Having just experienced a market that put in its worst first half of the year performance in 50 years, the question of what to own or how much to have invested in equities is taking on a more serious tone than what has been expressed by investors. The market selloff resembles a slow-motion train wreck where a final round of capitulation has yet to take place that historically defines a true bottom.

This uncertainty about where the bottom is has investors walking on eggshells, but also wanting to put cash to work when annual inflation is running north of 8%. Trying to out-earn inflation is a real challenge, and each of the 11 market sectors has gone through separate corrections as sentiment has moved from “own all things cyclical” to “get as defensive as possible as fast as possible.”

It seems forecasting where the market will be six months from now is way too speculative. How about where will the market be six weeks from now, or for that matter, one month from now? The next four weeks will feature consumer inflation data (CPI) on July 13, wholesale inflation data (PPI) on July 14, the core of second-quarter earnings season and the Federal Open Market Committee meeting on July 27.

Investors will be in a much better place this time next month after all these numbers and events have crossed the tape. Exercising some patience during this time and seeing how the market reacts means maybe missing out on some initial gains if the inflation data are tempering and earnings are holding up. But it also might mean preserving cash and principal if the inflation data are hot and earnings guidance is broadly negative.

For those that want some market exposure, regardless of near-term risks and conditions, they should focus on stocks that have been behaving best during this tumultuous time. The list is short, but it is blue-chip, and it’s worth noting that these stocks are a nice mix along with their corresponding dividend yields.

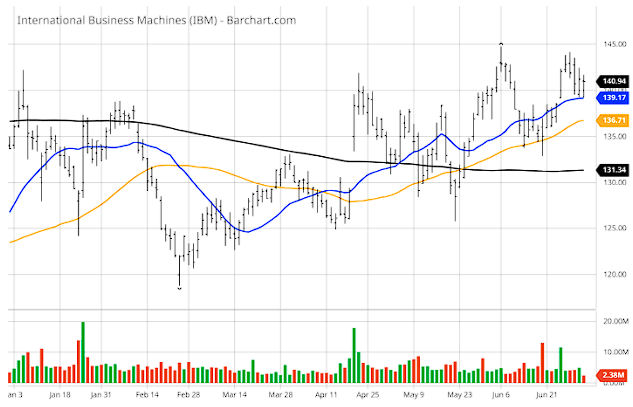

1. International Business Machines Corp. (IBM) — 4.68% Yield

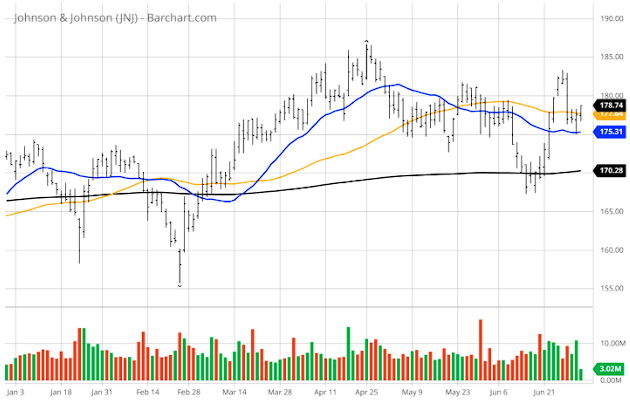

2. Johnson & Johnson (JNJ) — 2.53% Yield

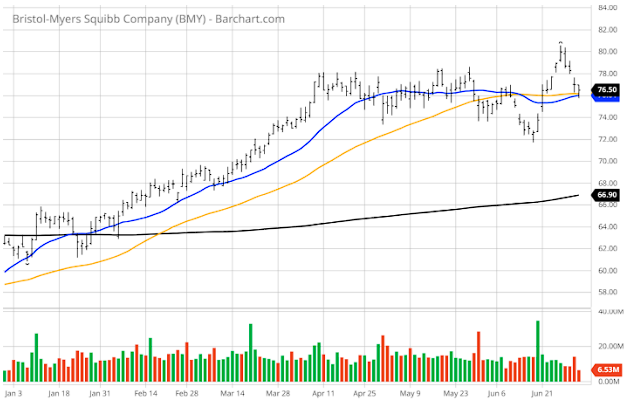

3. Bristol-Myers Squibb Co. (BMY) — 2.82% Yield

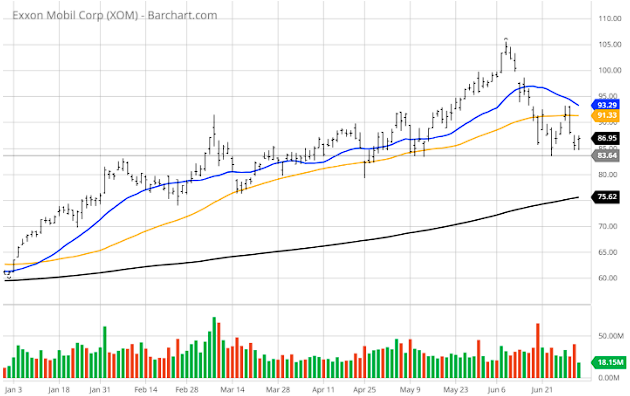

4. Exxon Mobil Corp. (XOM) — 4.05% Yield

The market is going to be what it’s going to be over the next month, but after the roller coaster ride investors have been through, these four stocks have weathered the volatility extremely well. When putting money to work or rebalancing portfolios, start with what the market is embracing, and then venture into riskier assets that have been sold down aggressively. Owning stable stocks in an unstable market is a great way to start the second half of 2022.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)