Vanguard International High Dividend Yield Index Fund ETF Shares (NASDAQ:VYMI) tracks a market-cap-weighted index of developed and emerging market firms that are expected to pay above average dividends over the next 12 months.

VYMI takes a conservative approach to international high dividend yields. Firms are ranked by forecast yield over the next 12 months, and those in the top half are selected. This relatively loose filter, combined with market-cap weighting, results in a large basket that doesn’t depart from the broad market as radically as some competitors.

REITs are excluded in keeping with the conservative approach. Emerging market names are also eligible for inclusion. Overall, VYMI provides balanced, comprehensive exposure to high-yield international stocks. To reduce turnover, the underlying index uses buffers during its annual reconstitution and rebalance. Vanguard uses a sampling approach to track the index.

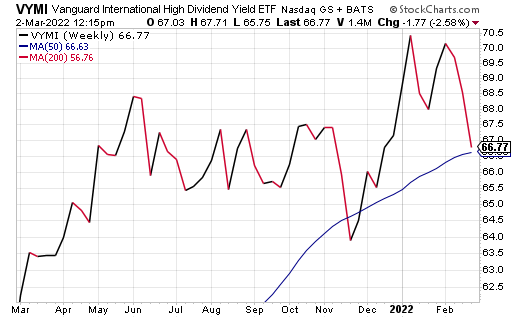

Source: StockCharts.com

The fund has almost $3 billion in net assets, a 0.04% average spread and 0.27% expense ratio, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds. It currently trades just under $67, giving it a very attractive 3.48% dividend yield.

The investment seeks to track the performance of the FTSE All-World ex US High Dividend Yield Index that measures the investment return of non-U.S. companies that are characterized by high dividend yield. The fund invests by sampling the index, meaning that it holds a broadly diversified collection of securities that, in the aggregate, approximate the full index in terms of key characteristics. The index focuses on companies located in developed and emerging markets, excluding the United States, that are forecast to have above-average dividend yields.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)