The holidays bring the season of giving, receiving and overall merriment.

For most, there is a common theme in all three of these things: shopping. Holiday shopping encompasses not only gifts but also food and decorations.

According to the National Retail Federation (NRF), the American budget for holiday gifts, food and decorations is roughly $998 for this year. In addition, a significant portion of the shopping will be done online. In fact, online retail sales have jumped from 11% to 15% year over year, according to the NRF.

One exchange-traded fund (ETF) that is reaping the benefits of holiday shopping is the VanEck Retail ETF (NASDAQ: RTH). The fund tracks the MVISA US Listed Retail 25 Index. RTH’s holdings run the gamut from distribution and wholesale retail to specialty and food retail.

One unique thing about RTH is how it started. RTH began as a holding company depository receipt (HOLDR) product offered by Merrill Lynch prior to December 2011. Though it is now a true ETF, it has clung to its roots and has retained its concentrated exposure to only U.S.-based retail companies. Even though the fund’s concentration excludes global retail companies, its holdings provide investors with access to U.S. retail giants that have worldwide reach, making it a potentially less risky investment than a retail fund with global holdings.

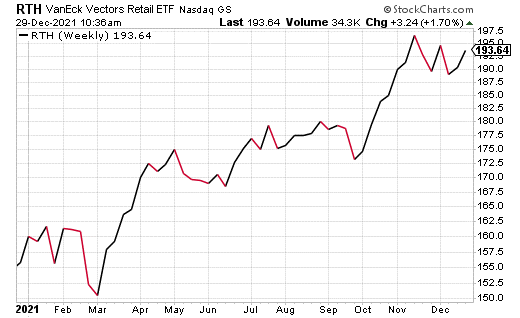

The fund not only has an appealing expense ratio of 0.35% but a distribution yield of 0.80%, as well. The fund has a weighted average market cap of $442.73 billion. It also has $258.35 million in net assets and $232.54 million in assets under management. As mentioned earlier, RTH is reaping the benefits of the holiday season, and the chart below is proof. After seeing a sharp dip in March, the fund began a steady upward climb, which then turned into a momentous spike in early October. Proving its strength, the fund opened at $193.14, which is at the high end of its 52-week range of $147.18 to $199.65.

Courtesy of Stockcharts.com

While RTH comprises only 25 holdings, they are big-name players and household names. Its top five holdings include: Amazon.com Inc. (AMZN), 20.28%; The Home Depot Inc. (HD), 11.60%; Walmart Inc. (WMT), 8.27%; Costco Wholesale Corp. (COST), 5.04% and Lowe’s Companies Inc. (LOW), 4.92%.

So, in the spirit of giving, receiving and merriment, the VanEck Retail ETF (NASDAQ: RTH) may be the perfect gift for investors who are looking for a fund with a solid expense ratio and strong current performance. Though the fund only invests in U.S.-based companies in the retail industry, its concentrated exposure makes it a safer play than its global counterparts.

However, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.