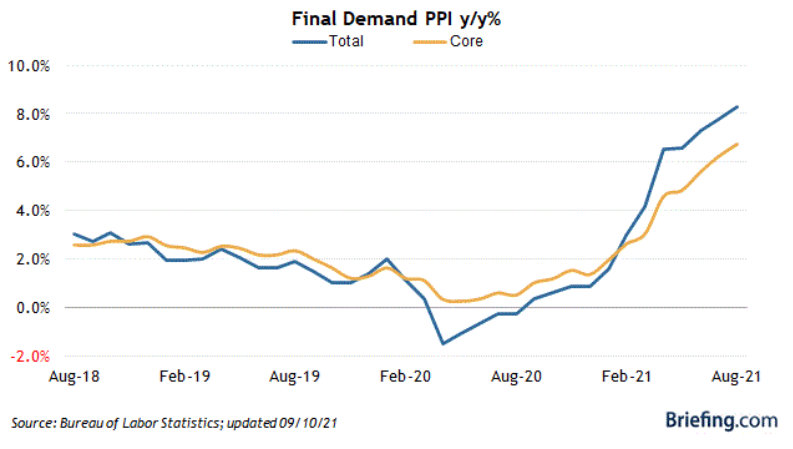

The U.S. economy may well be in the midst of a soft patch due to a very stubborn COVID-19 virus and some persistent inflation brought on by the ongoing global supply chain disruptions. Friday’s Producer Price Index (PPI) reading put a spotlight on the bottlenecks producers are contending with to manage profit margins.

The PPI for final demand increased 0.7% month-over-month in August (consensus 0.6%) after increasing 1.0% in July. On a year-over-year basis, the Producer Price Index for final demand was up 8.3% on an unadjusted basis, versus 7.8% in July. That has lifted the index past its record increase from last month. The index for processed goods for intermediate demand rose 1.0% in August and was up 23.0% year-over-year, its highest increase since February 1975. (Source: briefing.com)

For the second time in the past four weeks, Goldman Sachs has lowered its U.S. gross domestic product (GDP) forecast for 2021, down to 5.7% from 6.2%. For the third quarter, Goldman slashed its growth forecast to 5.5% from 9.0% due to the impact of the Delta variant, but also raised its outlook for the fourth quarter to 6.5% from 5.5%, citing expectations of fears over the virus diminishing and some supply chain shortages getting rectified.

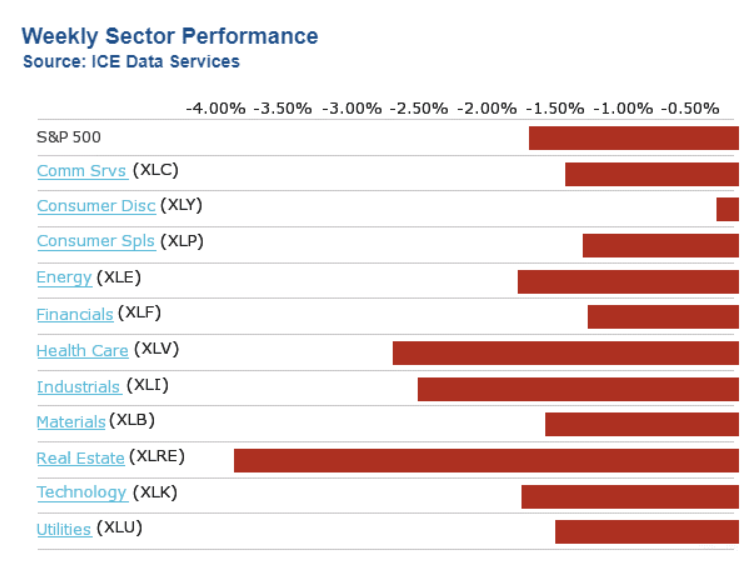

This lowered growth outlook from Goldman was issued just as investors were coming off of a long Labor Day weekend, triggering a four-day bout of selling that saw the S&P give back 1.7% and the tech-rich Nasdaq retreat 1.9%. The selling pressure was not offset by rotation into the Treasury market, as is usually the case. Instead, the 10-year yield rose to 1.34% in anticipation of this week’s Consumer Price Index (CPI) report for August, where a survey of economists is forecasting an increase of 0.5%.

Some late selling pressure Friday could also have been attributed to the 20-year anniversary of 9/11 happening over the weekend, but the week had already taken on a tone of distribution, especially in the home-building stocks, where supply chain disruptions have analysts lowering projections. There was really nowhere to hide as all 11 sectors closed down on the week, marking the biggest drop since February.

Aside from the Delta variant, supply chain issues and wage inflation, it’s my view that market participants are most concerned about what the plan forward is for Fed policy. From the Beige Book released on Sept. 8, there are some key takeaways that suggest Jerome Powell will continue to maintain a wait-and-see posture. From the transcript, a few comments seem to provide a few tea leaves for investors.

Overall Economic Activity

Economic growth downshifted slightly to a moderate pace in early July through August.

The deceleration in economic activity was largely attributable to a pullback in dining out, travel and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions.

The other sectors of the economy where growth slowed or activity declined were those constrained by supply disruptions and labor shortages, as opposed to softening demand.

Looking ahead, businesses in most Districts remained optimistic about near-term prospects, though there continued to be widespread concern about ongoing supply disruptions and resource shortages.

Employment and Wages

Demand for workers continued to strengthen, but all Districts noted extensive labor shortages that were constraining employment and, in many cases, impeding business activity.

Some Districts noted that return-to-work schedules were pushed back due to the increase in Delta variant cases. With persistent and extensive labor shortages, a number of Districts reported an acceleration in wages, and most characterized wage growth as strong — including all of the midwestern and western regions.

Several Districts noted particularly brisk wage gains among lower-wage workers. Employers were reported to be using more frequent raises, bonuses, training and flexible work arrangements to attract and retain workers.

Prices

Inflation was reported to be steady at an elevated pace, as half of the Districts characterized the pace of price increases as strong, while half described it as moderate.

With pervasive resource shortages, input price pressures continued to be widespread. Even at greatly increased prices, many businesses reported having trouble sourcing key inputs.

Some Districts reported that businesses are finding it easier to pass along more cost increases through higher prices. Several Districts indicated that businesses anticipate significant hikes in their selling prices in the months ahead.

These notes are, in my view, not the stuff of a Fed ready to pull the punch bowl when there is no major positive data that suggests the Delta variant is withering away, supply chains are returning to normal and dislocation in the job market is getting worked out. As long as these conditions persist, it’s going to drive prices higher for everything and negatively impact consumer spending in the current and fourth quarter.

Additionally, Congress remains in a stalemate about getting the $1 trillion infrastructure package passed anytime soon. The infrastructure legislation faces an uphill path in the House, where Nancy Pelosi has repeatedly said she will not take it up until the Senate clears the $3.5 trillion reconciliation bill. Again, I don’t see Powell and the Fed embracing the talk of tapering when Congressional pandemic stimulus has effectively run out, federal unemployment checks have expired and Congress can’t reach a deal.

Until these collective headwinds are addressed and satisfied, the chances appear remote that the Fed will add more uncertainty to the mix. Therefore, this current pullback the market is undergoing will likely result in a relief rally when the Federal Open Market Committee (FOMC) statement is released on Sept. 22. But investors should be prepared for another 2-3% downside leading up to this next Fed gathering, providing the 5% correction that has been the talk of Wall Street for the past week. If so, it will arguably be the best buying opportunity of the year.