Some funds attempt to provide market-like sector exposure in relation to their benchmark index, while other funds attempt to beat the benchmark.

One such fund trying to beat a benchmark is the First Trust Financials AlphaDEX Fund (FXO). In an effort to beat the U.S. Financials market sector, FXO seeks to replicate a unique index known as the AlphaDEX Index, which is part of the StrataQuant Series owned by ICE Data Indices, LLC.

The Index employs a unique quantitative strategy that is designed not only to generate excess returns relative to traditional cap-weighted benchmarks but also to identify stocks positioned to outperform.

Launched in 2007, the passively managed fund’s ultimate goal is to pick winning stocks by determining the degree to which companies outperform or underperform on a risk-adjusted basis relative to the Index which is applied to the Russell 1000 financial sector.

As FXO uses a multi-factored index selection methodology, it maintains a lower concentration of top holdings than cap-weighted funds. Simply put, the fund’s performance is not as dependent on a collection of large-cap stocks, which may allow interested investors broader access to financials.

As a testament to its innovative index selection methodology, FXO’s top 10 holdings only account for about 16.21% of its total assets under management. Moreover, as it uses an equal-weighted tiering method, the fund’s holdings are more skewed toward mid-cap stocks.

The fund has $1.52 billion in assets under management, $1.62 billion in net assets, a distribution yield of 1.92% and an expense ratio of 0.62%. Further, FXO has a modest price-to-earnings (P/E) ratio of 8.44 and a solid price-to-book (P/B) ratio of 1.30.

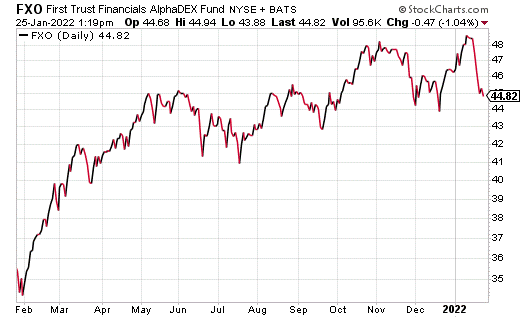

As indicated by the chart below, FXO started the new year with a bang and was trading at around $48.99, which is at the highest end of its 52-week range. At the time of this writing, the fund is trading at $44.99. Though that is lower than earlier in the first month of 2022, the chart shows that it has the ability to regain its upward momentum.

FXO’s top five holdings include: MGIC Investment Corporation (MTG), 1.78%; Berkshire Hathaway Inc. Class B (BRK.B), 1.75%; Allstate Corporation (ALL), 1.74%; OneMain Holdings, Inc. (OMF), 1.74% and Cincinnati Financial Corporation (CINF), 1.72%.

By seeking to replicate the AlphaDEX Index, the fund is comprised of stocks with a good chance of outperformance, in relation to the Russell 1000. Further, the fund’s top five holdings all boast low P/E ratios, as do the majority of the stocks within the fund.

Ultimately, while First Trust Financials AlphaDEX Fund (FXO) may be a bit pricier than its counterparts, it may be a smart move for investors interested in a fund that will provide broad exposure to the financial sector through its one-of-a-kind index methodology. However, this ETF may not be appropriate for all portfolios, and investors are encouraged to conduct their own due diligence to determine whether this fund aligns with their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.