Note: First in a series of ETFs growing their Assets Under Management (AUM).

While the composition of the G7 group of countries is fairly well-known, the BRICS group has remained in the background.

Composed of the countries of Brazil, Russia, India, China and South Africa (which entered in 2010), the BRICS have been meeting as a collective group since 2009. This decision to come together to encourage commercial, political and economic cooperation was not surprising, as the nations that make up the BRICS were at a similar level of economic development in 2009.

They also have a total population of 3.21 billion within their borders and a combined nominal gross domestic product of $19.6 trillion. Each of these countries has been labeled as an emerging market economy and is projected to dominate the international economy (either in terms of raw materials or manufactured goods) by 2050.

While the allure of emerging markets, due to President Biden’s victory in the recent election and a weaker dollar, has been glistening like the Sun in some investors’ eyes, it is sometimes difficult to know where to invest in order to maximize one’s return in this area. Thankfully, the exchange-traded fund known as Nifty India Financials ETF (NYSEARCA:INDF) may show the way.

The fund has been designed to track an index that reflects the performance of the Indian financial industry, which includes banks, financial institutions, housing finance companies, insurance companies and other financial services companies. The stocks within INDF are selected by looking at their free-float market capitalization. This is done to preclude “locked-in” shares that are owned by the government or insiders.

Some of this fund’s top holdings include HDFC Bank Limited (NYSE:HDB), Housing Development Finance Corporation Limited (NSE:HDFC), ICICI Bank Limited (NYSE:IBN), State Bank of India (NSE:SBIN), Axis Bank Limited (NSE:AXISBANK), Bajaj Finserv Limited (NSE:BAJAJFINSV), HDFC Life Insurance Co. Ltd. (NSE:HDFCLIFE) and Kotak Mahindra Bank Limited (NSE:KOTAKBANK).

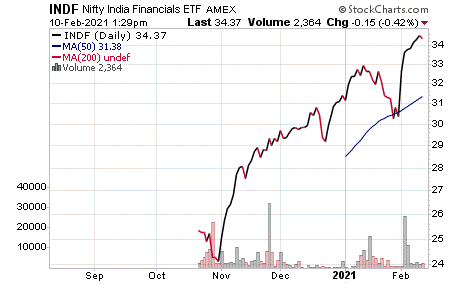

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Feb. 9, INDF has been up 5.39% over the past month and up 24.48% for the past three months. It is currently up 9.85% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $3.36 million in assets under management and has an expense ratio of 0.75%. Another important thing to note is that, according to ETF.com, INDF’s assets under management are growing briskly, reflecting the increased amount of investor interest in this part of the globe.

In short, while INDF does provide an investor with a chance to tap into the world Indian financial institutions, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.