Five big bank stocks to buy offer investors a way to avoid supply-chain and inflation-related headwinds.

The five big bank stocks to buy are aided by favorable microeconomic conditions that should boost business opportunities for financial institutions and their borrowers. A recent rally in the sector should keep the five big bank stocks to buy on their current roll in the fourth quarter amid rising interest rates and an improved economic outlook due to reduced COVID-19 cases.

Big banks account for a significant portion of what pension fund chairman Bob Carlson called one of his “favorite value stock” investments. Carlson, who leads the Retirement Watch investment newsletter and serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said Oakmark uses different valuation measures to assess companies in various industries. Those industries include financial services where big banks have offered value and profits for some time.

Retirement Watch chief Bob Carlson answers questions from Paul Dykewicz.

Five Big Banks to Buy Can Be Purchased Individually or in a Fund

Financial services account for 33.9% of Oakmark’s holdings and Citigroup Inc. (NYSE: C), a big bank in New York, is its fourth-largest position. Detroit-based Ally Financial (NYSE: ALLY) is the fund’s largest holding and comprises 3.9% of its portfolio.

When interest rates rise, big banks traditionally can widen the spreads they earn between what they pay for deposits compared to what they can collect in higher interest rates from borrowers. However, a problem can arise later if banks retain too many fixed-rate loans that can lose their luster if interest rates keep rising.

Floating rate business lending, specialty mortgage real estate investment trusts (REITs), property REITs, real estate trusts, covered-call blue-chip stock funds, private equity and convertible debt are just some of the asset classes to own when rates and inflation are ticking higher, said Wall Street veteran Bryan Perry. As the leader of the high-yield-focused Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader services, Perry seeks to move into stocks when their operating conditions ripen.

Paul Dykewicz interviews Bryan Perry about investing opportunities.

BofA Boosts EPS Estimates for Mega Banks by an Average of 3%

BofA recently raised its earnings per share estimates (EPS) for the big banks it follows by an average of 3%. Since rising earnings typically are correlated to increasing share prices, the improved outlook is meaningful.

The management teams at big banks generally have been offering guidance about expecting increased fee revenue, according to BofA. The investment firm’s estimates anticipate another quarter of credit-driven earnings per share (EPS) outperformance.

Loan growth/spread revenue and macro-economic trends likely will be two key drivers for the big bank stocks, BofA wrote in a recent research report. Further signals of big bank performance will come from the results of non-financials in the coming weeks to show whether supply chain disruptions are easing and whether consumers and businesses are spending, BoA added.

Five Big Banks to Buy Include Citigroup

New York-based Citigroup earned a $200 price objective from BoA. The investment bank assigned valuation multiples below the bank’s peers due to its lower return metrics.

Risks to Citigroup attaining that target include an economic downturn, further scrutiny of the financials industry and increased expenses tied to a consent order. To top those expectations, Citigroup would need better-than-expected credit performance, i.e., lower loan losses, and continued market share gains that drive revenue growth, BofA wrote.

Citigroup’s management recently offered guidance that it could face increased expenses. But Citigroup’s pursuit of the sale of its consumer businesses in 13 countries across the Asia-Pacific (APAC) region and other factors could skew its risk/reward to the upside, BofA added.

Chart courtesy of www.stockcharts.com

Goldman Sachs Gains Berth Among Five Big Bank Stocks to Buy

New York’s Goldman Sachs (NYSE: GS) received a $455 price objective from BofA. The investment firm wrote the valuation was in line with historical levels.

To exceed that outlook, stronger capital markets activity would be required, BofA wrote. Risks to meet that estimate are a weaker economy, macroeconomic or geopolitical issues, competition, structural pressures, tougher global regulation and litigation, BofA added.

Goldman Sachs has underperformed its peers since the September Federal Open Market Committee (FOMC) meeting. Goldman’s underperformance started with the announcement of its acquisition of Atlanta-based GreenSky, the largest fintech platform for home improvement consumer loan originations. The all-stock transaction is valued at approximately $2.24 billion.

In announcing the deal on Sept. 15, Goldman issued a statement that GreenSky’s differentiated lending capabilities and “market-leading” merchant and consumer ecosystem will help accelerate efforts to create a consumer banking platform of the future. A key goal is to help tens of millions of customers take control of their financial lives and drive higher, more durable returns.

A BofA research note mentioned some Goldman investors seemed unsure about the consumer strategy. However, BofA opined that the “negative sentiment” could be overdone and its “buy” rating on Goldman remains intact. I personally have owned Goldman’s stock for more than a year and have no plans to sell.

Chart courtesy of www.stockcharts.com

JPMorgan Chase & Co. Gains Spot Among Five Big Banks to Buy

New York-based JPMorgan Chase (NYSE: JPM) received a $190 price objective from BofA. Possible risks to JPMorgan Chase reaching BofA’s price objective are macro risks such as slower-than-expected rate increases, additional regulatory requirements and scrutiny of the financial industry.

“While historically, the stock has tended to sell-off post earnings, we believe that JPM still offers an attractive risk/reward,” BofA wrote in its recent research note. “Importantly, the market appears willing to look past JPM’s premium valuation and add exposure to the stock given the optionality to higher interest rates, to rebounding credit card balances and the potential for continued momentum in the capital markets business.”

The bank could outperform its outlook with better-than-expected credit quality, i.e., lower loan losses, and better interest rate defensibility, BofA wrote.

Chart courtesy of www.stockcharts.com

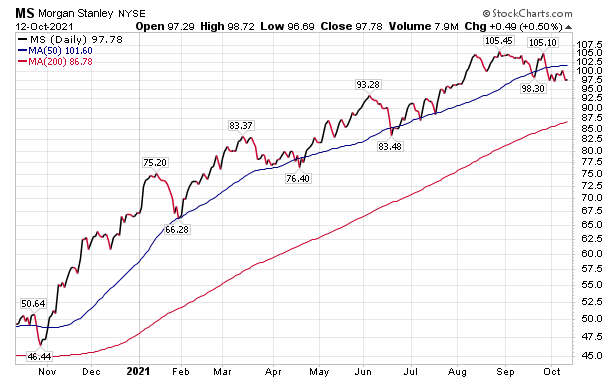

Morgan Stanley (MS) Wins Place Among Five Big Banks to Buy

A $105 price objective for New York’s Morgan Stanley takes into account a rising valuation multiple due to an increased recurring revenue mix and rising return on equity due to a strategic shift in its business. Potential outperformance of that target would depend on stronger wealth and asset management trends and capital markets activity, as well as higher rates, BofA wrote.

Risks to reach that goal include weak economy and capital markets, low rates for longer, increased macro issues, tougher regulation and litigation.

Chart courtesy of www.stockcharts.com

Wells Fargo & Company Takes Place Among Five Big Banks to Buy

Wells Fargo (NYSE: WFC), of San Francisco, gained a $60 price target from BofA. The investment firm described the valuation as in line with its peer average.

Risks to attaining the price objective are an economic slowdown, elevated expense trajectory and slower-than-expected resolution of its consent orders. To top the price target of BofA for the bank, the catalysts could include better-than-expected credit quality, i.e., loan losses, and material expense management that improves visibility on future earnings.

“Our conversations with investors suggest some concern around franchise attrition the longer Wells is required to operate under the asset-cap,” BofA wrote. “The path to stock outperformance is not straightforward, but at the current valuation, we see the risk/reward skewed to the upside.”

Chart courtesy of www.stockcharts.com

Improving COVID-19 Case Numbers Could Help Five Big Banks to Buy

The Delta variant of COVID-19 has proven to be a highly transmissible threat, but the number of current cases are sliding as the adult population increasingly is vaccinated and mask wearing occurs in hot spots for the virus. Plus, the U.S. Food and Drug Administration (FDA) recently issued emergency use authorization (EUA) for a single booster shot of the Pfizer-BioNTech COVID-19 vaccine for high-risk groups.

A booster shot of the Pfizer-BioNTech vaccine can be given to people aged 65 years and older at least six months after they receive a second dose of that vaccine to guard against COVID-19. The booster also is approved for those aged 18 years and older who have underlying medical conditions and people aged 18 and older who live or work in high-risk settings.

The Centers for Disease Control and Prevention (CDC) reported on Oct. 12 that 217,403,897 people, or 65.5% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 187,714,829 people, or 56.5%, of the U.S. population, according to the CDC.

COVID-19 cases worldwide totaled 238,678,058 cases and led to 4,864,825 deaths, as of Oct. 12, according to Johns Hopkins University. U.S. COVID-19 cases hit 44,561,383 and caused 716,470 deaths. America has the dubious distinction as the nation with the most COVID-19 cases and deaths.

The five big bank stocks to buy give investors a chance to earn much higher profits than they could receive from depositing money in an account at any of them.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing.