Seven uranium investments to buy for profiting from Russian President Vladimir Putin’s perplexing policies feature a combination of stocks and funds that should do well despite his invasion of Ukraine and attacks on its hospitals, schools, residential areas and nuclear power plants.

The seven uranium investments to buy for profiting from Putin’s perplexing policies that have led to the deaths of thousands of his soldiers, along with thousands of Ukrainian men, women and children, have triggered economic sanctions from other nations to pressure Russia’s leader to call his troops home. Putin’s self-made predicament includes bans by countries such as the United States, the United Kingdom, Canada, Japan, South Korea and Australia, as well as the European Union, on selected Russian products and natural resources such as oil, natural gas and uranium.

Staunch resistance from Ukrainian defenders protecting their homeland, families and communities has been juxtaposed with news reports that 31 senior Russian military officers, ranging from colonels to generals, have been killed in action since Putin sent them to attack neighboring Ukraine on Feb. 24. The battlefield deaths of Russian military leaders and highly trained soldiers have the risk of undermining the morale of their forces, while logistical problems and reports of substandard medical support for the wounded are further hurting Russia’s war-making campaign.

Seven Uranium Investments to Buy for Profiting Include Global X ETF

“The Russian conflict is going to bolster the case for continuing nuclear energy output at current levels with existing facilities,” said Jim Woods, who heads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader and High Velocity Options trading services.

“There is also a good chance that several nations take additional steps to enhance their energy security using this established method,” Woods continued. “Those factors enhance the appeal of global stocks engaged in the discovery and production of nuclear components.”

Paul Dykewicz meets with Jim Woods, who leads the Successful Investing and Intelligence Report investment newsletters.

Woods’ preferred vehicle to participate in this sector is via the Global X Uranium ETF (NYSEARCA: URA). The goal of this diversified ETF is to provide investors access to a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries, he added.

URA retreated 3.66% in the past week after surging 5.85% in the previous month, 10.32% for the past three months, 11.83% so far in 2022 and 42.69% in the past year.

Chart courtesy of www.stockcharts.com

Canada’s Cameco Is the Second of Seven Uranium Investments to Buy

As a result, the fund offers a basket of 50 global companies engaged in the uranium industry with its largest position, Canada’s Cameco Corporation (NYSE: CCJ), jumping 7% on Monday, March 21. The Saskatoon, Saskatchewan-based company, the world’s largest publicly traded uranium stock, benefited from a $5 gain per lb. in the price of uranium, equaling 10%, to reach $55 per lb. a week ago. Since then, price of uranium rose 6.9% to $58.80 per lb., as of March 29.

The multinational nuclear conglomerate accounts for nearly one-quarter of the ETF’s assets and has an “outsized influence” on the fund’s total performance, Woods said. He liked Cameco well enough to recommend it recently in the Fast Money Alert trading service that he leads with his co-editor, Mark Skousen.

Nuclear energy is the “best alternative energy source” currently available, Fast Money Alert wrote to its subscribers. Putin’s threats to use the “nuclear option” in his war against Ukraine has contributed to the rising price of the commodity and the stocks and funds tied to uranium.

But CCJ dipped 4.07% during the past week after jumping 14.24% in the last month, 26.49% for the last three months, 28.75% thus far in 2022 and 69.02% in the past year.

Chart courtesy of www.stockcharts.com

Skousen Predicts Uranium Will Sustain Its Rise

Uranium and other commodities traditionally are safe havens during times of war, Skousen wrote in the April 2022 edition of his Forecasts & Strategies investment newsletter. Skousen, who also leads the Home Run Trader, TNT Trader and Five Star Trader services, said traditional inflation hedges have consisted of oil, gold, silver, copper, uranium and other commodities.

Mark Skousen, editor of Forecasts & Strategies and a descendant of Benjamin Franklin, meets with Paul Dykewicz.

PICK offers the Third of Seven Uranium Investments to Buy

Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter, said he prefers to invest in uranium through iShares MSCI Global Metals and Mining Producers (PICK). Carlson began recommending the exchange-traded fund (ETF) last fall and has watched it jump by double-digit percentages.

PICK has climbed 6.64% in the past month, 21.32% for the last three months, 20.07% so far this year and 26.69% in the past 12 months. The ETF tracks an index of global mining companies that excludes gold miners but does include silver miners.

Chart courtesy of www.stockcharts.com

The index consists of 216 stocks, but its capitalization weighting means 50% of the fund is in its 10 largest positions. Top holdings recently consisted of BHP Group Ltd. (NYSE: BHP), Rio Tinto Limited (OTCMKTS: RTNTF), Vale S.A. (NYSE: VALE), Freeport-McMoRan Inc. (NYSE: FCX) and AngloAmerican plc (OTCMKTS: NGLOY).

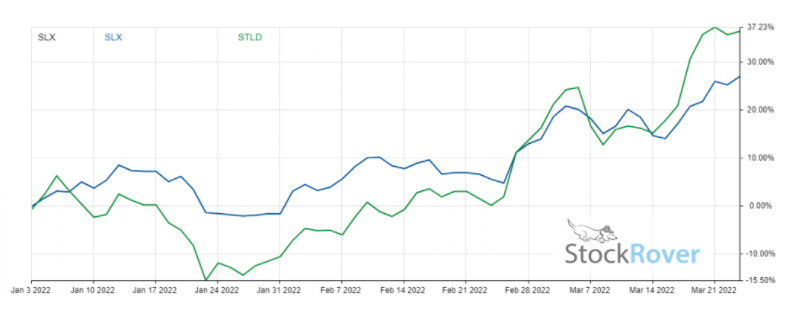

Chart generated using Stock Rover. Activate your 2-week free trial now.

“I was attracted to this ETF even before the invasion of Ukraine,” Carlson commented. “The mining companies had gone through a long bear market. They worked to reduce debt and otherwise clean up their balance sheets. Their more efficient operations mean most of them can profit at relatively low prices for their commodities and will earn strong profits as prices rise. The strong global demand, combined with the recent supply shocks, make them more attractive.”

Bob Carlson, head of Retirement Watch, speaks with columnist Paul Dykewicz.

Roughly 23% of the fund is in North American-based companies. Other leading regions in the fund are the United Kingdom, 13%; Developed Europe, 9%; Emerging Europe, 4.9%; and Africa/Middle East, 4.9%.

President of Portia Capital Management Prefers PICK to Gain Mining Diversification

Michelle Connell, a former portfolio manager who now is the president and owner of Dallas-based Portia Capital Management, said she also likes PICK to diversify beyond a pure play mining stock through a single investment.

Michelle Connell, CEO, Portia Capital Management

“There are several reasons for my rationale,” Connell told me.

One, PICK holds a “plethora of companies” that have very strong fundamentals, Connell continued. Second, PICK’s dividend yield is a compelling 5%, she added.

“Obviously, PICK is not a uranium pure play, but it provides some uranium exposure with more of an investment objective,” Connell counseled.

Uranium Energy Corp. Is the Fourth of Seven Uranium Investments to Buy

Uranium Energy Corp. (NYSE: UEC), a non-dividend-paying uranium mining and exploration company in Corpus Christi, Texas, describes itself as America’s fastest-growing uranium miner. UEC offers investors a pure play uranium stock that is advancing the next generation of low-cost, environmentally friendly in situ recovery (ISR) mining uranium projects.

ISR is one of two key extraction methods currently used to obtain underground uranium. That method recovers uranium from low-grade ores where other mining and milling techniques may be too expensive or environmentally disruptive.

UEC has two production-ready ISR hub-and-spoke platforms in South Texas and Wyoming that are anchored by fully licensed and operational processing capacity at its Hobson and Irigaray Processing Plants. The company also has seven U.S. ISR uranium projects that have major permits in place.

UEC Holds Diversified Collection of Uranium Assets

Plus, UEC has other diversified holdings of uranium assets. They include one of the largest physical uranium portfolios of U.S. warehoused U3O8; a major equity stake in the only royalty company in the sector, Uranium Royalty Corp (NASDAQ: UROY); and a pipeline of resource-stage uranium projects in Arizona, Colorado, New Mexico and Paraguay.

“With the way Russia has operated in Ukraine, they have forfeited their right to operate in Western markets,” said Scott Melbye, executive vice president at Uranium Energy Corporation (NYSE: UEC).

UEC’s stock price fell 10.45% in the past week after soaring 13.78% in the last month, 27.89% in the past three months, 35.5% so far in 2022 and 55.48% in the past year.

Chart courtesy of www.stockcharts.com

Uranium Royalty Corp. Is the Fifth of Seven Uranium Investments to Buy

Canada’s Uranium Royalty Corp., of Vancouver, is a non-dividend-paying a royalty company that acquires revenue streams of uranium projects. The uranium price had been improving on a fundamental supply and demand imbalance before Russia’s invasion of Ukraine, said Melbye, who also is the chief executive officer of Uranium Royalty Corp.

The opportunity to develop uranium mining operations in America is genuine, said Melbye, who added that Western companies cannot do business in Russia from an “ethical and moral” standpoint.

“Everybody is basically pulling out of Russia,” Melbye concluded.

Chart courtesy of www.stockcharts.com

UROY has been pulling back in the past month after roaring ahead 61.25% in the past 12 months. The stock is down 14.57% in the past week and 6.07% for the past month, while up 5.45% for the past three months and 6.04% for the year to date.

Toronto’s Denison Mines Is the Sixth of Seven Uranium Investments to Buy

Toronto’s Denison Mines Corp. (NYSEAmerican: DNN) is a uranium exploration and development company that has interests in the Athabasca Basin region of northern Saskatchewan in Canada. The company also has a 95% interest in its flagship Wheeler River Uranium Project, the largest undeveloped uranium site in the “infrastructure-rich” eastern portion of the Athabasca Basin region in northern Saskatchewan, company officials said.

Denison’s interests in Saskatchewan further include a 22.5% ownership interest in the McClean Lake joint venture, including several uranium deposits and the McClean Lake uranium mill, contracted to process the ore from the Cigar Lake mine under a toll milling agreement.

In addition, Denison Mines holds a 25.17% interest in the Midwest Main and Midwest A deposits, and a 66.90% interest in the the Heldeth Túé and Huskie deposits on the Waterbury Lake property in that province.

The stock fell 4.62% in the past week but has leaped 10.74% in the past month, 17,86% in the last three months, 20.44% so far this year and 51.38% for the last 12 months.

Chart courtesy of www.stockcharts.com

Sprott Physical Uranium Trust: Seventh of Seven Uranium Investments to Buy

Sprott, of Toronto, launched a new uranium product on July 19, 2021, called Sprott Physical Uranium Trust (TSX: U.U). The trust invests and holds substantially all its assets in uranium in the form of U3O8.

Sprott has bought more than 50 million pounds of uranium on the open market to speculate on the price of uranium for its investors. The company ranks as the world’s largest physical uranium fund, according to Morningstar.

“I have a pretty big personal stake in [the trust],” Melbye told me. Melbye’s holdings may not be much when compared to all the total shares outstanding, but he has proverbial “skin in the game” with his stake.

Since last July when the trust came into existence, the price of uranium has surged from $30-$40 per lb. last year to almost $60 per lb.

“Nuclear is carbon-free energy,” Melbye said. “Now, Democrats and Republicans both agree they like nuclear energy.”

The trust’s stock price fell 0.27% in the past week but zoomed 20.11% in the last month, 35.94% in the past three months and 33.97% so far in 2022.

Seven Uranium Investments to Buy Fueled by U.S. Government Policies

The seven uranium investments to buy should be helped by the U.S. government’s previously announced goal to cut up to 52% of its greenhouse gas emissions by 2030. At the same time, global demand for nuclear power is rising, as more countries commit to net-zero carbon goals, Melbye said.

The U.S. government further has taken action to ban imports of Russian oil, liquefied natural gas (LNG) and coal, but four Republican U.S. senators introduced legislation asking for uranium to be added to the list. Both Wyoming Sens. John Barrasso and Cynthia Lummis joined with Sens. Kevin Cramer, of North Dakota, and Roger Marshall, of Kansas, Thursday, March 17, to submit a bill to ban Russian uranium imports.

In the U.S. House, Congressmen Pete Stauber (R-MN), Adrian Smith (R-NE), Vicente Gonzalez (D-TX) and Henry Cuellar (D-TX) introduced legislation on Friday, March 25, to ban imports of uranium from Russia. The United States purchased more than 34 million pounds of uranium from 2016-2020, the Energy Information Administration estimated.

“It’s more important now than ever for the United States to achieve mineral dominance to secure our energy supply chain needs,” Rep. Stauber said. “By banning uranium imports from Russia, we can stop funding for Putin’s brutal war against Ukraine, create jobs for American workers and secure our national defense.”

As Putin continues his invasion of Ukraine, the United States must curb its reliance on Russia for resources and critical minerals, Rep. Smith said. America has the capacity to safely produce uranium domestically, rather than buy it from Russia and fund its war on Ukraine, he added.

FDA Approves Second COVID-19 Booster Vaccine; U.S. Cases Top 80 Million

The U.S. Food and Drug Administration announced on March 29 the expansion of its emergency use authorization for the Pfizer and Moderna COVID-19 vaccines to be received as a second booster shot by adults who are 50 and older. That second booster shot could come as soon as four months after the initial booster dose.

The move provides an additional safeguard to protect against the virus that could boost business activity and the economy further in the months ahead. The second booster would enhance protection for healthy older adults.

COVID-19 also has led to a new, highly contagious subvariant of Omicron, BA.2, that has spread a new wave of infections in Europe. China is enduring its worst outbreak since the virus initially surfaced in Wuhan. COVID cases also are on the climb in European countries such as Germany, the Netherlands and Switzerland.

COVID-19 deaths worldwide exceeded 6 million to total 6,113,459 on March 30, according to Johns Hopkins University. Cases across the globe have soared to 485,213,252.

U.S. COVID-19 cases, as of March 30, hit 80,019,128, with deaths rising to 978,691. America has the unenviable status as the nation with the most COVID-19 cases and deaths.

As of March 29, 255,362,450 people, or 76.9% of the U.S. population, have obtained at least one dose of a COVID-19 vaccine, the CDC reported. Fully vaccinated people total 217,498,967, or 65.5%, of the U.S. population, according to the CDC. In addition, 97.4 million people have received a booster dose of COVID-19 vaccine, up about 300,000 in the past week.

The seven uranium investments to buy offer stocks and funds that provide exposure to the rising value of an increasingly precious commodity that has supportive U.S. government policy and legislation. Despite Putin’s perplexing actions that are killing thousands of Russia’s own soldiers and Ukrainian men, women and children, Russian claims of progress in peace talks still do not seem near an agreement to end hostilities.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.