Five grocery store stocks to buy as hedges against inflation and recession offer enticing ways to protect against current economic pitfalls while pursuing potentially powerful profits.

The five grocery store stocks to buy feature four grocery store chains and a fund that includes shares of the best public companies within an industry that always has demand for its products to provide essential food to people. These five grocery store stocks to buy are as close to inflation-proof as possible, since the companies can pass along increased costs to their customers as long as other retailers do likewise.

Investors interested in the five grocery stocks to buy now can purchase shares at discounted prices after U.S. equities endured their worst week since 2020. However, stocks signaled pent-up investor interest by acquiring shares as the market rallied on Tuesday, June 21, when NASDAQ surged 2.51%, the S&P 500 rose 2.45% and the Dow Jones Industrial Average gained 2.15%.

Click here for a free two-week trial of Stock Rover.

Risks Remain for Five Grocery Store Stocks to Buy as Hedges Against Inflation and Recession

None of the five stocks to buy are insulated from rising costs for shipping, fuel and labor. However, all of them are well-positioned to survive the current crisis caused by Russia’s President Vladimir blockade of grain from Ukraine, China’s continued COVID-19 lockdowns to enforce its aim for zero tolerance of COVID-19 cases and last week’s central bank interest hikes of .75% in the United States and .25% in the United Kingdom to fight inflation.

Another way to dodge a potential meltdown in an individual grocery store stock is to buy shares in an exchange-traded fund (ETF) focused on the consumer staples sector. These stocks tend to do well when the economy weakens.

“They also tend to be able to pass through price increases in inflationary times, because they sell essential goods and services,” said Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter. “An ETF will include more than the grocery store chains. It also will include manufacturers who produce many of the goods sold in the stores.”

Bob Carlson, who leads Retirement Watch, meets with Paul Dykewicz.

Five Grocery Store Stocks to Buy as Hedges Against Inflation and Recession Include ETF

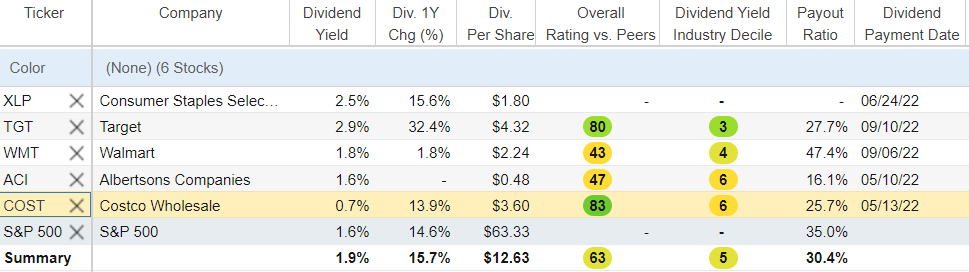

The fund is down 2.19% for the past week, 2.64% for the last month, 6.80% for the past three months and 10.33% so far this year. However, it rose 2.67% on Tuesday, June 21.

Chart courtesy of www.stockcharts.com

Putin’s Policies Jeopardize Food Supply and Availability

Russia’s President Vladimir Putin, who triggered sanctions on his country by sending troops into Ukraine in violation of international law, is insisting that other nations cease their restrictions on his country’s goods before he allows grain exports to resume. Russia’s invasion of Ukraine, described by Putin as a “special military operation,” has shelled hospitals, schools, residential areas, churches, nuclear power plants, oil refineries, a theater used as a shelter and even a train transporting food for World Central Kitchen, amid reports of potential war crimes by his soldiers who have been accused of raping, torturing, kidnapping and executing Ukrainian civilians.

Russia’s restriction of the world’s food supply stems from its continuing attack and blockade of Ukraine, potentially spurring the spread of a famine beyond 140 million undernourished people in needy nations. But the five grocery store chain stocks to buy serve developed nations that can afford to pay for food, unlike many people in the developing world who are the most vulnerable to Russia’s supply chain blockades.

Target Ranks Highly Among the Five Grocery Store Chain Stocks to Buy

One of the best grocery retailers is Minneapolis-based Target Corp. (NYSE: TGT), said Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management. Target has a place in a long-term portfolio for a number of reasons, she added.

The company produces 20% of its revenue on groceries and has done “an amazing job” growing its online sales, Connell said. Target’s online sales specifically have risen to 19% from 9% of its total sales in the past few years, Connell continued.

Despite the stock price taking a hit after its latest financial report showed short-term inventory oversupply, Target’s management expects its sales for the year 2022 to grow and its market share to increase, Connell counseled. Plus, Target is increasing its dividend by 20% this September, so its dividend yield should rise to 3.1% from 2.6% by year end, she added.

Michelle Connell, CEO, Portia Capital Management

Target’s inventory issue should be reduced by the second half of 2022, especially after its “Deal Days,” July 11-13, Connell said.

“This will be TGT’s largest Deal Days in its four-year history,” Connell said. “This online sale takes on Amazon’s Prime Day, except you don’t need a membership.”

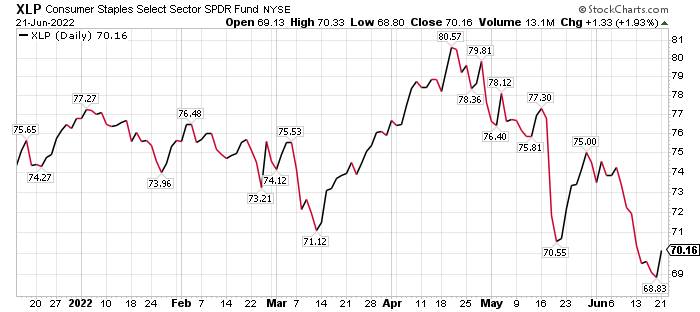

The stock jumped 3.88% on Tuesday, June 21, and looks comparatively inexpensive after a recent share price pullback that lowered the company’s current price-to-earnings (P/E) ratio to 12 from its long-term, historic valuation of 16. Connell pegged the estimated upside for TGT at about 30% from today’s price of $144 per share.

Chart courtesy of www.stockcharts.com

BofA Global Research cautioned that risks to Target include gross margin pressures from labor costs, investments and the rapid growth of the lower-margin e-commerce channel, as well as aggressive competition from competitors including Walmart and Amazon (NASDAQ: AMZN).

Five Grocery Store Chain Stocks to Buy Feature Walmart

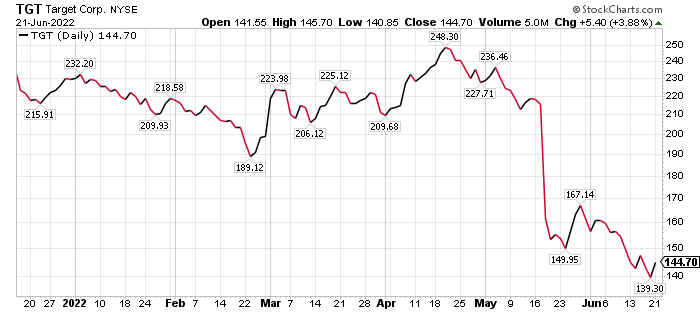

Walmart Inc., a superstore chain headquartered in Bentonville, Arkansas, has slid since mid-May but now is showing some resiliency by rising 3.28% on Tuesday, June 21. Investors seeking to buy Walmart at a discount should take into account the stock has fallen 14.79% so far this year.

Chart courtesy of www.stockcharts.com

“Walmart is one of the few stores that’s likely to benefit from rising inflation, as the store offers the best discounts of any major retailer,” said Jim Woods, leader of the Successful Investing and Intelligence Report newsletters, plus the High Velocity Options and Bullseye Stock Trader advisory services.

Woods told me he recommends Walmart in the Income Multipliers portfolio of his Intelligence Report newsletter due both to its history of raising annual dividends and its five-year total return of more than 71%.

Paul Dykewicz talks to Jim Woods, head of the Successful Investing and Intelligence Report newsletters.

Downside risks, according to BofA Global Research, are the impacts of foreign exchange, pharmacy headwinds and questions about Walmart’s longer-term ability to continue gaining incremental market share, despite its hefty size and a weakening global retailing environment.

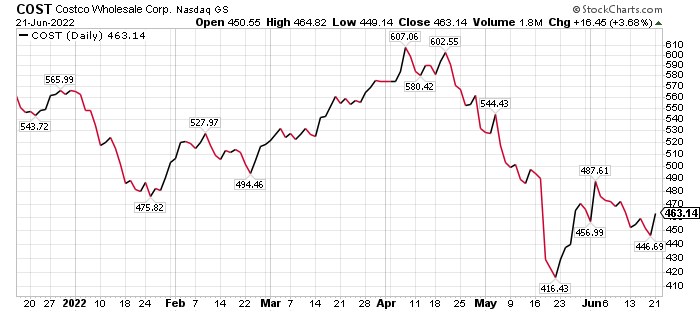

Costco Captures Place Among Five Grocery Store Chain Stocks to Buy

Costco Wholesale Corp., a membership-only, retail superstore chain headquartered in Issaquah, Washington, rallied 3.68% on Tuesday, June 21. It shows the start of a potential upturn, despite further inflation and recession risk, after the stock sank 3.59% in the previous week, 8.93% in the prior month, 19.03% in the past three months and 21.02% so far in 2022.

Good news for Costco and other brick-and-mortar retailers, such as Target and Walmart, is that spending trends for such sales have risen 4.7% since the same time last year, according to BoA Global Research. In contrast, online retail sales slipped 1.6% in the past year, even though they remain stronger on a three-year basis, including the COVID-19 lockdown period that has been scaled back with fewer government decrees to avoid exposure to the virus.

That brick-and-mortar retailer spending surge suggests support for Costco, Target and Walmart sales trends due to their “dominant U.S. store footprints,” compared to Amazon, which has a comparatively small brick-and-mortar presence, even with its Whole Food stores, from both a sales and margin perspective, according to BoA.

Chart courtesy of www.stockcharts.com

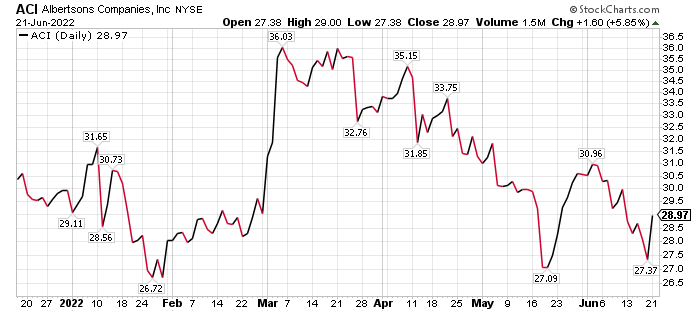

Albertsons Earns Position Among Five Grocery Store Chain Stocks to Buy

Albertsons Companies, Inc., an American grocery store chain founded and headquartered in Boise, Idaho, has more than 2,200 retail locations. The company is a BoA buy but faces further challenges than some of its bigger and better-known rivals in the grocery store chain business.

For example, Albertsons lacks general merchandise breadth of offering, with an accompanying higher gross margin profile that warrants a enlarged valuation for large discounters such as Target and Walmart, BofA wrote in a research note. Albertsons also may benefit less from favorable demographic trends in the South, where it has lower penetration compared to Walmart, Target, Costco and Dollar General (NYSE: DG).

Another drag on Albertsons is that it has nearly $5 billion in estimated off-balance sheet underfunding of multi-employer pension obligations, according to BofA. Other downside risks that Albertsons must navigate are its presence in a highly competitive retail food industry, a higher perishable mix that brings increased inflation exposure compared to its peers, e-commerce inroads at an earlier stage than for Walmart, its unionized workforce, competition from retail discounters and exposure to gas prices if shoppers opt to reduce driving.

Nonetheless, Albertsons jumped 5.85% on Tuesday, June 21, after gaining 2.33% in the previous week and 5.31% in the previous month. However, the stock is down 19.51% in the last three months and 3.25% so far this year.

Chart courtesy of www.stockcharts.com

Beware of Volatility With Further Interest Rate Hikes to Fight Inflation

Investors will not have a smooth recovery with the Fed still needing to raise interest rates further to cool the economy and quell inflation that rose 8.6% in the past year, based on the latest Consumer Price Index reading. Plus, investors need to be cautious about diving back into equities until the “three-headed dragon” of rate hikes, upward wage pressures and rising commodity prices have been slain to bring inflation under control, said Bryan Perry, a high-income aficionado who is a veteran of Wall Street firms and the editor of the Cash Machine investment newsletter.

The June 21 rally is a fresh bet that inflation has peaked with tough Fed jawboning, Perry wrote to his newsletter subscribers.

“The market could, and probably should, rally this week under the old rally cry of ‘whip inflation now’ by global central banks,” Perry opined. “However, the inflation rate shock of the past three months, coupled with the rally in the dollar, invites caution heading into the second-quarter earnings season, which will begin during the second week of July. I would also add that third-quarter guidance will likely be guarded and fairly opaque, as companies are citing highly fluid factors that will greatly influence year-end forecasting.”

Paul Dykewicz interviews Wall Street veteran Bryan Perry, who heads the Cash Machine newsletter.

Supply Chains Remain Vulnerable to China’s Lockdowns

A fresh Covid-19 outbreak in China is affecting the country’s technology hub of Shenzhen and spurring stepped-up testing, as well as a lockdown of certain neighborhoods. Meanwhile, the gambling mecca of Macau, an hour away by car, is enduring an outbreak of the virus for the first time this year.

Those new cases are coupled with encouraging news from major metropolitan areas of Beijing and Shanghai that have used lockdowns to curb new cases. However, the U.S. ambassador to China criticized China’s “zero-COVID” tolerance policy on June 17 for potentially causing serious damage to the global economy and foreign business with the resumption of lockdowns. However, China is seeking to contain outbreaks of COVID-19 with lockdowns, despite many other countries adopting policies to balance anti-coronavirus measures with exposure to the risk.

Disrupted supply chains for products such as rice, oil and natural gas are starting to normalize again in Shanghai, home to 25 million residents and the world’s largest port. China’s recent lockdowns have affected an estimated 373 million people, including roughly 40% of the country’s gross domestic product (GDP).

U.S. COVID Deaths Near 1.014 Million

U.S. COVID-19 deaths rose to 1,013,975, as of June 21, according to Johns Hopkins University. Cases in the United States climbed more than 225,000 in the past four days to reach 86,452,232 on that date. America holds the dubious distinction as the nation with the largest number of COVID-19 deaths and cases.

COVID-19 deaths worldwide totaled 6,321,976, up more than 4,500 the past four days, as of June 21, according to Johns Hopkins. Worldwide COVID0-19 cases have reached 540,535,654.

Roughly 78.1% of the U.S. population, or 259,198,178, have obtained at least one dose of a COVID-19 vaccine, as of June 21, the CDC reported. Fully vaccinated people total 221,924,152, or 66.8%, of America’s population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to 104.7 million people.

The five grocery store stocks to buy offer investors a chance to dodge the worst of the fallout from inflation and rising interest rates, since food is essential and price increases can be passed along by the retailers. With the highest inflation in 41 years, the appeal of such stocks is starting to gain investor interest but the road ahead could be rocky with the Fed expected to raise rates again between .75% and .50% next month to limit price hikes that are needed amid rising federal deficits, sustained supply chain disruptions and Russia’s unrelenting attacks on Ukraine.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

![[Walmart Logo]](https://www.stockinvestor.com/wp-content/uploads/walmart-store-front_129826456676858078.jpg)