The rally in crude oil prices, as measured by West Texas Intermediate (WTI) and North Sea Brent, have generated huge profits and fortunes for the investors who acquired a decent portfolio weighting leading up to the war in Ukraine.

It was already a broadly held view that coming out of the pandemic, a synchronous global economic recovery would put upward pressure on oil prices due to the cancellation of the Keystone Pipeline and more stringent federal and state regulations on exploration and production.

In yet another catalyst for higher oil prices, nuclear talks with Iran broke off without an agreement due to Russia’s interference with the negotiations. In addition, the Wall Street Journal reported on March 8 that the “Saudis have signaled that their relationship with Washington has deteriorated under the Biden administration, and they want more support for their intervention in Yemen’s civil war, help with their own civilian nuclear program as Iran’s moves ahead, and legal immunity for Prince Mohammed in the U.S.”

The crown prince faces multiple lawsuits in the United States, including for his alleged role in the killing of journalist Jamal Khashoggi in 2018.

It is probably sufficient to say that the underlying bid for oil over the near and intermediate term looks very firm. WTI crude closed at $109.33/bbl. after spiking to $130/bbl. earlier in the week. The issue of any further geopolitical risk of interruption or a lack of new higher supply to the global market could send prices above $150 with the new floor being $100, given the current demand curve and the sanctions on Russian imports.

To this point, the stock market has done an efficient job of pricing in much of the present prosperity in the energy sector, and likely some of the future expectation, knowing that, at some point, demand destruction sets in that slows economic growth altogether. The biggest impact of high oil prices is on the consumer and commercial transportation industries. Whereas coal, natural gas and renewables will continue to power electric grids worldwide, until solar, wind, hydro, biomass and geothermal sources make up a meaningful percentage.

Europe is in a most precarious position regarding a major energy deficit heading into summer and winter, when the demand for cooling and heat is at its highest.

Raman Madar, a design and application engineer at Excool, said, “It’s estimated, the electricity generation from coal power plants is 1,023,968 GWh in Europe. This represents 22.9 percent of Europe’s total electricity generation. Gas power plants generate 22.0 percent of Europe’s electricity with nuclear power plants being most dominant at 25.5 percent.”

Coal and natural gas account for about 45% of total electricity generation, with a heavy emphasis on transforming coal-fired plants to natural gas plants in the interim, while building out new renewable facilities. Europe is focusing big on renewables, but the grid is not yet equipped for intermittent sources like wind and solar to completely fill the gap.

CNBC reported on Feb. 24 that the European Union is the largest importer of natural gas in the world, according to the Directorate-General for Energy for the European Union with the largest share of its gas coming from Russia (41%). The region used to be independent with regard to natural gas, but then the North Sea reserves dried up.

A byproduct of the war in Ukraine has Germany halting the Nord Stream Two Baltic Sea gas pipeline project that was being built to increase the delivery of Russian natural gas to Western Europe, which now seeks to become energy independent of Russian gas. This is much easier said than done, and it sets up the conversation of which countries and companies will fill the gap for Germany and Europe’s natural gas deficit.

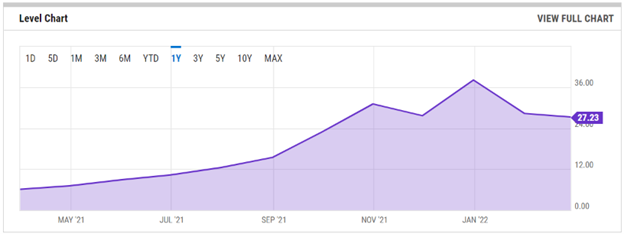

Chart courtesy of www.ycharts.com.

Imported natural gas in Europe is trading over five times that of the price of natural gas in the United States that closed at $4.77/MMBtu last Friday. Coming into what is called the “shoulder season,” where demand is low in spring and fall, natural gas prices are typically at their lowest levels for the year. There is a rising narrative that the United States will be the biggest solution for providing major natural gas supplies to Europe going forward. It suggests merit in considering the addition of natural gas stocks to portfolios during the low-demand season with the intent of seeing these assets greatly appreciate later this year.

One of the clear and most respected voices in the business of trading energy is Mark Fisher, founder and chief executive officer of MBF Trading. On March 9, he gave an interview on CNBC claiming that the price of U.S. natural gas could easily double going into the winter season later this year against a backdrop of intense export levels to Europe to replace Russian imports.

I think he is spot-on in his analysis. When looking ahead at how many of the natural gas-related stocks have pulled back from their recent peaks, this might be the best opportunity to buy the dip in the exploration and production (E&P), liquefied natural gas (LNG), pipeline and shipping companies. Very few investment themes outside of commodities are working due to the massive headwinds of inflation, tighter Fed policy and multiple contraction due to slower rates of growth being forecast.

As the first quarter comes to a close, some prudent rotation into blue-chip assets within the natural gas sector and a good dose of patience could produce some big year-end returns. Not many disparities as large as that between domestic and European gas prices exist. Either gas prices in Europe will come way down, or prices in the United States will more likely trade higher. The latter seems to make for the logical conclusion, and so does my proposed investment theme.