Seven e-commerce stocks to buy should benefit from the $1.9 trillion federal stimulus package, expanding COVID-19 vaccinations and further economic reopening.

The seven e-commerce stocks to buy appear posed to ascend after most of them pulled back recently as cyclical and so-called economic recovery stocks gained interest from investors who increasingly looked for value. Despite the recent volatility in e-commerce equities, investors still seem to like the long-term potential of such stocks that soon may show they are ripe for a rebound after their recent retreat.

BoA Global Research recently wrote a report favoring recovery stocks in the second quarter of 2021 due to the “strong” ongoing COVID-19 vaccine rollout. In contrast, “stay-at-home” stocks that markets have bid up during the past year face “tougher” comparisons from the previous year than the recovery stocks.

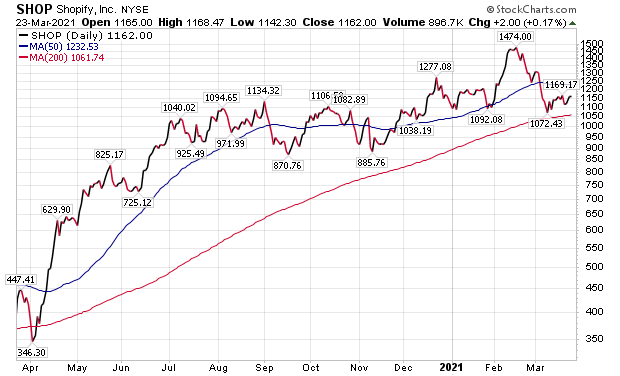

Shopify Is Among the 7 E-Commerce Stocks to Buy

“In terms of true retail technology, Shopify Inc. (NASDAQ:SHOP) retains the crown for running online stores,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services.

FactSet surveyed analysts who cover Shopify and found an even split of 45%-to-45% who rate the stock Buy or Hold, while the remaining 10% consider it a “Sell.” In February, the company reported its fourth-quarter results that spurred an increase in analysts’ consensus price target by 19.7% to $1,474.63, roughly 26.9% away from its close of $1,162.00 on March 23.

Chart courtesy of www.stockcharts.com

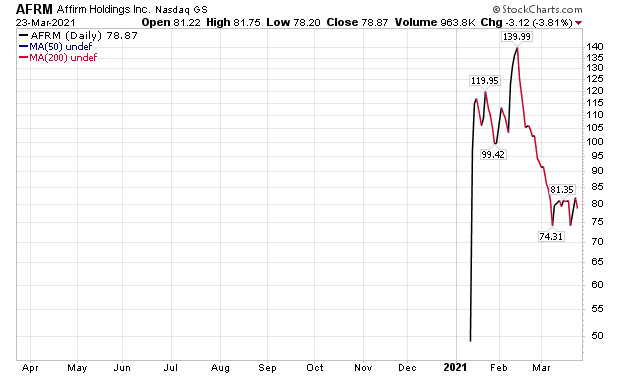

Recent IPO Affirm Holdings Earns Berth Among the 7 E-Commerce Stocks to Buy

Also keep a close eye on San Francisco-based Affirm Holdings Inc. (NASDAQ:AFRM), a publicly traded financial technology company that went public on Jan. 13 and rose 98% in its first day of trading. The company enables “installment plan purchases” in the digital era, Kramer said.

“If you’re buying something big online and don’t want to pay the full price up front, AFRM makes it happen,” Kramer said.

Affirm Holdings announced a partial early lock-up release that took effect on Feb. 26 for certain directors, officers and shareholders that reduced their restriction period before they could sell 10% of their AFRM shares, once certain stock price and other conditions are met. As a result, Affirm Holdings indicated that up to 15.6 million shares will became eligible for sale at the open of trading on March 3. The stock dropped dramatically in early March as the eligibility to sell the shares commenced.

Chart courtesy of www.stockcharts.com

“The pandemic pushed a lot of boutiques into virtual operations and now there’s no real incentive for them to reopen the storefront,” Kramer said. “That’s been a boon for the retail platforms that support small stores’ online presence: Etsy Inc. (NASDAQ:ETSY), PayPal Holdings Inc. (NASDAQ:PYPL), Shopify Inc. and soon Stripe will join them.”

Kramer expressed excitement about a possible initial public offering for Stripe. Whichever names one likes, online shopping is not going away just because malls are open again, she added.

“A year of retail habits is hard to break,” Kramer continued.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

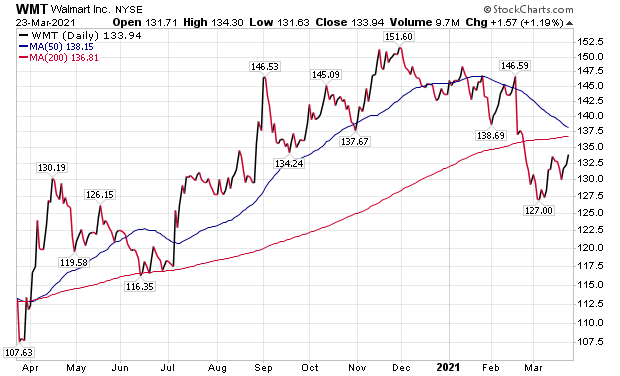

Walmart Is the Dividend Payer Among the 7 E-Commerce Stocks to Buy

“If you are looking to add to your holdings, the pullback in Walmart (NYSE:WMT) represents a great opportunity to do so at a discount,” said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader, as well as co-editor of Fast Money Alert.

Like Lowe’s Companies, Inc. (LOW), Walmart is likely to be the recipient of significantly increased consumer spending due to the big stimulus checks sent to individuals through the $1.9 trillion coronavirus relief package approved by Congress. Now that the latest federal stimulus bill has been passed, Woods said he expects both Walmart and Lowe’s to attract part of that money flow.

Chart courtesy of www.stockcharts.com

Walmart Is Among 7 E-Commerce Stocks to Buy

BoA is another fan of Walmart, which the investment firm praised in a recent research that noted the retailer’s “multiple drivers” of potential comparable upside during the current fiscal year from the previous one.

“We believe visibility will continue to rise on diversifying revenue streams, including digital advertising,” according to the investment firm.

BoA rates Walmart a Buy and gives it a $175 price objective, which reveals a 30.7% potential upside from its closing price of $133.94 on March 23.

Walmart Rates Among 7 E-Commerce Stocks to Buy

Walmart achieved strong growth in its e-commerce sales and revenue during fiscal year 2020. In the last several years, Walmart has been investing in e-commerce heavily.

During fiscal 2020, Walmart notched sharp growth in its e-commerce sales and revenue. The retailer also has been growing through acquisitions to enhance its online sales.

Despite becoming a retail giant through large brick-and-mortar stores, Walmart’s management has pursued digital shopping growth, as have many of its rivals in the United States and other parts of the world. Walmart’s e-commerce sales in fiscal year 2020 climbed 43.0% to $35.9 billion compared to $25.1 billion in fiscal 2019. The contributions of e-commerce are especially meaningful when compared to overall net revenue gains of 1.87% in fiscal year 2020 to $524 billion, up from $514.4 billion in fiscal 2019.

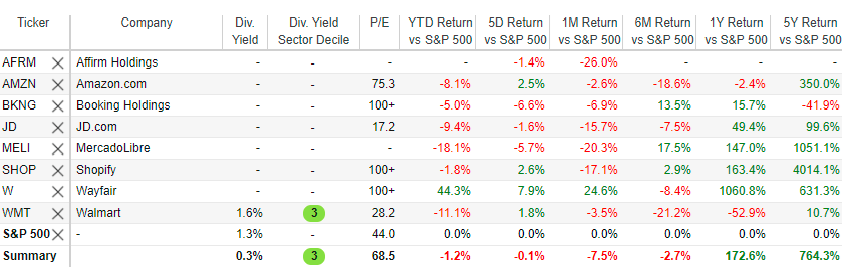

Source: Stock Rover. Click here to sign up for a free two-week trial for Stock Rover charts and analytics.

Latin American Online Retailer Joins 7 E-Commerce Stocks to Buy

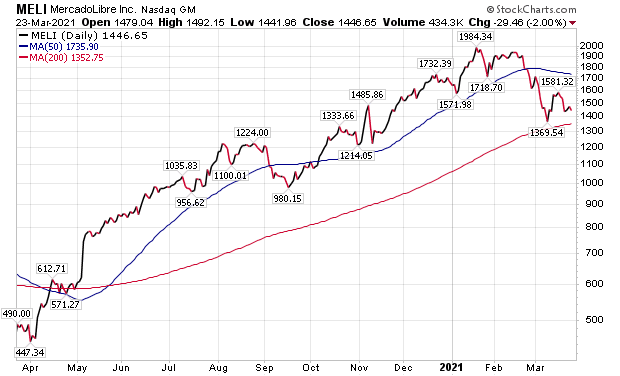

The up-and-down trading in Latin American e-commerce giant MercadoLibre (NASDAQ:MELI) involved it hitting a stop price in late February that Woods had set after recommending the position and achieving a gain of 32.17% for his subscribers from when he first recommended it. Yet because the stock is one in which tactical opportunities exist, Woods recommended the position again on March 5. Shares are up since then. Despite a nice gain, there is still plenty of upside left, he opined.

“If you have yet to re-allocate to MELI, I recommend you do so now and take advantage of the March volatility,” Woods said.

Chart courtesy of www.stockcharts.com

FactSet reports that MercadoLibre, of Buenos Aires, Argentina, has received 26 ratings with 62% giving Buy ratings, 35% ranking the stock a hold and the rest calling it a sell. The average price target for MercadoLibre has climbed 2.1% to $1,933.91, indicating 25.19% upside from the stock’s closing price on Tuesday, March 23.

MercadoLibre’s fourth-quarter revenue of $1.33 billion beat consensus estimates by $120 million but Generally Accepted Accounting Principles (GAAP) earnings per share came in at negative $1.02. The company’s gross margin of 36.8% and operating margin of 1.9% slipped beneath consensus estimates.

Columnist and author Paul Dykewicz meets with stock picker Jim Woods before COVID-19.

Chart courtesy of www.stockcharts.com

Certain analysts who follow MercadoLibre view the company as a winner of a shift occurring in Latin America towards increased e-commerce and financial technology adoption. MercadoLibre also operates a growing credit business. Analysts cite the company’s investments in these and other initiatives hurting its near-term profitability, but some of them only expect its margins to be pressured in the short term.

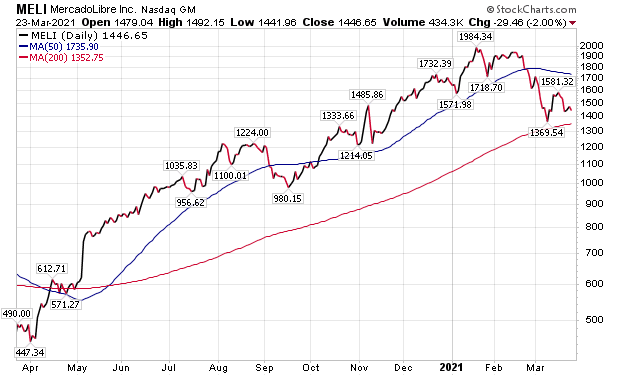

Wayfair Wins Spot Among 7 E-Commerce Stocks to Buy

Another e-commerce stock that Woods likes is Wayfair Inc. (NYSE:W). That e-commerce company provides approximately 22 million products for the home sector under various brands, nearly all of the items are at a big discount to retail prices, and everything usually comes with free shipping, he added.

Aside from liking the stock’s prospects, Woods said he appreciates its cool jingle, “Wayfair, you’ve got just what I need.”

“Wayfair is more than just a cool jingle,” Woods wrote to his Fast Money Alert subscribers on March 23. “It’s a cool earnings powerhouse. Last quarter, earnings per share (EPS) grew by 144% year over year, and in the coming quarter the company is projected to grow by another 109%.”

Chart courtesy of www.stockcharts.com

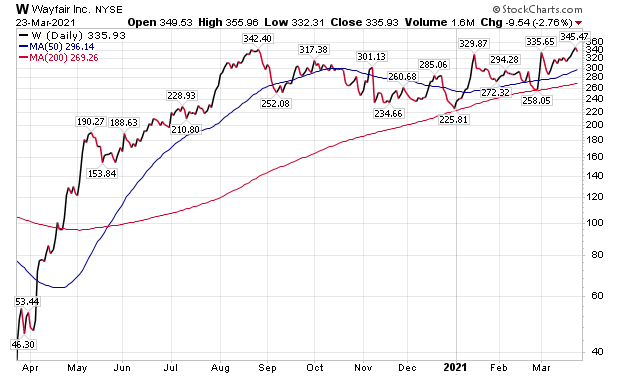

Asian Online Retail Powerhouse Earns Place Among 7 E-Commerce Stocks to Buy

JD.com, Inc. (NASDAQ:JD) trades just above its 200-day moving average and is starting to look ready to rise further after China’s government cracked down on other big-cap tech companies, said Bryan Perry, who also leads the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader advisory services. Perry, who further heads the monthly newsletter called Cash Machine that features dividend-paying equities, said he likes the stock’s prospects to keep climbing after its brief recent pause.

One advantage that China’s e-commerce juggernaut JD.com possesses is that it lately has outperformed its rival Alibaba during the pandemic. JD.com excels, in large part, by owning its own logistics network, warehouses and distribution.

Those capabilities have helped JD.com not only stay in business but grow. Some customers have shifted to JD.com and they are paying a small premium for white-glove service that the company offers to deliver food and other items during the pandemic.

Chart courtesy of www.stockcharts.com

European Company Gains Slot With 7 E-Commerce Stocks to Buy

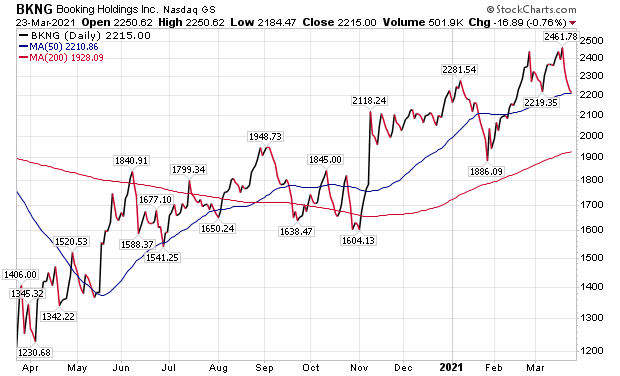

Booking Holdings (NASDAQ:BKNG), formerly Priceline, is BoA’s top European reopening stock. However, the stock fell both March 22 and 23 after Germany’s Chancellor Angela Merkel ordered a new shutdown as a third wave of COVID-19 cases broke out in the country.

Chart courtesy of www.stockcharts.com

In the internet sector, recovery stocks seem best positioned to outperform others in second-quarter 2020, according to BoA. These stocks include companies that were most depressed in 2020, including online travel company Booking. BoA recently upgraded the stock from “Neutral” to “Buy” with a price target boosted 15.7% from $2,550 to$2,950.

A leader in the European travel market, the company has an opportunity to leverage its Booking.com brand and business model to gain traction in North America, Asia and Latin American, BoA wrote in a research note.

“It is pursuing a large opportunity in alternative accommodations,” according to BoA. “It is a top beneficiary of vast vaccine supply increase in Europe by 3Q.”

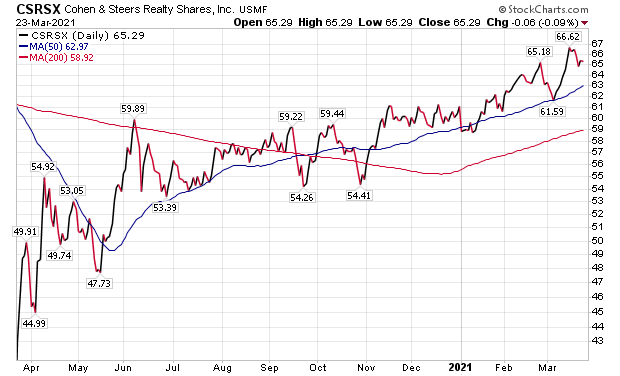

Selected REITs Offer an Additional Way to Profit from the Recovery

“Don’t forget about real estate investment trusts (REITs), especially the retail and office properties that suffered during the pandemic,” said Bob Carlson, editor of the Retirement Watch investment newsletter and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

They are benefiting as stimulus checks reach households and the economy opens up as more people are vaccinated, Carlson continued. Also, apartments should do well as employment increases and people move out of the group and family housing arrangements they entered early in the pandemic.

A good mutual fund is Cohen & Steers Realty Shares (CSRSX).

Chart courtesy of www.stockcharts.com

Individual REITs to consider are Simon Property Group (SPG), Spirit Realty Capital (SRC), National Retail Properties (NNN), Macerich (MAC), Weingarten Realty (WRI), American Campus Properties (ACC) and Brixmor Property (BRX), Carlson counseled.

COVID-19 Does Not Derail 7 E-Commerce Stocks to Buy

COVID-19 vaccinations are offering hope that new cases and deaths due to the virus will slow. The Food and Drug Administration (FDA) recently approved a third COVID-19 vaccine to allow additional people to be vaccinated.

U.S. COVID-19 cases have hit 29,922,392 and led to 543,843 deaths, as of March 24. Worldwide, COVID-19 cases have reached 124,202,265, while deaths have claimed 2,734,098, according to Johns Hopkins University. America has the dreaded distinction as the nation notching the most COVID-19 cases and deaths.

The seven e-commerce stocks to buy gives investors an array of choices to profit from online sales amid the $1.9 trillion federal stimulus package, increased COVID-19 vaccine availability and the economic reopening. A recent pullback of most of their prices offers interested investors an improved entry price than they could have obtained just a few weeks ago.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.

![[networked computers]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_78687250.jpg)