One of the best dividend aristocrat stocks to buy during the COVID-19 recovery is New York-based Consolidated Edison Inc. (NYSE:ED).

The utility has posted dividend payouts for 45 straight years and ranks among the elite Dividend Aristocrats. The stock’s high market capitalization of $25 billion and performance is worth highlighting and its role as a leader in developing a clean energy future boosts its appeal as a long-term investment.

About Consolidated Edison

One of the largest investor-owned energy companies in the United States, Consolidated Edison is among businesses that supported communities during the global pandemic. It reported a net income of $375 million for the quarter ended March 31, 2020, compared to $448 million the same quarter a year earlier. This drop largely occurred due to the devastating impact of the COVID-19 pandemic on the Greater New York area and affected Consolidated Edison’s customers.

Consolidated Edison reported an 8% drop in its revenues for the quarter ended March 31, 2020, compared to the same quarter a year ago. In contrast, its operating income in first-quarter 2020 rose 3% due to a reduction in its operating expenses. Its lower net income, a decline of 16.3% from first-quarter 2020, is largely due to a greater net interest expense.

John McAvoy, chairman, and CEO of Consolidated Edison praised its workforce for special dedication during the onset of the global pandemic in the United States. In terms of its recovery, Consolidated Edison has adjusted its predicted earnings per share range from the previous $4.30 to $4.50 to the new $4.15 to $4.30 after it missed its first-quarter projected range.

“All of us at Con Edison remain solely focused on the health and safety of our employees and our customers while continuing to provide the highest level of reliable service,” said McAvoy. “We must and will summon all the compassion, grace and strength needed to provide for the recovery.”

Consolidated Edison Continues Its Clean Energy Service

The company offers a reliable and sustainable energy service, and also holds a commitment to renewable energy and sustainability services. The company has committed to investing more than $1.5 billion to triple energy-efficient programs by 2025. As the seventh-largest solar power producer in the world, it has committed to 100% clean electricity by 2040.

45-Year Rising Dividend-Paying History

With 45 consecutive annual dividend increases, the company’s current quarterly dividend of $0.765 would convert to a $3.06 annual distribution to offer a 4.05% forward dividend yield. This company recently announced that it would implement a 3.38% increase in its annual dividend from 2019 to 2020.

Price/Book Ratio

Consolidated Edison currently trades at a 1.40 price to book ratio, so it is trading for greater than its book value.

Price/Earnings Ratio

Consolidated Edison recently has traded at a 19.60 trailing price-to-earnings (P/E) ratio, which is much lower than the overall S&P 500 P/E ratio of 28.17, as of July 27, 2020. This P/E ratio, compared to the S&P 500, suggests ConsolidatedEdison poses high earnings potential and corresponds to market expectations for its financial recovery from COVID-19.

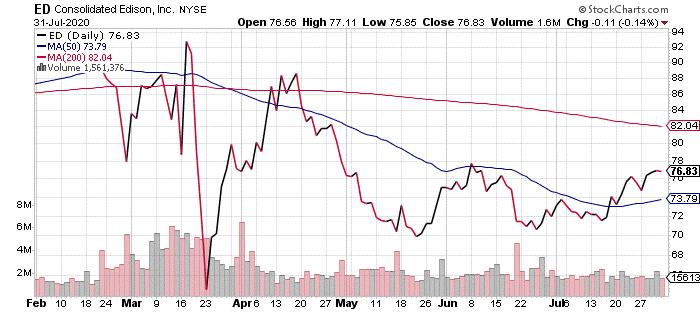

Recent Stock Price Performance

Its stock price has fallen 12.78% in the past 12 months and 14.94% so far this year. There appear to be two instances of decline. The first drop in price from the $90-range in February 2020 to a low of $65.35 on March 23, 2020, stemmed from the COVID-19-induced stock market crash. The second dip occurred in May 2020 and likely stemmed from downward pressure in the stock after Consolidated Edison reported that it had missed its first-quarter earnings per share (EPS) by 19%.

However, Consolidated Edison still is expected to recover faster than the energy industry. Its stock has regained 15.65% since its low, as of July 27.

Chart courtesy of www.StockCharts.com

New Investment in System Upgrades

Consolidated Edison has invested $1.3 billion in system upgrades for electric delivery to continue its reliable service in preparation for the hot summer months. This also includes an investment in clean energy systems in pursuit of one of Consolidated Edison’s long-term goals.

Consolidated Edison is rated as a BUY for the following reasons:

- Consolidated Edison has suffered financial losses due to COVID-19, but its operating income from the first quarter of 2020 shows the need for the company’s services has not slowed down. Its investments in system upgrades for long-term gain show potential for aiding its financial recovery.

- Its 45-year history of dividend growth and a compelling 4.05% dividend yield adds to the stock’s appeal.

- Consolidated Edison’s leading role to honor its commitments and investments in clean energy presents a good fundamental basis in innovation and long-term expansion.

Key Risks to Consider for Consolidated Edison:

- The reduction of predicted earnings per share range from $4.15 to $4.30, down from $4.30 to $4.50, shows the financial effect thus far from COVID-19 challenges and hints at a slower-than-expected recovery.

- Its energy operations and earnings, especially in the Greater New York City Area, are still vulnerable to adverse effects from the spread of COVID-19 and other potential unforeseen events.

Katie Kao is an editorial intern with Eagle Financial Publications and she writes for www.stockinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)