Top 4 oil stocks to buy for profiting from exploration and production growth offer a potential gusher of opportunity.

The top 4 oil stocks to buy for profiting from exploration and production (E&P) growth should be fueled by a 22% rise in global drilling & completion (D&C) spending in 2022 to mark the strongest annual jump since 2006, according to BofA Global Research. After a couple of tough years for the oilfield services (OFS) industry, BofA is predicting that this year could be one of robust D&C spending growth.

Unlike the prior cycle that was dominated by U.S. D&C spending growth, international spending is expected to be strong in 2022. As a result, BofA is projecting a broadened D&C spending recovery in 2022, including U.S. and international growth of 37% and 15%, respectively.

Top 4 Oil Stocks to Buy for Profiting from Exploration and Production Spending

E&P companies in the oil and gas industry are engaged in the early stage of energy production known as the upstream segment of the business. E&P involves searching for and extracting oil and gas from the ground.

Typically, E&P companies do not refine or produce energy but instead focus on finding and extracting raw materials. Midstream activities follow with companies that specialize in storing, processing and transporting the crude oil and raw natural gas products. The function of midstream companies is to operate tanker ships, pipelines and storage facilities to help move those raw materials and prepare them for the downstream process that refines the resources into fuels and finished products for marketing, distribution and sale.

Energy is one of the limited number of industries that are benefitting from the current rising yield environment. Increased prices have helped oil stocks and are producing buying opportunities for investors, according to the Jan. 18 issue of the Fast Money Alert trading service led by Mark Skousen, PhD, and Jim Woods.

Mark Skousen, a descendent of Benjamin Franklin, meets with Paul Dykewicz.

Top 4 Oil Stocks to Buy for Profiting from Exploration, Production and Inflation

Crude oil prices are surging on a combination of rising inflation, steady demand and a constricted supply, Skousen and Woods opined.

“Those rising prices have created a bullish setup in several oil stocks,” wrote Skousen and Woods. Skousen, named one of the world’s Top 20 living economists by www.superscholar.org, is the leader of the Forecasts & Strategies investment newsletter, as well as the Five Star Trader, TNT Trader and Home Run Trader advisory services. Woods writes the Successful Investing and Intelligence Report investment newsletters, as well as heads the Bullseye Stock Trader and High Velocity Options advisory services.

Jim Woods and Paul Dykewicz discuss stocks to buy now.

BofA reports it has been watching the private U.S. exploration and production companies closely, forecasting their rig activity is now above pre-COVID levels. However, the public U.S. E&Ps are still 45% below pre-COVID levels.

While public E&Ps will take their activity levels modestly above maintenance, likely producing 20%-plus year over year (y/y) growth in the group’s capital expenditures (capex), private E&Ps should provide the biggest increases in 2022. For example, BofA expects private E&P capex to surge by roughly 55% in 2022. Overall, U.S. E&P capex is projected by BofA to rise 37% this year, including 10% due to inflation.

Top 4 Oil Stocks to Buy for Profiting from Exploration and Production

Energy stocks had a strong finish to 2021 and most of the reasons for it continue in 2022, said Bob Carlson, who heads the Retirement Watch investing newsletter. Inflation is likely to remain high for much of 2022 and perhaps longer, helping to power energy stocks that traditionally serve as a good inflation hedge for such conditions.

“In addition, capital investments in the energy sector lagged the last few years, continued Carlson, who also serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “Capital investments aren’t going to surge enough to increase supply anytime soon. In fact, some governments are discouraging or prohibiting additional investments in traditional energy sources, and many banks and other capital sources reduced their exposure to the sector as part of their environmental policies.”

The result is demand likely will surpass supply for a while, absent a recession, Carlson counseled. Many energy companies, especially the shale oil producers, have made clear that they will be more friendly to shareholders going forward. Instead of investing heavily to maximize production, they will focus more on profitability and ensuring shareholders have cash distributions and stock price appreciation, he added.

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

BofA’s Top 4 Oil Stocks to Buy for Profiting from Exploration and Production

With BofA preferring oil stocks that have more exposure to the United States E&P market, it recommended Halliburton (NYSE: HAL), with dual headquarters in Houston and Fort Worth, Texas. BoA rated HAL as a buy and the “best-in-class” North American, large-cap E&P stock.

The investment firm released a research report recently that described Halliburton as its favorite offshore large-cap investment in the sector. One reason is that U.S. E&P capital discipline has reduced the sensitivity of domestic activity to oil prices, it noted.

But with oil now at $80, U.S. onshore activity may have underappreciated upside that will help to drive further gains for HAL’s consensus estimates, BofA continued. Amid that positive outlook, BofA reiterated its buy rating and raised its 2022 / 2023 earnings per share (EPS) and earnings before interest, taxes, depreciation and amortization (EBITDA) estimates to $1.85 / $2.66 and $3,659 million / $4,770 million, respectively.

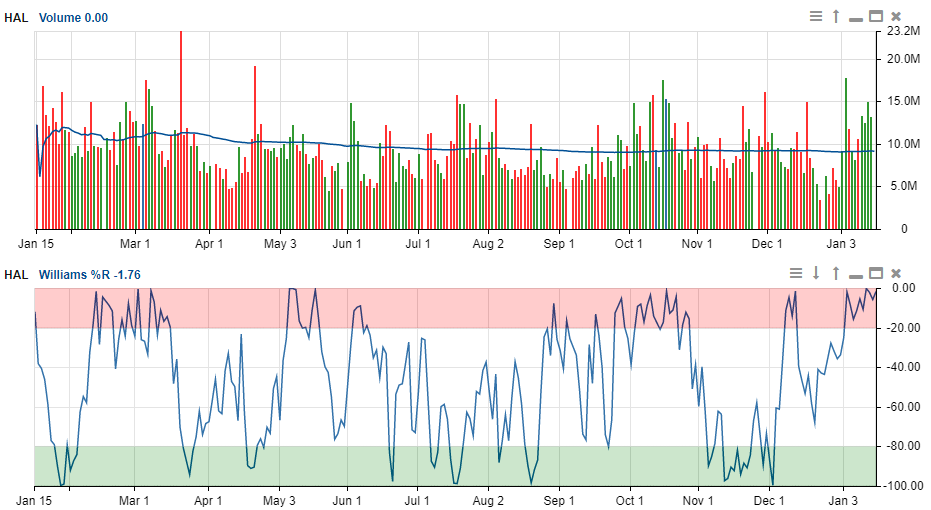

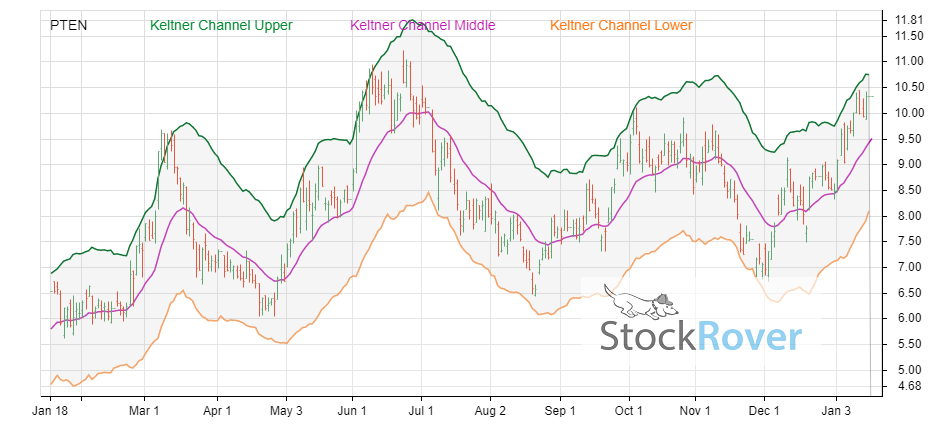

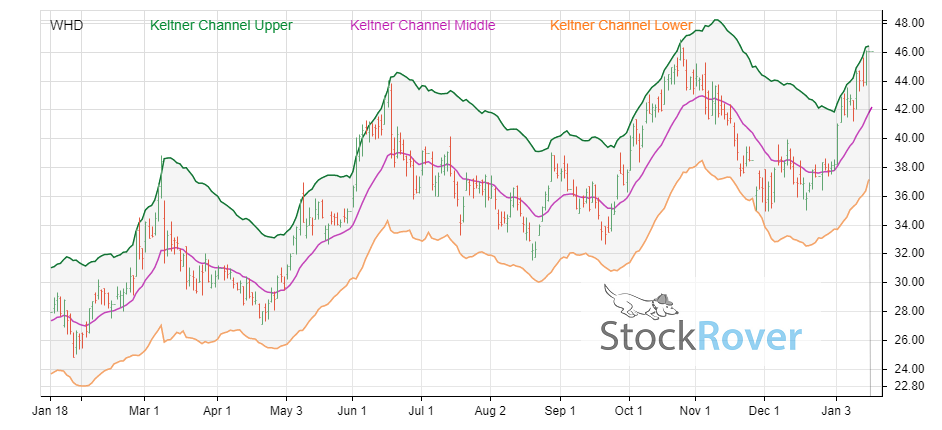

For those who like value-added charts, Stock Rover has provided such visual demonstrations of the recent track record of HAL and BofA’s other three recommended oil stocks of BofA.

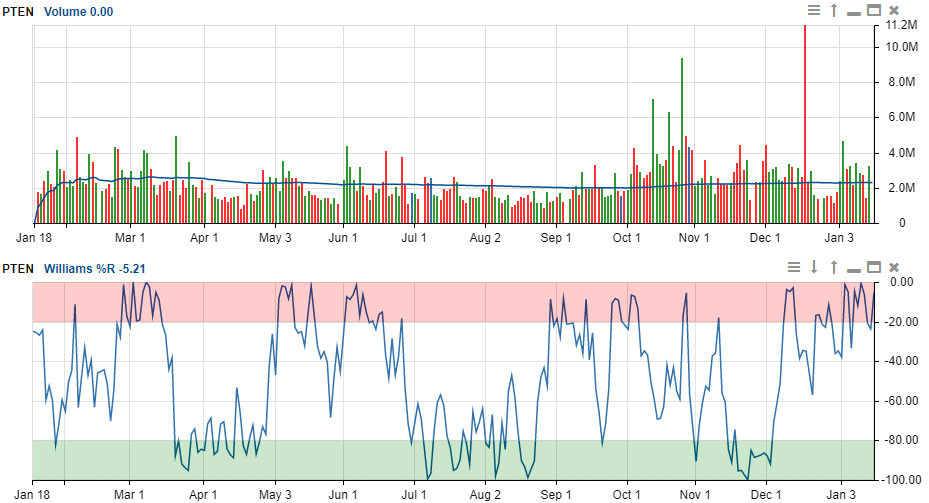

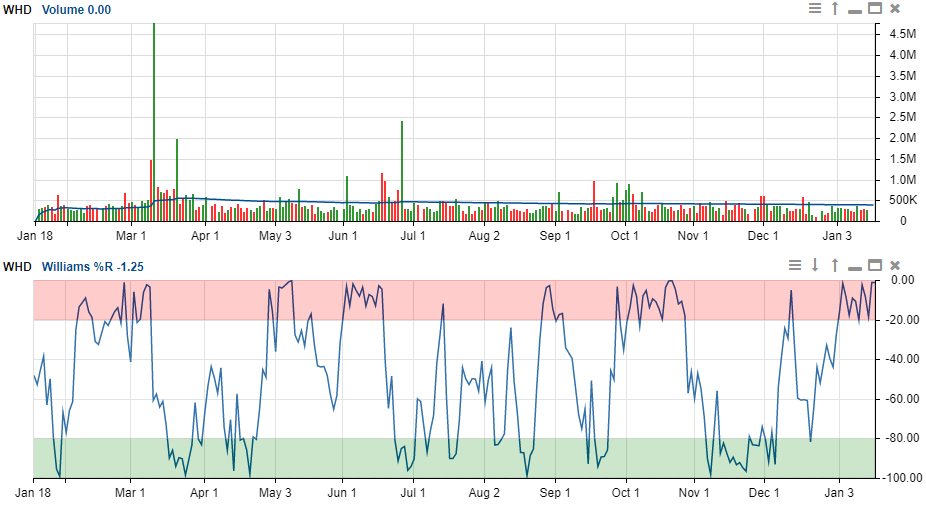

The Williams indicators in the illustrative Stock Rover charts show momentum, with 0 to -20 (shaded in red) considered overbought and -80 to -100 regarded as oversold. The accompanying Stock Rover charts also are overlaid with a volume indicator.

Chart generated using Stock Rover. Activate your 2-week free trial now.

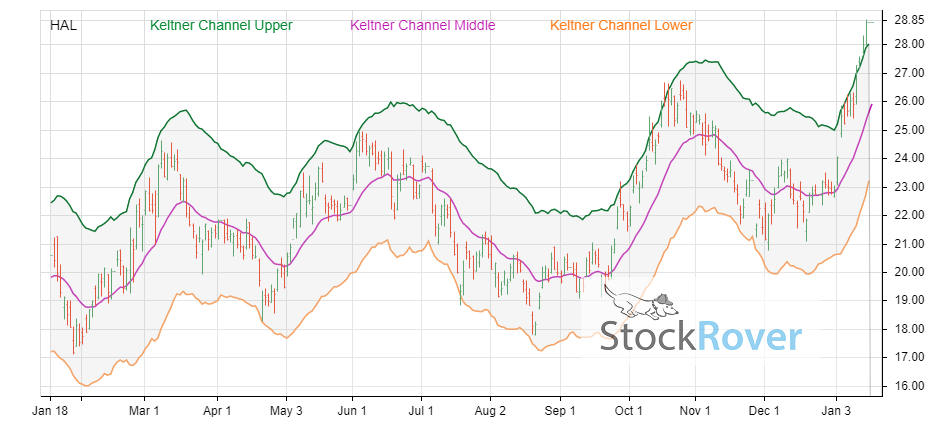

In addition, charts that feature Keltner Channels are a more informative variation on moving average lines.

Chart generated using Stock Rover.

NEX Joins Top 4 Oil Stocks to Buy for Profiting from Exploration and Production

Among the smallest 2,500 stocks within the broad S&P benchmark, three of those small- and mid-cap oil companies focusing on D&C received buy recommendations from BofA. One of them is Houston-based NexTier (NYSE: NEX), a land oilfield service company that has a diverse set of well completion and production services.

NexTier gained a buy recommendation from BofA partly as the “best way” to invest in tightening pumping fundamentals. Specifically, BofA is positive on U.S. hydraulic fracturing (a.k.a. pressure pumping) fundamentals. Basically, attrition is tightening the fracturing market much more quickly than investors might expect even though the crew count is still well below 2019 levels.

Despite NEX’s recent rise, the stock still appears undervalued, BofA added. Continued execution and market tailwinds should help this “exceptionally cheap” stock re-rate as consensus estimates move higher this year, the investment firm added.

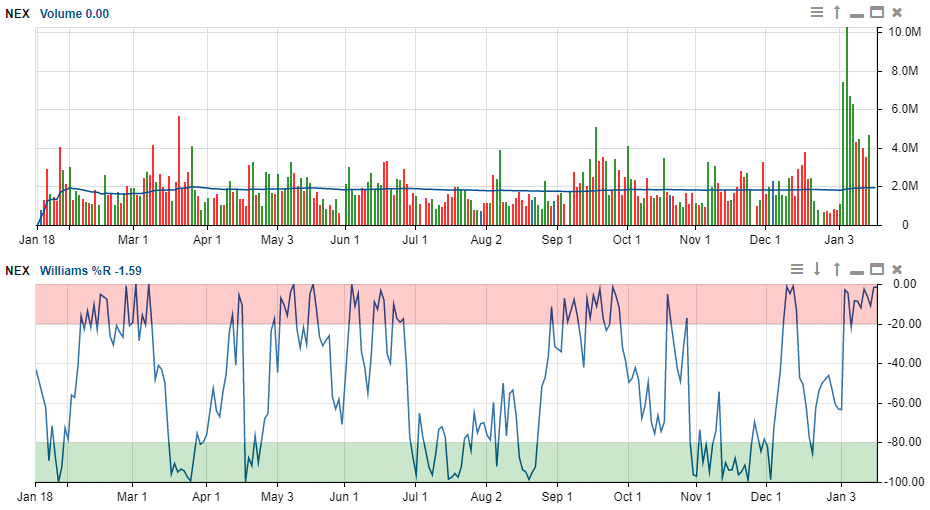

Chart generated using Stock Rover. Activate your 2-week free trial now.

As such, BofA affirmed its buy rating on NEX and raised its 2022 / 2023 EBITDA estimates to $329.9 million / $426.1 million.

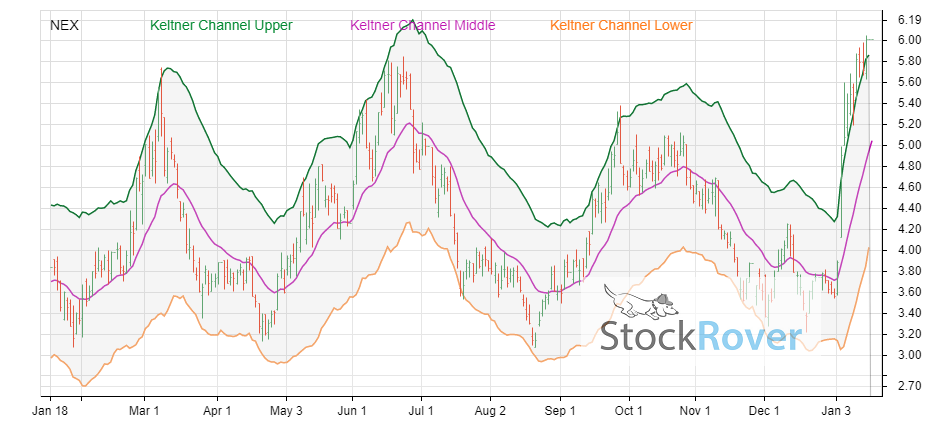

Chart generated using Stock Rover.

Top 4 Oil Stocks to Buy for Profiting from Exploration and Production: PTEN

Patterson UTI (NASDAQ: PTEN), a Houston-based provider of oilfield services and products to oil and natural gas E&P companies in the United States and other select countries, offers contract drilling, pressure pumping and directional drilling services. BofA wrote that rig count upside exists to drive day-rate momentum for PTEN.

The company is rated as BofA’s favorite land driller. Key reasons are (1) higher leverage to U.S. private E&Ps, (2) lower capex requirements, especially when compared to competitors, and (3) cheaper valuation than its closest peer, BofA opined.

“Furthermore, we think U.S. horizontal rig activity could end the year around 650 rigs, which implies more than 100 rigs added between now and the end of the year,” BofA wrote in a recent note. “And if activity plays out like we think this year, we expect day rates to climb into the mid-$20,000 range as total Super Spec rig utilization eclipses 90%.”

Chart generated using Stock Rover.

Upon taking all these factors into account, BofA reiterated its buy rating, while raising its 2022 / 2023 EBITDA estimates on the stock to $426.7 million / $594.3 million.

Chart generated using Stock Rover.

Top 4 Oil Stocks to Buy for Profiting from Exploration and Production: WHD

Cactus Wellhead (NYSE: WHD), of Houston, designs, manufactures, sells and rents a range of highly engineered wellhead and pressure control equipment. Its products are sold and rented principally for onshore unconventional oil and gas wells and are used during the drilling, completion and production phases of its customers’ wells.

In addition, Cactus Wellhead provides field services for all its products and rental items to assist with the installation, maintenance and handling of the wellhead and pressure control equipment. BofA forecasts U.S. drilling upside that could give WHD’s margins tailwinds.

WHD, with a 40%-plus share of the U.S. wellhead market, is set to benefit from continued momentum in U.S. drilling activity, BofA predicted. Plus, the investment firm forecast that the company’s product segment could be helped if its input costs, such as steel, come down even as Cactus Wellhead has had success boosting prices to offset inflationary pressures, BofA added.

“Keep in mind, though, that typically WHD does not have to concede some of the price gains captured previously as input costs come down, which is a possible added catalyst for margins in 2022,” BofA wrote. “Therefore, we reiterate our buy rating.”

Chart generated using Stock Rover.

BofA raised its 2022 / 2023 EBITDA estimates to $193.4 million / $272.5 million.

Chart generated using Stock Rover. Activate your 2-week free trial now.

Underappreciated Free Cash Flow Growth for the Oilfield Service Sector

With the oil and gas industry entering its “twilight years” amid a global push toward clean energy sources, investors have begun to focus more on free cash flow and less on growth, BofA wrote. With activity on the rebound and oilfield service pricing set to climb this year, the oilfield services sector is positioned to generate significant growth in free cash flow.

At this point in the cycle, cash flow growth really doesn’t require much, if any, growth capex, BofA added. Plus, use of the U.S. dollar to price oil favors such stocks, so any decline in the greenback compared to other currencies should increase the prices of oil and other forms of energy.

There are 21 stocks in the energy sector of the S&P 500. At the end of 2021, those stocks had a combined market value of about $1 trillion. That’s about a third of Apple’s (NASDAQ: AAPL) $3 trillion market value and a little more than the 2021 increase in the technology company’s market capitalization, Carlson commented.

Omicron Variant of COVID-19 Dominates U.S. Cases

The economy is affected by the Omicron variant of COVID-19 causing 99.5% of new coronavirus cases in the United States last week to show a slight increase from the previous week, according to Jan. 18 estimates from the U.S. Centers for Disease Control and Prevention. The Delta variant accounts for the remaining 0.5%.

An average of 750,000-plus new COVID-19 infections were reported every day over the past week, according to data from Johns Hopkins University. The U.S. Department of Health and Human Services reported that 156,000 people were hospitalized with COVID-19 on Jan. 16, based on the most recent data available at press time.

Reports indicate that the recent surge in COVID cases is causing some hospitals to run out of space to treat other patients in intensive care units. A squeeze also is occurring in the travel industry due to canceled flights from rising COVID cases, as workers at airlines, airports and related retailers call in sick.

COVID-19 Concerns Continue as Cases and Deaths Keep Climbing

The Centers for Disease Control and Prevention (CDC) reported that the variants still are spurring people to obtain COVID-19 boosters. But more than 60 million people in the United States remain eligible to be vaccinated but have not done so, said Dr. Anthony Fauci, the chief White House medical adviser on COVID-19.

As of Jan 18, 249,393,487 people, or 75.1% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. Those who are fully vaccinated total 209,312,770, or 63% of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Jan. 18, topped the 5.5 million mark to hit 5,554,152, according to Johns Hopkins University. Worldwide COVID-19 cases have zoomed past 333 million, reaching 333,705,640 on that date.

U.S. COVID-19 cases, as of Jan. 18, soared beyond 67.5 million, totaling 67,581,992 and causing 853,951 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The four stocks to buy for profiting from oil exploration and production growth give investors a chance to buy shares in stocks that are in an industry that until recently had lost favor due to its use of fossil fuels in an era of climate consciousness. Open-minded investors willing to invest in those stocks while they are on the rise and many other sectors are struggling could outperform the market this year.