Despite lying dormant for many years, inflation is back on the rise again, largely as a result of the Fed’s easy-money policies and massive amounts of government spending to combat the economic effects of the COVID-19 pandemic.

The most recent Consumer Price Index (CPI) figures stated that we saw a 0.6% rise in prices during the month of March. More specifically, energy (13.2%) and food (3.5%) saw the biggest rise in prices over this same period of time. To take advantage of these trends and to attempt to mitigate the corrosive impact of inflation on your money, I’ve identified four exchange-traded funds (ETFs) that might be worth considering.

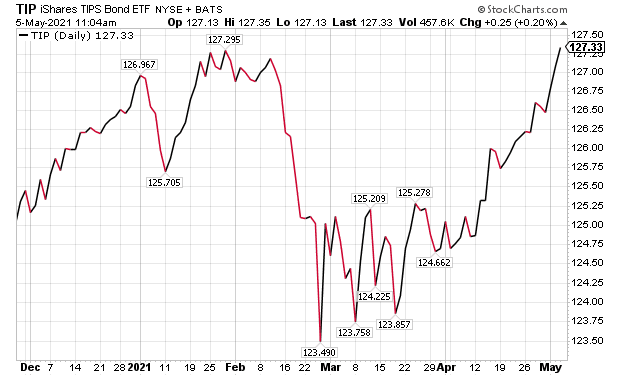

The first of those four funds draws on Treasury Inflation-Protected Securities (TIPS) in the form of the iShares TIPS Bond ETF (NYSEARCA:TIP).

Unlike regular government securities, which are negatively affected by inflation, the principal of TIPS investments increases during times when there is inflation in the economy and decreases when there is deflation, according to the CPI. Similarly, this means that while TIPS pay interest, the specific amount that they will pay out will vary every six months as they will be shaped by the presence of inflation or deflation at the time that the interest is paid.

Specifically, TIP tracks a market-value weighted index of U.S. Treasury inflation-protected securities that will not expire for at least one year.

TIP’s holdings consist of Treasury Notes of varying expiration date and yield.

This fund’s performance has been somewhat strong, even when including the damage done by the COVID-19 pandemic. As of May 4, TIP has been up 1.62% over the past month and up 0.13% for the past three months. It is currently up 0.20% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $27.04 billion in assets under management and has an expense ratio of 0.19%.

While TIP does provide an investor with a chance to tap into the world of TIPS, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether a given fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.