“The Federal Reserve has been the greatest source of instability.” — Milton Friedman

“Every recession in the United States has been caused by the Federal Reserve.” — Paul Krugman

In 1974, the last time that we battled double-digit-percentage inflation, Harry Browne wrote a book entitled, “You Can Profit from a Monetary Crisis.” It became a #1 bestseller.

Harry warned that “any currency not backed by gold was doomed to disaster.” He urged his readers to get out of traditional investments, such as stocks, mutual funds, bonds and even real estate, and invest in alternative funds that would protect you from a “crashing dollar, a new depression and runaway inflation.”

His motto was “buy gold, buy silver, buy Swiss francs.”

Harry’s advice to get out of the traditional stock and bond markets has made sense in 2022. Stocks have suffered a major bear market, with stock market averages down by 20-35%.

But there has been no crashing dollar. In fact, the U.S. dollar is up this year, no doubt due to the Fed’s decision to sharply raise interest rates in 2022.

Silver is down for the year, and gold is breakeven. Bitcoin has crashed.

The #1 Culprit in the Boom-Bust Cycle

We will continue to see booms and busts, bull and bear markets and monetary crises from time to time.

The Biden administration has blamed the high price of gasoline and the resurgence of inflation on the Russian invasion of Ukraine. The war has certainly exacerbated the rise in prices, but it’s not the root cause.

The root cause is the irresponsible “easy money” policy by the Federal Reserve and the trillion-dollar deficits by the Trump and Biden administrations.

Financial reporter Christopher Leonard has written a new book entitled “The Lords of Easy Money: How the Federal Reserve Broke the American Economy.”

I’d change the subtitle to “How the Federal Reserve Created an Unsustainable Bubble Economy.”

He points out that over the past 10 years, the Fed has adopted a “Zero Interest Rate Policy” (ZIRP) after the 2008 financial crisis. ZIRP created a bubble in the stock market, especially in tech stocks and real estate.

Now, the Fed has switched from “fighting recession” to “fighting inflation” by raising interest rates.

The fact is that the Fed has been the number one source of instability in our economy since its inception by switching back and forth from easy money to tight money, and from tight money to easy money — and it does so pretty regularly.

The Ideal Monetary Program

I was asked recently what the ideal monetary system should be. I favor the approach of Milton Friedman, who gave a lecture at Fordham University in 1959 and later published it under the title, “A Program for Monetary Stability.”

His answer was pretty simple: make sure the monetary aggregates (the money supply, broadly defined) increases at a steady rate. Avoid both tight money and easy money. Increase the money supply at a steady rate equal to the long-term growth rate.

Of course, under a fiat-money standard, this goal is easier said than done. But it’s worth a try, and better than what the Fed has been doing for the past 100 years.

How Should Investors Protect Themselves?

For investors, my best advice is found on p. 150 of “The Maxims of Wall Street”: “Don’t fight the Fed — fear the Fed.”

That should be your general approach.

When the Fed engages in easy money and “fighting recession,” that is bullish for stocks, bonds, gold, oil and other commodities.

When it fights inflation — the inflation it caused in the first place — that means the arrival of rising interest rates, which is bullish for cash, bank credit deposits (CDs), the dollar against other currencies and even shorting the market via exchange-traded funds (ETFs).

Fighting inflation also means a slowdown in the economy, threatening to produce a recession, bankruptcies and a credit crisis. If the Fed is too aggressive, it can cause a financial crisis.

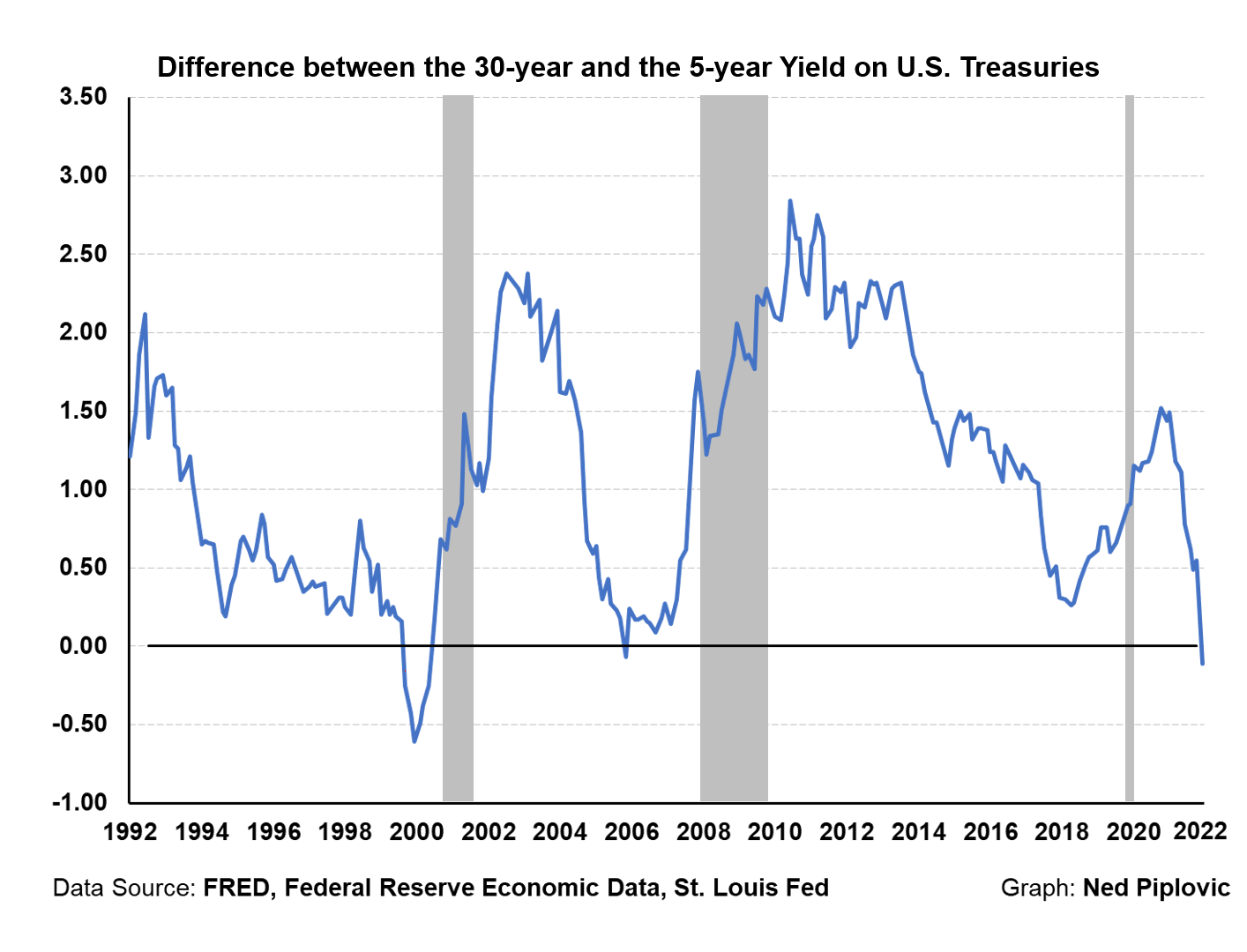

I used the yield curve as the best indicator of the business cycle — When short term interest rates rise faster than long-term rates, a recession is practically inevitable.

As the chart below demonstrates, whenever there is an INVERTED yield curve, which is when short-rate rates are higher than long-term rates, watch out below. A recession is coming our way. We are headed in that direction.

According to my Gross Output (GO) statistic, the economy is headed toward a recession. For more information, go to www.grossoutput.com.

However, I’m prepared. Click here to learn more about my “Biden Disaster Plan.”

Overall, it’s difficult to make money in a recession. As the late Dick Russell stated, “In a bear market, the winner is the man who loses the least.” (“Maxims”, p. 110).

Time to Consult the Bible on Wall Street

It is times like these where it pays to read from “The Maxims of Wall Street,” which Alex Green calls a financial bible that has become a classic (now in its 10th-anniversary edition).

“It’s my favorite financial book. Every quote is a lesson in finance.” — Kim Githler, president, MoneyShow

I devote over eight pages of the “Maxims” to the topics of bear markets, crashes, panics and prophets of doom. Here are a few:

“The light on Wall Street can at any time go from green to red without pausing at yellow.” — Warren Buffett

“The stock market takes the stairs up and the elevator down.”

And most importantly: “Owners of sound securities should never panic.”

To obtain your copy at the discounted price of $20, go to www.skousenbooks.com. All additional copies are $10 each. All books are numbered and autographed, and I pay the postage if mailed in the United States.

If you order an entire box (32 copies), the price is only $300 postpaid, and all of them are autographed and numbered. It’s the perfect gift for clients, customers, shareholders and friends.

Good news! The full agenda of 300 speakers and 250 sessions, panels and debates is now posted online. I’m overwhelmed as to how my staff can put this together each year. Click here to see it.

Big Debates at FreedomFest Start in One Month

“I love FreedomFest — wonderfully interesting people and non-stop intellectual stimulation. The debates are the best! I’m really looking forward to July in Las Vegas.” — John Mackey, CEO, Whole Foods Market

FreedomFest will start in a month! (July 13-16, at the Mirage Hotel & Casino, Las Vegas). We’re getting dozens to sign up every day. And the hotel block ends on Friday!

One of the big attractions is our debates. In the past, they have included Steve Moore vs. Paul Krugman about economic policy… Dinesh D’Souza vs. Christopher Hitchens about religion… John Mackey vs. Kevin O’Leary on the proper role of business and Ken Schooland vs. Captain Jim Green on open immigration, just to name a few.

The Moore-Krugman Debate in 2015.

And, of course, our mock trial is the most popular event every year.

One of the reasons why our debates are so popular is because we are seeing less and less of it in the media. Whether on CNN, MSNBC or Fox News, the host only interviews people that he or she agrees with. And when they do debate, it turns into a shouting match.

At FreedomFest, our debates are formal, so every voice is heard without interruption — and we hear both sides and then make up our own minds. That’s why FreedomFest is “the world’s largest gathering of free minds.”

Here’s a list of most of our debates at this year’s big show:

Wednesday, July 13

“Which is a Better Investment, the United States or Emerging Markets?” with the legendary Jim Rogers and Jim Woods, co-editor, Fast Money Alert.

“Buy and Hold, or Market Timing: Which Strategy is the Most Successful?” with long-term investor Mark Skousen taking on stock trader Mike Turner.

Thursday, July 14

“Should the Rich be Taxed More?” with Ben Stein debating Art Laffer. Plus: “Is the Laffer curve voodoo economics? Anyone, anyone?”

The Mock Trial! “Drug Legalization on Trial,” with Wayne Allyn Root as Judge; Alex Datig and Catherine Bernard attorneys, and star witnesses Judge Jim Gray, Avens O’Brien, and Hollywood biographer Marc Eliot.

The God Debate! Michael Shermer (of Skeptic magazine) takes on Eric Metaxas and his new book “Is Atheism Dead?”, moderated by Alex Green. Can’t wait!

Friday, July 15

My interview with Senator Rand Paul: “The Inside Scoop: A Conversation with Senator Rand Paul Confronting Government Officials on Capitol Hill,” with clips from Senator Paul’s verbal debates with Dr. Anthony Fauci and other Biden officials. It will be followed by a luncheon with Senator Paul.

“The Ultimate Bitcoin Debate: Is Crypto the biggest Ponzi scheme since the dot.com era?” John Mackey and Alex Green (yes) versus Max Borders and Brian Robertson (no).

Saturday, July 16

Andrew Yang (Forward Party) vs. Larry Sharpe (Libertarian Party of New York) on “Universal Basic Income: Should Every American Get a $1,000 a Month from the Government?”

And last but not least: “Election Chaos: Was the 2020 Election Stolen From Trump and Should 2024 Be His Year?” with reporter and critic Isaac Saul taking on Trump supporter Wayne Allyn Root, moderated by John Fund (of National Review). The sparks will fly.

Note! Our room block at the Mirage Hotel & Casino ends on Friday, July 17. This is your last chance to sign up for a room that costs $148 a night. We have also negotiated a much lower price for the resort fee (only $29 a night).

Register This Week and Get $50 Off

To register, go to www.freedomfest.com, and use the code EAGLE to get $50 off the registration fee. If you have any questions about FreedomFest, email Hayley at hayley@freedomfest.com.

See you in Vegas next month. Fly there, drive there, bike there, be there!

Good investing, AEIOU,

![]()

You Blew It!

Rent Control is Back!

“The rent is too damn high.” — James McMillan III

With price/wage/rent inflation comes a lot of bad policies that try to deal with the effects, not the cause, of inflation. The latest is that communities and city governments are hoping to put a lid on apartment and housing rents.

With housing prices skyrocketing, many people can only afford to rent. As a result, the occupancy of rental apartments and rental housing have increased by double-digit percentages lately.

Major cities such as St. Paul, Minnesota, are fighting back. The city just passed an ordinance prohibiting rents from going up by more than 3% a year. As a result, the number of new housing and apartment building permits has fallen by 65%, while it is going up in nearby Minneapolis.

But now Minneapolis is considering rent controls.

John Stossel has just released a great video exploring this crisis in St. Paul. As is his custom, he interviewed a city official who favors rent control. Watch the interview here. It’s Stossel at his best.