“The outlook for stocks, gold and the dollar is positive as we enter 2020 but beware of a ‘black swan’ event that could derail the longest-running bull market in history.” — January 2020 prediction in Forecasts & Strategies.

My prediction of a “black swan” event has generated a lot of interest by investors and the media this year. It turns out that there may be more than just one “black swan” event, aside from the pandemic that doesn’t want to go away. It’s like malaria. It keeps coming back.

Herd immunity may be our only choice since a vaccine is still waiting to be developed (scientists still haven’t found one for SARS or HIV).

Certainly, the government’s decision to lock down the economy has not helped matters, causing us to collapse into the worst depression since the 1930s. Only a massive injection of easy money and big spending in Washington has postponed the day of reckoning.

Another Potential Black Swan: Radical Democrats Take Over

Now there’s another black swan on the horizon: a regime change that could be a disaster for the country. According to the polls and election betting odds, the election still favors the Democrats to take over the presidency and both houses of Congress.

Is This the Fourth Turning?

Back in 1997, a popular book came out predicting a major crisis in the United States. It was called “The Fourth Turning.” The authors, William Straus and Neil Howe, said that history roughly repeats itself every 80 years, and those 80 years can be divided into four turning points.

The four cycles are: First, the “high” period of 1946-1964; second, the “awakening” of 1964-1984; third, the “unraveling” of 1984-2004; and fourth, the “crisis” stage of 2005-2025.

Like in all prediction books, the authors missed their mark by forecasting 2005 as the “crisis” year.

The crisis year didn’t come until 2008. I’m not a big fan of cycle theories and forecasts that specify the actual year of a crisis. I collect copies of doom-and-gloom books and on my bookshelf, I have titles like “The Depression of 1990” by Ravi Batra, and “Bankruptcy 1995” by Harry Figgie. Neither one proved accurate.

And neither did the authors of “The Fourth Turning,” who have long been forgotten.

A Watershed Year

But 2020 may be a watershed year, like 2001 (9/11 terrorist attacks). Permanent changes in our culture and the markets are happening, and it’s a bit scary.

I started my career as a financial advisor and newsletter writer in the 1970s when the economy was topsy turvy. Government policy led to double-digit inflation and double-digit interest rates. Price and wage controls led to shortages of major goods, including food and oil. Traditional investments, like stocks and bonds suffered, but those who transferred their wealth into inflation hedges like gold and silver, real estate and foreign currencies weathered the storm and profited nicely.

In 1987, the stock market collapsed again, but my subscribers were prepared.

Time to Act!

The sharp selloff in all assets — stocks, bonds, gold, oil and real estate investment trusts — may be the writing on the wall to prepare yourself for the Great Suppression under the Democrats.

On Friday and Saturday, Nov. 6-7, a few days after the election, I am holding an “off-the-record” private meeting at an undisclosed location in Las Vegas for a select number of investors and concerned citizens.

No recordings will be allowed. No press will be allowed.

I GUARANTEE, IT WILL BE WORTH YOUR WHILE TO ATTEND.

I know many of you are worried about travel restrictions and government regulations, but you will not regret your decision to join us next week after the elections.

This two-day summit will NOT be a government-approved “virtual” meeting.

Our Post-Election Summit is sponsored by FreedomFest and the Investment Club of America.

It will take place “in-person” at an undisclosed location in Las Vegas. After you register, you will be given the name and address of the hotel. We have made exclusive arrangements with this first-class hotel for only $99 a night, plus tax. There is no resort fee, and there will be free parking.

Why is this affair so private?

Because our First Amendment rights are being abridged by power-hungry politicians, and we need to maintain a low profile in an era of big government.

Because our government is out of control, and it can only get worse. We saw how they mismanaged the coronavirus scare — imagine what will happen when a severe pandemic or war hits the United States.

Why a secret meeting? We want to be free to discuss and disclose confidential information about the future of our nation, our wealth and our freedoms following this all-important election, without worrying about government surveillance and regulations.

However, we are limited in the number of people who can attend. So, if you want to join us, now is the time to act. Airfares are still cheap if you wish to fly in and out of Vegas. Others are driving.

We live in dangerous times, in which our freedoms and wealth are threatened as never before. The November 2020 election has become the most important election of the 21st century due to the stark differences between the two parties. President Trump and the Republicans are struggling to maintain power in the face of a never-ending pandemic. Their policies of tax cuts, deregulation and appointing conservative justices could be overturned soon.

As it stands today, the election betting odds still favor the Democrats. If the Biden/Harris ticket wins and the Democrats take over the House and the Senate, what will this mean for investors, entrepreneurs and the citizens of America? Will the stock market crash and gold soar? What changes will you need to make to ensure your wealth and wellbeing?

Will you be prepared for what is going to hit us in 2021?

Biden & Harris have promised massive tax increases on wealthy entrepreneurs, elimination of the long-term capital gains ‘break’ on stocks, bonds, gold, silver and real estate (with tax rates exceeding 50%). They have also promised socialistic programs like Medicare for All, free college tuition, a New Green Deal, a wealth tax, severe limitations on free speech, a new Supreme Court, all on top of out-of-control government spending. The Great Suppression has begun!

That’s why we are holding this Post-Election Summit. It is critical to your pocketbook and your way of life.

And to help make sense of it all, we have brought together some of the world’s top experts to discuss the outcome of the November elections. What will it mean in terms of our citizens’ rights to speak out, to run our businesses, to invest, to travel, to assemble and to be left alone?

Will our freedoms and standard of living be curtailed due to new government policies? Will our wealth come under attack with new taxes, inflation and regulation? Will tech and gold continue to be the favorite stocks after the November elections?

We have brought out the best and the brightest analysts in finance, economics and politics to provide their analysis and answer your questions, all in a private setting where you can speak your mind.

The price for this two-day event is $299. There are no discounts. To learn more about the conference and to register, go to https://globalfinancialsummit.co/.

After you register, you will be given the name and location of the Las Vegas hotel, and you then can reserve your room and make your travel arrangements.

Our Confirmed Speakers for This Private Meeting are:

I will speak on “The New Threats to Your Wealth in 2021.” I will analyze the impact of the November elections on the economy, the dollar, taxes and your wealth. I will give specific recommendations — what to buy, what to sell and what to expect in the next year for stocks, bonds, the dollar, real estate and commodities.

Jo Ann Skousen, associate editor of Forecasts & Strategies and director of the Anthem Film Festival, will discuss her greatest concerns for the future — the protection of the twin pillars of freedom.

John Fund, senior editor of National Review, is the nation’s foremost authority on politics, voter fraud and corruption in high places. He will assess the good, the bad and the ugly coming out of the November elections, and where we are headed in the next four years. And he will give you an up-to-date insider report on the Hunter Biden Affair.

NEW! Craig Huey, president of Creative Direct Marketing, will speak on “The New Political Reality: 12 Surprising Post-election Changes Impacting our Culture, our Economy and the Next Election.”

Our top financial gurus include:

Jim Woods, known as the Renaissance Man, the #1 financial blogger in the world according to Tip Ranks, and co-editor of Fast Money Alert with me, will discuss his favorite investment strategies for 2021.

Hilary Kramer, editor of the popular 2-Day Trader, a radio talk show host and a graduate of the MBA program at the Wharton School of the University of Pennsylvania, will discuss how the November elections will be a “GameChanger” (the title of her most popular book that was #1 on Amazon this year and was also on the Wall Street Journal bestseller list).

Bryan Perry, editor of the prestigious Cash Machine advisory service, will offer his best post-election investment choices in high tech and high-income.

Adrian Day, founder of Adrian Day Asset Management and the world’s top authority on global investing and mining stocks, will offer specific advice on the outlook for global investing, the dollar and commodities, with specific recommendations from blue-chip miners to penny stocks that are likely to double or triple in the coming year.

NEW! David T. Phillips, the world’s top expert on taxes and estate planning, will join us to discuss the future of your estate and wealth-building strategies under the next president. If it’s Biden, watch out — expect major tax increases and new ways to avoid them.

Barbara Kolm, Vice President of the Central Bank of Austria, is coming all the way from Europe to give us an update on the future of the euro and the European Union, and the outlook for the dollar –the world’s currency.

Time is short, and now is the time to act if you wish to be part of this historic gathering. Attendance is strictly limited, so sign up today at https://globalfinancialsummit.co/.

Hope to see you next week. It will feel good to get out and be free again!

Yours for peace, prosperity and liberty, AEIOU,

Mark Skousen

You Nailed it!

GDP Recovers Sharply, Just as GO Predicted

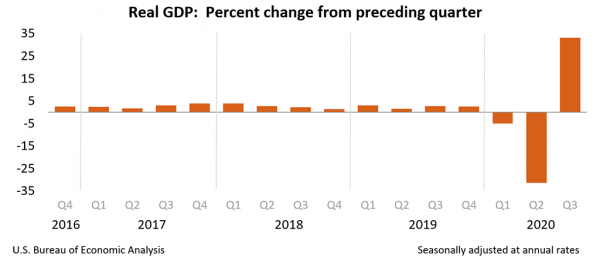

Today, the Federal Government’s Bureau of Economic Analysis (BEA) released the first estimate of third-quarter GDP. It blew away estimates, rising 7.4% in real terms (33.1% annualized) — see chart below.

Real GDP declined 9% in the second quarter, so the economy has still not fully recovered from the government-imposed lockdown. I would not call this a V-shaped recovery. Unemployment is still too high, and far too many businesses, including restaurants, travel and cruises, have been severely damaged by the imperial orders of governors in their attempt to slow down the coronavirus.

Earlier this month I reported in my Wall Street Journal article (Oct. 3) that my Gross Output (GO) statistic for the second quarter suggested that the recovery would be quick. To read the article, click here.

Based on GO matching the performance of gross domestic product (GDP), I suggested that the economy is more resilient and robust than we thought.

Reporters once again focused on consumer spending as the key to the recovery. For example, Yahoo Finance reporter Emily McCormick wrote today, “The advance came primarily from strength in personal consumption, which comprises about two-thirds of domestic economic activity.”

Like most reporters, she is under the impression that GDP is a complete measure of total spending in the economy. It’s isn’t, because it leaves out all the business-to-business (B2B) spending in the supply chain. GO is a much better, more comprehensive measure of domestic economic activity. Using GO, consumption is only around a third of total economic activity. GO includes the value of the supply chain. It turns out that business spending is over 60% of total spending in the economy. Consumption is the effect, not the cause of prosperity (according to Say’s law).

But like a bad penny, the idea that “consumer spending drives the economy” never seems to go away.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)