Investors in exchange-traded funds (ETFs) can choose from a vast number of different themes that they can use.

Corporate debt is one category that is sometimes overlooked in investors’ decisions about how to distribute their money between stocks, bonds and cash. An exchange-traded fund (ETF) that offers a chance to invest in corporate debt is VanEck Vectors Investment Grade Floating Rate ETF (FLTR).

This fund focuses on a market-value-weighted portfolio of U.S. investment-grade corporate debt. Holders can be paid a small dividend for owning shares of this fund, with a current dividend yield amounting to just under 1%.

The dividend is paid on a monthly basis, which may be an attractive feature for income seekers. The fund’s holdings are chosen based on risk and return characteristics, as well as limited to floating-rate debt. It holds debt that is not due to mature for at least six months.

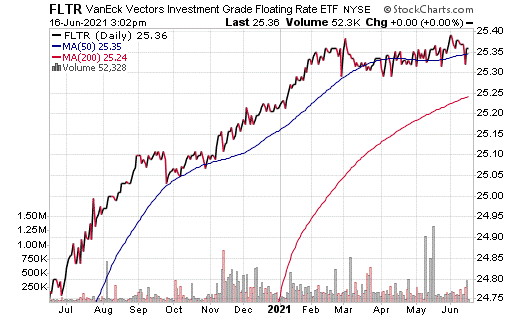

FLTR currently has an expense ratio of 0.14%, and its assets under management total $608 million. Because the fund invests in debt, it tends to have stable returns and not respond strongly to market events. Its chart tends to look quite flat. Although it declined during the pandemic, it did not have nearly as dramatic a dip as traditional stocks.

Given all this, it is unsurprising that FLTR is up just 1.58% in the last 12 months and 0.3% year to date. This is very much not the type of investment for those looking for a lot of variance or risk in their returns, but rather could be viewed as more of a safe haven that pays better than cash.

Among the top companies whose debt is held partly by FLTR are Morgan Stanley (MS), Wells Fargo & Co. (WFC), JPMorgan Chase (JPM), HSBC Holdings plc (HSBC) and Goldman Sachs (GS). Nearly 75% of assets are allocated to financial sector companies.

Investors looking for another option to protect their cash while earning a small return may benefit from researching VanEck Vectors Investment Grade Floating Rate ETF (FLTR).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)