Five semiconductor stocks to buy at the right valuations stand out as fast-growing companies that sometimes trade at higher prices than even their top fans might think they are worth.

Investment experts who follow the five semiconductor stocks that build products such as world-class computer chips for enabling advanced computing, graphics and visualization suggest that a recent retreat in their share prices may be a precursor to a further drop that could allow patient investors to buy them during a short-term dip. In hindsight, the best time to have purchased the semiconductor stocks in 2020 occurred during the market’s crash in March, but share prices rallied quickly within just weeks.

The technology-heavy NASDAQ 100 Index, consisting of the 100 largest publicly traded nonfinancial institutions, is 49% composed of six stocks: Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Google’s parent Alphabet (NYSE:GOOG), Facebook (NASDAQ:FB) and Tesla (NASDAQ:TSLA). Those same six stocks also account for 22% of the S&P 500’s value. Apple specifically is approaching the $467.77 per share it would need to reach a market capitalization of $2 trillion.

S&P 500 and NASDAQ Zoom to New Highs on Aug. 18

Those six stocks lifted the S&P 500 (SPX) to close at a record high on Tuesday, Aug. 18, for the first time since the COVID-19 pandemic slammed the United States. As the broadest index of Wall Street, the S&P 500 had been near an all-time high for days, and it attained one on Tuesday, Aug. 18, when it finished up 0.2% at 3389.78 to top its prior record of 3386.15 on Feb. 19.

The new high came just five months after its most recent trough to make the COVID-19 bear market the shortest in history. The NASDAQ Composite Index achieved a new record for the second consecutive day on Aug. 18 when it rose 0.73%, aided by Tesla soaring above $1,900 per share for the first time prior to finishing trading below that mark.

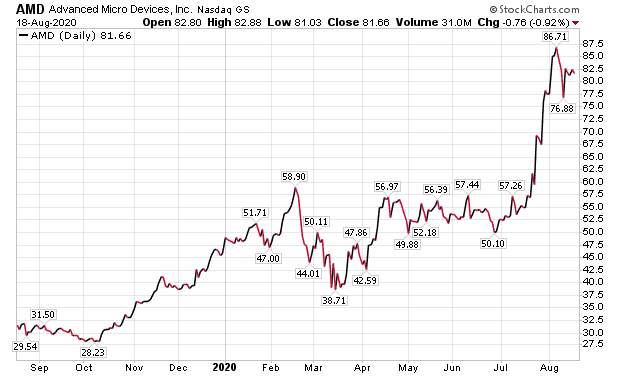

Advanced Micro Devices Joins Five Semiconductor Stocks to Buy at the Right Prices

Mark Skousen, PhD, a Presidential fellow at Chapman University, recommended computer chip maker Advanced Micro Devices, Inc. (NASDAQ: AMD), of Santa Clara, California, on May 12 in his TNT Trader service before it rose 47% prior to pulling back recently with other technology stocks. He advised the sale of the remaining half of his recommended October call options for a 317% gain. When combined with the sale of the first half of the options, the average return hit 226%.

Skousen, who also heads the Forecasts & Strategies investment newsletter and the Home Run Trader, Five Star Trader and Fast Money Alert advisory services, recently recommended the sale of Advanced Micro Devices stock for a three-month gain of 39.26% when he closed the trade Aug. 11.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz.

He also recommended the stock in 2018 to produce a profit of 55.53%, as well as a 351.64% average gain in the related call options. The stock does not pay a dividend and its price-to-earnings (P/E) ratio is a sky-high 158.74.

Chart Courtesy of www.StockCharts.com

Advanced Micro Devices, founded in 1969, has grown into a 10,000-employee behemoth that develops high-performance computing, graphics and visualization technologies that company officials describe as the “building blocks” for gaming, immersive platforms and data centers. One of its latest product rollouts is the AMD Radeon Pro 5000 series GPUs for the updated 27-inch iMac. A new graphics processing unit (GPU) powers a wide variety of graphically intensive applications and workloads, aiding creativity and productivity for both consumer and professional users, company officials said.

Bank of America set a $100 price objective on Advanced Micro Devices but also cautioned that it has downside risks. They include a sharp correction in its share price before a new rally, stiff competition from larger rivals, unsteady consumer and enterprise spending that may delay acceptance and success of new products, reliance on multiple manufacturing partners and the maturity of its current game console cycle.

Stock Picker Likes Four of Five Semiconductor Stocks to Buy at the Right Prices

“Like all things in life, no two semiconductor stocks are created equal,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. “Although tech has been a very crowded trade of late, the reason the smart money keeps flowing into tech is because that is where the growth can be found.”

Woods ranks semi stocks on the basis of their combined earnings growth history and relative price strength. He told me his favorite stocks in the segment are, in the following order, 1) NVDA, 2) AMD, 3) QCOM and 4) INTC.

“Investors looking to add money to semiconductors should concentrate on the two best performers in the segment, NVDA and AMD,” Woods said. “The two companies are leaders in their respective sub-segments of the chip space, and as such both represent the best of the best in those segments.”

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

Money Manager Kramer Expresses Caution about Semiconductor Stocks

“Unless you’re simply looking for a quick trading thrill, I would be wary of most of the chip stocks until we see a significant pullback,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and leader of the GameChangers and Value Authority advisory services. “This simply isn’t a great long-term entry point, especially when the global trade clouds that prevailed before the pandemic are still around.”

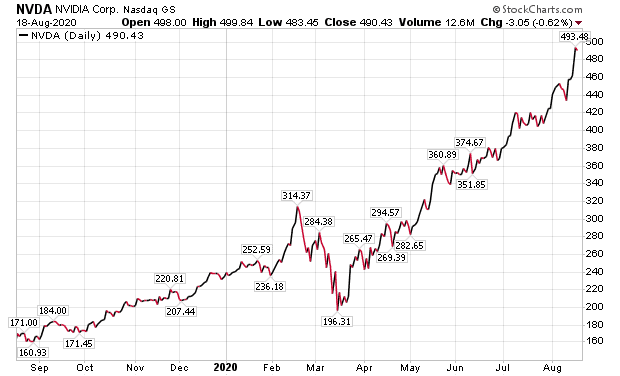

NVIDIA Inc. (NASDAQ:NVDA), of Santa Clara, California, is a “great company” but the stock seems more likely to fall below $300 than soar beyond $500 and stay there forever, Kramer said. Federal stimulus spending in the trillions of dollars is floating current stock valuations but the money will not “flow forever,” she added.

Chart Courtesy of www.StockCharts.com

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

Skousen recommended NVDA three times during 2019 and 2020 and produced a profit in each trade both in the stock and in the related call options that he chose. The biggest gain among those trades occurred in February 2020, when he closed out a call option recommendation for an average return of 124.54%.

Bank of America has a buy rating and a $520 price objective on NVDA. The valuation is at a premium to the sector and reflects NVIDIA’s superior long-term growth profile in large, underpenetrated markets, according to the investment firm.

“Our choice of multiple is in between NVDA’s historical 20x-45x P/E range,” according to a recent Bank of America research report. NVDA’s P/E ratio currently is 91.56 and it offers a tiny dividend yield of just 0.13%.

Qualcomm Gains Spot Among the Five Semiconductor Stocks to Buy at the Right Prices

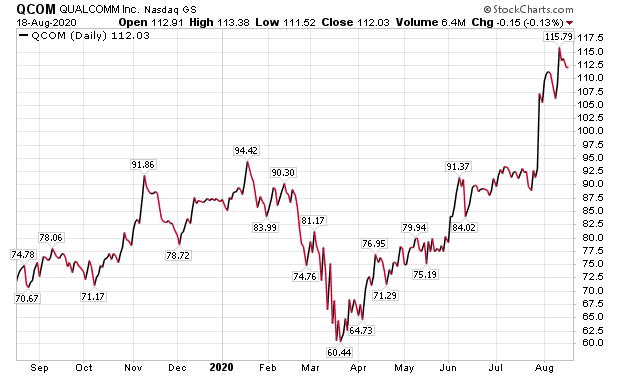

San Diego-based Qualcomm, Inc. (NASDAQ:QCOM), is a developer, designer and provider of digital telecommunications products and services. It specifically offers technology solutions for connected devices to unlock the speed and capability advances of 5G.

For now, investors with a long view can focus on names that are directly involved with the looming 5G boom. No matter who wins the November election, network buildout will be a priority, Kramer said. Qualcomm creates intellectual property, semiconductors and software and services related to wireless technology. It also has close to an ironclad grip on wireless antenna chips and is available now for half the earnings multiple as NVDA, she added.

The stock also currently pays a 2.6% yield, which isn’t fantastic but it’s a lot better than Treasury bonds while investors wait for a real growth spike in 2021, Kramer continued.

Chart Courtesy of www.StockCharts.com

Qualcomm’s P/E Ratio Is High Even for 5G Dividend-Paying Technology Stocks

The price-to-earnings ratio of 47.36 for Qualcomm is high, even by technology industry standards, so prospective investors may want to wait for a further price drop before buying the shares. Qualcomm’s total return of more than 70% during the last 12 months leaves room for a pullback with the rest of the high-flying technology sector, Kramer said.

On Aug. 5, Qualcomm announced that its latest premium tier Snapdragon 865 Plus 5G Mobile Platform would power Samsung Electronics Co., Ltd.’s newest flagship devices, including the Galaxy Note20 Ultra and Note20 in select regions, along with the Galaxy Z Fold2 and Galaxy Tab S7/S7+ globally. The Snapdragon 865 Plus is designed to deliver increased performance compared to the previous generation of technology for superior game playing, global 5G and “ultra-intuitive” artificial intelligence (AI).

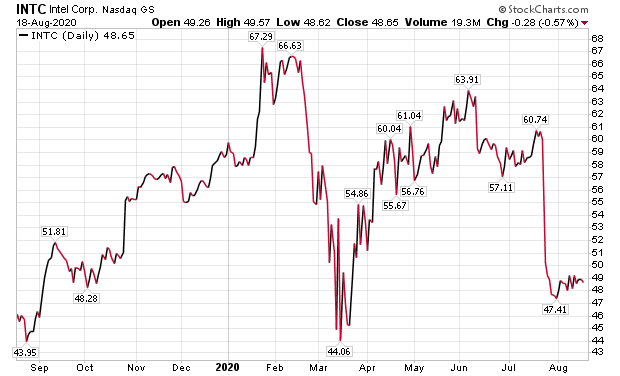

Intel Is Safe Pick in the Five Semiconductor Stocks to Buy at the Right Valuations

A more traditional hardware-oriented company like Intel Corp. (NASDAQ:INTC) just isn’t showing a new expansion is on the horizon for years to come. It has the highest dividend yield of 2.71% and the lowest valuation of the five semiconductor stocks with a price-to-earnings ratio of 8.95, but its share price is “barely crawling along,” Kramer said.

Intel Corporation, a giant global semiconductor company based in Santa Clara, California, supplies advanced technology solutions to the computing industry through semiconductors, microprocessors, chipsets and motherboards. Its CEO Bob Swan announced changes to the company’s technology organization and executive team on July 27 to boost product leadership while aiding focus and accountability in execution.

Chart Courtesy of www.StockCharts.com

Inspired by Moore’s Law, the principle that the speed and capability of computers should be expected to double about every 18-24 months due to increases in the number of transistors a microchip can contain, Intel seeks to advance the design and manufacturing of semiconductors to help address its customers’ greatest challenges. By embedding intelligence in the cloud, network and every kind of computing device, the company tries to unleash the potential of data to transform business and society, its officials said.

Bank of America issued a recent research report that noted the semiconductor industry has been driven for the past 50-plus years to build smaller, faster and lower-cost devices to gain higher volumes and revenues. Moore’s Law has been the essential element for predicting the industry. In 1965, Gordon Moore, Intel’s cofounder, observed that the number of transistors in an integrated circuit had doubled and associated costs had been cut in half approximately every 18 months.

Moore’s Law Drives Five Semiconductor Stocks to Buy at the Right Valuations

However, fulfilling the pace of technology advancement forecast in Moore’s Law has become challenging in recent years. This has been more evident for Intel than its rivals, according to Bank of America.

“Today, it costs approximately $10 billion to build and equip a leading edge wafer factory, or fab,” Bank of America continued. When Moore’s Law was initially introduced, node transitions occurred every 18 months. The pace of transitions then slowed to two years. More recently, in 2015 Intel extended the cadence of its node transitions to three years.”

Skousen produced profitable trades in Intel stock and call options in May 2012, June 2013 and January 2020. The highest return of 376.47% came in an Intel call options recommendation that Skousen closed in June 2013.

Intel also recently addressed the COVID-19 situation by donating $10 million for global relief efforts and pledging $50 million in a pandemic response technology initiative to combat the coronavirus through improved access to technology in patient care, speeding up scientific research and ensuring access to online learning for students and teachers.

Five Semiconductor Stocks to Buy at the Right Valuations Include Inphi

Paul Dykewicz interviews investment guru Bryan Perry at the Orlando MoneyShow.

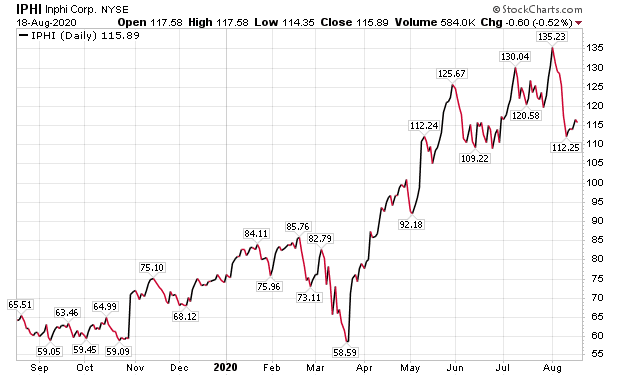

Inphi Corporation (NYSE: IPHI), a Santa Clara, California-based provider of high-speed data movement interconnects used in data centers is “flying big under the radar” of most investors, said Bryan Perry, who heads the Cash Machine, Premium Income, Quick Income Trader, Hi-Tech Trader and Breakout Profits Alert advisory services. Revenue in second-quarter 2020 hit a record $175.3 million, up 103.2%, compared with $86.3 million in second-quarter 2019. The increase came from higher demand for cloud and telecommunications products, as well as the inclusion of eSilicon revenues due to an acquisition that closed on January 10, 2020.

IPHI issued Q3 guidance of $0.83-$0.87 versus earnings per share (EPS) estimates of $0.68 and upped revenue guidance to $179-$182.5 million versus estimates of $155.88 million. The stock trades at $116 even as Bank of America raised its price target for IPHI to $150.

Chart courtesy of www.StockCharts.com

Next-generation data center technology to serve the launch of 5G is going to require the most advanced interconnection chips available, and they are made by Inphi, Perry said. The company reported a second-quarter operating loss of $4.3 million, marking big improvement from an operating loss of $14.2 million during the same quarter of 2019. The reduced operating loss mainly stemmed from increased gross profit, partly offset by higher operating expenses. As a money-losing stock, it does not have a P/E valuation. It does not pay a dividend.

SOX Can Identify Five Semiconductor Stocks to Buy at the Right Valuations

“The Philadelphia Semiconductor Index (SOX) historically is a good indicator of the path of the economy and the general market,” said Bob Carlson, who leads the Retirement Watch investment newsletter. “Since the market bottom in March, the SOX has outpaced the S&P 500 by a wide margin and really separated itself beginning in May.

“There have been a few brief periods when the SOX underperformed the broader market indexes, such as late July, but those have quickly reversed. Cautious investors should wait until the next period when the SOX lags the S&P 500 for a week or so before jumping into this sector.”

For the longer term, if the economy grows, semiconductor stocks should be “major beneficiaries,” Carlson concluded.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Growth in demand for enhanced computer chips will not wane despite COVID-19 infections that have caused 22,136,954 cases and 780,908 deaths globally, along with 5,482,416 cases and 171,821 lives lost in the United States, as of Aug. 19. America has the most cases and deaths of any country, including China, where COVID-19 first struck.

The five semiconductor stocks to buy at the right valuations show strong growth that should propel each of them in the years ahead. For patient investors who are willing to wait and watch for an inevitable technology pullback that could reduce the share prices of all or some of these stocks, the reward could cut the risk of taking a loss and enhance prospects for profitability.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.

![[networked computers]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_78687250.jpg)