The three best hotel stocks to buy now include an owner-operator of casino resort spas, an online travel agency website and a real estate investment trust that owns, acquires and leases properties for restaurant, retail and hotel use.

Although the hotel and travel industry have been hit hard over the past year and a half from the COVID-19 pandemic, it has begun to see major signs of recovery across the world as federal and local governments lift lockdown regulations, infection rates decline and vaccine rollout continues both nationwide and globally.

With the worst of the pandemic likely behind us, now may be a good time to invest in hotel stocks as they begin to rebound.

3 Best Hotel Stocks to Buy Now, According to DividendInvestor.com

These stocks were found and analyzed through our very own Dividend Screener on the Dividend Investor website. The Dividend Screener is a simple web-based tool that allows investors to sift through thousands of potential equities by adding their own customized criteria to find stocks that fit their portfolio’s unique needs.

Also used in the analysis of the three best hotel stocks to buy now was the platform designed by our partners at Stock Rover, offering a rigorous screening program to assess performance metrics for investors. To sign up for a free two-week trial, click here.

For the greatest ease of use and most comprehensive research, we recommend that savvy investors use both the Dividend Screener and Stock Rover in tandem.

Based on the research, here are the three best hotel stocks to buy now.

3 Best Hotel Stocks to Buy Now: #3

Four Corners Property Trust, Inc. (NYSE:FCPT)

Four Corners Property Trust, Inc. (NYSE:FCPT) is a real estate investment trust (REIT) that specializes in the acquisition and leasing of property for restaurant, retail and hotel use. The company is headquartered in Mill Valley, California, and owns more than 800 properties across 46 states and 85 brands, with Darden Restaurants and Brinker International among its largest clients.

Four Corners Property Trust is one of the few companies connected with the hotel or food-services industries that did not suffer a decline in revenue or profit from COVID-19. Instead, both company revenue and net income grew from 2019 to 2020 by 11.8% and 6.3%, respectively. The trend has since carried into 2021. FCPT has seen continued growth in first-quarter 2021, with a 10.0% increase in revenue and 6.7% in net income over Q1 2020.

FCPT suffered a 125% drop in share price in March 2020 due to COVID-19 but has since reclaimed most of its losses and experienced a 24.8% growth in share price over the past 12 months. Its one-year returns are charted below with a 50-day moving average line.

Chart provided by Stock Rover.

What differentiates FCPT is its high returns compared to the rest of the industry. With a return on invested capital, return on equity and return on assets of 6.6%, 9.3% and 4.6%, respectively, Four Corners stands well above the comparable industry averages of -6.4%, -17.2% and -7.7%. The company’s resilience and ability to stay profitable and generate strong returns during COVID-19, with a one-year volatility rate of 0.35 compared to the industry average of 0.52, makes it an attractive investment during a time of high volatility in the economy and markets.

As a REIT, Four Corners should appeal to those looking to invest in stocks with high dividend payments, since REITs are required by law to pay out more than 90% of their taxable income to their shareholders. FCPT currently has a dividend yield of 4.6%, compared to just 0.3% for the industry average and 1.2% for the S&P 500 average.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $31.50, 13.3% higher than its latest closing price of $27.81, with analysts projecting an 11.1% growth in sales for 2021, earning FCPT a “Buy” recommendation.

3 Best Hotel Stocks to Buy Now: #2

Monarch Casino & Resort, Inc. (NASDAQ:MCRI)

Monarch Casino & Resort, Inc. (NASDAQ:MCRI) is an owner and operator of casino resort spas in the western United States. Monarch’s business entirely derives from two locations: its flagship Atlantis Casino Resort Spa in Reno, Nevada, purchased upon the company’s founding in 1972, and the Monarch Casino Resort Spa in Black Hawk, Colorado, acquired in 2012. Both establishments have since undergone multiple expansions, renovations and rebrandings upon coming under Monarch ownership. The most recent one, an expansion of the company’s Black Hawk location, was completed in November 2020.

The company showed strong growth in the years before COVID-19. It reported a compound annual growth rate (CAGR) of an 8.01% for revenue and 22.11% for share price from 2011 to 2019. Although COVID-19 did negatively impact Monarch’s business, with annual revenue declining by 26% from 2019 to 2020, the company has rebounded, with sales not only projected to return to pre-COVID-19 levels but exceed them. Recent shareholder reports have shown Q1 2021 revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) to be 46.9% and 181.6% higher than Q1 2020 figures, respectively. The company’s year-to-date return of 17.0% also beat the industry average of 9.1% and the S&P 500’s 12.1%. IBISWorld predicts an average annual industry growth of 14.8% in revenue from 2020 to 2025.

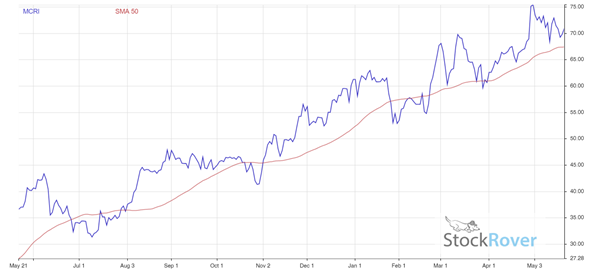

MCRI’s stock price for the last year is plotted below, alongside a 50-day moving average to show the consistent upward trend.

Chart provided by Stock Rover.

As a result of Monarch’s rebound and high growth potential, the company’s stock has skyrocketed, with a 352% increase in share price from $15.69 in March 2020 to $70.59 today.

Although Monarch has seen a significant increase in debt liabilities in recent years, with its net leverage ratio increasing from -0.1x in 2017 to 3.5x in 2020, it is not an area of concern. The company’s leverage remains well below the industry average net leverage ratio of 6.3x for hotel casinos for the past three years. Monarch also has reduced its net leverage ratio from 3.5x to 2.3x by the end of Q1 2021, while only decreasing cash on the balance sheet by approximately $4 million.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $79.33, 10.7% higher than its latest closing price of $71.64, with analysts projecting an 76.1% growth in sales for 2021, earning MCRI a “Strong Buy” recommendation.

3 Best Hotel Stocks to Buy Now: #1

Trip.com Group Ltd (NASDAQ:TCOM)

Trip.com Group Ltd (NASDAQ:TCOM), originally known as Ctrip.com International, Ltd, is an online travel services company headquartered in Shanghai, China, that specializes in hotel, train, airline and tour package offerings across the world. Since its founding in 1999, Trip.com has grown into one of the world’s largest online travel agencies and the biggest in China, with more than 400 million members and 45,000 employees.

Although the company saw a 49% decrease in revenue from 2019 due to COVID-19, it has since rebounded. Domestic sales in China, the company’s primary source of revenue, have largely recovered.

Chinese hotel and airline reservations from the website have returned to pre-COVID-19 levels for the same period in 2019. The accommodation reservation and transportation ticketing segments of the business had accounted for 77% of Trip.com Group’s revenue that year. Domestic corporate travel management also has grown 101% year-over-year and is up 6% from the same period in 2019.

The company has provided a higher return over the past year than the industry average and the S&P 500, with a year-to-date return of 16.6% compared to 11.9% and 12.1%, respectively. With a five-year earnings per share (EPS) growth average of 9.9% and a 0.98 beta, in contrast to the industry average of 9.9% and 1.43, TCOM also is a more profitable and safer investment compared to similar companies.

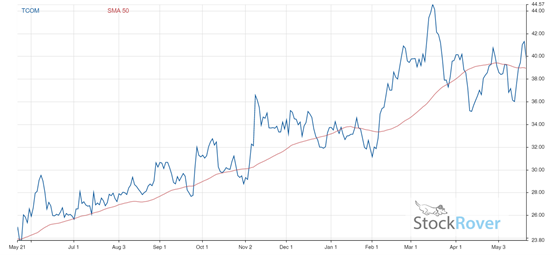

As shown by the chart below, which graphs the stock price for the last year, alongside a 50-day moving average, TCOM’s share price has grown by 66% over the past 12 months from $23.80 in May 2020 to $39.57.

Chart provided by Stock Rover.

Despite Trip.com experiencing a slower recovery internationally due to more stringent lockdown restrictions and higher COVID-19 case numbers abroad, the lifting of regulations in the West and rollout of vaccines will provide a boon for travel demand in the United States and Europe. IBISWorld expects a 10.9% annual increase in travel agency revenue over the next five years from 2021 to 2025 as the economy and travel industry both rebound from the pandemic.

A discounted cash flow (DCF) analysis using Stock Rover values the stock at $45.50, 15.6% higher than its latest closing price of $39.34, with analysts projecting a 33.8% growth in sales for 2021, earning TCOM a “Buy” recommendation.

The three best hotel stocks to buy offer investors a chance to profit from undervalued equities in an industry that is recovering from the past year’s COVID-19 shutdowns.

Capison Pang is an editorial intern who writes for www.stockinvestor.com.