Five 5G technology stocks to buy during a pullback feature a network builder, a content delivery system for up to 30% of web traffic and three high-speed broadband service providers.

The rollout of fifth-generation network services, also known as 5G, enhances the appeal of each of these five technology stocks, despite the ongoing COVID-19 public health crisis. These stocks are starting to capitalize on the rollout of 5G that experts describe as one of the fastest wireless technologies ever created.

The five 5G technology stocks to buy in a pullback either provide products or services for fifth-generation cellular networks to users who increasingly require heightened bandwidth for video streaming, chatting and games. With connected devices becoming common, demand for such services is destined to soar.

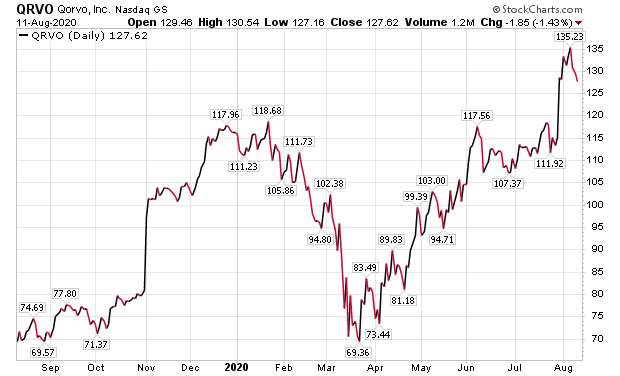

Qorvo Ranks as One of Five 5G Technology Stocks to Buy During a Pullback

One of the five 5G technology stocks to buy during a pullback is Qorvo Inc. (NASDAQ: QRVO), a Greensboro, North Carolina-based semiconductor maker and 5G network builder. The stock, recommended in the TNT Trader service by Mark Skousen, PhD, a Presidential fellow in economics at Chapman University, already is up double-digit percentages since June 16.

Since TNT Trader recommends options along with stocks, Skousen advised the purchase of QRVO call options. He recommended the sale of half the option position for roughly a 40% gain and informed his subscribers to hold the remainder for additional potential gains.

Skousen, who also heads the Forecasts & Strategies investment newsletter and the Home Run Trader, Five Star Trader and Fast Money Alert advisory services, pointed out that Qorvo was not founded until 2015 but is already profitable. The value of its stock rose sharply in 2019 but took a sharp downturn during the coronavirus scare.

Mark Skousen, a descendent of Benjamin Franklin, meets with Paul Dykewicz

Qorvo Shines as One of Five 5G Technology Stocks to Buy During a Pullback

Now things are looking up, aside from a recent pullback of technology stocks generally. Last year, Qorvo shipped more than 100 million radio-frequency module devices for use in 5G infrastructure. It is also a major defense contractor for battery management components and power loss protection.

The tech company is growing through acquisitions. Earlier this year, Qorvo purchased Decawave, a company that specializes in ultra-wideband technology.

Qorvo has $715 million-plus in cash, which is plenty to help cover its long-term debt of $1.65 billion. The stock is selling for only 19 times expected earnings this year, which is relatively inexpensive for a tech company, Skousen said.

However, the stock’s price-to-earnings (P/E) ratio is 38.50 and it does not pay a dividend. Thus, the stock may need to fall a bit further in price before value investors could become interested.

Chart Courtesy of www.StockCharts.com

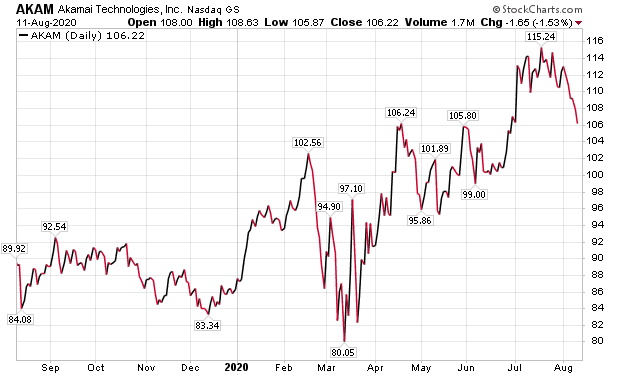

Akamai Rates as One of Five 5G Technology Stocks to Buy During a Pullback

Akamai (NASDAQ:AKAM), of Cambridge, Massachusetts, operates one of the largest content-delivery networks in the world. It is estimated to serve between 15-30% of all web traffic with a global content delivery network, cybersecurity, cloud services and web and internet security.

Chart Courtesy of www.StockCharts.com

Akamai is a “stealth 5G” investment, said Hilary Kramer, host of a national radio program called “Millionaire Maker” and leader of the GameChangers and Value Authority advisory services. While Akamai mainly facilitates online content delivery, more people using better phones means more content to serve, she added.

In addition, Akamai can become essential in an increasingly online world and, in the meantime, it’s even cheaper than Qualcomm (NASDAQ:QCOM), Kramer continued. The company is growing fast enough to make it extremely attractive at its current price level and could become yet more appealing if it dips further.

Its P/E ratio is a 32.19 and it does not pay a dividend, but Kramer liked the stock well enough to recommend it recently. Nonetheless, income investors may want to consider one of the two broadband service providers that offer respectable dividend yields.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services included 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

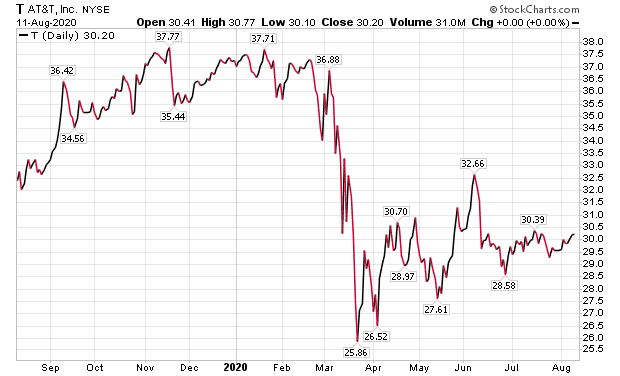

AT&T May Become One of Five 5G Technology Stocks to Buy During a Pullback

Dallas-based AT&T (NYSE:T) has a P/E ratio of 18.41 and offers a current dividend yield of 6.89% that certainly should please income investors. The stock is recommended in the Intelligence Report investment newsletter by Jim Woods, who also leads the Successful Investing and Bullseye Stock Trader advisory services. Income investors also will like that the stock has paid a dividend consistently since 1984.

Investors need to realize that AT&T has become heavily diversified into media content in recent years, so it is far from a pure play on the growth of 5G. Its WarnerMedia business includes the new HBO Max streaming media service that will become a company priority and spurred a leadership reorganization in the business unit during the past week.

The stock slipped after AT&T reported second-quarter results, ended June 30, when it missed several performance metrics that analysts forecast. The company’s revenues of $40.95 billion fell short of estimates by $100 million due to weakness in Latin America and in Xandr, Inc. a digital advertising and analytics division of WarnerMedia.

AT&T Feels Impact of COVID-19 Crisis

AT&T’s earnings per share (EPS) of $0.83 beat analysts’ forecasts by $0.04 but included a hit of 9 cents due to COVID-19. However, $0.66 came from amortization, cost savings and merger integration. The COVID-19 crisis proved to be a major headwind across AT&T’s varied business segments.

Mobile services net subscriber adds fell short of expectations in the second quarter, while Video and Broadband Entertainment net losses beat scaled-back forecasts. Investors should keep in mind that management did not provide guidance but did reiterate capital expenditures of roughly $20 billion and a dividend payout in the 60% range.

Subscriber churn improved in the second quarter, as analysts expected during the pandemic with more people having time to stay home or otherwise use AT&T’s services. It also helped that live sports and production cranked back up in the second quarter to serve as catalysts for retaining customers.

Out of the 28 sell-side analysts who track AT&T, 64% rate the stock as a hold, 29% consider it a buy and 7% advise selling, according to FactSet. At a reduced valuation than its current level, the stock could gain further appeal.

Chart courtesy of www.StockCharts.com

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss investments.

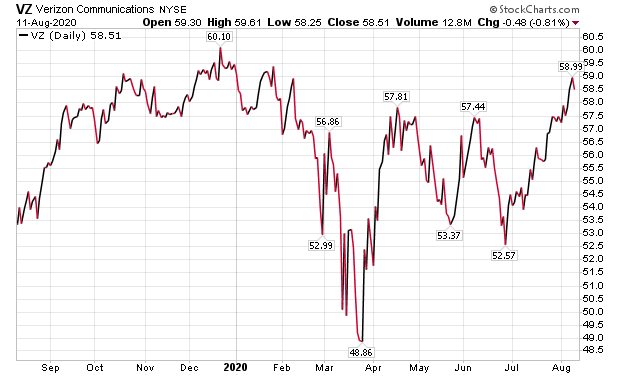

Verizon Earns Slot as One of Five 5G Technology Stocks to Buy During a Pullback

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, recommends giant telecommunications provider Verizon Communications Inc. (NYSE:VZ) and its enticing 4.20% dividend yield in his Retirement Watch investment newsletter. The New York-based conglomerate’s subsidiaries include well-known brands such as American’s largest mobile phone service Verizon Wireless, its Verizon Fios multi-channel video operation and AOL.

“I wouldn’t call Verizon COVID-19-proof, but I do think it’s a good stock to be holding now,” Carlson said. “The company has steady cash flow that increases over time. It also has a history of increasing its dividend. So, an income investor will see the annual income in dividends increase, regardless of what is happening with the stock price.”

The major negative, Carlson cautioned, is the company carries substantial long-term debt of $106.56 billion and current debt of $11.18 billion, totaling $117.74 billion. After adjusting for $7.05 billion in cash-equivalents, Verizon’s net debt settles at $110.69 billion.

Right now, that debt load appears to be manageable and does not put its dividend at risk, Carlson said.

Verizon’s Modest P/E and Dividend Could Gain Further Appeal in a Pullback

Verizon’s P/E ratio of 12.65 is only about one-third as high as that of T-Mobile, giving investors a comparatively much better entry point than its rival in mobile telecommunications. In addition, Verizon’s second-quarter earnings per share of $1.18 beat FactSet’s analysts’ consensus forecasts of $1.15. The company estimates that its Q2 EPS and adjusted EPS included a hit of approximately 14 cents due to COVID-19. The novel coronavirus held back wireless service revenue, advertising and search revenue of its Verizon Media business.

Verizon also recognized an aggregate tax benefit of $156 million from an internal reorganization that added 4 cents to second-quarter EPS and adjusted EPS. Its second-quarter revenues of $30.4 billion edged FactSet’s consensus estimate of $29.92 billion.

Chart courtesy of www.StockCharts.com

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became the norm after the outbreak of COVID-19.

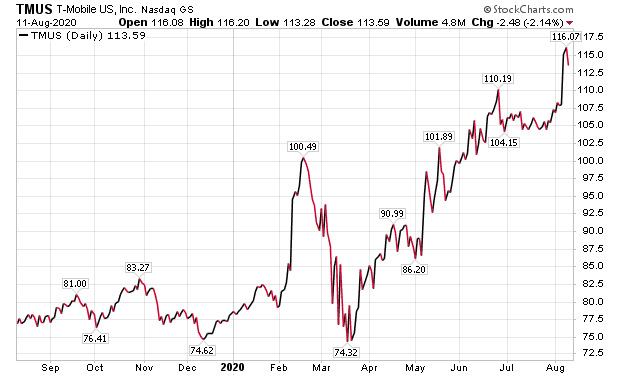

T-Mobile Becomes One of Five 5G Technology Stocks to Buy During a Pullback

Bryan Perry, who heads the Cash Machine, Premium Income, Quick Income Trader, Hi-Tech Trader and Breakout Profits Alert advisory services, recommended T-Mobile USA, Inc. (NASDAQ:TMUS) on July 31, and it already has jumped 6.71%. The stock gained a boost after the company announced on Aug. 7 that it would be the first provider in the world to launch a nationwide, commercial, standalone architecture 5G network.

That move will immediately expand the carrier’s 5G footprint to nearly 2,000 additional towns and cities, Perry said. He recommended the stock in his Hi-Tech Trader service’s 5G Portfolio and advised his subscribers to buy the TMUS Nov. 20 $105 Calls at $8.80 per contract on July 31, before telling them to sell at $14.85 for a gain of 68.7% within six trading days.

However, T-Mobile trades at a high P/E ratio of 37.08 and it does not pay a dividend. But the company outperformed FactSet analysts’ expectation on several key operating metrics in the second quarter that ended June 30.

T-Mobile’s EBITDA Beats Consensus Analysts’ Estimates by $900 Million

Bellevue, Washington-based T-Mobile’s Q2 adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) reached $7.0 billion, beating consensus analysts’ estimates of $6.1 billion. Net additions to its customer base totaled 1.25 million, up from the 761,000 forecasts by analysts.

Average revenue per user (ARPU) for prepaid mobile phone service in Q2 hit $37.80, topping analysts’ estimates of $36.35. As for second-quarter postpaid phone ARPU, T-Mobile produced $47.99, compared to analysts’ forecasts of $46.64. Q2 prepaid phone service churn of 2.81% also came in favorably by staying at just 2.81%, compared to the 3.09% expected loss of existing customers by analysts. Postpaid phone churn ended up a bit higher at 0.80% than the 0.75% analysts forecast.

Chart courtesy of www.StockCharts.com

Paul Dykewicz interviews investment guru Bryan Perry at the Orlando MoneyShow.

Investors should keep in mind that Sprint Corporation and T-Mobile US merged on April 1, 2020, in a stock-swap deal valued at $26 billion. The merger, initially announced on April 29, 2018, required a nearly two-year approval process before T-Mobile emerged as the surviving brand.

Overall, the number of connected devices that can be used in a single household will rise significantly with 5G technology, compared to earlier generation 2G, 3G and 4G. Until 5G, the number of connected devices would be much more limited than it will be now when someone may be able to put more than two or three dozen internet of things (IoT) devices on a given home network.

COVID-19 Causes More than 20 Million Cases Globally and 5 Million in America

The economy and the stock market still are affected significantly by the COVID-19 crisis that has caused 20,292,486 cases and 741,126 deaths worldwide, with 5,141,208 cases and 164,537 deaths in the United States, as of Aug. 12. America has the most cases and deaths of any nation, including China, where COVID-19 originated.

The five 5G technology stocks to buy during a pullback are riding a big trend that only will accelerate in the next several years. With vaccines for COVID-19 expected to become available in 2021, these five 5G technology stocks that are starting to pull back could gain appeal for buyers currently on the sidelines but looking to ride the industry’s next leg back up.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)