Five food investments to buy as hedges against inflation and war should avoid the worst fallout from rising prices and Russia’s disruption of agricultural commodities, food and grain that its continuing invasion of Ukraine has caused other countries.

The strain on the world’s food supply has only worsened in the past week as Pakistan has been deluged with flooding that has put one-third of the country underwater, its top officials said. Another calamity is a drought that has dried out food production in much of Africa, as well as hurting many European nations such as Spain.

Almost half of the 27-nation European Union is facing drought conditions, with Belgium, France, Germany, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Romania also increasingly affected. In fact, an ancient Roman military camp in northwestern Spain has been revealed fully as reservoirs have shrunk in Europe amid a record-breaking drought.

Five Food Investments to Buy Include ETF Picked by Pension Head

Food, beverages and other consumer staples investments normally outperform stock indexes during recessions and bear markets, said Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter. Such companies tend to have reliable cash flows and can raise prices as costs climb, he added.

“Consumers will reduce spending in other areas when money becomes tight,” Carlson continued.

Bob Carlson, leader of Retirement Watch, meets with Paul Dykewicz.

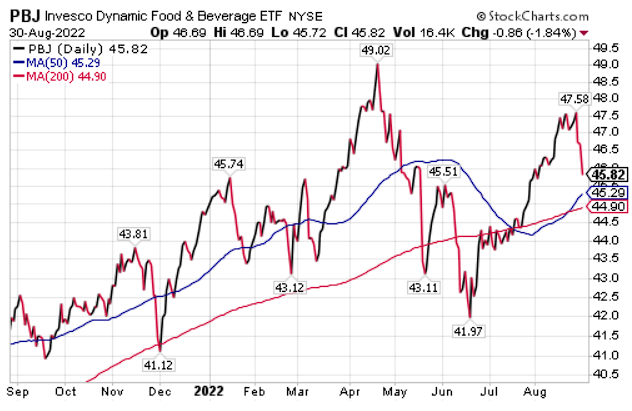

For a diversified position in food and beverage stocks, Carlson suggested an exchange-traded fund (ETF) such as Invesco Dynamic Food and Beverage (PBJ). The fund tends to have smaller and more growth-oriented companies than others in the consumer staples sector, he added.

The ETF has 29 stocks, and 47% of the fund is in the 10 largest positions. Top holdings recently were General Mills (NYSE: GIS), Keurig Dr. Pepper (NASDAQ: KDP), Sysco (NYSE: SYY), Hershey (NYSE: HSY) and PepsiCo (NASDAQ: PEP).

Hershey Recommended by Stock Picker Woods and BofA

The Hershey Company (NYSE: HSY), of Hershey, Pennsylvania, is the first recommended stock among the five food investments to buy. It has many favorable attributes, including a Buy recommendation from BofA Global Research, due partly to its resilience in times of economic distress when people crave sweets to eat as comfort food.

“I’m sweet on the company literally known for its ‘Kisses,’ and that is The Hershey Company,” said Jim Woods, who heads the Successful Investing and Intelligence Report newsletters, as well as directs High Velocity Options and Bullseye Stock Trader. He has recommended Hershey in the past in High Velocity Options and could do so again in that fast-paced trading service when the timing is right.

Paul Dykewicz meets with stock picker Jim Woods, who co-leads Fast Money Alert.

Woods explained that as the leading U.S. confectionery manufacturer, Hershey controls around 46% of the domestic chocolate space with brands such as Hershey bars, Reese’s and KitKat.

“Last quarter, HSY saw strong earnings per share (EPS) growth of 22% year over year, and I expect the company to deliver an even tastier result when they report earnings again in late October,” Woods said. “The reason being is that confection sales are up of late, and I think it’s because many consumers are taking refuge in the small pleasures in life where they can, especially considering the dual pinch of rising inflation and soaring gas prices.”

Another sweet aspect of HSY is the stock’s technical pattern, which is showing a bullish breakout over the past week that has vaulted it back above resistance at the 50-day moving average, added Woods.

Chart courtesy of www.stockcharts.com

Archer Daniels Midland Becomes One of Five Food Investments to Buy

Chicago-based Archer Daniels Midland (ADM) is one of the world’s largest processors of food and beverage ingredients. It also has a smaller business focused on nutrition for animals and people.

“The company is considered to have some of the strongest fundamentals for its industry,” said Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management. Those fundamentals feature one of the highest growth rates for return on assets, a five-year earnings per share (EPS) growth greater than the industry and a lower price/cash flow ratio than its competitors, she added.

Thus, an investor pays less for ADM’s cash flow than for the company’s competitors, Connell continued.

The company has been consistent in providing its investors with upside surprises for the last 12 quarters, Connell counseled. This is due to high demand for its products, sustained productivity improvement and product innovation, she added.

Chart courtesy of www.stockcharts.com

For example, the development of destination marketing for the company’s agricultural services business segment involves moving products from ports of entry to their ultimate destination, Connell said. This has enhanced profit margins for the segment, with ADM offering guidance that its volume growth will reach 30% for destination marketing by 2025, she added.

“Thus, this innovation will continue to be a future profit enhancer,” Connell counseled.

ADM, One of Five Food Investments to Buy, Offers Dividend Payout

Another plus is that ADM is a “solid dividend candidate” with a yield of 1.76%, Connell continued.

“ADM has been an exceptional investment… versus the underlying market or the S&P,” Connell said. “It should continue this trend in the foreseeable future.”

Michelle Connell leads Dallas-based Portia Capital Management.

Connell offered the following highlights for ADM.

- For the past 10 years, an investor in ADM would have made 239%, before factoring in its dividend yield. For the same period, the S&P has only returned 187%.

- For many years, ADM did not repurchase its stock. However, this past February, the company announced an 8 billion share repurchase program.

- While the stock is up over 30% year to date, most analysts believe that there’s more upside from ADM’s current price.

- The stock’s 12-month upside estimates range from 10-25%.

But ADM is not without risk, Connell said. Risks include foreign exchange exposure and a larger than anticipated impact on production from inflation.

J.M. Smucker Earns Berth Among Five Food Investments to Buy

J.M. Smucker (SJM), of Orrville, Ohio, is one of the largest U.S. food manufacturing and food service companies, with $8 billion in sales and $1.4 billion in operating profit in fiscal year 2022 across its four main sectors. Those sectors are U.S. retail consumer coffee, U.S. retail consumer foods, U.S. retail pet foods and international and food service.

BofA Global Research rates SJM shares as a Buy after several years of divestitures. The company now appears to be positioned well to take advantage of low price elasticities in its remaining portfolio compared to its center-store packaged food peers, according to BofA.

In addition, SJM has reduced its private label exposure, while optimizing margins and stimulating sales growth in core products through innovation and capacity expansion.

BofA’s $160 price objective on SJM, up recently from $155, is based on 17.5x of the investment firm’s 2023 EPS estimate. The valuation multiple is at a discount to overall peer group average of 19x, but more in line with centers store packaged food peers that is warranted as SJM executes against its fiscal year 2023 plan, BofA continued.

Chart courtesy of www.stockcharts.com

Potential outperformance could occur with faster-than-expected sales growth and greater share gains, specifically in “Uncrustables” and coffee, BoA wrote in a research note. Other pluses could come from lower-than-expected commodity cost inflation, a quicker-than-anticipated rebound after its Jif peanut butter recall and an improved balance sheet that allows for share buybacks or acquisitions.

Risks to BofA’s price objective include continued weakness in sales growth and profitability primarily within pet food as competition intensifies, slower pet food expansion plans, increased demand elasticity in roast and ground coffee and slower Jif recovery than expected.

PepsiCo Gains Slot Among Five Food Investments to Buy

BofA’s quality holding in consumer staples not only include Hershey but PepsiCo (NASDAQ: PEP), a Purchase, New York-based global snack and beverage company that manufactures and markets salty and convenient snacks, carbonated and non-carbonated beverages and foods. Key divisions include Frito-Lay North America (FLNA), Quaker Foods NA, North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA) and Asia, Middle East and North Africa (AMENA).

The company also operates in the United Kingdom, Mexico, India and China. Brands include Pepsi Cola, Mountain Dew, Gatorade, Tropicana, Frito-Lay, Quaker and among others. BofA has a Buy rating and a $190 price target on the stock.

“We continue to believe our multiple fairly reflects PEP’s balanced momentum, margin support and brand investments, capable of delivering the high end of their long-term outlook,” according to a recent BofA research report.

Upon taking the helm as PepsiCo’s CEO in 2018, Ramon Laguarta’s efforts to pivot the company towards a growth-oriented path have taken root, BofA wrote. Reinvestment in the business and an appetite for risk remain the cornerstone philosophies of this strategy, reflected in PEP’s ramping digitization efforts, new category expansion and supply chain investments to fuel a stronger innovation engine, BofA added.

Chart courtesy of www.stockcharts.com

U.S. COVID Deaths Near 1.045 Million

COVID-19 cases and deaths can affect supply and demand for products such food, particularly with global sourcing of ingredients. For that reason, trends warrant watching.

U.S. COVID-19 deaths rose for the fifth consecutive week by more than 3,000, jumping 1,044,730, as of Aug. 30, according to Johns Hopkins University. Cases in the United States climbed to 94,379,514. America holds the dreaded distinction as the nation with the largest number of COVID-19 deaths and cases.

Worldwide COVID-19 deaths in the last week increased by more than 33,000 to total 6,490,754, as of Aug. 30, according to Johns Hopkins. Global COVID-19 cases reached 602,256,881 on the same date.

Roughly 79.1% of the U.S. population, or 262,643,277, have received at least one dose of a COVID-19 vaccine, as of Aug. 24, the CDC reported. Fully vaccinated people total 223,914,723, or 67.4%, of the U.S. population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to 108.5 million people, up 300,000 in the past week.

The five food investments to buy offer investors protection from the worst of inflation in more than 40 years, drought and Russia’s unrelenting invasion of Ukraine. In the wake of 0.75% Fed rate hikes in June and July and possibly another increase of that size in September, based on the latest signals from central bank leaders, the five food investments to buy may be enticing to consider for the portfolios of savvy investors.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

![[woman shopping at grocery store]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_133181729.jpg)