(Note: third in a series on post-pandemic boom ETFs)

The SPDR S&P Bank ETF (NYSEARCA: KBE) tracks an equal-weighted index of U.S. banking firms of various sizes.

The exchange-traded fund (ETF) tracks the S&P Banks Select Industry Index. It seeks to provide exposure to the bank segment of the S&P TMI, which is comprised of the following sub-industries: asset management & custody banks, diversified banks, regional banks, other diversified financial services and thrifts & mortgage finance sub-industries.

KBE is designed to track a modified equal-weighted index which provides the potential for unconcentrated industry exposure across large-, mid- and small-cap stocks. It allows investors to take strategic or tactical positions at a more targeted level than traditional sector-based investing.

Heavily weighted in banks at 87.74%, the fund also has a significant stake, 5.6%, in property & casualty insurance, and 4.95% in investment management & fund operators. KBE’s top five holdings include SVB Financial Group (NASDAQ: SIVB), 1.99%; MGIC Investment Corporation (NYSE: MTG), 1.72%; First Republic Bank (NYSE: FRC), 1.71%; Bank of America Corp. (NYSE: BAC), 1.71%; and Voya Financial, Inc. (NYSE: VOYA), 1.69%.

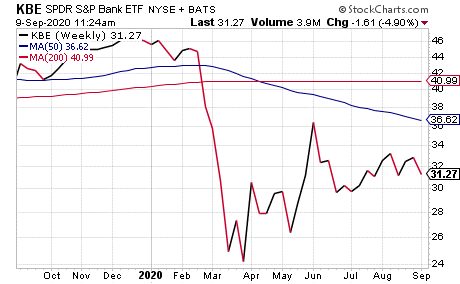

Chart Courtesy of StockCharts.com

The fund’s share price currently trades around $41.50. It has $1.2 billion in assets under management, 86 holdings and an impressive 3.16% dividend yield. It has an average spread of 0.3% and an expense ratio of 0.35%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

To sum up, the popular ETF tracks an equal-weighted index of U.S. banking stocks. Equal weighting puts big-name banks on equal footing with smaller ones and increases the emphasis on smaller firms on the whole. KBE fills a niche by providing exposure to a broad selection of banks in an equal-weighted wrapper. Overall, costs are low, too. KBE is tremendously liquid, charges a competitive fee and tracks its index well. However, I urge any interested investors to exercise their own due diligence in deciding whether this fund fits their individual portfolio goals.

Remember, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.