Eight gold and silver investments to buy as the dollar drops give investors an opportunity to reap rewards even as technology stocks fade amid valuations that appear too high for their currently reduced earnings during the COVID-19 economic crunch.

The price of gold and silver investments to buy reached an all-time high for the precious yellow metal and more than a seven-year peak for the shiny white metal with no end to their respective rallies in sight. The surge has been sparked by investors seeking a refuge from the falling U.S. dollar, inflationary federal spending and the growing threat of tax hikes if Democrats win the next election and take control of both the White House and Congress.

Gold jumped to a record high of $1,931.00 by the close of trading on July 27 and climbed further to $1,974.40 on July 28 to set an intraday record for the second day in a row. Despite the golden performance of the yellow metal, investors should remember that the eight gold and silver investments do not offer the 100% protection bank deposits provide through the Federal Deposit Insurance Corporation (FDIC), topping out at $250,000 for each person per bank.

Pension Fund Chief Picks 1 of the 8 Gold and Silver Investments to Buy

The strong current monetary stimulus from the Federal Reserve Bank will benefit the markets more than the economy, said Bob Carlson, leader of the Retirement Watch advisory service. As chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, Carlson seeks to protect the money of investors and he described gold as a hedge against future inflation.

“I’ve been recommending gold for about two years,” Carlson said. “Even before the pandemic, the Federal Reserve made clear that it wasn’t going to tighten monetary policy for some time. It didn’t want to risk a recession by prematurely tightening and was willing to risk letting inflation get a little high. Easy monetary policy generally is bullish for gold.”

Since the pandemic spread to the United States early this year, the Fed established a policy of ensuring the economy and markets would have all the money they needed to function, Carlson continued. There has been a historic expansion of the Fed’s balance sheet, and that is likely to continue, he added.

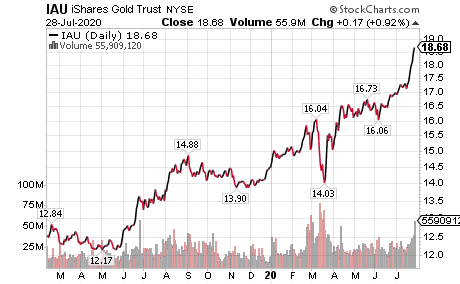

1 of the 8 Gold and Silver Investments to Buy Features iShares Gold Trust

Many other central banks around the world have adopted similar easy-money policies, spurring an interest among investors in gold, Carlson said. Those central bank policies have caused the U.S. dollar to have its worst month in “quite a while,” he concluded.

“Other currencies also are declining,” Carlson said. “Gold hit historic highs this week. These trends will continue for as long as the global economy needs easy monetary policy to avoid a deflationary spiral.”

Carlson indicated he favors a “straightforward investment in gold bullion” through exchange-traded funds (ETFs). In particular, he recommended iShares Gold Trust (IAU), an ETF that allows gold to be bought or sold anytime the markets are open, deviates little from its net asset value and offers an economical way to buy and own gold due to its low fee. Some other bullion funds lend their gold or take other measures to increase cash flow or boost returns, he added.

Chart courtesy of www.StockCharts.com

Mining Companies Offer Another Way to Buy Gold and Silver Investments

Investors who want heightened returns can invest in stocks of gold mining companies directly or through Carlson’s recommended method of using a mutual fund or an ETF that holds a diversified portfolio of equities. Keep in mind that investing in the stocks carries additional risk, he opined.

“You’re making a bet on the management of the company and risk the company might incur labor problems,” Carlson said. “Some companies contract to sell their gold at fixed prices in advance, which can reduce gains in the stock. Companies also carry different levels of debt, which can increase returns or cause problems for the company.

“In the short term, I expect a softening of gold’s price. A number of investors were selling gold short. They didn’t believe central banks would expand monetary policy as much as they did or successfully offset deflationary trends. Short covering by some of these investors is part of the reason for the recent surge. Once the short sellers have covered their positions, gold buying will decline for a bit before resuming.”

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became the norm after the outbreak of COVID-19.

iShares Gold Trust (IAU) does not pay a dividend, but it is up 10.34% in the last month, 28.83% for the year to date and 37.86% for the past year. The gold bull market should continue if central banks keep “pumping money” into the economy to offset the deflationary effects of the coronavirus, Carlson added.

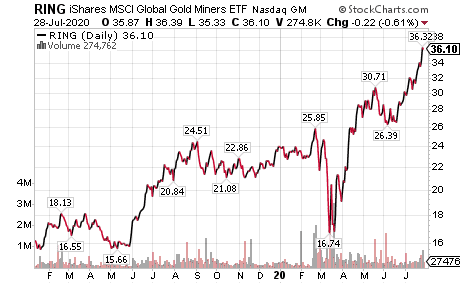

Trend-Following Guru Eyes a RING Among the 8 Gold and Silver Investments to Buy

The powerful surge in gold and silver mining stocks is the result of several key drivers operating in the market today, said Jim Woods, editor of the Intelligence Report, Successful Investing and Bullseye Stock Trader advisory services. The confluence of bullish gold factors has probably never been this complete, he added.

“First off, we now have ultra-low interest rates nearly around the globe,” Woods said. “Then we have governments essentially flooding the world with stimulus. Low interest rates make owning gold more attractive for yield-seeking investors.”

Woods specifically cited mining stocks in the iShares MSCI Global Gold Miners ETF (NASDAQ:RING) as one of his favorite “safety trades” right now. The ETF has risen 24.96% in the last month, 50.54% for the year to date and 68.86% for the past year.

Chart courtesy of www.StockCharts.com

RING is an ETF that features an array of major gold stocks. Investors who buy shares in RING can gain exposure throughout the sector by investing in just one fund.

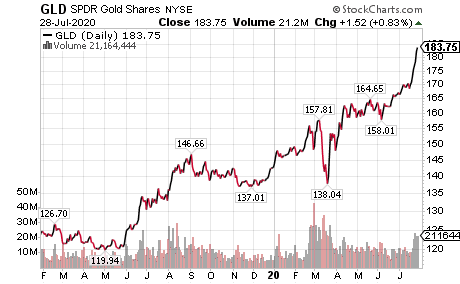

GLD Joins List of 8 Gold and Silver Investments to Buy

Since its most recent low on June 5, the SPDR Gold Shares (GLD), an ETF pegged to the spot price of gold bullion, is up a robust 16.29%. GLD’s advance included gains of 10.33% for the last month, 28.59% year to date and 37.50% for the past year.

Chart courtesy of www.StockCharts.com

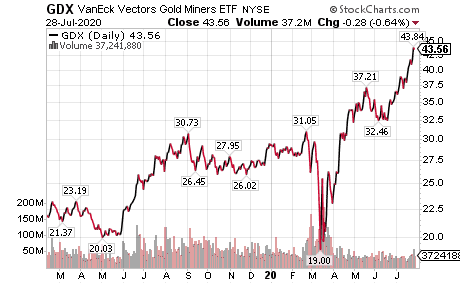

Mining ETF GDX Secures Spot Among 8 Gold and Silver Investments to Buy

Even bigger gains came from VanEck Vectors Gold Miners ETF (NYSE: GDX). The mining stocks that compose this ETF have surged by more than double the gains in the spot price of gold, as GDX climbed 34.20% since June 5. Plus, GDX rose 23.79% in the last month, 48.77% for the year to date and 60.45% for the past year.

Chart courtesy of www.StockCharts.com

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

Gold traders expect the government stimulus and spending ultimately to force a spike in consumer prices beyond any interest-rate increases that banks may pay depositors. That result would cause inflation and hurt the U.S. dollar’s purchasing power.

But it would lift the value of gold because additional dollars would be needed to purchase bullion. The price of an ounce of gold bullion then would rise and boost the value of gold mining stocks, as shown with the jump in share price for mining ETFs the iShares MSCI Global Gold Miners ETF (RING) and the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT).

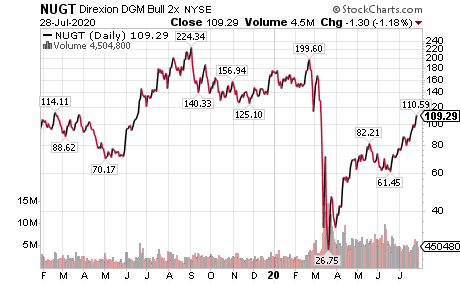

Double Leveraged Fund NUGT Gains Spot Among 8 Gold and Silver Investments to Buy

NUGT is double leveraged with the intent of rising twice as much as the gold miners index. NUGT previously had been triple leveraged but the fund scaled back to double leveraged as gold surged. The leverage turns NUGT into a volatile investment that can jump as it did when rising 51.52% in the past month or plunge as occurred when falling 37.26% year to date and 32.26% for the last year.

Chart courtesy of www.StockCharts.com

Falling real interest rates, calculated by subtracting inflation from reported or expected interest rates, are supporting the inflationary expectations of investors, while steady bond yields provide a key fundamental tailwind for both gold and silver. If that stays intact, precious metals should keep climbing.

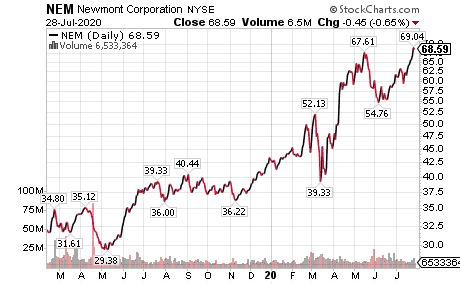

Money Manager Kramer Chose Newmont for 8 Gold and Silver Investments to Buy

The “most remarkable” part of the precious metals boom is the way the miners have outperformed commodity prices, said Hilary Kramer, host of a national radio program called “Millionaire Maker.”

Kramer, who also leads the Value Authority and GameChangers advisory services, said investors recognize both the defensive value in the reserves these companies have in the ground that remain to be mined and strong earnings growth when every ounce extracted is worth 20-25% more than during the previous year.

“Forget for a moment that we’re talking about those beautiful shiny metals that serve as a reservoir of value when the world looks unsettled and central banks deliberately invite inflation,” Kramer said. “Gold miners are tracking at least 20% earnings growth this year. That’s spectacular.”

Technology Giants Cannot Match Current Growth of Newmont

Microsoft Corp. (NASDAQ:MSFT) cannot deliver that, nor can Apple Corp. (NASDAQ:AAPL) or just about any other Silicon Valley giant.

Gold mining company Newmont Corp. (NYSE:NEM) just reported its second quarter in a row of 20%-plus growth and Kramer said it would not surprise her if that expansion rate triples by the end of the year. Yet NEM does not even trade at 27 times anticipated earnings.

Aside from the defensive nature of gold, investors understandably are bidding up the share price of miners that are growing 60% this year and priced at 27 times earnings, rather than a technology company such as Microsoft with growth of 7% and trading at a lofty 38 times earnings.

Chart courtesy of www.StockCharts.com

“I’d rather have the hard assets than the software,” Kramer said. “We see this throughout the group. Gold stocks are collectively cheaper than the S&P 500 as a whole. Unless you can find a faster-growing business at a comparable multiple, go for the gold. After all, the Fed is unlikely to quit printing money for the foreseeable future. This bullion boom has legs.”

Newmont zoomed 15.59% in the last month, 58.76% for the year to date and 85.78% for the past 12 months. The gold mining company further offers a current dividend yield of 1.13% that income investors should appreciate.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

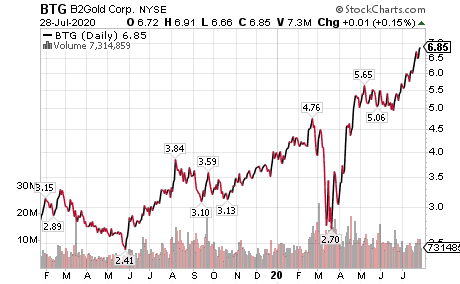

Silver’s rise typically trails gold, and the trend occurred again as the precious white metal is leaping ahead after falling well behind gold’s percentage gains until recently. Silver now is nearing $25 an ounce, while gold has jumped to $1,925 and could hit $2,000, wrote Mark Skousen to his Forecasts & Strategies investment newsletter subscribers on July 27. He previously predicted gold would reach $2,000 by year-end and it rapidly is approaching that mark.

“We currently have a 22% gain in gold bullion in SPDR Gold Shares (GLD),” Skousen reported. His other gold recommendation in that service is B2Gold (BTG), which is doing even better by rising 48% in three months. In addition, it offers a 1.2% dividend yield.

Chart courtesy of www.StockCharts.com

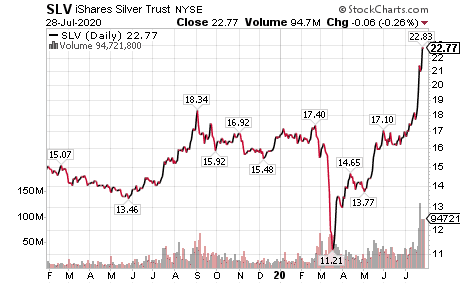

Silver could rise further than gold in the coming months when industrial demand for the white metal increases as the economy picks up its pace of growth.

“I think silver can move sharply higher,” Skousen wrote to his subscribers.

One way to invest in silver is through the iShares Silver Trust (NYSE:SLV). SLV has more than doubled in price between its near 52-week low of $11.21 on March 18 during the market crash and the $22.77 mark it hit at the close of trading on July 28.

Chart courtesy of www.StockCharts.com

“It is possible that silver could surpass its old high of $50 an ounce, which it has reached twice in my lifetime — in 1980 and 2011,” Skousen opined.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia. Skousen’s premium investment services consist of Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert.

The COVID-19 crisis not only has hurt the economy but has caused 16,664,963 cases and 658,914 deaths globally, along with 4,349,324 cases and 149,209 deaths in the United States, as of July 28. America has reported the most cases and lives lost of any nation due to the virus, including China, where COVID-19 originated.

The eight gold and silver investments to buy have been rocketing upward and are expected to continue to do so as long as the conditions powering them remain intact. For investors who are fretting about missing the opportunity, gold should keep gleaming in the months ahead and silver seems destined for a multi-year ascent as the industrial uses of that precious metal should expand as the economy rebounds.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Paseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.