Investors are becoming increasingly familiar with the idea that market-cap weighting can result in massive investments in just a few companies that dominate a particular index.

The NASDAQ is a perfect example. Investing in the NASDAQ as an index results in an investment of close to 30% in just three companies: Apple (NASDAQ:AAPL), Microsoft (MSFT) and Amazon (NASDAQ:AMZN).

Although not every index has this extreme imbalance, typically when we look to invest in an index, it’s with the hope of gaining broad and diverse exposure to a number of companies. It is one of the advantages of exchange-traded funds (ETFs).

One strategy to recapture this advantage is the use of equal weighting, a practice in which a fund invests equal sums in all components of an index. This is how we get investment vehicles like Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD). This fund is a cross between the equal weight concept and a sector ETF. However, unlike some equal weight funds, it will not have much allocation to very small companies, since such companies do not exist in the S&P 500 index.

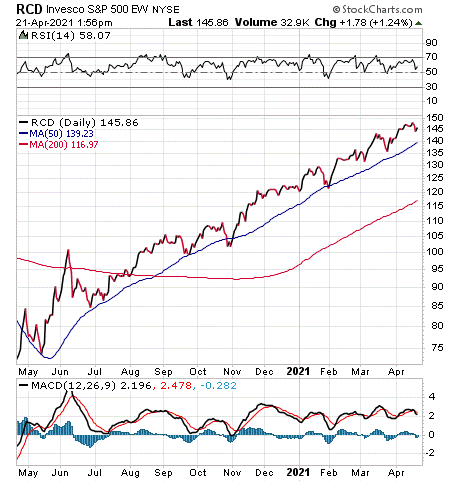

Like much of the market, this fund has had a great last 12 months. It is up nearly 94% during that period. It also has increased close to 20% in value this calendar year. The fund’s 0.40% expense ratio is in the typical range. Plus, RCD currently manages just under $950 million. The dividend yield is about 1%.

Chart courtesy of StockCharts.com

There are more than 60 companies held in this fund. Notably, the equal-weighting strategy prevents returns from being dominated by Amazon. RCD holds equal weight in an assortment of U.S.-based consumer discretionary names like Home Depot (NYSE:HD), Target (NYSE:TGT), D.R. Horton (NYSE:DHI) and Dollar General (NYSE:DG).

The increased allocation outside of mega-cap stocks due to this fund’s strategy means that the average market cap of its holdings is less than a fifth of the segment benchmark. This can be a good or a bad thing, depending on your feelings about the continued profit potential of massive companies like Amazon. If equal weighting sounds like a potentially profitable angle on the consumer discretionary sector, consider whether Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD) is right for your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.