The three best pharmaceutical stocks to buy now are two massive large-cap companies, one known for its COVID-19 vaccine and another for arthritis medication, and a smaller large-cap specializing in pain and inflammation treatments.

This article includes biopharma companies but does not include companies dedicated chiefly to the biotechnology space. The difference between pharmaceutical and biotech companies lies in production and research, since pharmaceutical companies use chemicals to create drugs, while biotech companies rely on living organisms.

With global health care spending reaching $8.3 trillion pre-pandemic, pharmaceuticals and medicine manufacturing are expected to generate more than $1.3 trillion in revenue in 2021, making the broad industry an attractive option for many investors. Although patent protections and government approval make finding a suitable investment tricky, it can prove to be immensely worthwhile in the long term. Top-performing pharmaceutical companies frequently produce some of the highest returns in the market.

3 Best Pharmaceutical Stocks to Buy Now, According to DividendInvestor.com

The three best pharmaceutical stocks to buy now were found and analyzed through our very own Dividend Screener on the Dividend Investor website. The Dividend Screener is a simple web-based tool that allows investors to sift through thousands of potential equities by adding their own customized criteria to find stocks that fit their unique needs.

Also used in the analysis of the three best pharmaceutical stocks to buy now was the platform designed by our partners at Stock Rover, offering a rigorous screening program to assess performance metrics for investors. To sign up for a free two-week trial, click here.

For the most comprehensive research, we recommend that savvy investors use both the Dividend Screener and Stock Rover in tandem.

Here are the three pharmaceutical stocks to buy now.

3 Best Pharmaceutical Stocks to Buy Now: #3

AstraZeneca (NASDAQ:AZN)

AstraZeneca (NASDAQ:AZN), a multinational British-Swedish pharmaceutical and biotechnology company headquartered in Cambridge, United Kingdom, is an industry giant with a market capitalization of $155 billion that is about to grow further with a new acquisition.

The company, formed in a 1999 merger between Swedish-based Astra and the U.K.-based Zeneca group, recently announced the planned acquisition of American pharmaceutical company Alexion Pharmaceuticals for $39 billion. The proposed acquirer currently produces and develops drugs across various therapeutic areas, including diabetes, gastrointestinal, cardiovascular, cancer, immunology and respiratory illnesses and ailments.

AstraZeneca has become a household name in the past year due to its joint research and development effort with University of Oxford scientists to produce a COVID-19 vaccine to combat the pandemic. However, the coronavirus vaccine comprises only a small portion of the pharmaceuticals and treatments the company manufactures and provides. The company’s other business areas have been so successful that it has allowed AstraZeneca to produce and sell its COVID-19 vaccine on a not-for-profit basis while simultaneously raising its outlook for 2021.

Cancer Treatment May Fuel 1 of the 3 Best Pharmaceutical Stocks to Buy Now

The company’s primary cancer drug, Tagrisso, used to treat metastatic non-small cell lung cancer, has seen sales increase by 17% during Q1 2021 to just under $1.15 billion with other cancer-related drugs, Imfinzi and Lynparza, seeing sales growth of 20% and 37%, respectively. AstraZeneca’s diabetes treatment, Farxiga, which is mainly used to treat patients with type 2 diabetes, has seen its sales soar by 54% in the first quarter of this year. With a 15% year-to-date (YTD) return rate and a one-year sales growth rate of 9.3%, the company has easily surpassed the industry average return rate of 5.7% and average sales growth rate of 5.5%.

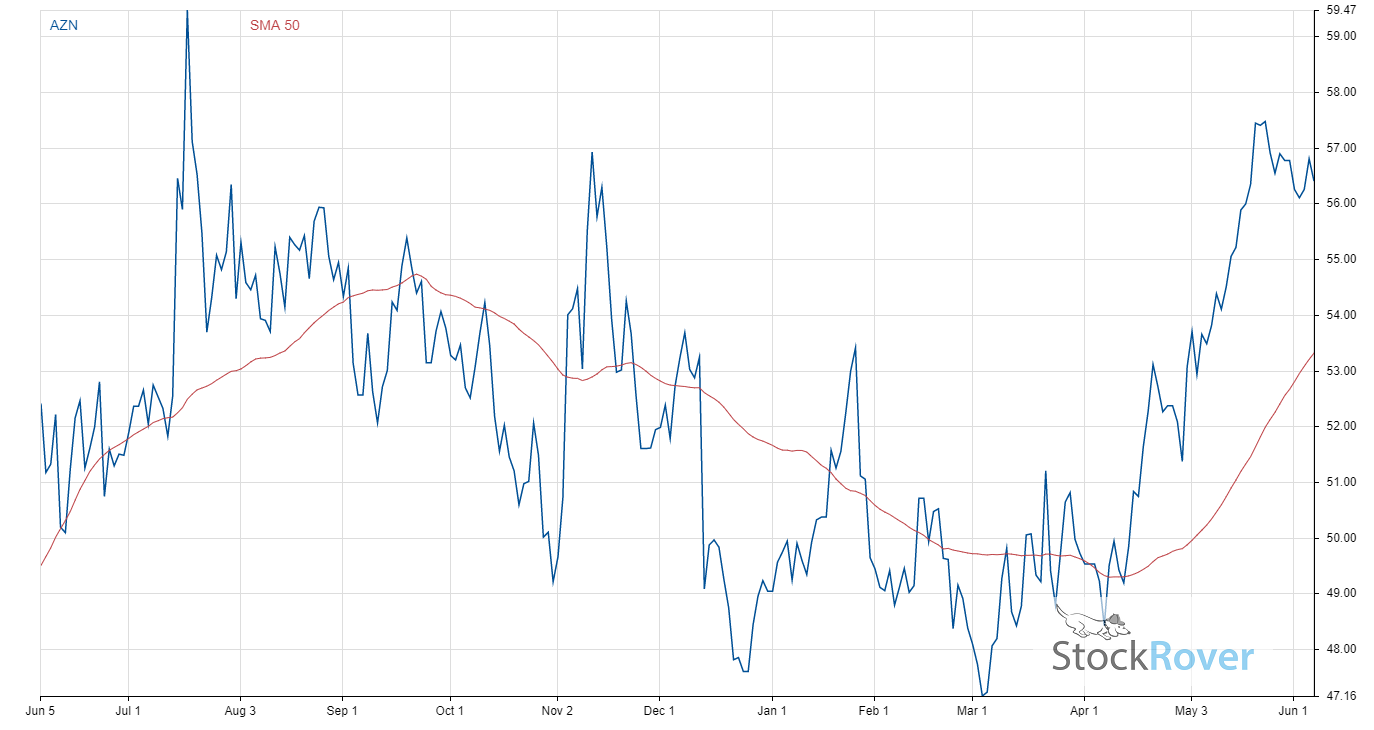

Although the AZN share price has seen an up-and-down year, growing by 4.0% since June 2020. It has maintained a steady climb upwards over the long-term with a 23.5% compound annual growth rate (CAGR) over the past two years and a 17.89% CAGR over the past five years. AstraZeneca also has signaled a return to rapid growth with a 15.1% increase in share price YTD. AZN’s stock price during the last year is plotted below, alongside a 50-day moving average.

Chart provided by Stock Rover.

Although AstraZeneca has suffered a public relations hiccup during the COVID-19 pandemic regarding vaccine distribution and possible side effects that include rare blood clots, the not-for-profit nature of that particular vaccine makes it reasonably easy for the company to recover financially since its management is not relying on the program to produce a return. With vaccine production and rollout rapidly increasing, experts currently predict that there will be enough vaccines for everyone on the planet by the end of 2021.

Pharmaceutical companies always must be forward-looking with their long-term goals. With 164 drugs in development, seventh-most in the world, and its planned acquisition of Alexion Pharmaceutical bringing in an additional 20 clinical development programs, AstraZeneca remains at the forefront of innovation. With analysts currently projecting a 23.2% increase in sales in 2021 and an 18.4% increase in 2022, AZN’s future appears bright.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $69.40, 15.4% higher than its latest closing price of $65.10, earning AZN a “Strong Buy” recommendation from Stock Rover and a place among our three best pharmaceutical stocks to buy now.

3 Best Pharmaceutical Stocks to Buy Now: #2

Horizon Therapeutics PLC (NASDAQ:HZNP)

Horizon Therapeutics PLC (NASDAQ:HZNP), formerly known as Horizon Pharmaceuticals PLC, is an Irish company specializing in developing, manufacturing and commercializing medicinal products designed to combat pain, arthritis and inflammation. The company, which sees 97% of its worldwide sales from the United States, moved its “legal headquarters” to Ireland in 2014 to benefit from the country’s permissive corporate tax system and lower rates. The transition has freed up cash on the balance sheet, allowing HZNP to engage in an acquisition spree of six companies over the past seven years and reach a market cap of $21 billion. The most recent and largest purchase of American biotechnology firm Viela Bio, a spinoff of AstraZeneca, for $3.05 billion in March 2021.

Even in a year that proved to be stellar for many companies in the pharmaceutical industry, Horizon Therapeutics stood out with a 69.2% jump in revenue from fiscal year 2019 to 2020. With a sales growth rate of 59.0% and a return rate of 85.4% over the past year, compared to industry averages of 7.1% and 9.6%, it should come as no surprise that its share price has skyrocketed 87.3%. However, HZNP’s success has not just been a recent phenomenon. The company boasts an average annual growth revenue rate of 20.8% and a return rate of 387.6% for the past five years, leading to a share price CAGR of 37.11% over the same period.

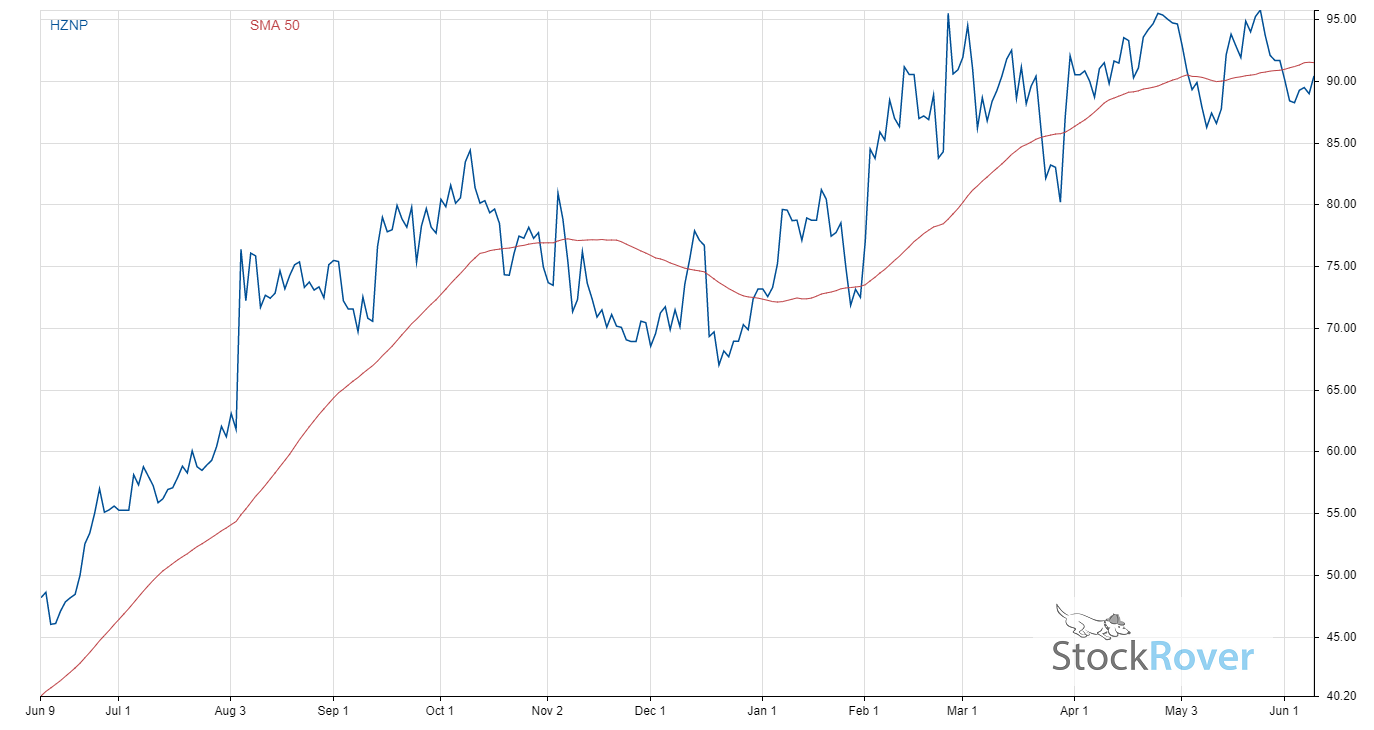

HZNP’s trailing 12-month share price and 50-day moving average are plotted below.

Chart provided by Stock Rover.

The best may still be yet to come. Since drug patents only last for 20 years, which often can be effectively less due to continued FDA testing and approval requirements, the key to continued success for a pharmaceutical company is the ability to develop new drugs and new uses for its current drugs. For a company of its size, Horizon Therapeutics excels in this element. It has 23 medicine and therapeutic development programs in its pipeline, led by label usage expansions for its top two revenue generators.

Tepezza is the only treatment currently approved by the FDA for thyroid eye disease. The company also has gout therapy medication Krystexxa. The acquisition of Viela Bio also brought Uplinza, a pharmaceutical used to treat neuromyelitis optica spectrum disorder (NMOSD), into HZNP’s portfolio. Uplinza is currently in two phase-three and two phase-two expanded use label trials. Each newly approved expanded use potentially lengthens patent protection by three years.

The biggest issue for investors is HZNP’s spike in its price-to-earnings ratio (P/E), trailing 12 months earnings, from 22.01 on March 20, 2021, to 68.6 today, potentially overvaluing the stock. For comparison, the average industry P/E is 39.7. However, with analysts projecting a 27.7% growth in sales for 2021 and a 26.0% growth in 2022, forward P/E is expected to drop to 17.5 in the next fiscal year, well below the current industry average to potentially quell overvaluation fears.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $116.30, 28.0% higher than its latest closing price of $90.83, earning HZNP a “Strong Buy” recommendation from Stock Rover and a place among our three best pharmaceutical stocks to buy now.

3 Best Pharmaceutical Stocks to Buy Now: #1

AbbVie (NYSE:ABBV)

AbbVie (NYSE:ABBV), a biopharmaceutical company with a market cap of $206 billion headquartered in North Chicago, Illinois, focuses on developing and manufacturing treatments for chronic and complex diseases. The company, which was spun off from Abbott in 2013, recently acquired Allergan in May 2020, adding several new drugs (mostly centered around women’s health and aesthetics, such as Botox) to its portfolio. AbbVie is primarily known for its development of Humira, which is used to treat severe rheumatoid arthritis. The drug currently accounts for nearly half of the company’s profits.

AbbVie has seen its revenue soar during the trailing 12 months. This is mainly due to its new aesthetic business smashing expectations, with total company revenue growing by 47.4% over the past year, dwarfing both the industry and S&P 500 averages of 5.5% and 14.3%, respectively. Similar to Horizon Therapeutics, ABBV has consistently managed to beat average industry return rates and revenue growth rates. The company currently has a five-year return rate of 135.1% and an average annual revenue growth rate of 16.1%, compared to the industry averages of 65.4% and 2.2%, respectively. However, what makes the company stand out is its ability to generate free cash flow (FCF).

With a price-to-FCF ratio of 11.4, compared to industry and S&P 500 averages 19.5 and 31.8, respectively, ABBV is an incredible opportunity for investors looking for consistent dividend payouts. The company’s tremendous FCF generation has allowed for a dividend yield of 4.6%, a projected dividend growth rate of 5% and a dividend payout ratio of 178.6%. The company is also part of the Dividend Aristocrats, a select group of S&P 500 companies that have increased their dividend payments every year for the last 25 years.

ABBV stock has soared by 26.5% over the past 12 months on the back of recent positive news and revenue growth. The FDA has announced it will consider AbbVie’s rheumatoid arthritis drug Rinoviq to treat psoriatic arthritis in Q2 2021 and for eczema in Q3. The company has seen a 44.0% jump in share price from $78.60 to $113.15, since its Q3 2020 earnings report was announced in October last year. ABBV’s stock price across the past year is plotted below, alongside a 50-day moving average to show the share price’s rise.

Chart provided by Stock Rover.

AbbVie’s most significant pain point is its Humira patents. The company lost patent exclusivity for the drug in Europe in 2018. With its United States patent set to expire in 2023, it is a significant point of concern for many investors. However, the company has taken steps to secure future revenue streams post-Humira exclusivity. Its total annual revenue has increased since losing patent exclusivity in Europe for Humira, with a CAGR of 18.3% since 2018. The company’s acquisition of Allergan and creations of “patent walls” around its other drugs, such as Imbruvica, has allowed the company to grow its non-Humira-related revenue to approximately $30 billion in 2020.

The company also has tremendous upside potential, with nearly 90 drugs in development and more than 20 programs in phase 3 clinical testing with the FDA. With the upcoming arrival of new medications, Skyrizi and Rinvoq, projected to cover any profit shortfall from the loss of patent exclusivity rights within two years, AbbVie’s future seems bright even post-2023.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $120.21, 6.37% higher than its latest closing price of $113.01. With analysts projecting a 21.9% growth in sales for 2021, ABBV received a “Strong Buy” recommendation from Stock Rover and a place among our three best pharmaceutical stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)