Investment entrepreneurs predict profitability for funds that are focused on rapidly growing digitalization throughout the world.

Kevin O’Leary, a wealthy investor on the “Shark Tank” television show and chairman of Boston’s O’Shares Investments, highlighted reasons why the digitalization trend is still in its early stages. Another investment firm leader, Frank Holmes, chief executive officer and chief information officer of San Antonio, Texas-based U.S. Global Investors (Nasdaq:GROW), spoke positively about technology companies that are gaining increased revenues by providing services on the cloud.

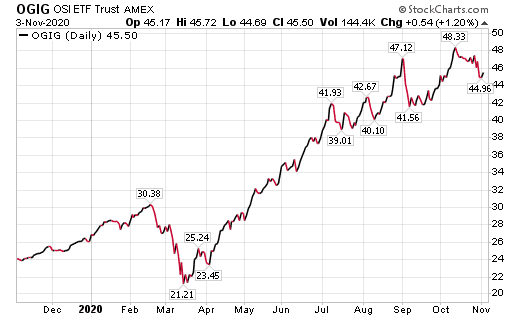

O’Leary called O’Shares Global Internet Giants ETF (NYSE ARCA:OGIG) the “best-performing asset” at the fund company, with jumps of 8.18% in the past three months, 74.29% so far this year and 89.33% in the last 12 months, compared to pandemic-plagued US Global Jets ETF (NYSE ARCA:JETS) gaining 11.21% in the past three months but losing 45.21% so far in 2020 and 44.17% in the last 12 months. Two holdings in OGIG that are fueled by the digitalization growth are online retailer Shopify (NYSE:SHOP), of Ottawa, Canada, offering an e-commerce platform primarily for small and mid-size businesses, and Zoom Video Communications, Inc. (NASDAQ:ZM), a video conferencing company headquartered in San Jose, California.

Chart courtesy of www.stockcharts.com

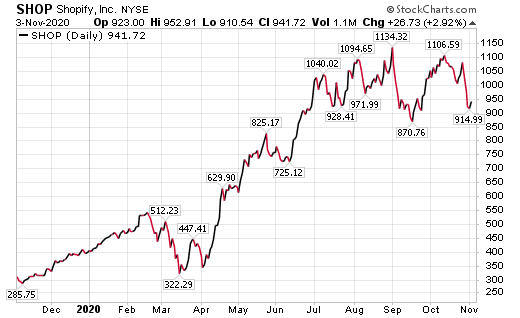

Chart courtesy of www.stockcharts.com

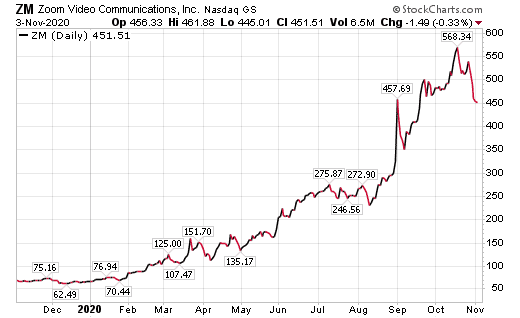

Chart courtesy of www.stockcharts.com

Investment Entrepreneurs Predict Profitability Fueled by OGIG’s Fast-Growing Holdings

OGIG’s growth has come on the strength the digitalization of companies, largely in America, to collect data, identify trends and use the information to help leaders make wise business decisions. The exchange-traded fund’s (ETF) top five positions, as of Nov. 2, were Alibaba Group Holding Ltd. (NYSE:BABA), Amazon.com Inc. (NASDAQ:AMZN), Tencent Holdings Ltd. (OTC:TCEHY), Alphabet Inc. (NASDAQ:GOOG) and Facebook Inc. (NASDAQ:FB).

Zoom, the eighth-biggest holding in OGIG, is a fast-growing, mid-capitalization stock that designs, produces and provides broadband services to facilitate video conferences and meetings that have proliferated during the COVID-19 pandemic, O’Leary said during a podcast with Holmes and O’Shares Chief Executive Officer and President Connor O’Brien. Zoom Video Communications provides a go-to digitalization tool that many people now use to avoid travel and the risk of in-person meetings amid the global pandemic.

Paul Dykewicz meets with Kevin O’Leary for a far-ranging interview before COVID-19 social distancing.

Investment Entrepreneurs Predict Profitability with Zoom in Mind

Digitalization tools, such as those offered by OGIG companies, will allow businesses to save roughly 12% on retail office space and reduce work-related travel expenses, O’Leary said. His calculations show that the trend will add 3% cash flow to reach 18% pre-tax, up from 15%, among the 50 businesses that he owns in whole or in part.

OGIG features all the top technology stocks, not only domestically but globally, that “power the digitalization” of the global economy, O’Leary said. All of a sudden, the whole world faced lockdowns due to COVID-19 and brick-and-mortar retail “gets shut down,” O’Leary added.

The struggles not only occurred domestically but internationally in Europe, Asia, Latin America, Canada and Mexico, O’Leary said. The only way for large and small businesses to survive required using digitalization, he continued.

Investment Entrepreneurs Predict Profitability by Following Technology Companies

The key for many businesses to transform their way of operating in an economic crisis was to use the digitalization tools of the 70-plus companies that are growing at 20%, 30%, 40%, 50% and 60% a year, O’Leary said. The growth is “phenomenal,” and aiding the entire global economy, he added.

In assessing his personal portfolio of the more than 50 small companies that are in America, O’Leary said they are licensing with Shopify, San Francisco-based DocuSign (NASDAQ:DOCU), a provider of eSignature services to let users use electronically on various devices. and JD.com NASDAQ:JD), an ecommerce company based in Beijing, China.

“Just to give you an idea of the power of these companies, Zoom became the tool by which many small businesses and people at home began to use to communicate,” O’Leary said. “That’s not going to go away.”

Investment Entrepreneurs Predict Profitability with Tech Stocks Helping People Work at Home

The reason why that change is not going away with an expected COVID-19 vaccine is that a typical portfolio of small American businesses that are optimized make 15% pre-tax, O’Leary said. With the tools of the OGIG companies, add in savings of about 12% with 15% of a company’s employees remaining at home after offices reopen to use tools like Zoom, DocuSign and everything else, O’Leary added.

“And we’re going to be cutting back on our business travel” by around 20% during the next two years, with more traffic shifting to leisure travel, O’Leary said.

“That is one of the reasons the S&P is so buoyant, even in these volatile times,” O’Leary said. “There is a new digital America emerging. “

The result is companies that are more productive, while achieving higher gross margins and faster growth as they become increasingly efficient from using the digitalization tools, O’Leary said.

Sales Growth and Balance Sheet Metrics Help Investment Entrepreneurs Predict Profitability

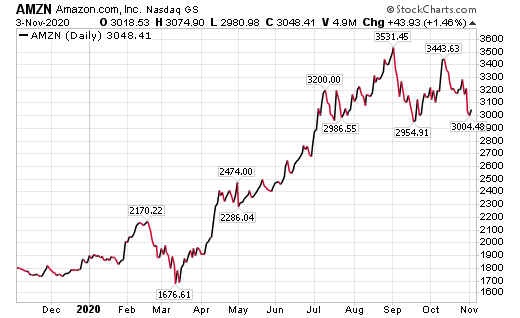

People used to say that they could not justify buying Amazon because its price-to-earnings (P/E) ratio was high enough for some investors to call it “ridiculous,” O’Leary said.

“Had you not bought it 10, 11 or 12 years ago, you missed out on one of the most incredible creations of wealth in history,” O’Leary said.

Chart courtesy of www.stockchart.com

Technology stocks like Zoom, DocuSign, Amazon and Facebook require that investors look at the underlying sales growth and the quality of their balance sheets, O’Leary said. OGIG does that analysis, he added.

Mid-sized, Fast-Growing Tech Companies Shine as Investment Entrepreneurs Predict Profitability

Amazon’s growth is “fantastic,” but investors also should check out the growth of Alibaba and JD.com, O’Leary said.

“They are companies growing even faster than the domestic FANGs, and that ends up being the determination of how these companies end up performing over time,” O’Leary said.

O’Leary said his son is enamored with OGIG’s big rise so far this and keeps “reminding me,” the father said.

“He doesn’t want to buy anything else,” O’Leary continued. “I have to really push him to diversify… he loves OGIG because he is a millennial. He understands all the names. He is an engineer. He totally gets the joke. Now he thinks everything goes up 70% a year. That’s the bad part. But the truth is we are in the third inning of digitization.

“You look at the performance of these incredible companies during the downturn [lately] and they have outperformed the S&P,” O’Leary said. “Zoom should be getting crushed but it is not because it has become the backbone of digitization.”

Microsoft Helps Investment Entrepreneurs Predict Profitability

Microsoft Corporation (NASDAQ:MSFT) is the “only stock in the world” that is found in dividend and growth strategies, O’Leary said. The stock offers a current dividend yield of 1.11%.

“It has pivoted to become an online behemoth,” O’Leary said. “It provides tremendous value in gaming as well. We own it in both OUSA and OGIG.”

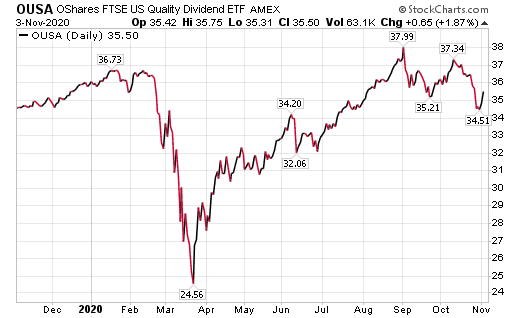

OUSE is O’Shares FTSE US Quality Dividend ETF and focuses on high quality, large-cap dividend-paying and dividend-growing stocks, without oil and without real estate investment trusts (REITs), O’Brien said. The strategy keeps energy and REITs, which have “really been struggling,” from pulling down the performance of the fund, O’Brien said.

“For Kevin’s family wealth, OUSA is a cornerstone of the portfolio,” O’Brien said.

Chart courtesy of www.stockcharts.com

Investment Entrepreneurs Predict Profitability by Riding the Fastest-Growing Tech Stocks

OGIG is up more than the big technology giants because it also owns even faster-growing mid-sized tech companies such as Zoom and Shopify, O’Brien said.

The increased use and acceptance of artificial intelligence has contributed to the rapid growth, after the technology stayed in a virtual “winter” for more than a decade, Holmes said.

“The growth of cloud has basically unleashed this animal,” said Holmes, whose US Global Investors pays a dividend yield of 1.17%.

Investment Entrepreneurs Predict Profitability and Watch Shopify Shine

The growth rate of some companies in OGIG is at 25% and others are climbing as high as 60%, O’Leary said. One of the standouts is Shopify, he added.

The mid-capitalization stock recently reported “spectacular” quarterly results and it now has 1 million businesses selling on its platform, O’Leary said. Such online retail sales platforms are growing so quickly because they are not just a domestic opportunity but a “global phenomenon,” O’Leary continued.

“As an investor, it behooves you to find all of the major players in every market as the entire globe digitizes,” O’Leary said. “My guess in the next 36 months is that the global economy is going to have a significant increase in productivity because of digitization, including the S&P 500. Every single company is examining its basic costs that can be changed through digitization.”

Prominent Investment Entrepreneurs Predict Profitability Based on Digital-Driven Sales

Holmes said the first mover advantage of any front-running business helps in capturing revenue. These companies have phenomenal revenue growth, so money flows in quickly due to the use of innovative technology, he explained.

“When I look at my own tear sheets of the 50-plus private companies that I am an investor in, either in debt or equity, our No. 1 spend is digital now,” O’Leary said.

In the current quarter, 81% of advertising by the companies in that portfolio in the United States is going to Facebook and Instagram, O’Leary said. He acknowledged writing “massive checks” and trying to consolidate digital buys to get reduced pricing from Facebook, etc., and try to cut customer acquisition costs.

A couple of years ago, O’Leary said he realized when writing checks to those companies that he should own shares in them to profit from their businesses.

“That was the genesis of OGIG,” O’Leary said. He then recalled having a conservation with O’Brien and suggesting they create a fund that could profit from the digitalization trend.

“Find me every company that is growing over 25%,” O’Leary said. “I want to own it.”

O’Leary Shifts His Family’s Portfolio to 70% Equities and 30% Fixed Income from Even Split

To manage family wealth, O’Leary made a major shift in his family wealth in the past year.

“In our operating company and our family trust, we used to be 50-50 between equities and fixed income,” O’Leary said. “This is the first time in over a decade that we shifted to 70% equities and 30% fixed income.”

One reason is that a review of BBB debt and above showed companies now are raising funds by issuing commercial paper for five years’ duration and just 50, 60 or 70 basis points, equaling 0.50%, 0.60% and 0.70%, respectively, O’Leary said.

“That is under 1%,” O’Leary said. “Why would I want to own that when I could buy the equity and get a 1.7-2% in a dividend yield in a trust or an operating company?”

“Frankly, if I buy the bond, I don’t have any protection against inflation,” O’Leary said. “I like pricing power. During inflationary times, equities tend to outperform inflation. That’s my thinking. We’ve really made that major shift for the first time ever. And we’re getting long in high quality equities likes OUSA and OGIG.”

Election Investing Strategy for Holmes Features Gold

“I’m not going to vote red,” Holmes said. “I’m not going to vote blue. I’m going to vote gold. Gold has done exceptionally well for the last 20 years and I think that is going to continue.”

Holmes said he has cut way back on tax-free bonds and increased exposure to equities and technology-based companies.

OGIG should do well regardless of who is elected president, O’Leary opined.

“Even if [Joe] Biden becomes president, his job will be to get unemployment from 8.5% to 5% and it will probably take 36 months,” O’Leary said. “He’s of the age where he won’t be doing a second term. He’s going to have a benign presidency.”

Green Deal May Be Too Politically Damaging for a President to Support

The gigantic green deal frequently discussed by the most liberal Democrats in Congress would cost 3 million jobs in America, O’Leary said. There would be political consequences to pursuing it, he added.

A key reason why the presidential election may end up really close and contested is Biden’s acknowledgement in his last debate with President Trump that he plans to transition away from oil as an energy source, O’Leary said.

“It has hurt him in Texas, Pennsylvania and any other state that is based on oil, gas and hydrocarbon infrastructure,” O’Leary said. “That, in my view, may be the reason this is a surprise outcome to everybody.”

Pension Fund Chairman Also Likes Ecommerce Stocks

“I’m positive about the internet and ecommerce stocks,” said Bob Carlson, head of the Retirement Watch investment newsletter and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “Politicians are trying to scare people out of the stocks with threats of antitrust and other charges. It isn’t working because the companies are successful due to innovation and smart moves. Also, even if the cases do go forward, it will be many years before there’s a resolution. The economy, markets, and these companies will change a lot during that time.

“One factor I like about OGIG is that it is global. Too many investors focus on the U.S. big five, or FAANG stocks. They’re missing out on strong gains in Alibaba, Tencent, and more. The internet and ecommerce are global, and there are strong innovators around the world. U.S.-centric investors shortchange themselves by not expanding their portfolios to the rest of the world.”

Bob Carlson answers questions from columnist and author Paul Dykewicz.

New York Money Manager and Radio Host Favors Ecommerce, Too

“Internet stocks have always gone up over the long term, so portfolios like OGIG will ultimately make patient investors happy, said Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services. “However, Big Tech might test that patience in the coming months. Earnings were good enough. These stocks have proved that they can withstand everything the pandemic threw at them and didn’t even flinch. But Wall Street wanted even more… and since we didn’t get it, it’s going to be at least another quarter until Big Tech gets its groove back.

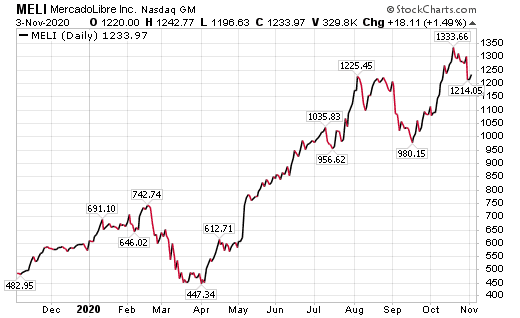

“It reminds me of October 2018, when Amazon.com Inc. (NASDAQ:AMZN) and Apple Inc. (NASDAQ:AAPL) warned that their business was slowing, triggering a three-month correction in the process. While it stung in the short term, those who hung on have done extremely well over the last two years. And I’ve always loved a lot of Kevin O’Leary’s stocks. My Inner Circle was in MercadoLibre Inc. (NASDAQ:MELI) at $77, AMZN and Alphabet Inc. (NASDAQ:GOOG) under $600.

Chart Courtesy of www.stockcharts.com

“Those have been extraordinary investments that get better every year,” Kramer said.

Paul Dykewicz interviews money manager Hilary Kramer before COVID-19.

Woods Offers His Market Analysis

“If we get a COVID-19 vaccine that is widely adopted and that is effective at curbing the spread of the virus, then one of the biggest beneficiaries will be the travel industry,” said Jim Woods, who heads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader advisory service.

Woods predicts the biggest moves in the market on substantively positive vaccine news would be in the sectors that have been hardest hit from COVID-19, and those sectors revolve around consumer and consumer spending. More specifically, industries such as cruise lines, hotels, travel booking sites, movie theatres, car rental companies, theme parks and, of course, airlines will be big vaccine winners, and that means the airline stocks in the ETF JETS, he added.

Paul Dykewicz meets with investment guru Jim Woods before the COVID-19 crisis.

The COVID-19 pandemic has caused massive economic fallout and forced deep job cuts. COVID-19 has led to 9,379,580 cases and 232,553 deaths in the United States, with 47,328,401 cases and 1,211,844 deaths worldwide, as of Nov. 3, according to Johns Hopkins University. America has endured the most cases and deaths of any country in the world, not even sparing President Donald Trump, who was hospitalized Friday, Oct. 2, until Monday, Oct. 5, after he contracted the virus.

The technology sector’s recent pullback could be considered a buying opportunity for investors who hoped to buy at reduced share prices after many elite companies in that industry soared. Savvy investors who seek to profit from the fast-growing technology stocks that are pursuing digitalization strategies may find buying shares in a fund like OGIG a good way to gain some diversification within that industry without the risk of buying single stocks that could fall victim to unanticipated woes.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.