to “normal” (remember what that is?). Moreover, the encouraging vaccine headlines over the past several days from companies such as Moderna (MNRA), Pfizer (PFE), BioNTech (BNTX), Johnson & Johnson (JNJ), Gilead Sciences (GLID) among others have been fueling the bull run. “As long as one of them is successful within a year or so, then we should see a relatively quick economic bounce back in 2021 and 2022,” said Essaye.

The second reason, what El-Erian calls “socializing the downturn,” simply means that governments around the world have stepped up their activity to ameliorate the financial pain of the coronavirus shutdown. In fact, they’ve done so in a very big way via central bank intervention, stimulus checks, loans to businesses (the Paycheck Protection Program), increased unemployment checks, lines of credit, etc.

“Instead of standing by and letting the downturn hit the economy in a traditional way, the government is essentially giving citizens money and in turn taking on massive debt, i.e. socializing the downturn. This limits the economic pain for citizens, but the risk is we create massive debt and deficits,” Essaye remarked.

While the threat posed by massive debt and deficits is a real and long-term issue that could wreck the U.S. economy at some point, from a market standpoint, it represents a tailwind that can keep stocks pushing higher.

So, will stocks ever go down anymore?

While the real answer is yes, of course, stocks can and will go down eventually, the short- and medium-term fate for equities that are being driven by the euphoric cloud of vaccine hopes and a socialized downturn can keep the bulls running a lot longer than anyone suspects — so invest accordingly.

*********************************************************************

The Color of Capitalism

“Capitalism knows only one color: that color is green; all else is necessarily subservient to it, hence, race, gender and ethnicity cannot be considered within it.”

–Thomas Sowell

This brilliant economist has a way of cutting through issues with rapier-sharp wit. In this quote, he reminds us that the essence of capitalism is the pursuit of profits and not some kind of social justice pursuit that divides us along racial, gender and ethnic lines.

Companies exist to create a product and/or service that people are willing to pay for and ensure that the product or service can be offered at a lower cost than it can charge (i.e. at a profit). That profit motive cares not if you are black, white, yellow, red or any combination thereof — nor should it. It’s this colorblind nature of the profit motive, and the ability to create what others are willing to pay for, that makes capitalism the most moral and most efficient system ever created.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods