Top cleaning stocks to buy during the COVID-19 pandemic offer an opportunity amid rising demand for such products and services that have the potential to become “long-lasting and transformative,” according to a recent research report from Barclays.

The top cleaning stocks to buy during the COVID-19 pandemic should benefit from heightened expectations by consumers and employees seeking enhanced hygiene. Cleanliness may have been taken for granted in the past but not any longer after nearly a year of soaring cases and deaths due to the novel coronavirus.

Many stores have limited consumers from purchasing more than two canisters of disinfecting wipes, if they are even in stock, according to Barclays. Plus, past assumptions that commercial locations were properly sanitized and safe are no longer valid, and Barclays forecasts that consumers will need increased visible assurances of cleanliness well past the pandemic.

Top Cleaning Stocks to Buy During COVID-19 Pandemic Include Clorox, Pension Leader Says

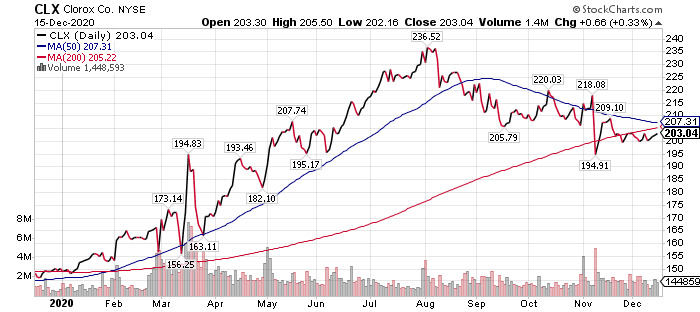

The top cleaning stocks to buy during the COVID-19 pandemic feature Clorox Co. (NYSE:CLX), a global manufacturer and marketer of consumer and professional cleaning and other products, said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. Carlson, who also heads the Retirement Watch investment newsletter, described Oakland, California-based Clorox as “my longtime favorite” in this category.

“It’s a well-managed, focused company that’s a solid brand name in both the household and commercial sectors,” Carlson said.

The stock also currently is selling well below its August high, Carlson continued. Plus, unlike most other stocks in this sector, Clorox offers a nice dividend yield of 2.19% and has a history of increasing its payout, he added.

Clorox has a price-to-earnings (P/E) ratio of 22.57 and its share price has pulled back 2.60% in the past three months, after soaring 35.07% since the start of the year and 36.70% in the past year. Its sector notched a gain of 0.18% in the last three months, 11.20% since beginning of 2020 and 9.16% in the last 12 months.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became the norm after the COVID-19 outbreak.

Barclays Cites Clorox’s Growth Prospects for Becoming a Stock Cleaning Stock to Buy

Barclays cited Clorox’s slew of business partnerships since the start of the pandemic that include Uber Technologies Inc. (NYSE:UBER), United Airlines Holdings (NASDAQ:UAL), AMC Entertainment (NYSE:AMC), Cleveland Clinic and most recently Enterprise Rent-A-Car. Clorox “wisely” is growing its institutional business on the credentials of its known and trusted brands, Barclays added.

Despite consumers pleased to see familiar brands in public spaces, a Barclays survey found that cleaning frequency and visible cleaning activity, regardless of brand, are more important. As Clorox builds out this business, it is taking on both advisory and supplier business-to-business (B2B) partnerships, with the latter likely to produce more revenue, Barclays concluded.

The Professional Products Division (PPD) is one of the more compelling growth opportunities available to Clorox in the future, according to Barclays. Institutional disinfecting and cleaning markets refer to commercial rather than residential customers that have offices, factories, restaurants, hotels and other “away-from-home” spaces, Barclays added.

Chart courtesy of www.stockcharts.com

Ecolab Is Another of the Top Cleaning Stocks to Buy During COVID-19 Pandemic

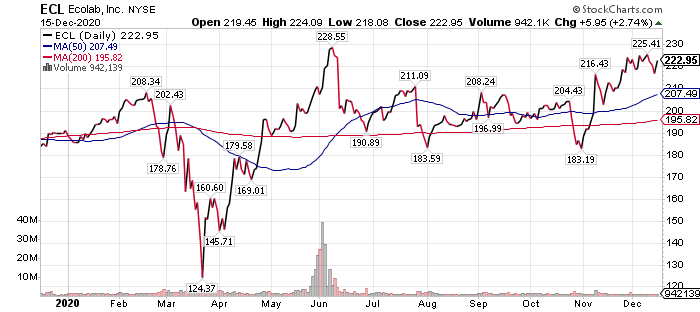

Services companies like Ecolab Inc. (NYSE:ECL), of St. Paul, Minnesota, have a long history of providing products for its business-to-business customers, but the average consumer is not necessarily aware of the company’s expertise, Barclays opined. Ecolab, which offers a 0.86% dividend yield, develops and offers services, technology and systems that specialize in water treatment, purification, cleaning and hygiene in a variety of applications.

“As the #1 institutional cleaning player with leading scale, innovation and service capabilities, we view Ecolab as a clear long-term winner from the secular trend towards enhanced focus on cleaning,” Barclays wrote.

Even though Ecolab’s near-term volumes were hurt by government-imposed business shutdowns, shareholders should be willing to look past near-term headwinds, since the company is positioned to come out of the COVID-19 crisis stronger than ever, Barclays concluded. Reasons include its core water and sanitation solutions gaining heightened relevance across sectors and geographies; its superior scale giving it a competitive advantage; its blue-chip, multi-national customers being well positioned to survive and grow market share in the coming years; and its 27,000 field service force and best-in-class innovation are “unmatched,” Barclays wrote.

Ecolab’s share price has moved roughly in line with its sector by climbing 8.13% in the past three months, 16.59% since the start of the year and 21.46% during the past 12 months. In comparison, its sector rose 9.09% in the last three months, 16.88% for the year to date and 19.24% in the last year.

Chart courtesy of www.stockcharts.com

Cintas Joins List of Top Cleaning Stocks to Buy During COVID-19 Pandemic

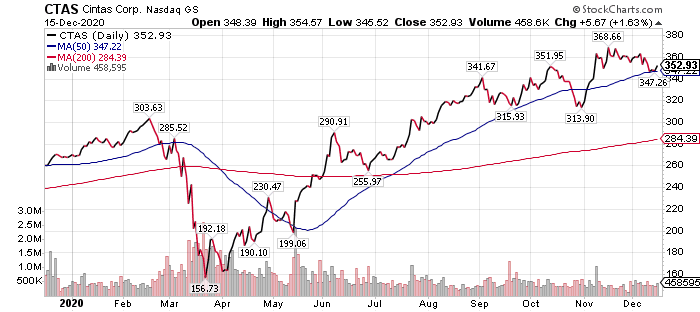

Cintas Corp. (NASDAQ:CTAS), known mainly as a uniform rental company, has done a “nice job” in the last decade by diversifying into hygiene services to account for 10% of its overall revenues, according to Barclays. Its hygiene services typically involve weekly or biweekly visits to customer locations to provide paper towels, toilet paper, air fresheners, etc., Barclays added.

The company sells all its hygiene and facility services products directly from its trucks, while offering a wide selection of styles and colors to meet customer needs, Barclays wrote. Cintas helps its customers outsource a non-core but important function of cleaning and sanitization services.

Hygiene and facility services are a multi-year growth driver for Cintas, allowing the company to attract new customers in the form of bars, restaurants and white-collar offices, Barclays reported. Customer concerns about COVID-19 have let Cintas provide needed sanitizers and personal protection equipment (PPE) that its customers and competitors could not do during the heart of the pandemic, Barclays added.

Top Cleaning Stocks to Buy During COVID-19 Pandemic Still Can Grow in Niches

Cintas signed up a California university for a multi-year hand sanitizer service agreement and provided another university with more than 1 million face masks. Cintas has a sales team in place to serve such customers, offering cleaning and sanitizing products that have been coveted in a COVID-19 world.

As for cleaning and sanitization in hospitals, health care currently accounts for 7% of total revenues of roughly $500 million at Cintas, with management eyeing it to become its first vertical market to produce 10%+ of its overall sales mix. With health care accounting for 17% of gross domestic product (GDP), Barclays forecasts it to become a $1 billion business over time.

“In our view, Cintas appears uniquely positioned to gain significant share in the space,” Barclays concluded.

Chart courtesy of www.stockcharts.com

Procter & Gamble Is Far from a Pure Play Investment on Cleanliness

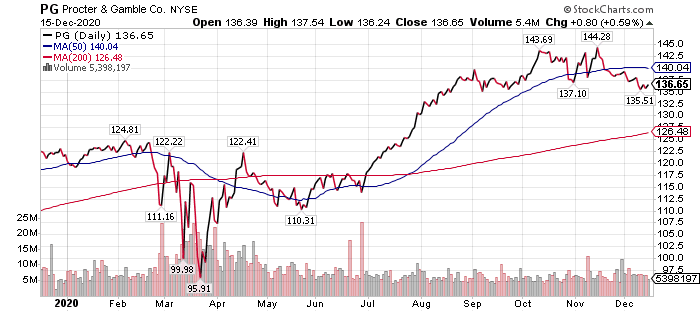

P&G Professional generates roughly $1.2 billion in revenue, accounting for 15% of the Fabric & Home Care division and about 2% of total company sales. The P&G Professional business unit is the fifth-largest provider in the fragmented institutional cleaning market, Barclays reported.

The Procter & Gamble (NYSE:PG) business has evolved in the past decade from a heritage in the food service marketplace, where it also marketed its then-owned Folgers & Millstone coffee brands. Since then, the business has been squarely focused on cleaning focused on hospitality and food service customers, with a presence in educational institutes, retail and non-acute health care customers.

Barclays wrote that P&G has been steadily gaining share in the overall industry segments in which it competes. Importantly, P&G Professional has long operated as a standalone business in an end-to-end manner with dedicated sales and research and development (R&D) resources.

P&G Is One of the Top Cleaning Stocks to Buy During COVID-19 Pandemic

The P&G business geographically spans North America and Europe, though the European business is in earlier stages of development but showing strong growth and returns on investments in the past 18 months since the division obtained new management. The strategy of P&G Professional has evolved significantly in the last decade and is focused on core competencies in cleaning through discrete formulations of brands such as Dawn, Tide and, most recently, Microban 24, rather than its historical focus on food service, Barclays noted.

P&G’s products tend to be priced at a premium but offer superior performance and net cost savings, Barclays wrote. Examples in the Professional division include Dawn Pots & Pans, which claims 4x cleaning power and savings on water usage, and Tide Cold Water Pro, which claims savings on energy costs and a reduction in linen replacement costs.

Overall, Cincinnati-based Procter & Gamble is well-positioned to gain market share, but it is not a pure investment on the trend toward enhanced hygiene. Investors who like its 2.31% dividend yield and its other businesses may find its shares worth buying. But the stock’s P/E ratio of 25.58 is not cheap and should be assessed by investors in comparison with other potential investments. The company’s share price dipped 0.86% in the past three months but gained 11.90% since the start of 2020 and 11.40% in the past year, compared to its sector’s rise of 0.18% in the past three months, 11.20% year to date and 9.16% in the last 12 months.

Chart Courtesy of www.stockcharts.com

Money Manager Kramer Weighs in about Cleaning Stocks to Consider Buying

Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services, said she has been keeping an eye on ABM Industries Inc. (NYSE:ABM), a New York-based facility management provider in the United States that could be the “ultimate cleaning stock.” The company specifically has a division that does janitorial work. However, at 20X next year’s earnings per share (EPS) estimates, she expressed concern about its current value and is not recommending the stock.

She previously recommended MSC Industrial Direct Co. Inc. (NYSE:MSC) in her Value Authority trading service. The company sells janitorial supplies that helped to support its earnings in 2020. But she questioned whether its stock price would rise enough to justify recommending it at the current valuation.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

Although the COVID-19 pandemic has created opportunities for companies focused on hygiene and cleaning, the virus has caused economic fallout and big job cuts. A surge in cases recently included President Trump, who was hospitalized between Friday, Oct. 2, and Monday, Oct. 5. The overall weekly hospitalization rate is at its highest point in the pandemic, with steep increases in individuals aged 65 years and older, according to the Centers for Disease Control and Prevention (CDC).

COVID-19 cases have totaled 16,724,753 and led to 303,849 deaths in the United States, along with 73,510,718 cases and 1,635,995 deaths worldwide, as of Dec. 16, according to Johns Hopkins University. America has the dubious distinction of incurring the most cases and deaths of any nation.

The top cleaning stocks to buy now largely feature companies that offer more than just hygiene protection for their customers. Nonetheless, investors looking to tap into the COVID-19 cleaning movement have several worth considering.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a holiday gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.