(Note: second in a series on hedged-equity, low-volatility ETFs)

The DeltaShares S&P 400 Managed Risk ETF (DMRM) seeks to track the investment results, before fees and expenses, of the S&P 400 Managed Risk 2.0 Index.

This exchange-traded fund (ETF), created on July 31, 2017, has amassed $87.52 million in total assets by offering investors exposure to mid-sized U.S. companies. DMRM is intended to satisfy investor demand for mid-cap equity exposure during rising markets, while using risk management strategies aimed at limiting losses amid sustained market declines.

In addition, DMRM was created to help construct increasingly efficient portfolios that can complement U.S. mid-cap equity positions. With 404 holdings, the fund offers plenty of diversification to reduce risk.

The holdings of DMRM currently are 60.17% invested in Treasury instruments, accounting for $51.85 million. The next four largest positions, their percentage share and their asset value in the fund are: Pool Corp. (NASDAQ:POOL), 0.32%, $274,987.98; FactSet Research Systems Inc. (NYSE:FDS), 0.31%, $265,164.24; Fair Isaac Corp. (NYSE:FICO), 0.30%, $258,889.26 and Trimble Inc. (NASDAQ:TRMB), 0.30%, $255,655.92.

DMRM has a net expense ratio of 0.45, and its primary benchmark is the S&P MidCap 400. The fund also has offered a yield of 0.98% during the past 12 months with quarterly dividend payments. The ETF’s investment manager is Transamerica Asset Management, Inc., and its sub-adviser is Milliman Financial Risk Management LLC (Milliman).

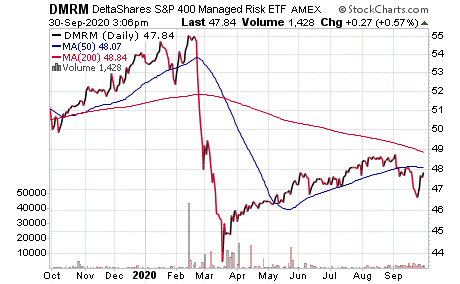

Chart Courtesy of www.stockcharts.com

As for total returns, DMRM is up 1.24% for the past week and down 1.66% for the last month. It further eked out a 0.72% gain in the past three months, following losses of 11.91% for the year-to-date and 6.62% for the one-year time periods.

As usual, I encourage you to conduct your own research to consider whether this fund warrants a place in your personal portfolio. Each investor should consider his or her own goals and risk tolerance before making an investment.

In closing, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.