Five defense stocks to buy give investors ways to deploy their money strategically as China pursues a military spending spree combined with increasingly threatening words and actions against other nations.

The five defense stocks to buy are headquartered in the United States and might find growing demand for their products in the wake of China sending 56 of its military jets into Taiwanese air space on Oct. 4 in a show of force. Between Oct. 1 and Oct. 4, a total of 145 Chinese air force planes flew into Taiwan’s air defense identification zone (ADIZ) in the latest of its hostile acts to challenge Taiwan’s sovereignty.

U.S. President Biden met with China’s President Xi Jinping in a virtual summit on Nov. 16 that lasted three and-a-half hours but ended with both leaders still at odds with the policies of the other. Even though China regards Taiwan as a breakaway province to be reunified with the mainland one day, the United States has pledged to help Taiwan defend itself in the event of an attack but also recognizes and has formal ties with China.

New Military Contracts Could Boost Five Defense Stocks to Buy

Australia is another Asia-Pacific country whose leaders have accused China of threats against it that include trade strikes. In fact, Australia’s former Prime Minister Tony Abbott said Chinese officials are trying to bully Taiwan and potentially lash out aggressively with disastrous consequences if it was not stopped..

As part of Australia’s plan to strengthen its national defense, the country’s Prime Minister, Scott Morrison, announced in October that at least eight nuclear-propelled submarines using American or British technology will be built in Australia to begin serving the country in the late 2030s. France’s ambassador to Australia, Jean-Pierre Thebault, said on Nov. 3 that Australia acted with deceit when it abruptly cancelled a multi-billion dollar pact with Paris to build a fleet of submarines and instead struck a deal with the United States and the United Kingdom.

Due to such conflicts, BofA Global Research defense and aerospace analyst Ron Epstein wrote a research note on Nov. 15 that predicted future U.S. defense spending may be driven by China. Epstein elaborated that America’s defense spending will become less cyclical, have an absolute floor level and likely will continue to grow.

Rising U.S. Military Spending Should Lift Five Defense Stocks to Buy

For example, the U.S. House of Representatives passed the National Defense Authorization Act (NDAA) with bipartisan support to increase spending to approximately $740 billion. Although China’s defense spending is murky due to its leaders’ secrecy, the Stockholm International Peace Research Institute (SIPRI) estimates the country in 2020 was responsible for 13%, or about $252 billion, of world’s $1.981 trillion in global military spending, with the United States accounting for 39%.

When adjusted for military purchasing power parity (PPP), China defense spending is around 55-75% of the United States, Epstein estimated. But defense spending does not directly equal military power, since intangibles such as alliances, modernization of equipment, unmanned vehicles and original technologies rather than acquired intellectual property must be weighed.

Low defense stock valuations are missing the fundamental shift as the market has been focused on short-term budgetary concerns, Epstein wrote. In that light, defense stocks should do well in the next few years.

Pension Chief Picks His Favorite of the Five Defense Stocks to Buy

“The U.S. defense budget will increase despite the withdrawal from Afghanistan as policy shifts toward containing China and Russia,” said Bob Carlson, who leads the Retirement Watch newsletter. “Defense stocks sell at solid valuation discounts to the S&P 500, despite having higher estimated earnings growth than the S&P 500.”

Carlson, who further serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said that his favorite defense stock is Raytheon Technologies Corporation (NYSE: RTX). The Waltham, Massachusetts-based company’s earnings for next year are likely to increase more than the other companies in the sector, he added.

Retirement Watch chief Bob Carlson talks to Paul Dykewicz.

Nonetheless, Raytheon’s share price has been in a trading range since June, Carlson commented. The stock also is a recommendation of BofA.

Raytheon Heads the List of Five Defense Stocks to Buy

Raytheon Technologies, the world’s second-largest aerospace & defense company, came into existence through the all-stock merger of equals between Raytheon and United Technologies on April 3, 2020.

The combined company has four operating units: 1) Pratt & Whitney, a maker of military and civil aircraft engines and provider of service operations, 2) Collins Aerospace Systems (interiors, aviation controls and systems), 3) Intelligence, Space & Airborne Systems, and 4) Integrated Defense & Missile Systems.

BofA’s price objective of $110 for Raytheon is based on a discounted cash flow (DCF) analysis that factors in a discount rate of 10% and a 7% next five-year growth rate. The investment firm noted that Raytheon’s free cash flow (FCF) assumptions do include the potential impact of the research and development (R&D) amortization tax change to forecast conservatively.

Risks to BofA’s price objective are a downturn in commercial aviation due to the natural business cycle or an exogenous event such as a terrorist attack or a pandemic. A severe global economic slowdown would affect top-line growth as 45% of sales are generated outside the United States.

Five Defense Stocks to Buy Face Executive Risks

Execution risk on defense programs always could result in cost overruns and margin contractions, BofA noted. Plus, orders from international programs are difficult to time due to the complexity of the process.

As a result, international orders could show some “lumpiness,” Epstein wrote. Unexpected cancellations to programs in both commercial and military manufacturing further could materially impact Raytheon’s share price, he added.

Potential catalysts that may help Raytheon outperform BofA’s estimates of its price objective include commercial aerospace and business aviation jets beating expectations and earnings faring better than the investment firm projects. If margins top BofA forecasts, there could be upside potential its valuation of Raytheon.

If the company executes on its existing programs better-than-expected, market share gains in the international market or a materially accretive acquisition could produce greater-than-anticipated upside in the shares, Epstein wrote.

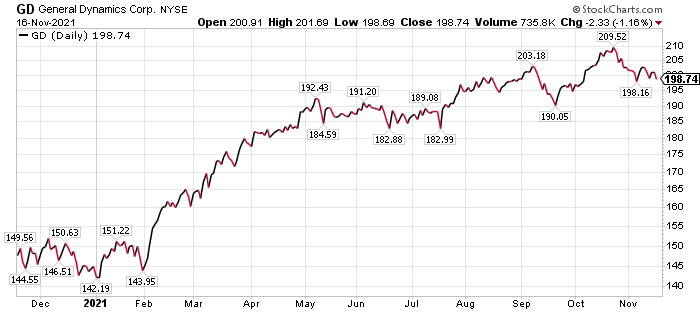

Chart courtesy of www.stockcharts.com

Stock Picker Chooses One of the Five Defense Stocks to Buy

Reston, Virginia-based General Dynamics (NYSE: GD), the world’s third-largest defense and aerospace company, is a recommendation of seasoned stock picker Jim Woods. A former U.S. Army paratrooper, Woods chose General Dynamics as one of the stocks to include in his Intelligence Report newsletter’s Income Multipliers Portfolio. Woods also leads Successful Investing newsletter, as well as the Bullseye Stock Trader advisory service.

General Dynamics has produced a five-year average return of 27%, the best of any of five industrial stocks in that portfolio. Income investors may appreciate that the company has been paying a dividend since 1979.

Paul Dykewicz interviews Jim Woods, who leads Intelligence Report.

BofA gave the stock a price objective of $260, using a two-stage DCF analysis which assumes a 9.3% discount rate, 5.2% 2025-2030 growth rate and 2.7% long-term growth rate to reflect the added benefit of Gulfstream G400/G800 business jet deliveries. The investment firm forecasts that the company’s defense program exposure, especially in its Marine unit, coupled with Gulfstream, could provide near-term and medium-term organic growth.

Additionally, the company’s strong balance sheet and solid cash generation could sustain dividend growth and share repurchases, Epstein added. But the forecast is not without risks.

Potential downsides to the stock reaching BofA’s price target include: 1) A downturn in business jets, due to an exogenous factor, 2) An unexpected devaluation in the dollar could significantly impact order activity, since business jets are priced in dollars, 3) Poor execution on defense programs could adversely impact margins, 4) Any defense budget cuts may hurt growth in the medium- and long-term.

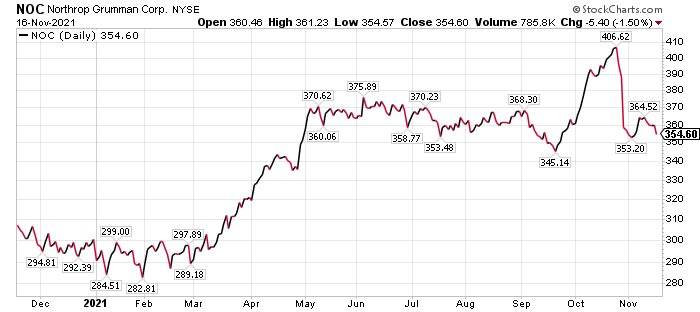

Northrop Grumman Joins List of Five Defense Stocks to Buy

Northrop Grumman (NYSE: NOC), a Falls Church, Virginia-based multinational aerospace and defense technology company, employs 90,000 people and produced more than $30 billion in annual revenue. It also is one of the world’s largest weapons manufacturers and military technology providers.

BofA gave Northrop Grumman a price objective of $460, based on a DCF analysis that reflects a 4% year over year (Y/Y) growth rate for 2025-2030 estimates, a 2.5% long-term growth rate and an 8.3% discount rate. The U.S. Defense Budget Authorization has grown at a 1.8% compound annual growth rate (CAGR) in constant dollars since post World War II.

Since the most profitable production phase of the B-21 Raider program starts in about 10 years and the Ground Based Strategic Deterrent (GBSD) will enter production at the end of this decade, BofA expects the company’s next terminal growth rate could top the historical growth rate of U.S. defense spending. The GBSD is a future American land-based intercontinental ballistic missile system currently in the early stages of development that is slated to replace the aging Minuteman III missiles.

Downside risks to BofA’s price target could come from any execution problems with defense programs that cause cost overruns and margin contractions, as well as unexpected cancellations.

Chart courtesy of www.stockcharts.com

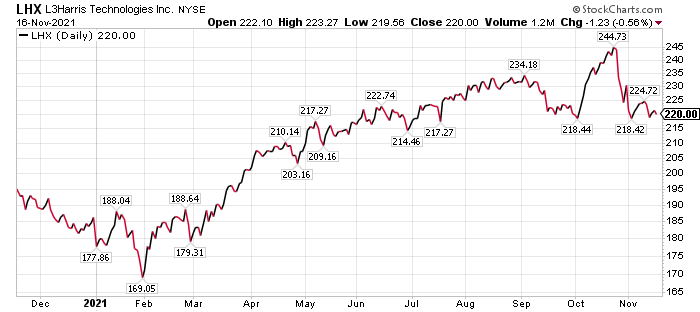

L3 Harris Leaps onto List of Five Defense Stocks to Buy

L3 Harris (NYSE: LHX), a Melbourne, Florida-based defense contractor and information technology services provider, produces command, control, communications, computers, cyber-defense, combat systems (C6) and intelligence, surveillance and reconnaissance (ISR) systems and products. The company also offers wireless equipment and tactical radios.

BofA’s price objective of $251 for L3 Harris puts the company’s valuation in line with the defense pure play average along with Lockheed Martin (NYSE: LMT) and Northrop Grumman. Potential for outperforming BofA’s price objection could come from LHX winning more content on new and existing programs vs. the investment firm’s expectations.

Downside risk to BoA’s price target could stem from L3 Harris not integrating the operations of L3 Technologies and Harris Corporation as expected. The companies merged on June 21, 2019 ,but any continuing integration challenges could put a strain on cash and impact our BoA’s free cash flow estimates.

Chart courtesy of www.stockcharts.com

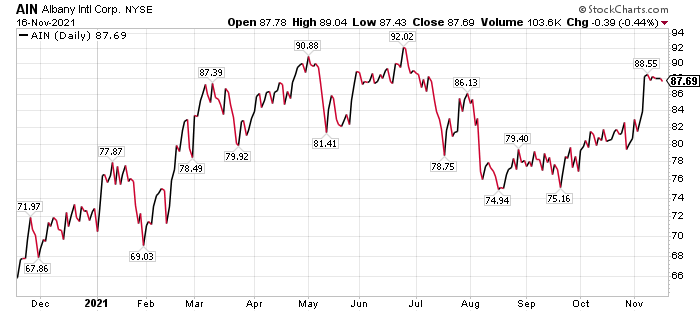

Five Defense Stocks to Buy Include Hybrid Company

Albany International Corp., (NYSE: AIN), headquartered in Rochester, New Hampshire, operates 23 facilities in 11 countries, while employing approximately 4,000 people worldwide. The company is a global advanced textiles and materials processing company that also serves the defense industry.

Albany International develops and manufactures engineered components, using advanced materials processing and automation capabilities, with two core businesses. They are:

- Albany Engineered Composites, a growing designer and manufacturer of advanced materials-based engineered components for demanding aerospace applications, supporting both commercial and military platforms.

- Machine Clothing is one of the world’s largest producers of custom-designed, consumable belts that are essential for the manufacture of all grades of paper products.

BofA’s price objective of $105 accounts for the differing valuations of both units. The valuation of Albany Engineered Composites is slightly higher than the other business segment and is comparable to other aerospace peers, Epstein wrote.

Risks to the price objective are that the Machine Clothing segment is AIN’s primary driver of cash. Global slowdown in paper production or disruption in the production of paper could hurt the company’s profits and cash profile, according to BofA.

In addition, a disruption in cash generation in Machine Clothing could hinder management’s ability to invest in aerospace and defense. A commercial aerospace downturn that affects narrowbody aircraft that have the CFM Leap engine could materially affect Albany. Unexpected cancellations to programs in both commercial and military could materially impact the company, too.

Upside to BofA’s price target could come from the Airbus A320neo, Boeing 737 MAX and Comac C919 announcing production rates are increased, The company would benefit as a sole sourced supplier to the CFM LEAP engine and could give lift to the BofA estimates. Increased scope of work on existing programs or new program wins could provide upside in the medium term.

Chart courtesy of www.stockcharts.com

COVID-19 Risk Rises as Cases and Deaths Jump in Certain States

The highly transmissible Delta variant of COVID-19 has continued to plague the United States with new cases and deaths. It remains a big concern for public health experts who still urge increased vaccinations and booster shots, as well as mask wearing.

The Centers for Disease Control and Prevention (CDC) specifically has held the variant responsible for unleashing a resurgence of cases and deaths early in the fall. However, the variant is leading to a jump in the number of people vaccinated from COVID-19.

As of Nov. 16, 227,691,941 people, or 68.6% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. The fully vaccinated total 195,435,688 people, or 58.9%, of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Nov. 16, topped the 5 million mark, reaching 5,114,533, according to Johns Hopkins University. Worldwide COVID-19 cases topped 250 million, hitting 254,371,074, as of that date.

U.S. COVID-19 cases, as of Nov.16, reached 47,308,983 and caused 765,791 deaths. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

The five defense stocks to buy for profiting through the growing conflict between China and other countries should be aided by increasing government spending during and beyond the pandemic.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.