To put it mildly, the overall performance of real estate investment trusts (REITs) this year has been less than stellar.

So far, in 2020, the overall sector has lost 13.6%, which is considerable, especially when we take into account that the S&P 500’s loss for the same period was just 5%. When REITs are aggregated by sector, the losses are even more startling.

Not surprisingly, the REITs that have done the worst are in the industries that were the hardest hit by the COVID-19 pandemic. Shopping malls, hotels, office buildings and others such services were forced to close, and the inflow of money in the form of rent payments began to slowly dry up.

Other REITs, such as technology, or ones that do not depend on human-to-human contact, have done much better. For instance, tech-oriented REITs in the S&P 500 have, on average, produced a return of 11% over the past year. Similarly, the Federal Reserve’s decision to cut interest rates to zero for the considerable future is another positive signal for at least part of the sector.

Thus, while the recent step backward in the REIT market can be seen as an opening for investors, it is crucial that real-estate-focused investors sail into the sheltered harbor of less-risky REITs to decrease the possibility of being dashed against the shore of the weaker parts of this sector.

Thankfully, an exchange-traded fund (ETF) called the iShares Residential Real Estate Capped ETF (NYSEARCA: REZ) tracks a market-cap-weighted index of U.S. residential, health care and self-storage REITs. At the same time, despite the “residential” label in this ETF’s name, a great deal of its portfolio falls outside this moniker. Indeed, much of the portfolio is composed of self-storage, health care and senior care companies.

Some of this fund’s top holdings include Public Storage (NYSE:PSA), Welltower, Inc. (NYSE: WELL), AvalonBay Communities, Inc. (NYSE: AVB), Equity Residential (NYSE: EQR), Ventas, Inc. (NYSE: VTR), Sun Communities, Inc. (NYSE: SUI), Extra Space Storage Inc. (NYSE:EXR) and Invitation Homes Inc. (NYSE: INVH).

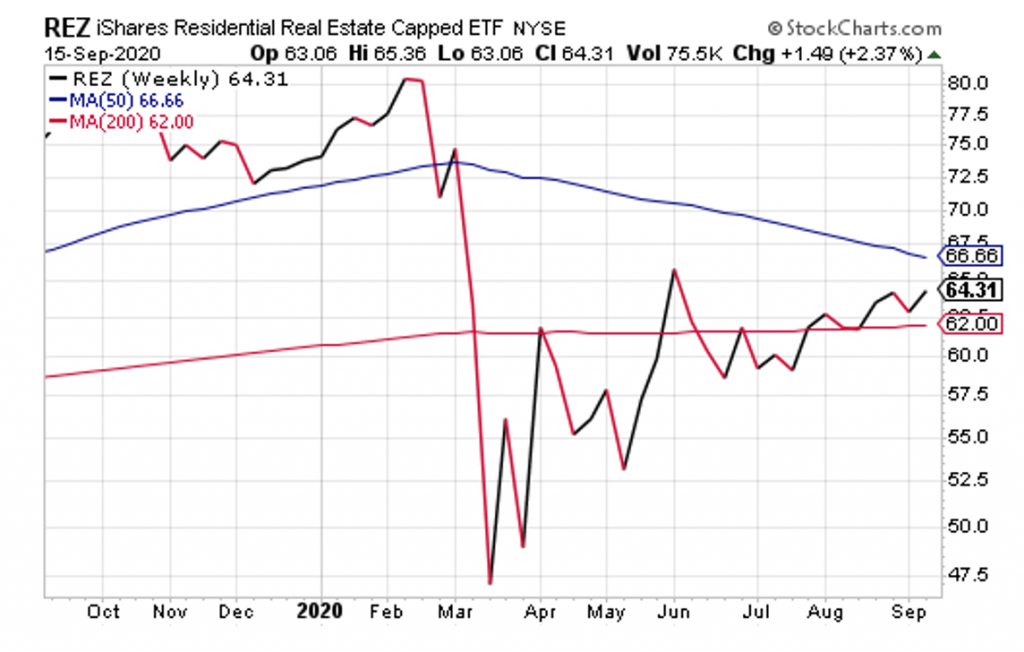

This fund’s performance has begun to recover after falling due to the ongoing COVID-19 pandemic. As of Sept. 11, REZ has been up 1% over the past month and 4.28% for the past three months. As of Sept. 15, it is currently is down 18.85% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $379.65 million in assets under management and has an expense ratio of 0.48%. Income investors should like its current dividend yield of 3.30%.

In short, while REZ does provide an investor with a chance to tap into American real estate, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)