Five defense stocks to buy as Ukraine fights to preserve its freedom, since a Feb. 24 invasion by Russian troops, offer investors their choice of a broad-based industry fund and four large-cap aerospace giants.

The five defense stocks to buy as Ukraine attempts to defend itself from an unrelenting attack by Russia’s forces gives investors opportunities to pursue profits from the biggest military conflict to occur in Europe since the end of World War II. Many Western countries have provided military equipment to Ukraine as it attempts to fend off Russia’s attacks, and the use of ammunition and destruction of other weapons requires replenishment to stop the invaders’ troops from overrunning the country.

The horrors of war also have resulted in estimates that tens of thousands of Ukrainians and more than 35,000 Russian troops have been killed. Many Russian deaths include conscripts who were among those sent across their shared border with Ukraine and ordered by their leaders to attack civilian, industrial, cultural and military targets. Despite Russia’s President Vladimir Putin calling the attack of Ukraine that he ordered a “special military operation,” leaders of the European Union, the United Nations and some countries have countered that the invasion of a sovereign country is a clear violation of international law and involve outright war crimes against civilians.

Five Defense Stocks to Buy as Ukraine Seeks to Stay Free Show Paradigm Shift

The war in Ukraine has caused a paradigm shift from using military forces as a deterrent to avoid invasions by other countries to direct combat with Russia’s troops that attacked their neighboring nation and have continued the onslaught with no end in sight. Amid the multi-month fighting with heavy armaments, stockpiles of weapons and ammunition have been depleted and need replacement.

Russia’s sustained assault on Ukraine has spurred leaders of many nations to voice support for fortifying their national defenses and operational readiness. European nations, in particular, are on high alert due to the proximity of the battle in Ukraine to their own borders, amid threats from Putin and other Russian leaders that their ultimate plan is to seize the territory of other nations.

Despite the devastation, defense companies will benefit from the increased military spending. U.S. defense spending specifically will continue to grow with strong congressional support through inflation adjustments and additional aid packages.

Five Defense Stocks to Buy May Benefit from Rising Federal Spending

“The Department of Defense (DoD) has also included special provisions to major contractors to alleviate supply chain and worker constraints impacting critical programs such as the Virginia class submarine,” according to a recent research note from BofA Global Security’s defense and aerospace analyst Ron Epstein. “We anticipate defense spending levels to remain elevated and could reach about $1 trillion by 2025 or 2026.”

Defense stocks have remained somewhat “insulated” from the worst of the market’s recent retreats and outperformed on a relative basis due to their low beta nature, Epstein continued. The increase in defense modernization priorities, inflation pass-through on contracts, and few substitutes will support the defense market in outperforming the general markets, he added.

Click here for a free two-week trial of Stock Rover.

Putin’s Policies Precipitate New Economic Penalties on Russia’s Defense Entities

Putin has caused sanctions to be placed on his country in direct response to his attack, and he is blocking the important grain exports from Ukraine, preventing food from reaching people as far away as Africa, where people are enduring famine conditions as a result. Not only is he insisting that other nations cease their restrictions on his country’s goods before he allows grain exports to resume, but his troops have shelled civilian targets in Ukraine mercilessly.

Russian troops have decimated hospitals, schools, residential areas, churches, nuclear power plants, oil refineries and a theater used as a shelter, amid reports his soldiers raped, tortured, kidnapped and executed Ukrainian civilians. In the latest high-profile civilian attack by Putin’s forces, a Russian missile strike hit and caused deaths at a crowded shopping center with 1,000-plus civilians on Monday, June 27, in the central Ukrainian city of Kremenchuk, an industrial city of 217,000 and home of the country’s biggest oil refinery before Russia’s Feb. 24 invasion.

At the G7 meeting in Germany on Tuesday, June 28, the United States, the United Kingdom, Canada and Japan announced that they agreed to stop importing Russia’s gold, the largest non-energy revenue source that totaled $15.47 billion for the country last year. The U.S. Treasury and State Department each announced on June 28 that they were sanctioning a combined 115 entities and 48 individuals that are “critical” to Russia’s defense industrial base.

“The United States reaffirms our commitment to working alongside our allies and partners to further impose severe consequences on President Putin and his supporters for Russia’s unprovoked and unjustified war against the government and people of Ukraine,” the State Department announced.

Pension Fund Head Recommends Defense ETF to Buy

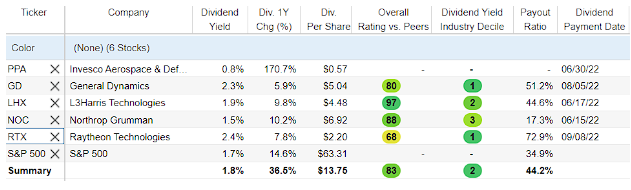

Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter, spoke favorably about an defense industry exchange-traded fund (ETF) Invesco Aerospace and Defense (PPA). The fund is more focused on defense than aerospace and seeks to track the SPADE Defense Index, which is composed of stocks of companies that are systematically important to the industry, Carlson continued.

Bob Carlson, who leads Retirement Watch, meets with Paul Dykewicz.

About 86% of the fund is in stocks classified in the industrial sector by S&P and about 13% are in the technology sector, Carlson counseled. The fund recently held 55 stocks and 55% of the fund was in the 10 largest positions. Top holdings in the fund recently included major U.S. defense stocks.

Chart courtesy of www.stockcharts.com

The fund is down 4.19% in the past month, 11.63% over the last three months, 3.43% for the year to date and 7.19% over the previous 12 months. However, it has outperformed the market and is up 2.03% in the last week.

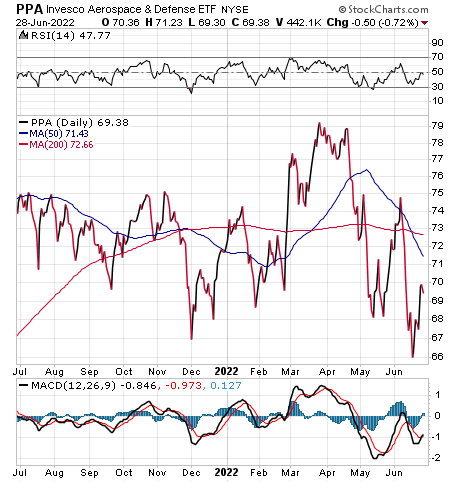

General Dynamics Garners a Buy Rating from Intelligence Report Head

General Dynamics (NYSE: GD), a global aerospace and defense company based in Reston, Virginia, is a recommendation of stock picker Jim Woods in his monthly Intelligence Report investment newsletter. The company’s products include combat vehicles, nuclear-powered submarines and communications systems to provide safety and security.

General Dynamics employs more than 100,000 people worldwide and generated $38.5 billion in revenue in 2021. Woods highlights that the company also pays a dividend that currently yields 2.3%.

Paul Dykewicz meets with Jim Woods, leader of the Successful Investing and Intelligence Report newsletters, plusHigh Velocity Options and Bullseye Stock Trader.

General Dynamics also received a “buy” recommendation from BofA, which set a price objective of $305, based partly on a 5.0% 2025-2030 growth rate and 2.8% long-term growth rate, as well as increased defense budget expectations. BofA wrote that the company’s defense program exposure to land and sea priorities, coupled with its Gulfstream business jet manufacturing segment, could provide near-term and medium-term organic growth.

Other plusses are the company’s strong balance sheet and solid cash generation to help sustain dividend growth and share repurchases, BofA wrote.

Potential downside risks to reaching that price target, according to BofA, are a possible downturn in business jet sales due to an exogenous factor and the pricing of business jets in dollars, making the company vulnerable to an unexpected devaluation of the U.S. dollar that could significantly impact orders. Further, any adverse impact on margins for defense programs and unforeseen government budget cuts could limit growth in the medium- and long-term.

Chart courtesy of www.stockcharts.com

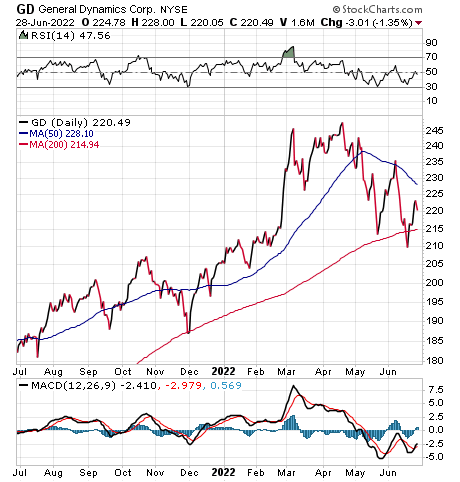

L3Harris Lands a Buy Recommendation from BofA

L3Harris (NYSE: LHX), a Melbourne, Florida-based defense contractor and information technology services provider that produces C6ISR systems and products, wireless equipment and tactical radios, also netted a buy recommendation from BofA. The defense company, consisting of Integrated Mission Systems; Space & Airborne Systems, and Communication Systems, received a $285 price objective from BofA.

The valuation is in line with the median for a pure play defense stock, BofA wrote. However, an improved sentiment on defense spending should sustain a relative valuation slightly above historical average, the investment firm added.

Potential reasons for the company to beat its price target include winning more business on new and existing programs versus BofA’s current expectations. Downside could occur if integration of past acquisitions put a strain on its cash and impact free cash flow estimates.

Chart courtesy of www.stockcharts.com

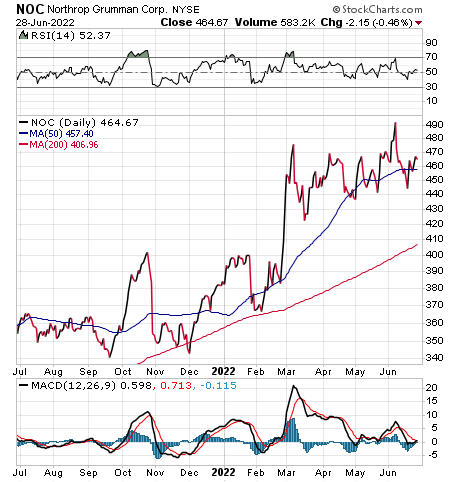

Northrop Grumman Gains Recommendation from Money Manager

Northrop Grumman (NYSE: NOC), a multinational aerospace and defense technology company headquartered in Falls Church, Virginia, is one of the world’s largest weapons manufacturers and military technology providers with 90,000 employees and $30 billion-plus in annual revenue. It also is a recommendation of BofA and has the potential to rise 20-25% in the next 12-18 months compared to the company’s current share price, said Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management.

Michelle Connell, CEO, Portia Capital Management

Increased geopolitical tensions do not look likely to end soon and defense stocks should continue to have an allocation in an investor’s portfolio, Connell counseled. Until the “exacerbated pullback” in the markets, defense stocks such as Northrop Grumman had performed very well, she added.

Northrop Grumman stands out from the defense pack, Connell said, partly due to:

-Developing the first B-21 bomber for the Air Force, after the company passed its first round of tests about the efficacy of the bomber that is expected to be released in 2023.

-Preparing next-generation ballistic missile systems under the name of Sentinel.

-Growing three-year revenue and profits strongly, even though sales were weak in the last quarter due to shortages of labor and supply chain issues that could continue into the rest of 2022.

Interested buyers of the stock may want to wade in with purchases and take a first step before July 29 to receive the next dividend payment, Connell advised.

Institutional Buying of Northrop Grumman Has Been Taking Place

“I take some solace in knowing that before the recent pullback, the stock volume and institutional buying for NOC had increased,” Connell said.

BofA derived a $550 price objective on the stock, partially due to a 4% year over year growth rate for 2025-2030 estimates and a 2.5% long-term growth rate. In addition, the U.S. Defense Budget Authorization has grown at a 1.8% compound annual growth rate (CAGR) in constant dollars since post World War II, BofA’s Epstein wrote.

Northrop Grumman’s growth rate may exceed the industry norm with the most profitable production phase of the B-21 Raider program starting in about 10 years and the U.S. Air Force’s Ground Based Strategic Deterrent (GBSD) entering production at the end of this decade. The GBSD is the replacement weapon system for the aging LGM-30 Minuteman III intercontinental ballistic missile (ICBM) system.

Potential risks to the stock include possible defense program cost overruns and margin contractions. Further stumbles could come from unexpected cancellations to both the company’s commercial and military programs.

Chart courtesy of www.stockcharts.com

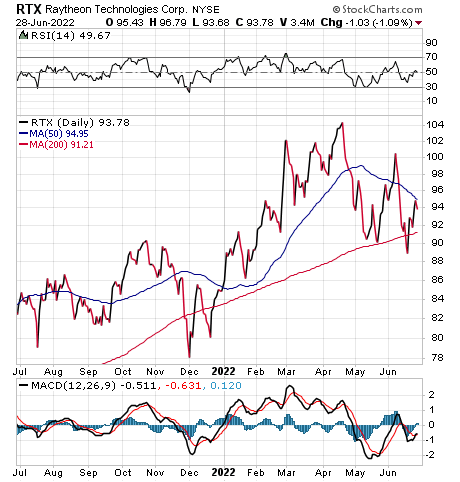

Raytheon Technologies Ranks Among Five Defense Stocks to Buy

Raytheon Technologies Corp. (NYSE: RTX), of Waltham, Massachusetts, is another buy recommendation of BofA. The multinational aerospace and defense conglomerate is one of the largest aerospace, intelligence services and defense manufacturing providers in the world by revenue and market capitalization. The stock has a $130 price objective from BofA. Those projections include the risk of a potential impact of the research and development (R&D) amortization tax change to reflect conservatism, BofA wrote.

Risks to Raytheon reaching that price target include a downturn in commercial aviation due to the natural business cycle or an exogenous event such as a terrorist attack. A severe global economic slowdown would affect top-line growth, since 45% of sales are generated outside the United States.

In addition, any execution risk on defense programs could result in cost overruns and margin contractions. Orders from international programs also are difficult to time due to the complexity of the process, BofA wrote.

“Thus, we could see some lumpiness with regard to international orders,” according to a recent BofA research note. “Unexpected cancellations to programs in both commercial and military could materially impact RTX.”

Chart courtesy of www.stockcharts.com

Supply Chains Remain Vulnerable to China’s Lockdowns

China’s President Xi Jinping said Wednesday, June 29, that the Communist Party’s strategy of lockdowns to curb the COVID-19 pandemic was “correct and effective,” as well as worth keeping. As the world’s most populous country, it would have suffered “unimaginable consequences” had it adopted a hands-off strategy, he added during a June 28 visit to the central city of Wuhan where the virus first was reported.

Meanwhile, a fresh COVID-19 outbreak in China is affecting the country’s technology hub of Shenzhen, spurring stepped-up testing and leading to lockdowns of certain neighborhoods. In addition, the gambling mecca of Macau, an hour away by car, is responding to an outbreak of the virus for the first time this year.

Those new cases are coupled with positive news from major metropolitan areas of Beijing and Shanghai that have used lockdowns to stop the spread of new cases. However, the U.S. ambassador to China criticized China’s “zero-COVID” policy on June 17 for potentially causing serious damage to the global economy and foreign business with the resumption of lockdowns.

Disrupted supply chains for products such as rice, oil and natural gas are lessening in Shanghai, home to 25 million residents and the world’s largest port. China’s recent lockdowns have affected an estimated 373 million people, including roughly 40% of the country’s gross domestic product (GDP).

U.S. COVID Deaths Top 1.016 Million

U.S. COVID-19 deaths rose to 1,016,766, as of June 29, according to Johns Hopkins University. Cases in the United States climbed to 87,221,661 on that date. America still holds the dubious distinction as the nation with the largest number of COVID-19 deaths and cases.

COVID-19 deaths worldwide totaled 6,332,611, up more than 11,000 since Friday, June 24, according to Johns Hopkins. Worldwide COVID-19 cases have reached 545,473,714, up nearly 5,000 since June 24.

Roughly 78.1% of the U.S. population, or 259,426,758, have obtained at least one dose of a COVID-19 vaccine, as of June 28, the CDC reported. Fully vaccinated people total 222,123,223, or 66.9%, of America’s population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to 105.1 million people.

The five defense stocks to buy as Ukraine fights to defend its freedom from Russia’s invasion give investors a chance to protect their portfolios from the worst of its volatility, collect dividends for staying patient and position themselves for future profitability. With the highest inflation in 41 years and further interest rate hikes by the Fed still ahead, the allure of defense stocks remains, despite sustained supply chain disruptions and Russia’s unrelenting attacks on Ukraine.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

![[tractor mowing wheat]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_48384775.jpg)