There are some companies that can reasonably be expected to have their fortunes rise with the upcoming political agenda, regardless of whether the Democrats gain control of the Senate.

One issue that often gains bipartisan support is infrastructure spending, and one way to capitalize on that potential trend is through Global X U.S. Infrastructure Development ETF (PAVE). Indeed, PAVE is a market-cap-weighted fund that invests in the biggest names in U.S. infrastructure, so any increase in such spending by the federal government is sure to benefit these companies.

Construction, transportation and engineering are all industries that fall into this larger theme. The fund is focused primarily on U.S. companies, including ones that are involved in the production of raw materials and heavy equipment.

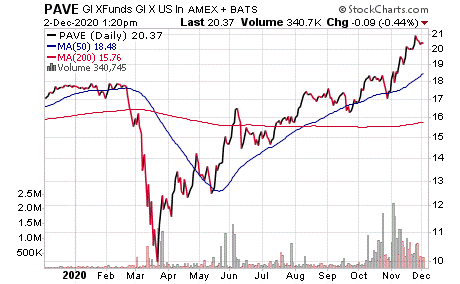

PAVE is up about 16% year to date. Its performance in the last few months has been particularly strong and may appeal to momentum investors. Assets under management currently total $661 million, and the expense ratio is 0.47%, which is approximately covered by the 0.45% dividend yield.

Chart courtesy of StockCharts.com.

PAVE trades at a small premium to net asset value. The fund lets investors buy and sell a broad basket of U.S. equities involved in infrastructure projects, while gaining the tax efficiency of doing so though a single investment.

Top holdings for PAVE include United Rentals, Inc. (URI), 3.82%; Fastenal Co. (FAST), 3.67%; Rockwell Automation Inc. (ROK), 3.38%; Trimble Inc. (TRMB), 3.34%; and Eaton Corp. Plc (ETN), 3.31%. The top 10 holdings make up 32.63% of PAVE’s portfolio, which contains 95 companies in total. The majority of these companies are classified as industrials.

For investors looking to play in the infrastructure space as the next administration begins work in Washington on Jan. 20, Global X U.S. Infrastructure Development ETF (PAVE) is one of the more popular and liquid ETF options out there.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)