(Note: second in a series on post-pandemic boom ETFs)

There are many possible investment strategies to use within a single market segment, including leisure and entertainment.

This exchange-traded fund (ETF), Invesco Dynamic Leisure and Entertainment ETF (PEJ), focuses on leisure and entertainment with a different strategy. Many funds tend to be composed of the largest companies in the industry that they track, leaving out lower market-cap stocks.

However, this fund is different. It holds entertainment stocks based on a combination of factors, including growth, valuation and timing. In practice, this has meant that it is not heavily weighted on the largest companies, but rather on other factors.

There are usually about 30 holdings in PEJ. Currently, its holdings are more weighted toward smaller public companies, compared to other ETFs.

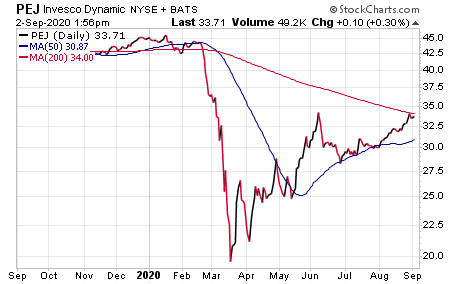

PEJ currently has $318 million in assets under management, making it a relatively small ETF. Its expense ratio of 0.63% is a bit pricey, but it offers a current dividend yield of 0.56%. As this industry has not fully recovered from the COVID-19 crash and shutdowns earlier this year, it is no surprise that PEJ is substantially down by 25.58% so far this year. However, it is up 11.39% in the last month, so hope exists.

Chart courtesy of StockCharts.com

In terms of leisure and entertainment subindustries, the largest allocation is to restaurants and bars. Other strongly featured themes in this ETF include broadcasting, leisure & recreation and entertainment production.

PEJ has nearly half of its assets in its top 10 holdings. These include Chipotle Mexican Grill, Inc. (CMG), 5.90%; ViacomCBS Inc. (VIAC), 5.89%; Yum China Holdings, Inc. (YUMC), 5.83%; The Walt Disney Company (DIS), 5.06%; and Hilton Worldwide Holdings, Inc. (HLT), 5.02%.

For investors who are looking to invest in a differently determined basket of leisure and entertainment stocks, the smaller and growing companies represented in Invesco Dynamic Leisure and Entertainment ETF (PEJ) may provide an interesting investment thesis, along with potential profits.

Remember, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.