“I believe there is no better hedge against inflation than Bitcoin.”

— Cathie Wood, CEO, Ark Innovation Fund

Bitcoin hit an all-time high of $45,000 after CEO Elon Musk announced in a U.S Securities and Exchange Commission filing last week that Tesla, the electric car company, has “invested $1.5 billion in bitcoin” and will soon start accepting it as payment for its products.

Simon Peters, an expert on cryptocurrencies at eToro, concluded, “If there were any doubters as to the mainstream acceptance of bitcoin, this surely must mark the end of any skepticism. Multiple other brands already accept bitcoin as payment, and we would imagine that, in time, other major companies will follow Tesla’s example.”

“The world is moving online more and more, and bitcoin sits at the heart of online transactions, and with this kind of endorsement from a multi-billion-dollar company, it’s likely the price will hit $50,000 by the end of the week,” he added.

Why Bitcoin is Headed Higher

It may even be possible for bitcoin to hit $100,000 by year-end. It will be volatile on the way up, so this investment is not for the faint of heart.

In our Forecast & Strategies trading service, we have more than doubled our money in a publicly traded investment company in only three months — with more to come. To subscribe, click here.

Bitcoin is the first and most dominant digital currency that serves as online payment for goods and services and as an investment asset. Since the price is so volatile and can explode upward from time to time, most investors use it as an asset allocation in their portfolio.

Bitcoin also uses blockchain technology, which is a decentralized, transparent data storage system that is bound to expand over time. Once blockchain technology is fully developed, it could revolutionize data storage for the trading of stocks, bonds, commodities and real estate.

Bitcoin is likely to keep rising in price for several reasons.

First, institutional retail adoption. Both Square and Paypal now accept bitcoin as a legitimate payment system. Other retailers will be joining them soon.

Second, institutional money and asset managers will be adding bitcoin to their ideal portfolio. Even if they allocate only 2% of their managed accounts to bitcoin, it will mean a sharp increase in demand for bitcoin and other cryptocurrencies.

More than a dozen well-known Wall Street firms, such as Ark Invest, Skybridge Capital, Rothschild Investment Group and Boston Private Wealth, have invested in Bitcoin recently.

Third, influential investors and money managers are promoting digital currencies, including commodity trader Paul Tudor Jones, Wall Street legend Bill Miller, Mark Cuban and hedge fund billionaire Stan Druckenmiller.

“Bitcoin could be an asset class that has a lot of attraction as a store of value to both millennials and the new West Coast money and, as you know, they got a lot of it,” Druckenmiller told CNBC. “It’s been around for 13 years and with each passing day it picks up more of its stabilization as a brand.”

Bill Miller, founder of Miller Value Partners, brands digital currencies the “single best performing asset class” today.

Bitcoin Has Replaced Gold as THE Inflation/Crisis Hedge

The Biden administration is set to push through an additional $1.9 trillion in spending this year. Joe Biden has already increased spending dramatically after signing a series of executive orders (more than any other president in his first week in office since FDR).

The Fed has been extremely accommodating, with the money supply (M2) growing at an astonishing 26% rate in 2020.

Cathie Wood, CEO of Ark investment funds, says the growth of the money supply has been one of the “biggest surprises” she has ever seen in her entire career.

She is bullish on bitcoin and gold as inflation hedges.

“I believe there is no better hedge against inflation than Bitcoin. As we know, gold has been moving, although now it’s lagging Bitcoin fairly dramatically so there’s probably some share shift but I do believe that both of them will do well over time.”

But don’t count out gold. It’s struggling right now due to a strong US dollar, but eventually gold will get back on track. Meanwhile, silver is doing much better due to its usage demand in electric cars, batteries, solar frames and windmills.

Interviews on the Tom Woods and Larry Elder Shows

Last week, I was interviewed on the popular Tom Woods Show. You can listen to the podcast here.

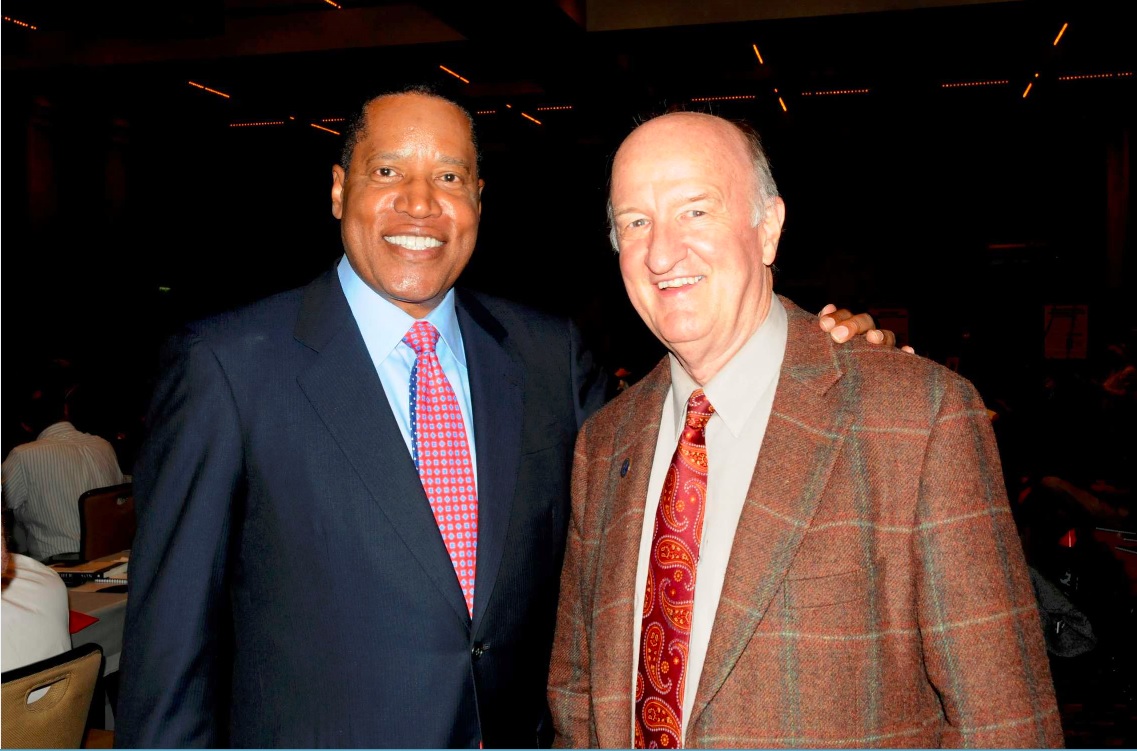

I was also interviewed on the Larry Elder Show, which airs on over 100 radio stations every day, and talked about the GameStop (NYSE:GME) scandal, the incredible rise of bitcoin and our upcoming show in South Dakota.

Larry is a subscriber to my newsletter and loves it.

Larry Elder (left), Gov. Kristi Noem (center) and Tom Woods (right) will join us at FreedomFest.

I’m pleased to announce that Larry Elder, “The Sage from South Central”, will be one of our keynote speakers at FreedomFest, July 21-24, at the Rushmore Civic Center in Rapid City, South Dakota — only 20 minutes away from Mount Rushmore. Gov. Kristi Noem will also welcome us during our opening ceremonies on Wednesday, July 21. (We will have over 200 speakers at the event, including Tom Woods!)

The excitement is building. We already have nearly 1,100 people registered for the event, and our hotel rooms are filling up fast. Take advantage of the “early bird” discount (which ends on March 31) — only $399 per person, $299 per guest. To see our agenda, go to www.freedomfest.com. To register, call 1-855-850-3733, ext. 202, talk to Hayley and use the code Eagle21.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew it!

Impeachment Trial: Look Who’s Calling the Kettle Black

I had to laugh seeing the Democrats at the impeachment trial self-righteously claiming that Donald Trump encouraged his supporters to seize the Capitol building on Jan. 6.

Meanwhile, there are plenty of examples in which these same Democrats incited violence in the past couple of years and encouraged Americans to riot, destroy federal property and go beyond peaceful protests. Why not impeach them, too?

Examples include:

In 2020, Senator Chuck Schumer of New York threatened two Supreme Court justices: “I want to tell you, Gorsuch, I want to tell you, Kavanaugh, you have released the whirlwind, and you will pay the price. You won’t know what hit you if you go forward with these awful decisions.”

Senator Cory Booker urged people to answer a “call to action” to protest at the Capitol. “Please, get up in the face of some Congress people,” Booker said at a conference.

In 2018, former presidential candidate Hillary Clinton said civility was only an option if the Democrats controlled the legislative branch. “You can’t be civil with a political party that wants to destroy what you stand for and what you care for.”

Former U.S. Attorney General Eric Holder encouraged a group of “liberal activists,” to fight back, a sentiment that was met with applause and laughter. “Michelle [Obama] always says, ‘When they go low, we go high,’” Holder began. “No. No. When they go low, we kick them.”

Shortly after claiming “God is on our side,” Rep. Maxine Waters of California urged activists to physically confront the Trump administration in public places, saying, “You get out and create a crowd. You push back on them. You tell them they are not welcomed anymore or anywhere.”

That’s exactly what happened to Senator Rand Paul and his wife Kelly when a mob assaulted them in Washington DC, and they were luckily saved at the last minute by police.

In 2018, House Minority Leader Nancy Pelosi told reporters that she is confused why Americans aren’t “uprising” against the Trump administration over conditions on the border with Mexico.

“I just don’t even know why there aren’t uprisings all over the country, and maybe there will be when people realize that this is a policy that they defend,” she said. “It’s a horrible thing, and I don’t see any prospect for legislation here.”

Sen. Jon Tester, of Montana, took it one step further, encouraging people to “punch Trump in the face. I mean, the truth is, this guy is bad for this country.”

Hillary Clinton’s former running mate Tim Kaine called for Democrats to “fight in Congress, fight in the courts, fight in the streets, fight online, fight at the ballot box.”

During an interview with New York’s Hot 97 in 2019, Congresswoman Alexandria Ocasio-Cortez (AOC) declared, “I believe injustice is a threat to the safety of all people. Because once you have a group that is marginalized and marginalized and marginalized…once someone doesn’t have access to clean water, they have no choice but to riot.”

Finally, New York Governor Andrew Cuomo said this about Donald Trump: “He better have an army if he thinks he’s gonna walk down the street in New York. New Yorkers don’t want to have anything to do with him. He can’t have enough bodyguards to walk through New York City.”

What is this country coming to?