(Note: Second in a series on Europe-focused ETFs)

The WisdomTree Europe Hedged Equity Fund (HEDJ) seeks to provide exposure to the European equity market while hedging against fluctuations between the U.S. dollar and the euro.

The fund is hedged against the euro for U.S. investors. HEDJ targets dividend-paying firms, and, as the ticker implies, aims to remove euro currency exposure for the benefit of investors who are based in the United States. However, this exchange-traded fund (ETF) adds another twist: it screens to find publicly traded companies that obtain at least 50% of their sales from exports outside the Eurozone.

Such stocks should do well when the euro is weak or weakening. The WisdomTree currency-hedged equity funds use its currency-hedging strategies by entering one-month forward contracts each month and rebalancing at each month’s end.

In a weakening euro scenario, the hedge seeks to protect local gains from getting lost in the conversion back into U.S. dollars. In a strengthening euro environment, the fund is designed to safeguard against poor local returns and no foreign exchange gain. Effectively, HEDJ doubles down on its bet against the euro.

The fund charges a hefty fee, but it has had no trouble attracting assets. Consequently, it is one of the most liquid ETFs in the developed European space, making it ideal for short-term tactical trading. Investors may want to consider trading in the morning (New York time), when European markets are still open, for the best price.

HEDJ is heavily weighted in three countries; France, 32.35%; Germany, 30.10%; and the Netherlands, 18.75%. Its sectors are heavily weighted in five sectors: Consumer Non-Cyclicals, 22.16%; Consumer Cyclicals, 20.27%; Health Care, 15.58%; Industrials, 14.72%; and Basic Materials, 14.28%.

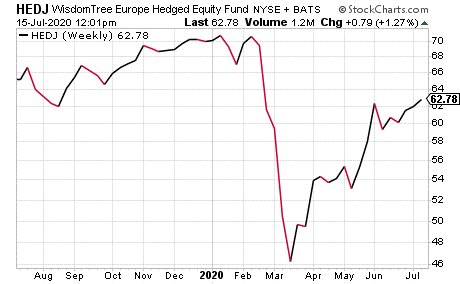

Source: StockCharts.com

The fund has $2 billion in assets under management, 103 holdings and an average 0.02% spread. It has a 1.52% distribution yield and an expense ratio of 0.58%, meaning that it is more expensive to hold in comparison to many other exchange-traded funds.

To sum up, HEDJ tracks an index of Eurozone dividend-paying companies that derive a majority of revenue from exports outside that zone. This fund could be beneficial for short-term tactical traders, but please exercise your own due diligence in deciding whether or not this ETF is suitable for your individual investing and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.