The best dividend-paying stocks to buy now include New York’s AllianceBernstein Holding L.P. (NYSE:AB).

AllianceBernstein has been able to grow in the past year despite market difficulties by offering services to three distribution channels: institutions, private clients and retail. It currently has a market capitalization of $2.7 billion.

About AllianceBernstein (NYSE:AB)

One of the best dividend-paying stocks to buy is AllianceBernstein, a global asset management firm that offers a 9.32% dividend yield. Occasionally, it has paid out higher special dividend amounts with no prior declaration.

With operations in investment management and research services, AllianceBernstein has performed well to acquire asset holdings during its recovery from the COVID-19 crisis. The company increased its assets under management (AUM) by 0.7% to $600 million on June 30 from $596 million at the end of May 2020. This increase in assets mainly came from asset appreciation and firm-wide net inflows of funds to manage during the month of May.

Performance of AllianceBernstein

In comparing results for the second quarter ended June 30, 2020, to the same quarter a year ago, AllianceBernstein reported a 1.6% increase in its revenues. It also increased its operating income by 13.8% to $209 million in second-quarter 2020, compared to $184 million from the same period a year ago. In comparison to its operating income for the first quarter ended March 31, 2020, AllianceBernstein was able to gain 17.6% in the second quarter. This increase in earnings primarily stemmed from a jump in base fees with higher average assets under management (AUM) across all three distribution channels.

Upon the release of its second-quarter earnings report, Seth P. Bernstein, president, and CEO of AllianceBernstein acknowledged the difficulties faced during the COVID-19 crisis and praised the company’s success amid recovery.

“The firm delivered strong second-quarter results in a dynamic operating environment, as financial markets rebounded from March crisis lows,” Bernstein said.

“Both Retail and Institutional had very strong sales quarters, and our pipeline of institutional mandates reached a new record, reflecting continued active equities and alternatives strength. Investment performance improved in our fixed income strategies as credit sectors recovered. We expanded operating margins both year-over-year and sequentially.”

AllianceBernstein Presents High Forward Dividend Yield

AllianceBernstein has a current quarterly dividend of $0.61 that would convert to a $2.63 annual distribution and offer its 9.32% forward dividend yield. This payment is a 4.7% decrease from its first-quarter dividend payment of $0.64. The company was forced to cut its dividend due to financial difficulties caused by COVID-19.

Price/Book Ratio

AllianceBernstein currently has a 1.84 price to book ratio, so it is trading slightly greater than its book value.

Price/Earnings Ratio

AllianceBernstein also has a 10.87 trailing price-to-earnings (P/E) ratio, which is 38% lower than the financial services industry P/E ratio of 17.56. This weak P/E ratio indicates the stock price trades relatively low to the stock’s high performance.

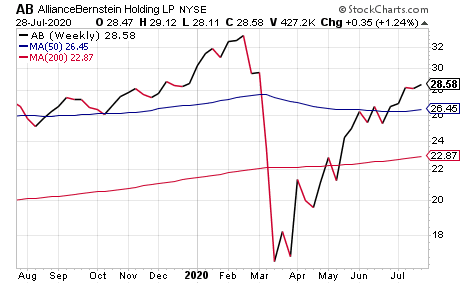

Recent Stock Price Performance

AllianceBernstein’s stock price has fallen 7% since the start of the year, but the stock has recovered 93% from its low on March 18, 2020, as of July 27. Although the stock price was affected by a market-wide crash from COVID-19, falling from the $30 range in January 2020 to the $20 range in April 2020, it has since recovered well into the high $28 range during July 2020. Prior to this, AllianceBernstein’s stock price showed consistent holdings in the $30 range at the end of 2019.

AllianceBernstein Announces Acquisition of AnchorPath

AllianceBernstein announced it had acquired Connecticut-based AnchorPath Financial, LLC. earlier in the second quarter on June 17. This acquisition brings AnchorPath’s innovative approach in managing risk during market downturns under AB’s Multi-Asset Solutions Business. The acquisition is expected to further AB’s Multi-Asset Solutions business and has already added more than $400 million in assets under management.

Daniel Loewy, the Head of AB’s Multi-Asset Solutions, said, “AnchorPath uses a unique lens to construct solutions that enable funds to outperform relevant indexes with decreased downside risk and will benefit from AB’s distribution expertise.”

Why AllianceBernstein is a BUY for investors:

- AllianceBernstein has demonstrated strong business performance during the recovery from the COVID-19 crisis by increasing its operating income by 17.6% for the second quarter ended June 30, 2020.

- Its acquisition of AnchorPath brings in an experienced investment management firm specializing in cost-effective strategies of pro-active risk control.

- The company’s P/E ratio is low compared to the financial services industry average and poses a high earnings potential for AllianceBernstein.

Key Risks to Consider for AllianceBernstein:

- While it has a high dividend yield, it does not maintain consistent growth in dividend payouts and has lowered its dividend payouts. However, its special dividends are usually higher than its quarterly dividend.

- The revenues and results of operations depend on the market value and composition of its assets under management.

- Market volatility in 2020, including heightening trade tensions between the United States and China, as well as impacts of COVID-19, could adversely affect the company’s revenues.

Katie Kao is an editorial intern with Eagle Financial Publications and she writes for www.stockinvestor.com.