The three best cryptocurrency stocks to buy now include a former biotechnology company that now is a leader in the blockchain industry, one of the most influential e-commerce platforms in the world and a social media giant known for bold moves.

Over the past 10 years, we have seen cryptocurrency rise from obscurity to mockery to acceptance by major corporations from PayPal (NASDAQ: PYPL) to Starbucks (NASDAQ: SBUX). Bitcoin, the most popular cryptocurrency on the planet, has reached a market capitalization (market cap) of $902.5 billion, compared to Tesla (NASDAQ: TSLA), the seventh-largest company in the world, with a market cap of $776.1 billion.

Although many companies are still cautious in implementing or accepting cryptocurrency, digital currencies are undoubtedly here to stay. Investment titan David Rubenstein, the co-founder and CEO of Carlyle Group, the second-largest private equity firm globally, stated in May 2021, “Cryptocurrency is not going away, just like gold is not going away.”

Even fierce detractors have begun to accept begrudgingly that digital currencies are part of the future. In recent years, the CEO of JP Morgan Chase, Jamie Dimon, one of Wall Street’s most influential executives, has been one of the most outspoken critics of digital currencies. Dimon has publicly called Bitcoin a “fraud” and stated that “[he] would fire a trader in a second for trading Bitcoin.” In early August 2021, however, JP Morgan Chase quietly moved to reveal six crypto funds for its wealth management clients.

Like many new technology spaces, cryptocurrency is filled with buzzwords (mining, blockchain, digital wallet, etc.). The technology and infrastructure can also vary significantly from each digital currency, confusing new investors. However, the important takeaway is that cryptocurrency is intended to be a decentralized form of currency. By decentralizing the storage information of a digital currency, it makes it impossible for an institution, organization or person to control.

There are some exceptions, but the general appeal of the major cryptocurrencies is that they cannot be influenced by monetary policies from world governments, protecting investors from devaluation due to money printing.

It may be prudent for individuals seeking opportunities in the cryptocurrency industry to invest in cryptocurrency stocks rather than the currencies themselves. Crypto stocks are typically more liquid and less volatile than the currencies. As a result, we have highlighted the three best cryptocurrency stocks to buy now.

3 Best Cryptocurrency Stocks to Buy Now: #3

Facebook (NASDAQ:FB)

Facebook (NASDAQ:FB), founded in 2004, was created as an exclusive social platform for university students. However, since moving out of Mark Zuckerberg’s Harvard dorm room, the company has grown to become the world’s largest online social network, with more than 2.85 billion current active monthly users. Synonymous with reach and influence, Facebook has been branded a “FAANG” company, an acronym representing five (Facebook, Amazon (NASDAQ:AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX) and Google Inc. (NASDAQ: GOOGL) of the world’s most powerful technology companies. Headquartered in Menlo Park, California, Facebook is the sixth-largest company globally, with a market capitalization (market cap) of $956.9 billion.

Although on the surface, Facebook may not appear as revolutionary as when it first appeared, with the arrival of rivals such as Twitter (NYSE: TWTR), WeChat, YouTube and TikTok, it easily remains as one of the most innovative and audacious companies in the world. Its acquisitions of Instagram, WhatsApp and Messenger over the years have established its reputation of consistently spotting new trends and being unafraid to make bold moves to capitalize on them.

Facebook’s gambles have more than paid off. The company currently owns four out of the top five social media platforms globally (Facebook, WhatsApp, Instagram and Facebook Messenger). Instagram, alone, boasts 6x more users than Twitter and possesses a market valuation of $100 billion.

Facebook has also shown a consistent and dedicated push to expand beyond social media, purchasing leading virtual reality developer Oculus in 2014, neurotechnology startup CTRL-labs in 2019 and computer vision startup Scape Technologies in 2020. The company even announced in September 2021 that it would dedicate $50 million over the next two years to developing a more ethical metaverse as part of a much larger multi-billion dollar project to create an expansive virtual world for users.

It should come as no surprise then that Facebook has moved to eagerly embrace the cryptocurrency world, even as most other Fortune 500 companies approach the topic with hesitancy. While companies like MasterCard (NYSE: MA), Paypal and Starbucks have slowly begun accepting digital currencies for transactions, Facebook has been backing the development of a new cryptocurrency intended to change global finance for the past two years: Diem.

Branded initially as Libra when first revealed in June 2019, the digital currency was designed to become a universal, international currency to connect the world. However, it undoubtedly experienced a shaky start. Despite opening with a consortium of corporate backers, from MasterCard to PayPal to eBay, the cryptocurrency immediately began to draw scrutiny from regulators due to potential design flaws that could make it vulnerable to exploitation by criminal groups. Libra’s rollout was halted, and the token saw many of its backers leave.

However, since then, digital currency’s infrastructure and design have undergone a significant reorganization and restructuring. The token was rebranded from Libra to Diem. According to First Digital Assets Group’s Chief Executive Officer Ran Goldi: Diem’s technology has “changed dramatically over the past year and a half from a naive blockchain to a very sophisticated blockchain that you can see is trying to answer some of the questions that regulators had.”

Although Diem has seen some of its original flare diminish due to its troubles, it still retains the backing of major corporations like Spotify, Uber and Lyft, and the potential to shake up the global financial system. Michael Casey, chief content editor of CoinDesk, noted that part of the reason Libra drew so much scrutiny was that due to Facebook’s reach, it had the potential to disrupt the global monetary system and even challenge the United States dollar as the dominant international currency. Even if Diem is not as flashy out of the gate as Facebook originally intended, it still possesses revolutionary potential.

Facebook, as a whole, has shown no signs of slowing down, despite turning 17 years old this February. The company has averaged a 33.5% increase in revenue over the past five years alongside a 164.5% return rate, as it maintains a perfect 100 Stock Rover growth score. Facebook is projected to continue the trend for the near future as it develops its video-sharing services and offerings outside of traditional social media. The company has a 39.0% forecasted sales growth in 2021, including a 24.2% jump in Q4 2021.

FB has seen a 29.6% increase in share price over 12 months, which is shown below alongside a 50-day moving average.

Chart provided by Stock Rover.

Facebook’s crypto wallet platform, Novi, which initially debuted alongside Libra, and was designed as a partner service, has set the stage for Diem’s growth. The platform has reportedly already processed $100 billion in crypto transactions over the last 12 months and will be a vital tool in spreading Diem’s reach.

If there is ever any digital currency that can grow to match the United States dollar, it will be the one backed by a 2.89 billion person strong network.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $401.30, 18.2% higher than its latest closing price of $339.39, earning FB a “STRONG BUY” recommendation from Stock Rover and a place among our three best cryptocurrency stocks to buy now.

3 Best Cryptocurrency Stocks to Buy Now: #2

Shopify Inc. (NYSE:SHOP)

Shopify Inc. (NYSE:SHOP), founded in 2006, is an e-commerce company headquartered in Ottawa, Canada. The company boasts a market cap of $184.8 billion and provides a platform for businesses to open and customize their digital storefronts. Shopify has two business segments: subscription solutions and merchant solutions. Subscription solutions allow merchants to conduct business on Shopify’s website, social networking sites and even physical stores and kiosks. Merchant solutions are add-on products for Shopify vendors, such as Shopify Payments, Shopify Capital and Shopify Shipping.

One of the biggest issues surrounding cryptocurrency is its liquidity. Since digital currencies are not a traditionally accepted form of payment, an individual cannot directly purchase a sandwich from his local sandwich shop using Bitcoin. It can be difficult for the average consumer to devote resources to investing in digital currencies. Shopify has set out to change that.

Shopify has long prided itself on providing its users with complete customizability and control over their online store, from the layout to branding to the customer experience. As a result, the company has been one the earliest proponents and adopters of cryptocurrency in its business model. Shopify has allowed its various vendors and merchants to accept Bitcoin since November 2013 and has since expanded its in-house cryptocurrency support to over 300+ different digital currencies on its platform. However, that was not enough for the e-commerce platform.

Shopify announced in May 2020 that it would begin an official partnership with CoinPayments, a payment processing software dedicated to cryptocurrencies. CoinPayments accepts over 1,800 different digital currencies and allows over 1.75 million merchants to faster process and receive crypto payments. The partnership enables countless more businesses on Shopify to accept digital currencies as payments by increasing their liquidity. The deal also allows the e-commerce platform to better tap into the more than 100 million crypto users around the globe.

Although synonymous with small and medium-sized businesses, Shopify’s accessibility and customizability mean that it also boasts large corporate clients such as Nestle (OTCMKTS: NSRGY) and Tesla, which use the platform to power their own online stores. The platform’s move to completely integrate cryptocurrency usage opens the door for dozens of other major corporations to begin accepting digital currencies as payment.

Shopify has experienced solid and consistent growth since its initial public offering (IPO) in 2015. Over the past five years, the company has seen an average sales growth of 68.6% and a return rate of 3,242.2%. Shopify is expected to continue its upward trend with a 58.3% increase in revenue in 2021, including a projected 39.0% year-on-year growth in Q4 2021, as the global economy recovers from COVID-19 and worldwide e-commerce sales increase. The global business-to-consumer e-commerce market alone is expected to reach $8.65 trillion by 2030, from $3.67 billion in 2020, with a compound annual growth rate (CAGR) of 8.95%.

SHOP has seen its share price rise by 58.0% over the past 12 months, displayed below alongside a 50-day moving average.

Chart provided by Stock Rover.

Shopify should not be seen as a single entity. Every action and decision it makes affects millions of businesses across the world. The platform’s move to accept the digital currency can kickstart a circular effect. Allowing more merchants to accept cryptocurrencies raises the awareness and ethos of digital currencies, which, in turn, drives more merchants to accept crypto as payment. The e-commerce platform has positioned itself at the center of the digital currency revolution.

Since Shopify’s core business does not revolve around crypto, however, SHOP is great for investors seeking to invest in the cryptocurrency space but also limit their risk. The company possesses a near-perfect 99/100 quality score from Stock Rover.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $1,657.33, 22.2% higher than its latest closing price of $1,355.78, earning SHOP a “BUY” recommendation from Stock Rover and a place among our three best cryptocurrency stocks to buy now.

3 Best Cryptocurrency Stocks to Buy Now: #1

Riot Blockchain Inc. (NASDAQ:RIOT)

Riot Blockchain Inc. (NASDAQ:RIOT) is a leading American blockchain company headquartered in Castle Rock, Colorado. The company develops, supports and operates blockchain technologies. Riot possesses a market cap of $2.8 billion and owns stakes in cryptocurrency trading platform Coinsquare, blockchain payment software TessPay and blockchain auditing and accounting platform Verady.

Distributed blockchain is a digital ledger used to store decentralized and encrypted information securely. Blockchain technology can be used as a medium of exchange or unit of account. It is most commonly used as the backbone of most cryptocurrencies to decentralize the storage of information and prevent manipulation. Simply put, Riot Blockchain is a cryptocurrency mining company.

Amazingly, Riot Blockchain was a biotechnology company known as Bioptix until 2017. The corporation initially focused on developing veterinary medicine and medical diagnosis instruments. The change occurred after Riot Blockchain invested in Coinsquare, one of Canada’s largest crypto exchanges, in October 2017. The investment subsequently caused Bioptix to make a complete 180-degree turn in business strategy, change its name to Riot Blockchain and shift its focus to cryptocurrency. The move, which initially brought enormous skepticism, has been a massive success for the company.

Riot Blockchain now possesses over 7,000 mining units, making it the largest cryptocurrency miner in North America. Over the past five years, the company has averaged an annual sales growth of 231.6%, with a return rate of 752.3%. The industry average for software applications over the same period is negative 3.7%. However, RIOT is expected to experience its most significant growth in the coming months.

Riot Blockchain currently possesses a hash rate — the measure of a cryptocurrency miner’s performance — of 2.07 exahash per second (EH/s), which is projected to more than triple to 7.7 EH/s by Q4 2022. EH/s, the standard measurement for how fast an organization can mine, typically takes around 120 exahash to mine one Bitcoin. The sharp increase in mining rate is primarily due to the company purchasing 42,000 top-of-the-line S19j Antminers from Bitmain for $138.5 million in April 2021.

Furthermore, China’s recent crackdown on cryptocurrencies has provided a significant opening for Riot Blockchain. The country has long been attractive to crypto miners due to its cheap electricity and ready access to technology supply chains. In 2020, Chinese crypto miners accounted for approximately 65% of the global Bitcoin hash rate.

In order for a miner to receive a Bitcoin, it must solve a hashing algorithm. Once an algorithm is solved and verified, the solver is awarded Bitcoin, and a new algorithm is generated. Every miner across the globe works to solve the same algorithms, which means the more competitors, the less likely it is for a miner to succeed, and the more resources that are required.

As part of a larger clampdown on the country’s technological and financial industries, Chinese Vice Premier Liu He ordered officials, in May 2021, to ban domestic cryptocurrency trading and mining to better ensure financial stability. Immediately following the announcement, Chinese cryptocurrency exchange Huobi announced that it would stop hosting crypto mining on its platforms. HashCow, the owner of some of the largest crypto farms in the world, halted the sale of its equipment to the country. BTC.TOP, which accounts for 18% of China’s Bitcoin hash rate, suspended its domestic operations the same month. The Chinese crypto industry, once at the top of the world, has come to a screeching halt.

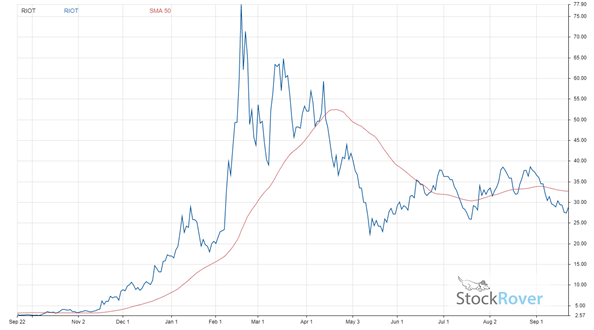

The significant growth of Riot Blockchain’s mining capabilities in the coming months, along with the decline of China’s crypto industry, has opened the door for the company to experience unimaginable growth. The company is forecasted to see a 1,681.2% jump in revenue in 2021, including a projected 1,611.2% year-on-year increase in Q4 2021. No, those numbers are not a typo. RIOT is projected to soar. As a result, the stock has seen an 880.5% skyrocket in price over the past year. The growth is shown below alongside a 50-day moving average.

Chart provided by Stock Rover.

Despite its climb, RIOT is a cheap stock for the company’s earnings. Riot Blockchain carries a (share) price-to-earnings (P/E) ratio of 60.0, well below the industry average of 100+. RIOT is projected to experience such massive growth that its forward P/E is forecast at 20.0, meaning it will become three times cheaper relative to its earnings.

The main risk of Riot Blockchain, compared to other companies on this list, is its heavy exposure to Bitcoin price movements. Since its core business is focused entirely on “producing” Bitcoin, a swing in its price can yield major returns or losses for RIOT investors. However, although short-term RIOT returns may be unpredictable, it is relatively safe as long as cryptocurrency continues to gain acceptance.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $55.00, 114.1% higher than its latest closing price of $25.70, earning RIOT a “STRONG BUY” recommendation from Stock Rover and a place among our three best cryptocurrency stocks to buy now.

Capison Pang is an editorial intern who writes for www.stockinvestor.com and www.dividendinvestor.com.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)