The arbitrary weighting of indices can give investors increased risk and decreased profit — but smart beta investing seeks to solve that problem.

When investors purchase a piece of the S&P 500 through exchange-traded funds (ETFs) such as the SPDR S&P 500 ETF Trust (NYSE:SPY) or SPDR Portfolio S&P 500 ETF (NYSE:SPLG), they bet on a diverse combination of every company in the index. In both of these ETFs, the amount of each of the 500 companies is determined by market capitalization, where bigger companies make up more of the funds’ holdings and smaller companies make up less.

This is traditionally how all indices and ETFs are arranged — the bigger the market capitalization, the more weight the company has in a fund’s holdings. The smaller the company’s market capitalization, the less its stock price movement affects the overall portfolio.

Even if a large company is widely considered overvalued or a small company is poised for rapid growth, the indices automatically weight each company according to size alone. Needless to say, this can lead investors to take on an often unnecessary amount of risk and lose out on potentially great returns.

Smart beta investing challenges this tradition. ETFs organized with a smart beta methodology use the same set of companies as a predetermined index or asset class, but weight them according to a unique set of rules. Smart beta prioritizes assets likely to grow in value and attempts to minimize risk in the process.

Many portfolios, instead of using an underlying index, will now use a smart beta program to screen for and automatically trade stocks based on the set of rules hardwired into it. This makes smart beta investing an effective mix of active and passive investing. When utilized properly, smart beta investing can reward investors with the best of both worlds.

Smart Beta Investing Has Been Used Since the 1970s

The first smart beta ETF did not launch until 2003 but it is gaining momentum.

The term smart beta was first coined by the financial services firm Towers Watson. It combined two basic ideas important to the strategy — “beta” is a common objective metric used in the strategy (although it is far from the only one), and “smart” is used to delineate an alternative or somehow more optimal weighting system. The idea of restructuring already existing indices in line with these two ideas led to the rise of smart beta investing.

Investors have used this style of selecting and rebalancing equities since the early 1970s, and more did so after the first index mutual fund launched in 1975. Yet, it wasn’t until nearly 20 years later in 1993 that the first ETF was created and became the most popular medium for smart beta investing today. In addition, 2003 was the first time an ETF explicitly used smart beta investing strategies, and researchers have been polishing the methodology since then.

Some investors will use the term “smart beta” to refer to any rule-based fund that weights its investments according to mathematical evidence. This idea goes back to Benjamin Graham, widely considered the father of value investing.

Smart Beta Investing Has Three Primary Objectives

The goals of smart beta investing are threefold, and typically operate in tandem with each other.

- High alpha

- Minimized risk

- Maximized diversification at low cost

The first target, alpha, is a measure of how a given portfolio performs against some benchmark. If a smart beta ETF is measured against the S&P 500 and has an alpha of 2, then the ETF outperformed the S&P 500 index by 2% over a given period of time. Similarly, if the ETF has an alpha of -5, then it underperformed the S&P 500 by 5%.

The goal of most smart beta funds is to regularly beat the S&P 500. The funds attempt to do this while taking on a minimal amount of risk and diversifying their portfolios in more cost-efficient ways than a traditional ETF would. This requires an awareness of each stock’s underlying relationship to the market — most notably, its beta.

Beta is a Measure of Volatility Important to Funds’ Diversification Decisions

For funds to appropriately weight investments in a manner that minimizes volatility, the risk associated with each and every equity is meaningful. Fund managers measure this risk by using beta, which describes the volatility of an individual security relative to the greater market. The S&P 500 acts as a proxy for the greater market and has a beta of 1.

A security with a beta of 3 is expected to triple the magnitude of any S&P 500 movement, whether it’s positive or negative. If the S&P 500 grows 1%, the security will grow 3%. If the S&P 500 drops 3%, the security will drop 9%.

Likewise, a security with a beta of 0.5 will move half as much as the S&P 500 in the same . For example, if the S&P 500 crashed and dropped 10%, the given security should only drop 5%.

Negative beta has been theorized and would imply the security has an inverse relationship to the stock market. Some economists argue that gold has a negative beta, but the overall investing community has yet to come to a consensus on whether or not negative beta can exist in the real world.

Knowing the beta of each holding in a fund allows managers to distribute capital in a more optimal way than by market capitalization alone. This is the essence of smart beta investing: attempting to add value by screening for, choosing, weighting and rebalancing a portfolio based on objective factors, including both beta and several others.

Smart Beta ETFs Automatically Rebalance According to a Given Set of Rules

Generally speaking, smart beta funds take an underlying index and reorganize the investment weight by ranking stocks according to their own unique set of rules. As an example, let’s examine one of the oldest smart beta ETFs on the market: ProShares Large Cap Core Plus ETF (BATS:CSM).

CSM begins with the initial S&P 500 index and ranks every stock according to 10 different metrics, measuring growth, value, volatility and several other variables. It then overweights the highest ranking stocks and bets against the lowest ranking stocks. This leads to a similar makeup as many other S&P 500 tracking ETFs, with companies like Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOG,GOOGL), making up the majority of the top holdings, but in a slightly different weight than usual.

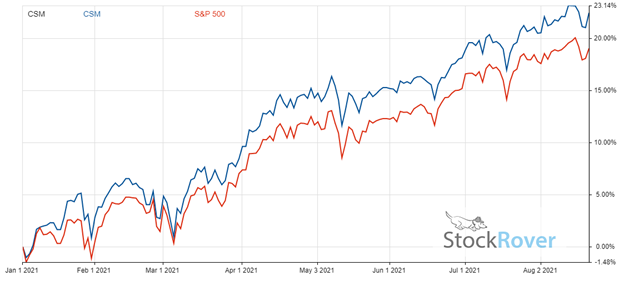

This alternative weighting can lead CSM to outperform the S&P 500 on a semi-regular basis. Some quarters will have lower returns still, but year to date (YTD), CSM has grown 22.4% compared to the index’s 19.0%.

Chart provided by StockRover, start your free trial here.

The ETF automatically rebalances according to these 10 rules once per month. However, no set of mathematical rules can perfectly predict the future — some of these alternative weightings will lead to rapid growth or soften any market tension, while others will overweight what are, in hindsight, the wrong equities.

In the trailing one-year period, CSM has outperformed the S&P 500 by 0.9%. Its fluctuation has been charted below, where its graph has been normalized relative to the S&P 500 as a baseline. When under the red line, CSM is underperforming the market. When above the line, CSM is outperforming the market.

Chart created using Stock Rover.

Chart created using Stock Rover.

The organization of CSM is typical for smart beta funds: take an index, apply a set of mathematical rules, and rebalance on a regular basis.

Many Smart Beta ETFs Pay Regular Dividends

Compiled below is a list of some of the top smart beta ETFs that pay regular dividends to investors.

| Ticker | Consecutive Annual Dividend Hikes | Market Cap | Latest Close Price | Projected 12 Month Dividend Yield | Trailing 12 Month Dividend Yield |

|---|---|---|---|---|---|

| VTV | 13 | $25.40B | $158.13 | 2.44% | 2.44% |

| VUG | 1 | $45.74B | $331.14 | 0.56% | 0.56% |

| IWF | 2 | $84.62B | $324.03 | 0.55% | 0.60% |

| VIG | 10 | $44.64B | $176.59 | 1.83% | 1.83% |

| IWD | 2 | $39.62B | $173.66 | 1.92% | 1.93% |

| VYM | 13 | $435.58M | $117.66 | 2.91% | 2.90% |

| IVW | 2 | $30.35B | $81.40 | 0.82% | 0.82% |

| RSP | 2 | $12.82B | $162.46 | 1.58% | 1.58% |

| USMV | 2 | $21.96B | $81.17 | 1.80% | 1.80% |

| SCHD | 12 | $52.25B | $77.77 | 3.43% | 3.44% |

| QUAL | 0 | $25.49B | $157.67 | 0.92% | 1.15% |

| VBR | 3 | $7.05B | $182.95 | 2.11% | 2.11% |

| IVE | 0 | $12.09B | $180.98 | 1.67% | 1.67% |

| ESGU | 5 | $26.06B | $110.96 | 1.28% | 1.28% |

| DGRO | 9 | $3.77B | $56.54 | 2.35% | 2.35% |

| SDY | 1 | $21.60B | $128.06 | 2.57% | 2.57% |

| DVY | 3 | $22.04B | $120.22 | 3.72% | 3.72% |

| VLUE | 0 | $14.23B | $102.80 | 2.52% | 2.52% |

| CSM | 2 | $936.36M | $58.34 | 1.11% | 1.11% |

Smart Beta Investing Offers a Modern Mix of Passive and Active Investment Growth

Smart beta investing continues to grow in popularity as investors see the benefits offered by ETFs using this strategy. Like any portfolio, it is subject to highs and lows. The optimal reorganization of stocks in powerful indices can lead to increased gains for investors. Smart beta is a strategy for value investors that like their choices steered by mathematical models rather than intuition. That approach has proven to be very successful when done well.

Jonathan Wolfgram is an editorial staffer who writes website content at Eagle Financial Publications. He graduated from the University of Minnesota with Bachelor’s degrees in Finance and Philosophy. Jonathan writes for www.DividendInvestor.com and www.StockInvestor.com.