For investors looking for a fund to help position an income portfolio for rising rates, the one-of-a-kind Invesco Variable Rate Preferred ETF (VRP) may be of interest.

The exchange-traded fund (ETF) offers exposure to both U.S. and foreign-issued floating- and variable-rate preferred stocks, as well as certain types of hybrid securities that are comparable to preferred stocks. Both the stocks and hybrid securities pay a floating or variable rate dividend or coupon (an annual payment).

As a bit of background, floating-rate preferred stocks link dividends to a reference benchmark rate and a fixed spread. Variable-rate preferred stocks begin with a fixed dividend for a certain amount of time but ultimately morph into a floating-rate structure.

Preferred stocks have always been viewed as a solid alternative income generator as they offer uncorrelated price trends and hefty dividends. Since preferred stocks have the ability to diversify away from traditional bonds, the fund can help to smooth out volatility and enhance long-term returns.

Hybrid securities, on the other hand, can combine the characteristics of two groups of securities: debt and equity.

Because VRP holds hybrid securities with floating-rate components, such as senior loans, it is able to achieve a lower effective duration, which can help to mitigate against duration risk. The floating-rate components lend themselves to regular adjustments based on the dominant interest-rate environment, which, in turn, lowers the fund’s sensitivity to Treasury yield fluctuations.

Invesco.com states that VRP’s effective duration is slightly less than three-and-a-half years and has a 30-day U.S. Securities and Exchange Commission (SEC) yield of 3.78%. According to the site, the fund’s relatively low yield is credited to its strong returns and ability to hit all-time highs throughout the recovery phase of the risk-asset rally. Moreover, like a traditional bond fund, shareholders are paid monthly dividend payments.

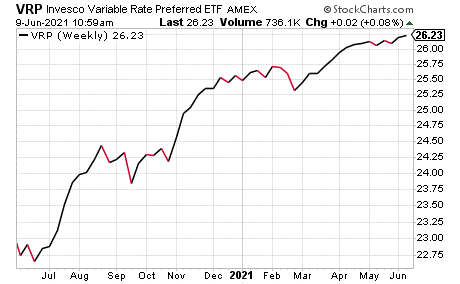

The open-ended fund charges an annual expense ratio of 0.50% and has a 4.22% dividend yield. VRP has $1.63 billion in total assets and $1.70 billion in assets under management. Year to date, the fund’s performance has been incredibly strong. VRP had a significant dip in mid-September 2020 but saw a large spike in early November. From that point on, the fund climbed rapidly and only saw one minor dip in late February 2021. Today, the fund opened at $26.22 and is currently trading at $26.23, which is at the high end of its 52-week range of $23.35 to $26.25.

According to Invesco, VRP has 273 holdings and 75% of them are allocated to the financial sector, while the remaining 25% of its holdings are a mixture of energy, industrial and utility stocks. The fund’s top five holdings have the following weightings of each, followed by their respective annual coupon payment — the interest paid each year on a bond between its issue date and the date of maturity — include General Electric Company 3.51%, 2.41%; Wells Fargo & Company 3.90%, 1.61%; JPMorgan and Chase Company 4.60%, 1.37%; JPMorgan Chase & Co. 3.68%, 1.34% and The Charles Schwab Corporation 5.38%, 1.23%.

In sum, VRP offers exposure to both U.S.- and foreign-issued floating- and variable-rate preferred stocks and certain types of hybrid securities. It is the only fund in its segment with an emphasis on variable rate coupon securities to align itself with a rising interest-rate trend. Further, the floating-rate components of the hybrid securities allow for regular adjustments based on the dominant interest-rate environment, thus lowering the fund’s sensitivity to Treasury yield fluctuations.

So, for conservative investors, Invesco Variable Rate Preferred ETF (VRP) may be a fund worth looking into. However, interested investors are always advised to conduct their own research and decide whether a given fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)