Three generic pharmaceutical manufacturers to buy for profitable investing opportunities feature companies that have risen near the top of that sector.

The three generic pharmaceutical manufacturers to buy include two dividend payers and offer the potential that they all could produce further growth organically and through acquisition. The trade-off is that the three generic pharmaceutical manufacturers to buy typically would not offer the potential blockbuster new drugs that could cause their share prices to soar.

One of the three generic pharmaceutical manufacturers to buy is from India, while the other two are based in the United States. The company based in India may have one of the most recognized brands in the generic industry because it was founded and named after Kallam Anji Reddy, PhD. He earned his doctorate in Chemical Engineering from India’s prestigious National Chemical Laboratory.

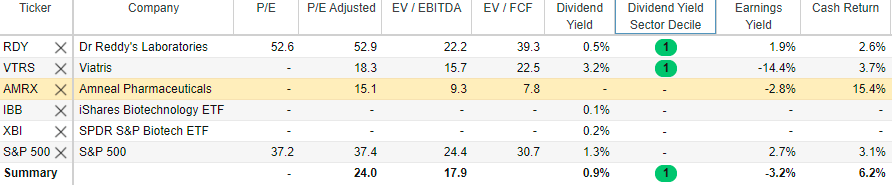

Source: Stock Rover. Click here to sign up for a free two-week trial.

For investors interested in gaining exposure to generic pharmaceutical companies, look to India, which has become a “global powerhouse” in the industry, said Bob Carlson, leader of the Retirement Watch investment newsletter.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz.

Three Generic Pharmaceutical Manufacturing Stocks to Buy Include Dr. Reddy’s Laboratories

Among the top prospects for investors interested in companies that provide generic pharmaceuticals are Dr. Reddy’s Laboratories (NYSE:RDY), Sun Pharmaceutical industries (524715.India), Divi’s Laboratories (532488.India) and Cipla (500087.India). However, the generic sector of the pharmaceutical industry has had its problems, Carlson cautioned.

It also generally been under fire for overpricing generic drugs, Carlson continued. U.S. pharmacies and other buyers have consolidated further than in the past and are negotiating reduced prices with the generic drug makers as several government investigations have occurred in the sector, he continued.

Dr. Reddy reported in its fourth-quarter 6-K document filed with the U.S. Securities and Exchange Commission (SEC) that it is involved in disputes, lawsuits, claims, governmental and/or regulatory inspections, inquiries, investigations and proceedings, including patent and commercial matters that arise from time to time in the ordinary course of business. Most of the claims involve “complex issues” that are subject to uncertainties and the probability of a loss, the company added.

Dr. Reddy’s Headlines Three Generic Pharmaceutical Manufacturing Stocks to Buy

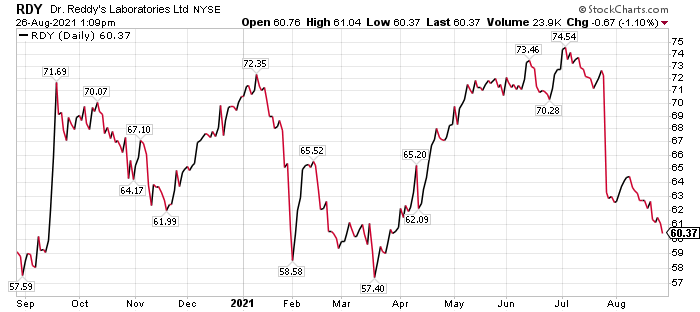

However, Dr. Reddy’s rising share price since the end of 2020 shows that the stock’s fortunes have not been ruined by those risks. Aside from manufacturing generic pharmaceuticals, Dr. Reddy partnered with the Russian Direct Investment Fund to cooperate on clinical trials and distribution of Sputnik V COVID-19 vaccine in India. Upon regulatory approval in India, RDIF agreed to supply Dr. Reddy’s with 100 million doses of the vaccine that is based on a well-studied human adenoviral vector platform to provide proven safety and to complete clinical trials to show its efficacy against COVID-19, the company announced.

Carlson commented that the coronavirus pandemic created supply shortages of compounds used to manufacture generic drugs. There are no U.S.-based locations that produce the compounds, which put American generic drug manufacturers at a disadvantage to those in India and China, he added.

A potential problem for the India-based companies is that as the pandemic wanes, the U.S. Food and Drug Administration (FDA) will have more extensive examinations of the factories in India than has been the case the last 18 months or so, Carlson said.

Three Generic Pharmaceutical Manufacturing Stocks to Buy Offer Diversified Revenues

Dr. Reddy’s operates three core segments: Pharmaceutical Services and Active Ingredients, Global Generics and Proprietary Products. Its management described its strengths as Chemical Synthesis, Formulation Development and Manufacturing; Clinical and Regulatory expertise; and robust global supply chain and strategic networks.

Analysts at Barclays PLC upgraded its rating of Dr. Reddy on Feb. 2 to “overweight” from an “equal weight” rating due to the company’s planned launch of its Sputnik vaccine. The heightened rating also included an increased price target of $70.00, up from $56.00. The stock subsequently showed those projections were conservative when the share price closed at $73.51 on July 13.

Chart courtesy of www.StockCharts.com

Money Manager Picks Two of Three Generic Pharmaceutical Manufacturing Stocks to Buy

“Pure generic drug investment opportunities have become scarce over the years because success in that business is either predicated on moving up the industry food chain into proprietary products or reaching scale via consolidation,” said Hilary Kramer, who heads the GameChangers and Value Authority advisory services. “Either way, the number of companies focused on off-patent drugs shrinks over time as leaders move on and laggards get bought out.”

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

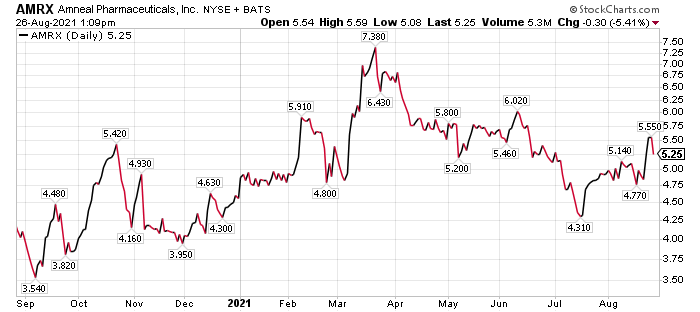

“One pure play I’d recommend right now: Amneal Pharmaceuticals Inc. (NYSE:AMRX), which shot into the market spotlight with generic epinephrine pens,” Kramer said. “But even though that initial surge is flattening out now, the stock is still interesting here below $5. You’re effectively paying under six times earnings for long-term EPS expansion of around 12% a year, which is classically an attractive price for that kind of growth profile.”

Three Generic Pharmaceutical Manufacturing Stocks to Buy Include Amneal

Amneal Pharmaceuticals, headquartered in Bridgewater, New Jersey, focuses on the development, manufacture and distribution of generic and specialty drug products. The company announced earlier this year that the Food and Drug Administration (FDA) has accepted the Biologics License Application (BLA) for its Bevacizumab, with a standard review goal date in second-quarter 2022, according to the BsUFA (Biosimilar User Fee Act).

Chart courtesy of www.StockCharts.com

On April 5, Amneal completed its previously announced acquisition of a 98% interest in Kashiv Specialty Pharmaceuticals, LLC. Kashiv Specialty Pharmaceuticals focused on the development of complex generics, innovative drug delivery platforms and novel 505(b)(2) drugs.

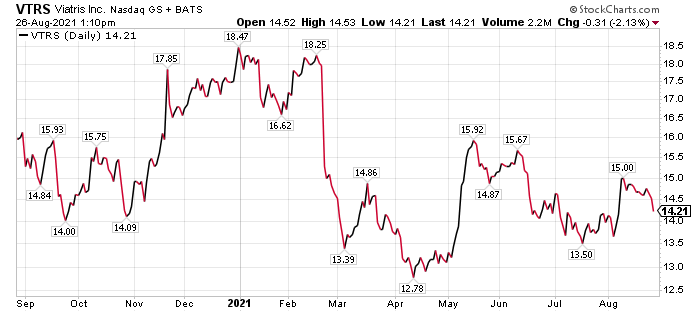

Viatris Emerges as One of Three Generic Pharmaceutical Manufacturing Stocks to Buy

Otherwise, investors probably are better off simply buying into a big pharmaceutical manufacturer like Viatris Inc. (NASDAQ:VTRS), a Canonsburg, Pennsylvania-based specialty and generics drug company that was formed by a merger between Pfizer’s (NYSE: PFE) Upjohn legacy brands business and Mylan, a generic and biosimilar drug manufacturer. Viatris has a “commanding franchise” and pays a 3% dividend as a bonus, Kramer counseled.

Chart courtesy of www.StockCharts.com

Funds Offer Alternative to Three Generic Pharmaceutical Manufacturing Stocks to Buy

Biotechnology stocks and funds have been doing well recently, and that’s likely to continue, Carlson said. Companies continue to announce breakthroughs, and a number of biotech companies are going public, he added.

It is tough to identify the best individual stocks in the sector to buy. He recommends a diversified exchange-traded fund (ETF) for most investors. But even that is difficult, because of differences in the stocks held by the leading ETFs. The best move for investors seeking alternatives to the three pharmaceutical manufacturing stocks to buy might be to hold positions in the two leading biotech ETFs.

iShares Biotechnology (IBB) aims to track the NASDAQ Biotechnology Index, so it holds only stocks listed on the NASDAQ and that are classified as either biotechnology or pharmaceutical companies. This tends to be the more volatile of the funds, and over some periods its returns can be substantially higher or lower than alternatives.

IBB Rose More Than 25% in Both 2019 and 2020

IBB returned 25.21% in 2019, 26.01% in 2020 and 6.35% so far in 2021. Its three-year annualized return is 14.24%, and its five-year return is 14.71%.

The other fund is SPDR S&P Biotech (XBI), which aims to track the S&P Biotechnology Select Industry Index. The sector index is derived from a U.S. total market composite, so it isn’t limited to S&P 500 stocks. But the fund uses a sampling strategy to try to track the index instead of holding all the stocks in the index. XBI tends to favor stocks with greater liquidity, so it does not own many smaller companies or those with limited trading volume.

XBI Carries Less Risk Than Three Generic Pharmaceutical Manufacturing Stocks to Buy

Though it is less volatile than IBB, XBI is more volatile than the market indexes and the health care sector. The fund returned 32.56% in 2019, 48.33% in 2020, but so far in 2021 is down 7.90%. The fund’s annualized returns are 13.01% over three years and 21.94% over five years.

The difficulty of categorizing stocks and funds in the sector is evidenced by Morningstar’s classification of these funds. IBB is in the Specialty-Technology category and XBI is in the Specialty-Health category.

IBB tends to hold larger capitalization companies than XBI. Despite their differences, Morningstar says the two funds have a correlation of 94%.

Three Generic Pharmaceutical Manufacturing Stocks to Buy as New Variants of COVID-19 Spread

The increasingly transmissible Delta variant of COVID-19 has spread to almost every state in America, raising concerns among health officials about potential spikes in cases. Genetic variants of SARS-CoV-2 have been emerging and circulating around the world throughout the COVID-19 pandemic, according to the Centers for Disease Control and Prevention (CDC).

A variant has one or more mutations that differentiate it from other variants in circulation. The Delta variant is expected to become the dominant coronavirus strain in the United States, the CDC director said. With more than half the U.S. population not fully vaccinated, public health officials caution that a resurgence of COVID-19 cases could occur in the fall when many unvaccinated children are expected to return to school.

Progress in the COVID-19 vaccination process lifts hope that new cases and deaths will keep falling. So far, 184,543,821 people, or 55.6% of the U.S. population, have received at least one dose of a COVID-19 vaccine. Those fully vaccinated total 159,675,163 people, or 48.1%, of the U.S. population, according to the CDC.

Three Generic Pharmaceutical Manufacturing Stocks to Buy Operate Amid Rising COVID-19 Cases and Deaths

Plus, the Food and Drug Administration recently approved a third COVID-19 vaccine, manufactured by Johnson & Johnson (NYSE:JNJ), which requires only one dose rather than two, as needed with the first two vaccine providers: Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA).

COVID-19 cases worldwide have hit 187,798,855 and caused 4,048,903 deaths, as of July 14, according to Johns Hopkins University. U.S. COVID-19 cases totaled 33,914,884 and have led to 607,771 deaths. America has the dubious distinction as the country with the most COVID-19 cases and deaths.

The three generic pharmaceutical stocks to buy offer ways for investors to profit amid the pandemic. Rising COVID-19 vaccine availability, improving economic data and a recent $1.9 trillion federal stimulus package should help to lift the valuations of the three generic pharmaceutical stocks to buy.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing!

![[gold pill]](https://www.stockinvestor.com/wp-content/uploads/3022618543_9ab124cc98_b.jpg)