Over the past few decades, we have seen a remarkable shift in the materials that the world uses to power its machines and generate the energy that is needed to run all the devices that make living life as comfortable as possible.

While carbon-based fuel sources, such as oil and coal, have been used since the Industrial Revolution, they have increasingly fallen out of favor due to their impact on the environment. Instead, we are seeing a rise in interest in renewable energy sources, such as solar and wind power, as they have fewer of the negative drawbacks of coal and oil.

At the same time, we also are seeing a movement toward more efficient ways to store energy and use smart grids. These are electrical grids that contain many energy-saving and energy-efficient measures, including smart meters and smart appliances.

The Nov. 3 presidential election of Joe Biden, who has publicly expressed his support for green energy, might impel investors to turn toward such stocks. So, it is time to turn our attention to the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (NASDAQ: GRID).

GRID tracks a market-cap weighted index of global equities that are in the smart grid and electrical energy sector. These are divided into pure play — where more than 50% of the company’s revenue comes from these two sectors — or diversified — where less than 50% of the company’s revenue comes from these two sources. After being screened for minimum liquidity and market capitalization, the stocks are then given a collective weight of 80% for pure play stocks and 20% for diversified stocks.

Some of this fund’s top holdings include Aptiv PLC (NYSE: APTV), ABB Ltd. (NYSE: ABB), Johnson Controls International plc (NYSE: JCI), Schneider Electric SE (OTCMKTS: SBGSY), Eaton Corp. plc (NYSE: ETN), Enphase Energy, Inc. (NASDAQ: ENPH), SolarEdge Technologies, Inc. (NASDAQ: SEDG) and Prysmian S.p.A. (OTCMKTS: PRYMY).

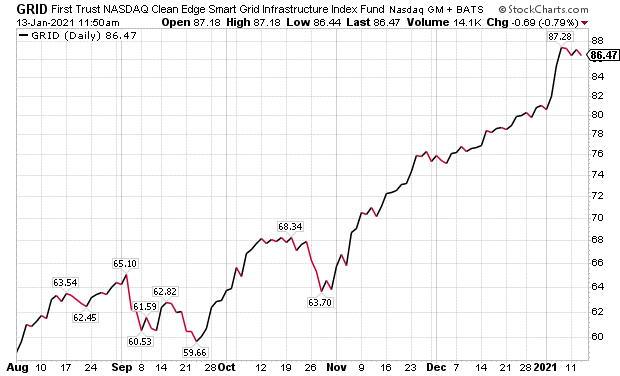

This fund’s performance has been strong, even when including the damage done by the COVID-19 pandemic. As of Jan. 12, GRID has been up 13.58% over the past month and up 27.73% for the past three months. It is currently up 7.60% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $156.56 million in assets under management and has an expense ratio of 0.70%.

In short, while GRID does provide an investor with a chance to tap into the world of electrical grids, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.