As if the all the rage surrounding Bitcoin needed another catalyst, news of Elon Musk buying $1.5 billion of the leading cryptocurrency swept over the digital currency world, and it saw its price vault above $48,000 for the first time. Musk is following in the footsteps of Square Inc. (SQ) and MicroStrategy Inc. (MSTR) in buying Bitcoin for their corporate treasuries.

Mr. Musk is also considering allowing buyers of Tesla autos to pay in Bitcoin. Not to be outdone, MasterCard (MA) announced late last week that it is evaluating having its vendors allow for purchases in Bitcoin and other cryptocurrencies. PayPal Inc. (PYPL) started allowing its 35 million vendors around the world to accept payment in Bitcoin, and the stock has soared since.

Against these developments, Wall Street is under increasing pressure to allow for the trading of cryptocurrencies on mainstream trading platforms. Investors want to trade cryptocurrencies at Schwab, Fidelity, TD Ameritrade, E*TRADE, etc., which is putting the heat on these firms to accommodate their clients.

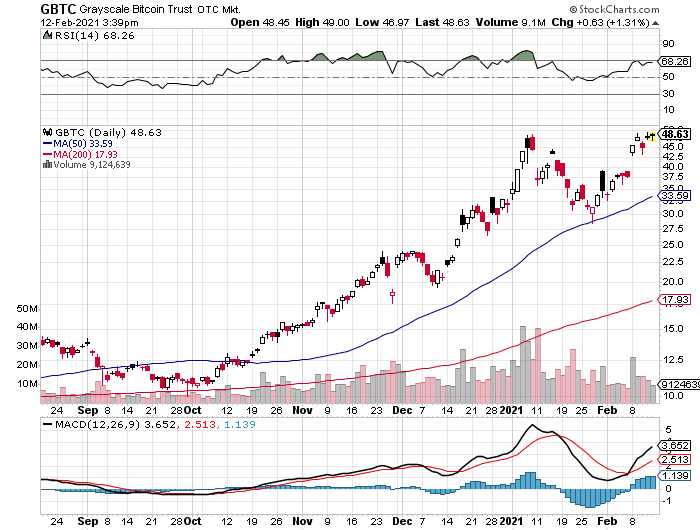

At present, the only instrument traded at the biggest brokerages is Grayscale Bitcoin Trust (GBTC), shares of which are highly correlated to underlying price movement of Bitcoin. And like every other asset that trades on the NYSE and Nasdaq, GBTC is open for trading at 9:30 am EST and closed for trading at 4:00 pm EST.

Because Bitcoin and other cryptocurrencies trade 24/7, the big brokerages have to determine if they want to staff up a crypto desk that never closes, even on weekends. It’s a tall order, but will likely come to pass, just as commission-free trading swept over the industry when Schwab first introduced it.

Trading cryptos is about to become very widespread among retail customers at the big brokers, and the very last thing they want to see is money leaving for Coinbase.com.

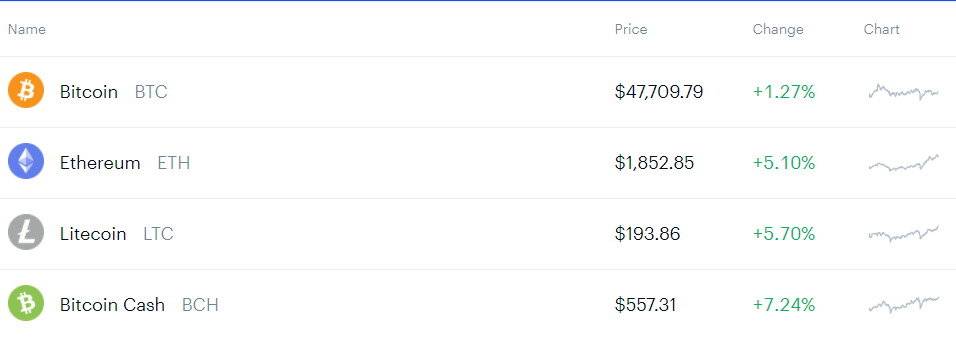

Source: www.coinbase.com

Stay tuned for what should be a digital gold rush by Wall Street to be the first to market with a trading platform for cryptocurrency investing and trading. As a result, these digital coins are very likely to increase in value, just on the exposure alone. My take on this situation is to consider accumulating some of these digital currencies before they hit Wall Street trading floors and wait for the tsunami of new crypto investors to buy in.