“Life is about to change radically.” — Cathie Wood, CEO, Ark Investment Fund

Since 1980, when I started writing my newsletter, Forecasts & Strategies, the bond market has been in a raging bull market. Interest rates have gradually declined from 21% down to practically zero.

But, in 2021, long-term rates are starting to rise again, thanks to irresponsible government spending, out-of-control deficits and the Federal Reserve pumping money into the economy like never before (the money supply rose 26% last year).

Interest rates have long been linked to the inflation rate.

Now, it appears that inflation is back, and we’re seeing it in higher prices in the grocery store, at the gas pump and in asset prices — stocks, real estate, commodities and Bitcoin.

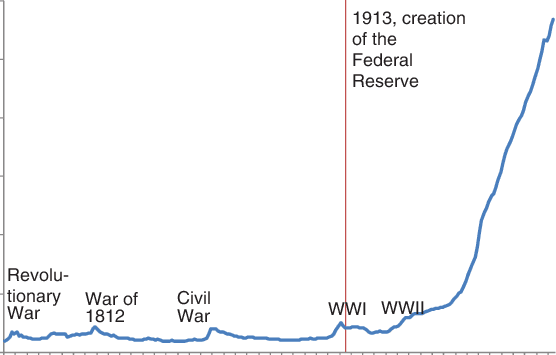

That brings me to a remarkable chart that was created a few years ago by Harvard professors Ken Rogoff and Carmen Reinhart. They estimated the Consumer Price Index (CPI) in the United States from 1776 to present. It showed that inflation flared up during various wars, but always dropped back down after the war ended.

But that all changed after World War II ended in 1945. Thereafter, inflation, as measured by the CPI, kept rising. See the chart below.

So, I asked my students at Chapman University the following question (go ahead and take the quiz):

“Why did the pattern of inflation change after World War II?”

A. Never-ending wars after 1945.

B. The creation of the Federal Reserve.

C. Adoption of Keynesian economics.

D. Going off the gold standard.

E. All of the above.

Let’s look at each possible answer.

A. Never-ending wars after 1945. One could argue that we have entered a period of never-ending wars and rising government spending to pay for standing armies and the “military-industrial complex.” Since 1945, we’ve been involved in wars in Korea, Vietnam and the Middle East, and the “Cold War” against the Soviet Union and Red China.

B. The creation of the Federal Reserve in December 1913. As a central bank, its purpose was to defend the dollar (the gold standard) and be a lender of last resort during a monetary crisis. It failed as a lender of last resort, however, and we still witnessed a deflationary pattern after World War I and into the Great Depression. But after World War II, it learned its lesson. Whenever there’s a downturn in the economy, inject liquidity! They learned this lesson from…

C. The universal acceptance of Keynesianism. British economist John Maynard Keynes revolutionized the economics profession by creating an ingenious model that justified deliberate deficit spending and easy money during economic recessions. His followers argued that a little inflation was good for the economy during periods of unemployment, which was most of the time. Since 1945, the government has run deficits 95% of the time. It was unprecedented, and it put more pressure on the Fed to keep pumping money into the system.

D. Going off the gold standard. Keynes and his followers rejected gold as the “barbarous relic,” mainly because it provided a strict discipline on inflation and deficit spending. The United States broke its last tie to gold on August 15, 1971, when President Nixon closed the gold window, and no longer was willing to sell gold at $35 an ounce to foreign banks. Notice that price inflation took off after that and hit double-digit rates by 1980.

E. So, in many ways, the correct answer is “E,” although, I would argue that the universal adoption of Keynesian economics was the primary cause of never-ending inflation.

Why Didn’t We Suffer Runaway Inflation After Going Off the Gold Standard?

Many of my gold-bug friends thought that when we went off the gold standard in August 1971 the United States would suffer runaway or hyperinflation of 100% or more. Why didn’t it happen? Paul Volcker became the Fed chairman in 1979 and adopted the monetarist policy of controlling the money supply (as advocated by Milton Friedman), and we have enjoyed a disinflationary policy ever since (until now).

Question: What institutions replaced the gold standard to discourage inflation?

The answer: The bond and stock markets. The fact is that inflation is an enemy to the stock and bond markets, and Wall Street supported Volcker’s decision to control inflation.

But, the Keynesian idea, “a little inflation is good” has prevailed, and that’s why price inflation continues to be with us, and why gold, real estate, stocks and Treasury Inflation-Protection Securities (TIPS), bonds and other asset classes are good long-term investments.

Good News! Newsmax to Cover FreedomFest

This year’s FreedomFest is becoming big news. Newsmax, the fastest-growing cable news network, has just informed us that it will be covering all three-and-a-half days of FreedomFest, July 21-24, at the Rushmore Civic Center in Rapid City, South Dakota. Here’s your chance to show the world that the freedom movement is alive and well. Of course, it will only be covering the general sessions. If you want to be a part of the other 90% — breakout sessions, the Anthem film festival, the bustling “Trade Show for Liberty” exhibit hall and a chance to meet your favorite speaker in person — you will want to be there.

So far, over 1,300 attendees have signed up, and the numbers are accelerating. (These are real numbers; we don’t exaggerate our attendance figures like other conferences.) We had nearly 100 people sign up in the past week, including many subscribers.

Every year Peter Studebaker, our resident libertarian magician, entertains our crowd at the opening cocktail reception and Saturday night banquet. He lives in Las Vegas, but he has agreed to join us in Rapid City, South Dakota — be amazed as he transforms paper money into silver dollars, and bitcoin into digital gold!

Hurry! Early Bird Discount Ends in Seven Days!

Our “early bird” discount ends on March 31. NOW is the time to register. Only $399 per person and $299 per guest. Students and young professionals are eligible for special discounts. After March 31, the price goes up to $499 per person.

Go to www.freedomfest.com, or call Hayley at 1-855-850-3733, ext. 202, to register or get more information. Use code Eagle2021.

Special Private Reception for Subscribers Almost Full — Only 10 Tickets Remain!

Remember, subscribers to my newsletter and trading services get a 2021 American Eagle silver dollar and signed copy of “The Maxims of Wall Street” at our special Eagle private meeting at FreedomFest. The room at the historic Alex Johnson Hotel (where Ronald Reagan and five other presidents have stayed) is limited to 200 subscribers. We’re almost sold out (only 10 tickets remaining), so I urge you to sign up right away.

It will be an unforgettable F&S family reunion in July. Meet up with the Eagle gang, including Jim Woods, Hilary Kramer, Roger Michalski and yours truly.

Good investing, AEIOU,

![]()

Mark Skousen

You Blew It!

Red Badge of Courage: Being Airbrushed Out of History!

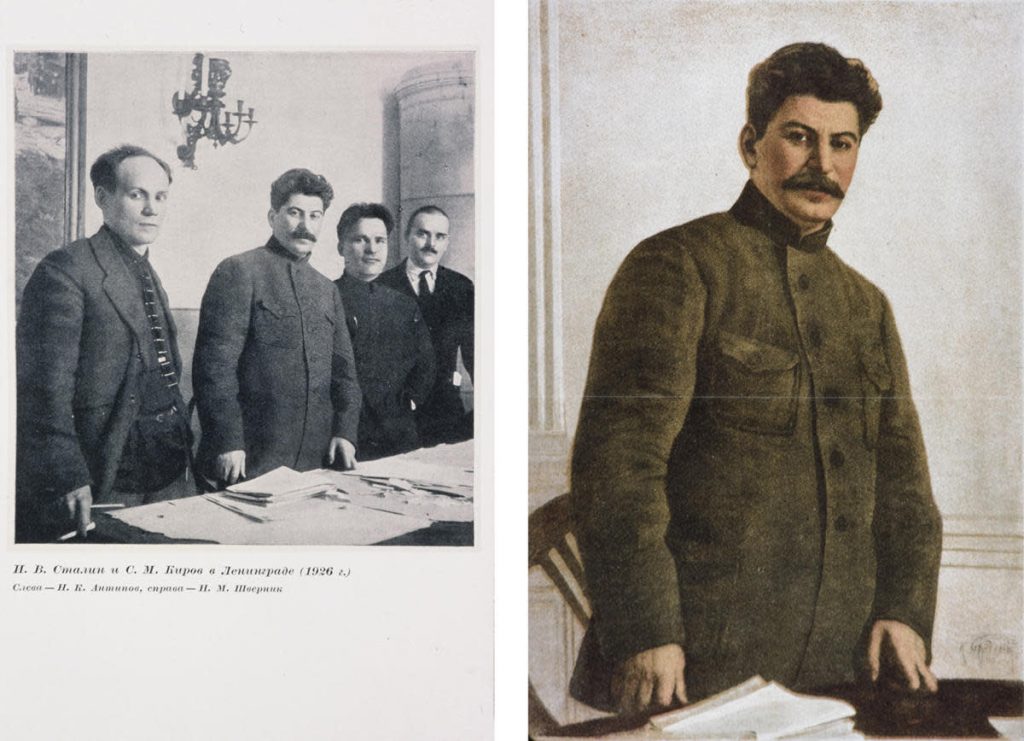

The current “cancel” culture — eliminating the statues and names of founding fathers and famous people in history — reminds me of the Communist era where Joseph Stalin in the Soviet Union, and Mao Zedong in China, airbrushed important people out of photos, often those who opposed the tyranny of the all-powerful State.

There is a famous photograph of Stalin with three comrades taken in the 1930s. See the photo below.

Source: History.com – “How Photos Became a Weapon in Stalin’s Great Purge.”

During the Great Purge a few years later, one by one these comrades became enemies of the State and were executed by firing squad. Then, Stalin had their images removed from the original photograph, disappearing from the official record and into the black hole of history.

I am reading a fascinating biography of Lin Yutang, my favorite Chinese philosopher from the 20th century. He lived a remarkable life and was the most traveled Chinese man in world history. During his 80 years, he lived in both the East and the West.

He compared the two civilizations in a most entertaining way in his classic book, “The Importance of Living,” which was the #1 bestselling non-fiction book of 1938. It’s the most irreverent book I’ve ever read on Chinese philosophy in life. Read my review here: The Art of Letting Go — MSKOUSEN.COM

Lin was also a life-long defender of individuality and human rights and was an ardent opponent of Mao and the Chinese Communist Party. As a result, his books were censored in China and he was forbidden to visit China in his later years.

Ironically, he died in 1976, the same year Mao died, and was buried in Taiwan (I visited the Lin Yutang House in Taipei in 2014 — highly recommended).

His biographer, Qian (“Jay”) Suoqiao, shows two photographs of Lin being airbrushed out of official photographs. The Communists really feared him. When “Lin Yutang and China’s Search for Modern Rebirth” (Palgrave Macmillan, 2017) was translated into Chinese, the censors removed all references to Mao and the Communist Chinese Party. But, in some ways, the censorship backfired. When Jay took a book tour in China, he was constantly asked what was left out of the Chinese translation.

The “cancel” culture is alive and well in China — and tragically spreading to the United States and the West.

Fortunately, Lin Yutang’s reputation is growing in China, and many cities are naming streets and parks after him. He deserves more recognition here and abroad as “the” libertarian Chinese philosopher.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)