Much of the market’s performance is highly tied to the current narrative, be it bullish or bearish or a mixture of both, depending on the headlines that move markets and influence investor sentiment.

The first week of 2022 showed just how powerfully rooted the current investor mindset is focused on inflation and rising bond yields. It is amazing how a 40-basis-point move in the 10-year Treasury can impact stocks.

Seeing the benchmark yield move from 1.37% to 1.77% as of last Friday in the span of three weeks was a scenario the Nasdaq wasn’t prepared for. The release of the Federal Open Market Committee (FOMC) minutes from the December meeting set into motion another round of collective thinking that the Fed is having an epiphany moment and doubling down on its admission that they have wrongly downplayed inflation — and the market is responding accordingly.

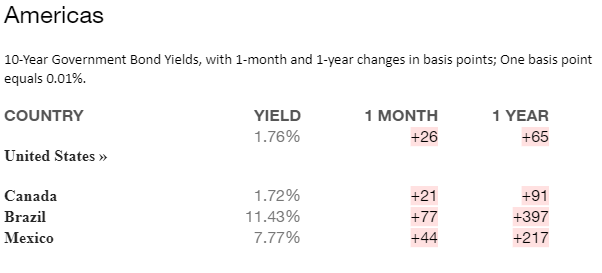

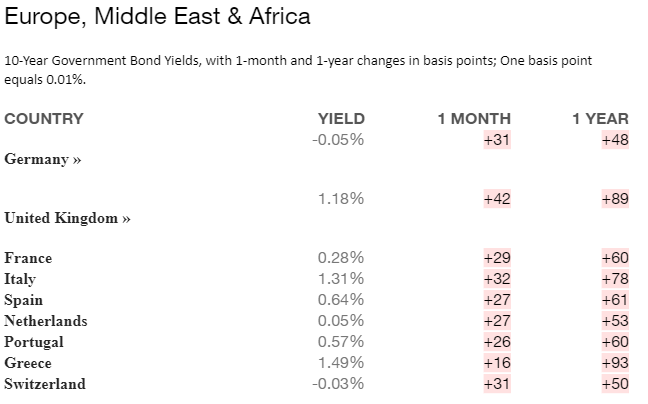

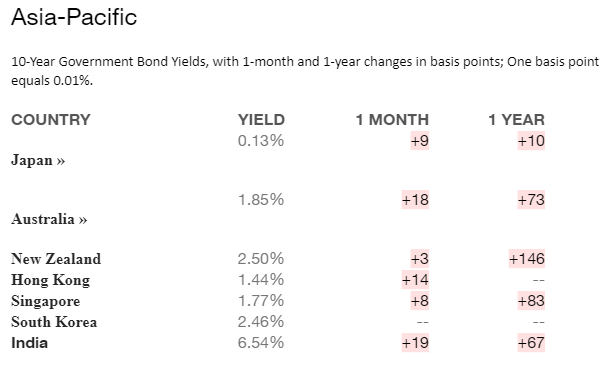

The question that needs to be asked at this point is whether the bond market has adjusted enough to take a wait-and-see approach to further economic and earnings data. The one-year technical chart of the 10-year Treasury would suggest a short-term top in bond yields will define the near-term. If not, then a move to 2.0% is almost assured. The table below of global 10-year sovereign yields shows the U.S. 10-year paying considerably more than that of most of the developed nations, and shockingly higher than that of Italy and Greece.

Source: www.bloomberg.com

What is consistent with the bond table is the one-month change across the spectrum of global rates pushing higher in light of inflationary pressures, but also that of future growth prospects — a topic, that in my view, doesn’t get enough attention. It can be argued that the Omicron phase of COVID-19 will be the blow-off top to the pandemic, after which a rainbow of synchronous global economic prosperity will follow. I don’t think this a rose-colored view, but a scenario that could potentially play out starting in late March-early April.

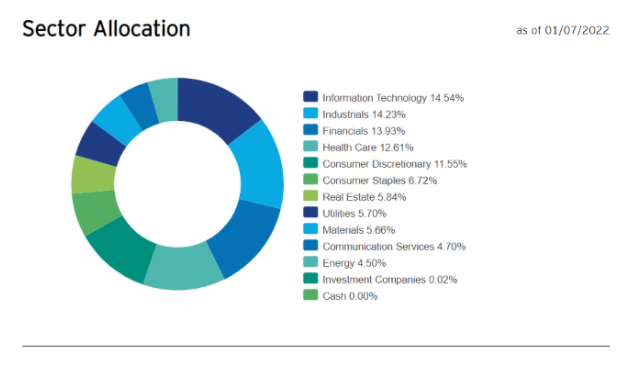

So much emphasis is put on the major indexes because mega-cap information technology (IT) companies dominate roughly 27% of the S&P and 52% of the Nasdaq. As of last Friday’s close, the S&P was down 2.9% from its all-time high and the Nasdaq was off by 7.8% from its all-time record. At the same time, the S&P Equal Weight ETF (RSP) is down 1.9%, reflecting the strength in the energy, materials, industrial and financial sectors. RSP better reflects the current market profile and might be considered as a good template for asset allocation weighting given its strong performance.

Source: www.invesco.com

Too much emphasis tends to be placed on all things tech by the media in that while the mega-cap tech stocks determine much the direction of the S&P and Nasdaq, there are some highly bullish developments taking place within sectors and stocks that are leveraged to the economy. In some sectors and stocks, growth is accelerating, and not decelerating as forecast by some well-known Wall Street pundits.

Shares of steel, iron ore, aluminum, aggregates, chemicals, heavy equipment, machinery, banks, trucking, railroads and even hotel operators are trading new all-time highs — implying a cyclical trend of healthy economic growth lies ahead for the domestic and possibly international economies. There is great opportunity to profit from the current rotation underway within the broader market.

IT is still the top sector weighting in RSP, but it represents 14.5% versus 27.2% in the S&P SPDR ETF (SPY). Within the tech sector, shares of lower price-to-earnings (P/E) semiconductor, semiconductor equipment and network equipment stocks are trading just off their highs, or within 10%. Not everything in the tech sector is getting crushed — mostly just the high beta, high price-to-sales stocks. However, FAANG stocks are trading lower as well, showing a crowded trade where fund managers are trimming to buy into the aforementioned cyclical sectors and stocks.

To summarize, investors need to be in tune with “what the market wants to own” and rebalance their portfolios accordingly. Inflation looks to remain elevated for some time longer than originally anticipated, and interest rates are reflecting not just higher inflation but expectations of stronger gross domestic product (GDP) growth. Identify which sectors of the market are under high-volume accumulation, get involved in those stocks and exchange-traded funds (ETFs) on pullbacks, and enjoy the ride. As we all know, there is always a bull market somewhere.