The market has entered what I like to term a “work zone” or “construction area,” where everyone is wearing a yellow vest and a hard hat.

No one has left the job site, but no one is taking the undo risk of getting injured either. Last week, we saw how one can get hurt badly by being overweighted in stocks with exorbitant price-to-sales (P/S) ratios and virtually no price-to-earnings (P/E) ratios.

There is no way to sugarcoat the damage. It was a bloodbath for the high-priced growth stocks. While the S&P shed about 5% and the Nasdaq dropped about 7% from their recent highs before catching a late Friday afternoon bid, stocks of artificial intelligence (AI), enterprise, cyber security, cloud and most Software as a Service (SaaS) shed anywhere from 20% to as much as 50% of share valuations. To say the bubble got pricked is an understatement.

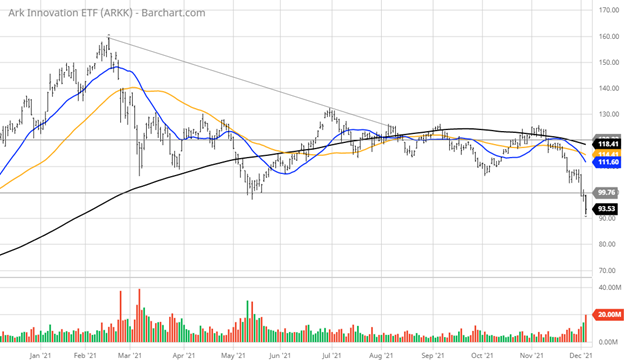

The Ark Innovation Exchange-Traded Fund (ETF) (NYSEARCA: ARKK) has been labeled as somewhat of a poster child for hyper-growth stock investing. Clearly, this fund is breaking down on a big spike in trading volume. At its zenith, the eight Ark ETFs had over $52 billion in assets under management (AUM). The latest data from ETF.com states that the total AUM is around $35 billion. A firehose of money is leaving these and other hyper-growth mutual funds and ETFs.

Even though the yield on the 10-year Treasury note fell to 1.34% as of Friday’s close, the Street is convinced that the Fed is now in inflation-fighting mode and that this will result in a higher fed funds rate once tapering is complete. The thought is that this will lead to higher bond yields as well. How much higher?

No one knows, but the perception is that the Fed is behind the inflation curve and the market is responding by way of multiple contractions for stocks that have enjoyed a first-class seat on the quantitative easing (QE) express train for the past two years.

That ride is about to end, and investors are wasting no time in rebalancing portfolios to de-risk away from stocks with no P/E ratios, no matter how good the underlying story is. Investors have voted to reprice these hot growth stocks at considerably lower multiples. Meanwhile, end-of-the-quarter portfolio window dressing and year-end, tax-loss selling are making for some further stiff headwinds for the balance of December.

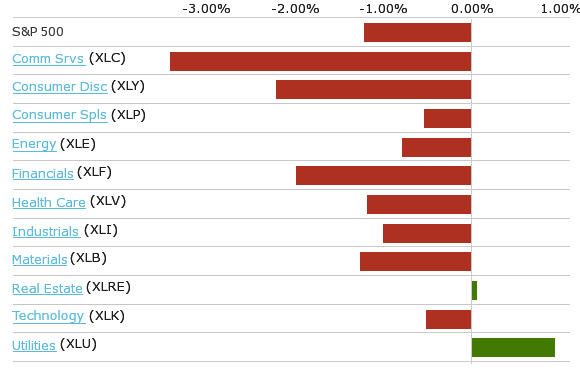

The week ended with only utilities and real estate showing gains, with the other nine sectors closing in the red. There were few places to hide. The biggest winner on the week was the iShares 20+ Year Treasury Bond ETF (TLT), which closed up 6.9% on a sharp flight to safety.

Source: spdralerts@factsetdigitalsolutions.com

Investors are not fully abandoning these hot growth sectors, but they are rotating into related big-cap stocks that have reasonable P/S and P/E ratios, as well as strong dividend growth and robust stock buyback programs. This was clearly evident within the semiconductor sector price action late last week. At the time, the Nasdaq was under heavy selling pressure, but several chip stocks bucked the trend and traded higher.

For investors who are seeking yields from their portfolios that take taxes and inflation into account, bonds are a tough call right now. With the 10-year Treasury note paying 1.34% and the iShares Investment Grade Corporate Bond ETF (LQD) paying 2.26% with a 9.6-year average maturity, there is clear downside risk in an up-rate market, not to mention the fact that income received is taxed at ordinary income tax rates. Meanwhile, inflation is running at two to four times these current yields.

This scenario kind of throws the traditional barbell investment strategy out the window. Even so, millions of investors need income to stay on top of the rising cost of living. According to Investopedia, the barbell strategy advocates pairing two distinctly different types of assets. One basket holds only extremely safe investments, while the other holds only highly leveraged and speculative investments.

This approach famously allowed Nassim Nicholas Taleb, a statistician, essayist and derivatives trader, to thrive during the 2007-2008 economic downturn, while many of his fellow Wall Streeters floundered. Taleb described the barbell strategy’s underlying principle as follows:

“If you know that you are vulnerable to prediction errors, and accept that most risk measures are flawed, then your strategy is to be as hyper-conservative and hyper-aggressive as you can be, instead of being mildly aggressive or conservative.”

This was all well and good when the yield on the 10-year Treasury note was trading between 4-5% during the 2007-2009 time-frame, when everything hit the fan. Holders of long-dated Treasury zero coupon bonds made out huge during the Great Recession.

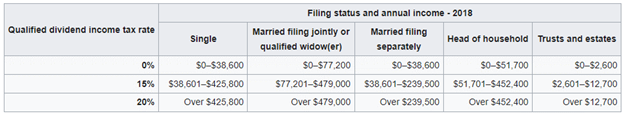

In the current environment, with bond yields back down to levels that have not been seen since January, and hyper-aggressive stocks being revalued lower, blue-chip stocks with dividend aristocrat profiles are an alternative way to capture healthy yields and qualified dividends. Here, the highest income earners pay a top tax rate of 20%.

Source: Wikipedia.org

The Schwab U.S. Dividend Equity ETF (SCHD) pays a pretty attractive 2.90% current dividend yield. And the iShares Core High Dividend ETF (HDV) pay a juicer yield of 3.50%. However, neither of these two ETFs nor most blue-chip, dividend-paying stocks, will trade higher like Treasuries in the event of a black swan event like the Great Recession or the pandemic of March 2020. In this case, when rates are already so low, there is probably no substitute for cash when trouble hits.

But when seeking inflation-hedging income that includes stock appreciation, low multiples and a history of growing dividend payouts, blue-chip stocks with defensive characteristics are an option for lowering beta in portfolios while still maintaining exposure to leading industries with bullish, secular growth trends. In addition, the ETFs charts are very stable in an otherwise volatile market landscape.