The three best small-cap stocks to buy now consist of a gaming accessories brand, a manufacturer of semiconductor cleaning equipment and a smart vehicle tracking and analytics software-as-a-service (SAAS) platform.

Small-cap companies are corporations with market capitalizations (market cap) between $300 million and $2 billion. Companies at this size occupy a unique position in the investor space since they possess enough of an established track record to no longer be considered speculative investments for venture capital or angel investing.

However, most companies are still in the growth phase of their life cycle, providing a chance for higher returns. Plus, small-cap index funds often outperform the S&P 500.

The potential for increased returns carries with it a higher risk. Smaller companies tend to be more susceptible to volatility, such as supply disruptions and changes in demand, as well as scalability challenges. Much of the value from small-cap corporations comes from their potential to grow and scale their business. However, very few firms have the ability to expand like Facebook (NASDAQ:FB) or Walmart (NYSE:WMT).

By investing in the right stocks, we can capture the upside of high returns from small-cap stocks while mitigating our risk. Here are the three best small-cap stocks to buy now.

3 Best Small Cap Stocks to Buy Now: #3

ACM Research Inc (NASDAQ:ACMR)

ACM Research Inc (NASDAQ:ACMR), founded in January 1998, is an American-based corporation headquartered in Fremont, California, specializing in the development, manufacturing and sale of single-wafer wet cleaning equipment under the brand name Ultra C. Semiconductor manufacturers use wafer fab equipment (WFE) to remove defects, particles and contaminants to improve quality and performance in chips. ACM Research currently has a market cap of $1.57 billion.

Semiconductors are a crucial part of nearly every piece of advanced electronic equipment we use today, from smartphones to refrigerators to magnetic resonance imaging (MRI) machines. Its usefulness derives from its sensitivity to electronic and magnetic fields, making them excellent sensors. Prior to the invention and popularization of semiconductors, computers relied on tubes and dials to operate. As technology continues to advance and matriculate into our everyday lives, demand for semiconductors is expected to skyrocket. Already worth $425.96 billion in 2020, the global semiconductor industry is projected to rise to $803.15 billion by 2028.

One of the primary challenges in manufacturing semiconductors is their minuscule size. Semiconductor chips are measured in nanometers or a billionth of a meter. Standard commercial manufacturing stands at 10 and 14 nanometers, with semiconductor companies racing to develop ever-smaller chips. As a result, chips must be immaculately clean, with manufacturing cleanrooms as immaculate as surgical suites. Even the tiniest dust particle can ruin the chip due to its size. Hence, the importance of semiconductor cleaning equipment manufacturers such as ACM Research.

What sets ACM Research apart is its rapid growth. Even in an industry known for performing well above the S&P 500, the company stands above the rest. The average industry rate of return over the last three years stands at 222.0%. Since its initial public offering (IPO) in November 2017, ACMR has averaged a 49.4% increase in sales annually over the past three years and has generated a 634.9% return rate over the same period. Furthermore, ACM Research is projected to continue its strong growth with a 43.2% projected increase in sales in 2021 and a 36.9% jump in 2022.

The company possesses strong ties with China to create a unique investment profile. Three Chinese companies, Shanghai Huali Microelectronics Corporation, Yangtze Memory Technologies Corporation and Semiconductor Manufacturing International Corporation, combined for 76% of ACM Research’s total revenue in 2020. This deep connection has provided the company with immense upside as China is currently the fastest-growing WFE market globally and has unique challenges.

The United States-China trade war has caused ACMR to remain relatively flat, causing the stock only to rise by 0.9% over the past 12 months. Despite being headquartered in California, ACM Research’s weak share price gain is similar to what has occurred with many Chinese technology companies that, in some cases, have seen a decline in share price in recent months.

Chart provided by Stock Rover.

However, investor fears have become overstated. Howard Wang, head of Greater China equities at JPMorgan Asset Management, commented in May 2021 that “declines in Chinese tech shares — due to the regulatory risks or investors rotating out of growth stocks — appear overdone and have resulted in pretty decent value in some Chinese tech stocks.” The decrease in share price has made ACMR, a stock with a growth score of 100 and a quality score of 93 from Stock Rover, a buy.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $124.72, 50.7% higher than its latest closing price of $82.75, earning ACMR a “BUY” recommendation from Stock Rover and a place among our three best small-cap stocks to buy now.

3 Best Small Cap Stocks to Buy Now: #2

Turtle Beach Corporation (NASDAQ:HEAR)

Turtle Beach Corporation (NASDAQ:HEAR), founded in 1975, is an American-based gaming accessory company headquartered in San Diego, California. The company offers a broad selection of gaming headsets, keyboards and mice for computers, consoles and mobile devices. The Turtle Beach brand sells and distributes its products through various retailers, including Amazon (NASDAQ:AMZN), Target (NYSE:TGT), Walmart, Best Buy (NYSE:BBY) and GameStop (NYSE:GME).

Over the past few decades, video games have grown into the most lucrative entertainment industry by far, with more than three billion players across the world. In 2019, the global video game market generated $147.5 billion in revenue, compared to $62.7 billion from worldwide box office and music sales in the same year. By 2026, global video games sales are expected to reach more than $240 billion.COVID-19 has only compounded the success of video games.

Twitch’s video streaming platform saw a 50% increase in watch time from March to May 2020, and Microsoft announced that it had seen a 130% increase in multiplayer engagement from March to April 2020. Last year, the global gaming industry surpassed total revenue from the international film industry and the North American sports market combined.

Although new consoles, graphics cards and game releases typically draw the most attention in the gaming community, some of the most common equipment used by players are headphones, keyboards and mice. A 2019 survey of the United States, France, the United Kingdom, Germany and Sweden markets — four of the five largest Western gaming markets — found that 51% of all gamers owned a gaming headset. In addition, 38% of gamers in those markets also owned a gaming mouse and 36% had a gaming keyboard.

Turtle Beach has become the industry leader in console gaming headsets since launching its first model in 2005. The company has captured 45% of the North American market and 40% of the market in the United Kingdom in 2020. The company currently claims eight out of the 10 best-selling Xbox and PlayStation gaming headsets by revenue. Console gaming comprises 28% of the industry market share, behind only mobile gaming, raking in $51.2 billion globally in 2020.

Similar to the rest of the video game industry, last year proved stellar for Turtle Beach, achieving a market cap of $466 million for the company. Sales jumped by 58.9% over the past year, and it boasts a one-year return rate of 80.3%.

First-quarter 2021 figures proved strong across the board for video game publishers, quashing fears of a significant industry downturn despite COVID-19 reopenings. Two out of the three largest video game studios in the United States: Activision Blizzard (NASDAQ:ATVI), the largest in the world, and Take-Two Interactive (NASDAQ:TTWO), saw Q1 2021 revenue increase year-over-year. Activision Blizzard saw a 27.2% jump in sales, while Take-Two experienced a 10.4% increase. Electronic Arts (NASDAQ:EA), the exception, encountered a 3.0% drop in revenue due to a lighter slate of new game releases relative to the competition. However, the company saw net bookings grow by 18.6%, driven by repeat spending from its Evergreen titles.

Turtle Beach sales are also expected to remain strong as revenue is projected to increase by 6.9% in 2021 and 8.8% in 2022. As a result, HEAR has seen a 95.4% increase in share price over the past 12 months. The company’s stock price is in an upward trend.

Chart provided by Stock Rover

Despite the climb in the stock price in recent months, HEAR is surprisingly undervalued compared to its competitors. It boasts a Stock Rover value score of 92 with price-to-earnings (P/E), price-to-sales (P/S) and enterprise value-to-earnings before interest, taxes, depreciation and amortization (EV/EBITDA) of 9.8, 1.3 and 5.6, respectively. All are well below the industry averages of 29.2, 4.5 and 23.8, respectively, marking the stock as undervalued.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $40.60, 32.7% higher than its latest closing price of $30.60, earning HEAR a “strong buy” recommendation from Stock Rover and a place among our three best small-cap stocks to buy now.

3 Best Small Cap Stocks to Buy Now: #1

Karooooo Ltd. (NASDAQ:KARO)

Karooooo Ltd. (NASDAQ:KARO), founded in 2001, is an international corporation specializing in providing real-time mobility data analysis for individual consumers and transportation companies. Headquartered in Singapore, Karooooo’s SAAS Cartrack platform provides clients with insights and analytics to better optimize and track their connected vehicles and other assets to increase efficiency, decrease costs, improve safety, manage risk and monitor environmental impact.

Possessing a market cap of $1.1 billion, the company has grown strongly since its days as an anti-vehicular theft service in South Africa. Karooooo currently supports more than 1.3 million subscribers and 75,000 businesses across 23 countries with $161 million in sales over the trailing 12 months. The company offers two primary service offerings: private tracking for vehicular theft recovery and monitoring for enterprise fleet management.

Cartrak is primarily marketed towards traditional automobiles but has expanded in recent years to include other modes of transportation such as construction equipment, refrigeration units and even boats. As the number of vehicles worldwide rises, the number of cars and trucks worldwide is projected to reach nearly 2.8 billion by 2040. Along with the expansion of artificial intelligence and ridesharing, demand for vehicular and fleet tracking is also expected to skyrocket. The global automotive telematics market, valued at $50.4 billion in 2018, is forecast to surge to $320.6 billion by 2026.

Karooooo’s serviceable addressable market is expected to reach $77.4 billion by 2026, compared to $12.2 billion in 2018. In fiscal year (FY) 2019 alone, ending February 2020, the company saw its subscriber count increase by 165,717, or 17.2%. Despite COVID-19, the trend continued in the nine months between February and November 2020, and Karooooo added 119,574 subscribers. The strong growth is projected to continue with steady increases in revenue, including a 14.8% jump in FY 2021 and a 19.8% increase in FY 2022.

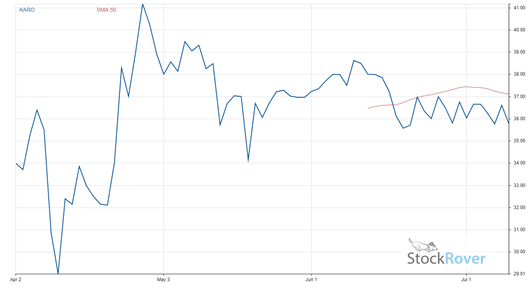

KARO has seen its share price jump by 5.3% in the three months since its initial public offering (IPO). The increase in stock price is displayed below with a 50-day moving average to illustrate the change better.

Chart provided by Stock Rover

Often, the riskiest and most contentious parts about investing in high-growth, small-cap companies are the narrow margins or lack of profitability, especially with technology startups. However, Karooooo does not have this problem. The company is not only profitable, generating $22 million in profit over the past 12 months, it also has some of the best net and operating margins in the software application industry. While the average operating margin in the industry is 3.8%, Karooooo has an operating margin of 30.6%. The company also has a net margin of 13.9% compared to the industry average of 3.6%.

Despite its upside and profitability, the stock is extremely cheap compared to its counterparts. KARO’s P/E, P/S and EV/EBITDA of 32.8, 4.6 and 15.1, respectively, are much lower than the industry averages. For comparison, competitors PubMatic (NASDAQ:PUBM) and Viant Technology (NASDAQ: DSP), which possess market caps within a few hundred million of Karooooo, have P/E ratios of 56.8 and 78.1, respectively.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $47.08, 31.6% higher than its latest closing price of $35.78, earning KARO a “strong buy” recommendation from Stock Rover and a place among our three best small-cap stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.