For those of us who have been investing in the stock market for the past three decades, the way the market is handling negative news today is uncanny.

During last Wednesday’s intrusion of the U.S. Capitol building, with the market open for business, the S&P 500 never traded in the red as the world watched the events unfold. By Friday, the S&P closed at a new all-time high.

Leading up to this history-making moment, it was widely reported on Dec. 14 that there had been a massive cyberattack by the SVR (Russia’s civilian foreign intelligence service, formerly known as the KGB), which created a backdoor into SolarWinds’ (NYSE: SWI) Orion software update. The attack targeted all five branches of the U.S. military, the White House, the National Security Agency (NSA), 425 of the Fortune 500 companies, all five of the biggest accounting firms and hundreds of colleges and universities.

Last Tuesday, the blue sweep of the White House and Congress was completed as Democrats won the special election for two U.S. Senate seats in Georgia to give them control of both houses of Congress and the White House. With expectations of fiscal stimulus, stocks rallied strongly, contrary to the view that the result would be a negative for the markets as Democrats likely would adopt tax hikes and new regulations.

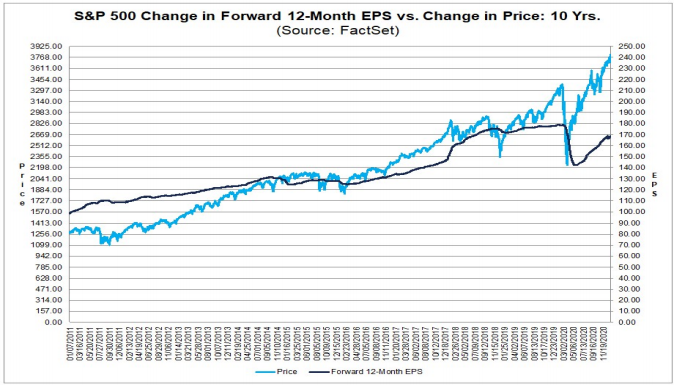

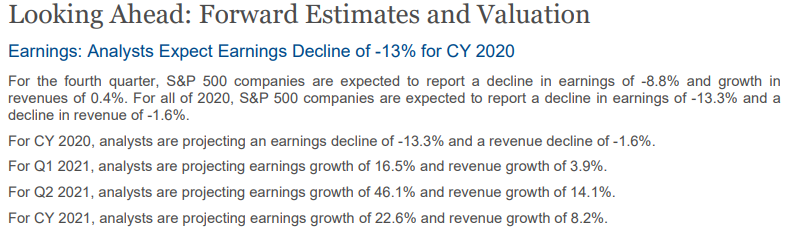

Last Friday, FactSet reported its latest data that showed the forward 12-month price-to-earnings (P/E) ratio for the S&P 500 is 22.6. This P/E ratio is above the five-year average of 17.5 and above the 10-year average of 15.7. It is the widest disparity between price and earnings per share (EPS) in the past decade. The $170 forecasted earnings for 2021 in the S&P 500 — shown in the chart below — naturally is a forward number, since the year has just begun. In my post two weeks ago, I noted that this current estimate is likely to be revised considerably higher as the year progresses, or else it stands to reason that the present gap would narrow by way of a market correction.

Last Friday, the Labor Department reported December nonfarm payrolls decreased by 140,000 (much weaker than the consensus estimate of 125,000 new nonfarm payrolls). Plus, nonfarm private payrolls decreased by 95,000 (far worse than the consensus forecast of 115,000 nonfarm private payroll gains). The unemployment rate was unchanged at 6.7%, as expected. In prior times, a miss of 260,000 jobs would have mattered, but instead, the major indexes all rallied to new highs.

On Sunday, the AP reported that as of Jan. 8, “even as 22 million doses of vaccines have been delivered to the states, only 6.6 million people had received their first shot,” according to the Centers for Disease Control and Prevention. The American Hospital Association has estimated that 1.8 million people need to be vaccinated daily from Jan. 1 to May 1 to reach widespread immunity by the summer. The current pace is more than 1 million people per day below that. One would think from extrapolating what that means to the recovery would matter.

Presumably, the market hasn’t been bothered by large-scale social unrest, Russian espionage, a very weak jobs report, a Democratic sweep of the White House and Congress and a slow vaccine rollout. The prevailing view seems to be that, ultimately, vaccines will reopen the economy and more fiscal stimulus is coming under a Biden administration and a Democrat-controlled Congress.

Reports indicate that President-elect Biden will propose a $3 trillion infrastructure package and will prioritize passing $2,000 stimulus checks soon after he takes office on Jan. 20. This combines with the constant drumbeat of the Federal Reserve to foster aggressive quantitative easing (QE) for as long as it takes to revive the economy. Add to this agenda the projected hockey-stick-like recovery of 2021 earnings and we get a powerful combination of catalysts.

Source: FactSet, Jan. 8, 2021

It’s also being reported by CNBC and other financial media outlets that any new tax policies that would negatively impact ordinary income and capital gains for corporations and individuals won’t occur for many months, thereby giving the market a free pass to not worry about such legislation, at least for the time being. Short of another strain of COVID-19 that is resistant to the Pfizer, Moderna and AstraZeneca vaccines and can mutate rapidly, it is hard to argue for a pullback to the rally of more than 5%.

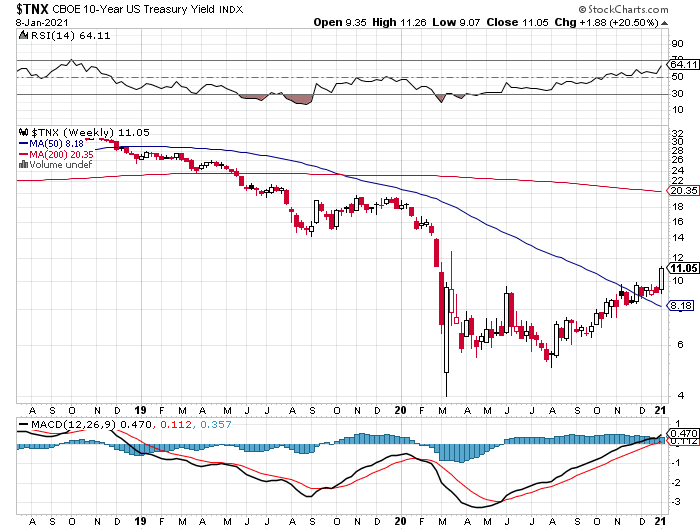

Bonds are also quickly going out of favor, with evidence of heavy selling in the Treasury market last week. The yield on the 10-year T-Note traded above 1% last week, with the next technical resistance level looking like 1.4%. Here, too, money for the sale of fixed income has to go somewhere, and with cash delivering a negative return when factoring in inflation, equities are a natural destination for those proceeds.

If the market can withstand these kinds of newsworthy body blows with such resilience, then investors should be at the ready for when the market does provide the highly anticipated pullback, because it will likely be shallow and short. The promise of more massive deficit spending is on the way, and that is sweet music to a market addicted to monetary stimulus.