The three best cannabis stocks to buy now include an industrial biotechnology company revolutionizing the cannabis cultivation industry, the largest producer and retailer of dried cannabis products in Canada and the largest U.S. provider of lawn care products and supplies.

The cannabis industry has seen some significant wins in North America in recent years. In just a few decades, it has gone from an illicit product on the continent to one of the fastest-growing industries in the United States and Canada.

Ten years ago, recreational cannabis was outlawed across the United States, and only 12 states sanctioned medical use. Now, 48 out of the 50 states permit medicinal cannabis, and recreational use is authorized in 18 states.

It is safe to say that cannabis has become a big business. The number of American cannabis dispensaries reached 7,490 in 2020. Canada had 769 cannabis stores the same year.

For comparison, there were a combined 5,164 Walmarts across Canada and the United States last year. The global cannabis industry is currently valued at $20.5 billion and is expected to reach $90.4 billion by 2026, a compound annual growth rate (CAGR) of 28.1%, driven by North American legalization.

Picking the right investments in this industry can yield astronomical returns. GrowthGeneration (NASDAQ:GRWG), an American specialty hydroponic and organic gardening retailer centered on the cannabis industry, rewarded investors with a record-breaking 881.0% return rate in 2020. By selecting the right stocks, we can avoid unwanted risk from this upstart industry while positioning ourselves to experience the highest possible returns.

Here are the top three best cannabis stocks to buy now.

3 Best Cannabis Stocks to Buy Now: #3

Scotts Miracle-Gro Co (NYSE:SMG)

Scotts Miracle-Gro Co (NYSE:SMG), founded in 1868, is the largest provider of lawn care products and gardening supplies in the United States. The company, headquartered in Maryville, Ohio, boasts a portfolio of some of the most recognizable brands in the lawn care industry, including Roundup, Miracle-Gro, Tomcat, Ortho and Scotts. In addition, Scotts is a market leader in providing cannabis-growing equipment throughout North America under its Hawthorne subsidiary.

California was the first state to legalize medical cannabis in 1996. Recreational cannabis has only recently begun to become legalized, starting with Washington and Colorado in 2012. As a result, much of the cannabis industry is in its infancy and populated with relatively risky startups. Cannabis cultivators present some of the highest upside in the industry, but with more than 16,500 licensed businesses in the United States in 2019 and no company possessing more than 0.2% of the market share, it is difficult to predict which cultivators will succeed.

With a market capitalization (market cap) of $10.0 billion, Scotts Miracle-Gro provides an opportunity for investors looking for the upside of the high growth industry without the downside risk. Scotts’ Hawthorne brand offers a full suite of equipment and services for cannabis growers, from all-in-one heating, ventilation and air conditioning units to professional consulting advice. No matter which cultivator or dispensary wins the cannabis market share war, Scotts profits.

Hawthorne is one of the largest and fastest-growing brands in Scotts’ portfolio, seeing $364 million in sales in Q2 2021 alone, a 66% jump in year-over-year revenue. The recent results mark the fifth consecutive quarter in which Hawthorne sales grew by more than 60%. The company projects a 40-45% increase in revenue for the brand for fiscal year (FY) 2021, ending in September.

The rest of Scotts Miracle-Gro also has experienced stellar growth and returns. The company has seen revenue increase by 23.9% over the past three years alongside a 135.7% return rate over the same period. The industry averages are 26.6% and 23.9%, respectively. Scotts also expects total company revenue to grow by 17.1% in FY 2021 alongside the rebounding American economy.

SMG has seen a dip in the stock price in recent months due to Scotts’ plans to raise prices for many of its products in August and concerns surrounding Bayer’s possible cessation of its Roundup line of herbicide in the United States. Scotts serves as the marketing agent for Roundup. However, the downside has been overstated, and the sell-off appears to have created tremendous value for intelligent investors.

Scotts’ share price for the trailing 12 months is plotted below alongside a 50-day moving average. Despite the decrease in the stock price in recent months, SMG has seen a 25.7% jump in price over the past year.

Chart provided by Stock Rover.

Even if Bayer ultimately ends Roundup offerings in the United States, the brand has become an ever-decreasing source of revenue for Scotts over the years. In 2017, the company generated 5.5% of its total revenue from Roundup. In Q1 2021, it only accounted for 3.5% of the $1.8 billion in sales for Scotts.

Although sales are expected to decrease by 0.8% during the next fiscal year due to price hikes, total profit is projected to grow from the increased margins. Earnings per share (EPS) are forecast to improve by 7.6%, from $9.23 in FY 2021 to $9.30 in FY 2022. Simply put, investor fears have become exaggerated. Hedge fund activity also backs this analysis. The number of hedge funds holding SMG in their portfolios has increased by 17% from a year ago.

The recent decline in share price has created a disparity between earnings and risk for SMG. Despite leading the industry in growth in returns over the past three years, Scotts has a price-to-earnings (P/E) ratio of 18.9. The industry average is 42.9. As a result, SMG received one of the best value scores in the industry from Stock Rover: 84.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $224.60, roughly 24.7% higher than its latest closing price of $180.11, earning SMG a “STRONG BUY” recommendation from Stock Rover and a place among our three best cannabis stocks to buy now.

3 Best Cannabis Stocks to Buy Now: #2

Amyris Inc. (NASDAQ:AMRS)

Amyris Inc. (NASDAQ:AMRS), founded in 2003, is an industrial biotechnology and renewable chemical company headquartered in Emeryville, California. The company, which currently possesses a market cap of $4.3 billion, specializes in developing, manufacturing and selling various consumer and industrial products, including cosmetics, fragrances, solvents and cleaners, polymers, lubricants and fuels.

At first glance, it may not seem like a company that typically develops shampoos and sweeteners belongs on a list of top cannabis stocks, but Amyris arguably is one of the most exciting and groundbreaking companies in the industry. The company is at the forefront of developing synthetic cannabinoids, which could drastically shake up the cannabis industry by making it less reliant on costly growing facilities. The medical and recreational marijuana growing industry is already worth $11.6 billion and is forecast to grow 18.3% annually on average in the next five years.

Cannabis cultivation is expensive due to high energy costs, the need for proper ventilation and fertilizers. The price tag for a 7,700-square foot warehouse for 1,000 cannabis plants with a projected yield of 350 pounds and four harvests a year costs an estimated $830,000 just to begin operations.

Amyris plans to tackle the problem by synthesizing cannabigerol (CBG) molecules (a precursor of cannabinoids) with yeast. The process allows cannabinoid (CBD) particulates to be manufactured more potently at a lower price.

The company began delivering its synthetic CBG products in Q4 2020. In March 2021, executives announced that they expect over one million retail units to be sold in the next 12 months. The development phase of the CBG molecule, from the initial target to full-scale production, took less than nine months.

Beyond its CBG development, Amyris is firing on all cylinders. In Q1 2021, the company’s product revenue increased by 47%, a 73% jump in consumer sales and a 25% growth in ingredient sales, among other business segments. Overall, Amyris has seen total revenue rocket by 138.3% in the trailing 12 months.

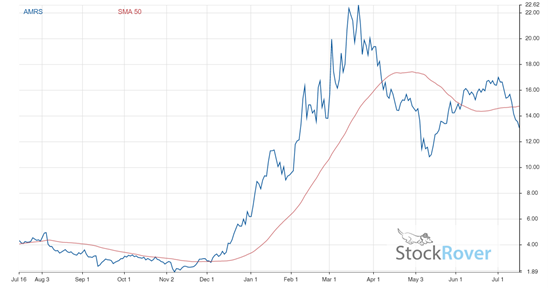

The immense upside of the stock has caused AMRS to climb by 205.1% over the past 12 months. Amyris is projected to see revenue surge by 124.6% in 2021. The company’s share price and its 50-day moving average in the past 12 months are displayed below.

Chart provided by Stock Rover.

The biggest concern surrounding Amyris for investors is its profitability. The company has trailed further and further into the red in recent years, losing $531 million over the trailing 12 months. Amyris has only been profitable once, in 2014, when it saw $2 million in net earnings.

However, the company’s growth has allowed it to raise cash from investors with ease. Its average revenue growth for the past five years stands at 54.1%. Amyris currently possesses $144 million in cash on its balance sheet, ensuring its survivability for the foreseeable future. The company’s high growth also means profitability is on the horizon, with some analysts predicting the company could generate positive annual net income as early as 2022.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $24.00, 83.8% higher than its latest closing price of $13.06. That earned AMRS a “STRONG BUY” recommendation from Stock Rover and a place among our three best cannabis stocks to buy now.

3 Best Cannabis Stocks to Buy Now: #1

Village Farm International Inc (NASDAQ:VFF)

Village Farms International Inc (NASDAQ:VFF), founded in 1989, owns and operates agricultural greenhouses, primarily in Canada, alongside operations in the United States and Mexico. The company, headquartered in Delta, Canada, has three main business segments: produce, cannabis and energy. The produce segment grows and sells tomatoes, bell peppers and cucumbers. Village Farms’ Pure Sunfarms subsidiary manufactures and distributes various cannabis products, including vape cartridges, pre-rolls, oils, gummies and other dried goods. The company also recycles landfill gas in British Columbia, Canada, to create clean energy.

In September 2020, Village Farms announced that it would acquire Emerald Health Therapetuic’s 41.3% stake in Pure Sunfarms to assume complete control of the cannabis producer. The cannabis company possesses operations across five of the 10 Canadian provinces, covering approximately 70% of the legal marijuana market in the country.

The acquisition has allowed Village Farms to raise its market cap to $632 million and position itself as an industry leader in the Canadian cannabis market. Already possessing the top-selling dried cannabis brand in Canada, Raymond James predicts the transaction could drive Pure Sunfarms to capture up to 20% of the Canadian cannabis market in the coming years. The Canadian market is currently valued at $2.05 billion and is projected to reach $6.78 billion by 2026.

We did not have to wait years for Village Farm’s acquisition to pay dividends. In Q4 2020, the company reported $47.4 million in quarterly revenue, a 43% increase year-over-year. The growth primarily was driven by Pure Sunfarms’ 87% year-over-year jump in net sales in the same quarter. VFF saw its share price soar by 77.0% from September 2020 to January 2021.

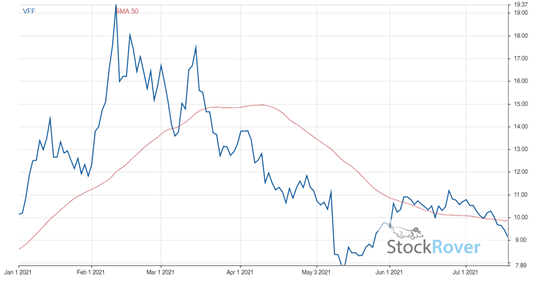

However, since then, the company’s share price has stagnated. Its year-to-date stock growth stands at -6.9%. The decline in stock price primarily has to do with Village Farms’ drop in profit from its produce and cannabis business segments. The company generated $7 million in profit in Q4 2020 but lost $7 million in Q1 2021. VFF’s movement over the past year is shown below, alongside a 50-day moving average.

Chart provided by Stock Rover.

The decline in profit primarily can be attributed to nationwide lockdowns in Canada that occurred this spring to combat a surge in COVID-19 cases. The pandemic raised costs due to supply-line disruptions. However, future economic shakeups from COVID-19 are expected to decrease dramatically as vaccination rates rise. Currently, 75% of Canadians over the age of 12 have received at least one vaccine dose. Many experts view future lockdowns in the country as unlikely.

The Q1 2021 figures are simply a minor setback for the company, which has provided investors a discount at one of the fastest-growing stocks in the cannabis industry. Despite a decrease in net income, the company saw revenue jump by 10.6% from Q4 2020 to Q1 2021 and 63% year-over-year. Analysts predict sales to climb by 25.1% in 2021 and by a further 23.0% in 2022. Village Farms is also projected to return to profitability in 2022 with an EPS of 0.25, compared to an EPS of 0.20 in 2020.

In April 2021, Raymond James analyst Rahul Sarugaser stated that “[as] we undertake a quantitative analysis of Village Farms versus peers, [we] find that VFF is >60 percent undervalued using whichever basis for comparison or peer sub-group we throw at it.”

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $19.21, 102.88% higher than its latest closing price of $9.47, earning VFF a “STRONG BUY” recommendation from Stock Rover and a place among our three best cannabis stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.