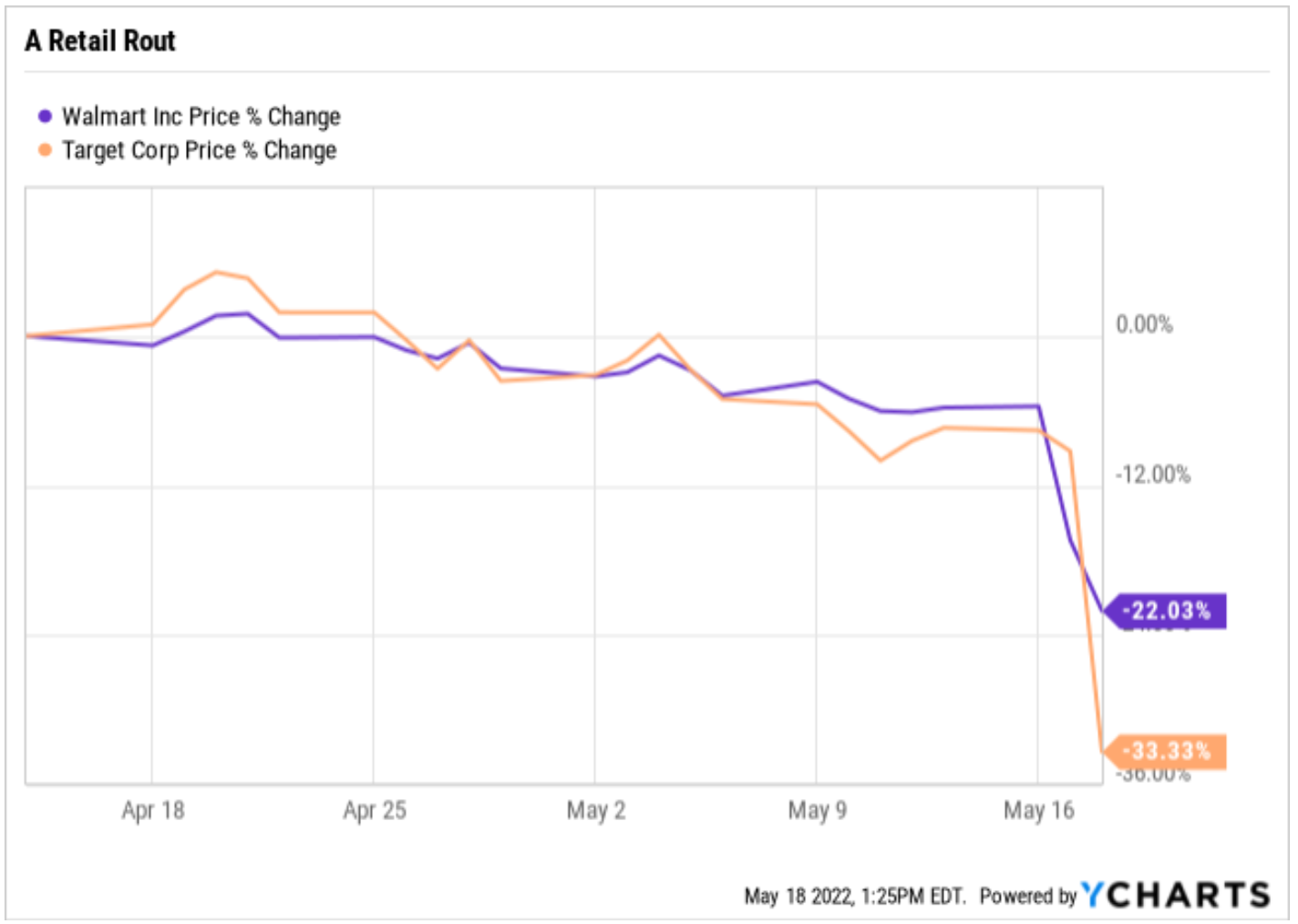

Retail stocks are getting slammed, and the culprit is something that has Wall Street rightly concerned.

On Wednesday morning, retail giant Target Corp. (NYSE: TGT) reported a very ugly first-quarter earnings miss, as the company cited cost increases in areas such as freight and inventory for its very bad results. About halfway through the trading session, TGT shares were down more than 26% — yes, that’s just today!

On Tuesday, the world’s biggest retailer, Walmart Inc. (NYSE: WMT) also reported pressured earnings and, like TGT, the company saw cost increases compress its margins. Also like TGT, shares of WMT were down big on Tuesday, and again today (albeit not nearly as much).

“The conclusion from both reports is the same: Consumers are starting to tighten their belts and switching from discretionary items to staples such as food,” said Tom Essaye of Sevens Report Research. Tom is my personal go-to source for making sense of the macro and how it influences markets.

“More broadly, the weakness in WMT and TGT over the past two days reinforces a point I’ve been making for months: Despite equity market volatility, we have not even started to see the negatives from a slowing economy, and that’s one of the main reasons we’re hesitant to declare last week’s low the bottom,” added Essaye.

In this morning’s issue of my daily marketing briefing, the Eagle Eye Opener, I explained to readers that Walmart missed earnings because of two main factors. First, consumers bought less high-margin merchandise and instead, spent more money on lower-margin food. Additionally, WMT saw a shift from brand names to private label.

This is potentially important because those two shifts (from merchandise to food and brand names to private label) both anecdotally imply the middle and lower-end consumers are starting to get squeezed by inflation, and they are beginning to “cut back” on non-essential items.

To a point, this also was partially confirmed by the Home Depot (NYSE: HD) results, although that company had a much better quarter. HD beat earnings and raised guidance. The stock rallied. But while sales amounts were strong, customer transactions fell 8.2% in the quarter. That drop in business was offset as the average ticket price per sale was up 11.4%.

The truth here is that the economy and investors are in very unfamiliar waters right now, and nobody knows just how quickly the economy will slow. Right now, the market is facing multiple 50-basis-point interest rate hikes in the months ahead, something we haven’t seen in more than two decades. And now that we are starting to see inflation really affect retail earnings, the thought of a real recession hitting the economy is causing both a retail stock rout and, at least today, a huge equity sell-off.

Now, I want to be clear that the downbeat retail earnings this week do not necessarily mean that we’re headed for a pernicious recession. They also don’t necessarily mean that stocks will plunge well below last week’s lows. After all, we have already seen a lot of selling in this market already, so the downside from here is arguably largely baked into the current valuations.

Yet as of this midday Wednesday, the Dow Jones Industrial Averages was down more than 1,100 points, or some 3.4%. As such, the reality is the bears are still very much center stage, and they’re still delivering their morose monologue for this market.

***

If you want to get access to this kind of unique market analysis every trading day, directly to your inbox at 8 a.m. Eastern, then I invite you to check out my Eagle Eye Opener right now. There’s no time like the present to gain more market insight.

*****************************************************************

Of Tigers and Bears

“An infallible method of conciliating a tiger is to allow oneself to be devoured.”

— Konrad Adenauer

Tigers have a lot in common with bears. They’re both top predators, and they can both fell you with one swipe of their paws. Right now, there’s a bear swiping away at shareholder value, but one sure way to placate that bear is to let yourself be consumed with the fear that accompanies its presence.

Yes, bear markets are scary. Yet they are eminently navigable, and sometimes the best strategy is to just stay calm and stay the course. Easier said than done, I realize, but whoever said making the right decisions in life was easy?

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods